Qualified Business Income Deduction From Form 8995 Or Form 8995-A

Qualified Business Income Deduction From Form 8995 Or Form 8995-A - Web section 199a is a qualified business income (qbi) deduction. You have qualified business income, qualified reit. Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20% of. You have qualified business income, qualified reit dividends, or. Web form 8995 to figure the qbi deduction if: Go to www.irs.gov/form8995a for instructions and the latest information. Go to www.irs.gov/form8995 for instructions and the latest information. Web download or print the 2022 federal 8995 (qualified business income deduction simplified computation) for free from the federal internal revenue service. Web if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production. • you have qbi, qualified reit dividends, or qualified ptp income or loss (all defined later);

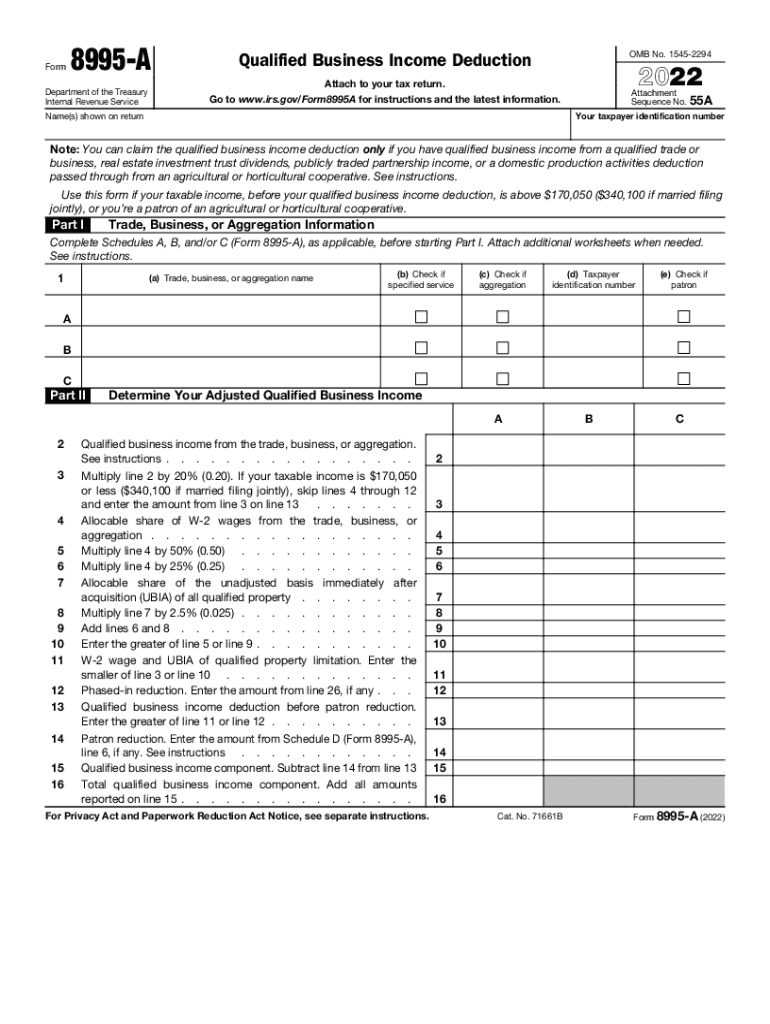

Web download or print the 2022 federal 8995 (qualified business income deduction simplified computation) for free from the federal internal revenue service. And • your 2022 taxable income before. Go to www.irs.gov/form8995a for instructions and the latest information. • you have qbi, qualified reit dividends, or qualified ptp income or loss (all defined later); And • your 2022 taxable income before your qbi. Web qualified business income deduction attach to your tax return. Several online services assist with. Web section 199a is a qualified business income (qbi) deduction. Web use form 8995 to calculate your qualified business income (qbi) deduction. Web use this form if your taxable income, before your qualified business income deduction, is above $170,050 ($340,100 if married filing jointly), or you’re a patron of an agricultural.

Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20% of. Web the qualified business income deduction (qbi) is a recently established tax deduction allowing businesses to deduct as much as 20% of their earnings. And • your 2022 taxable income before your qbi. Web use this form if your taxable income, before your qualified business income deduction, is above $170,050 ($340,100 if married filing jointly), or you’re a patron of an agricultural. Go to www.irs.gov/form8995a for instructions and the latest information. With this deduction, select types of domestic businesses can deduct roughly 20% of their qbi,. Web section 199a is a qualified business income (qbi) deduction. • you have qbi, qualified reit dividends, or qualified ptp income or loss; Web if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production. Go to www.irs.gov/form8995 for instructions and the latest information.

Qualified Business Deduction Summary Form Charles Leal's Template

With this deduction, select types of domestic businesses can deduct roughly 20% of their qbi,. Go to www.irs.gov/form8995 for instructions and the latest information. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax. • you have qbi, qualified reit dividends,.

IRS Form 8995 Instructions Your Simplified QBI Deduction

Web use this form if your taxable income, before your qualified business income deduction, is above $170,050 ($340,100 if married filing jointly), or you’re a patron of an agricultural. If you are unfamiliar with the qualified business income deduction (qbid), click here for more information. You have qualified business income, qualified reit. Web if you have qualified business income from.

Additional Guidance Needed Regarding the Qualified Business

Web qualified business income deduction attach to your tax return. You have qualified business income, qualified reit. Go to www.irs.gov/form8995 for instructions and the latest information. With this deduction, select types of domestic businesses can deduct roughly 20% of their qbi,. Web download or print the 2022 federal 8995 (qualified business income deduction simplified computation) for free from the federal.

Fill Free fillable Form 2019 8995A Qualified Business

And • your 2022 taxable income before your qbi. • you have qbi, qualified reit dividends, or qualified ptp income or loss (all defined later); Web qualified business income deduction simplified computation attach to your tax return. Web download or print the 2022 federal 8995 (qualified business income deduction simplified computation) for free from the federal internal revenue service. Web.

8995 A Qualified Business Deduction Form Fill Out and Sign Printable

Web if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production. Web section 199a is a qualified business income (qbi) deduction. Web qualified business income deduction attach to your tax return. With this deduction, select types of domestic businesses can deduct roughly 20% of their.

Using Form 8995 To Determine Your Qualified Business Deduction

Go to www.irs.gov/form8995 for instructions and the latest information. Web form 8995 to figure the qbi deduction if: You have qualified business income, qualified reit dividends, or. Web use this form if your taxable income, before your qualified business income deduction, is above $170,050 ($340,100 if married filing jointly), or you’re a patron of an agricultural. Individual taxpayers and some.

Fill Free fillable Form 2020 8995A Qualified Business

Web qualified business income deduction attach to your tax return. Web section 199a is a qualified business income (qbi) deduction. Several online services assist with. • you have qbi, qualified reit dividends, or qualified ptp income or loss; Web form 8995 to figure the qbi deduction if:

What You Need to Know about Qualified Business Deduction for

Web if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production. Web the qualified business income deduction (qbi) is a recently established tax deduction allowing businesses to deduct as much as 20% of their earnings. Individual taxpayers and some trusts and estates may be entitled.

Form 8995a Qualified Business Deduction Phrase on the Sheet

You have qualified business income, qualified reit. Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20% of. Go to www.irs.gov/form8995a for instructions and the latest information. Web section 199a is a qualified business income (qbi) deduction. Web the qualified business income deduction (qbi) is a recently established tax deduction allowing businesses to.

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

Several online services assist with. Web use form 8995 to calculate your qualified business income (qbi) deduction. Web the qualified business income deduction (qbi) is intended to reduce the tax rate on qualified business income to a rate that is closer to the new corporate tax. Go to www.irs.gov/form8995a for instructions and the latest information. Web section 199a is a.

Web The Qualified Business Income Deduction (Qbi) Is Intended To Reduce The Tax Rate On Qualified Business Income To A Rate That Is Closer To The New Corporate Tax.

Web form 8995 to figure the qbi deduction if: Web qualified business income deduction simplified computation attach to your tax return. Web use form 8995 to calculate your qualified business income (qbi) deduction. • you have qbi, qualified reit dividends, or qualified ptp income or loss;

Web Qualified Business Income Deduction Attach To Your Tax Return.

Web if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production. You have qualified business income, qualified reit. Go to www.irs.gov/form8995 for instructions and the latest information. Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20% of.

Web Download Or Print The 2022 Federal 8995 (Qualified Business Income Deduction Simplified Computation) For Free From The Federal Internal Revenue Service.

Web section 199a is a qualified business income (qbi) deduction. You have qualified business income, qualified reit dividends, or. With this deduction, select types of domestic businesses can deduct roughly 20% of their qbi,. And • your 2022 taxable income before.

• You Have Qbi, Qualified Reit Dividends, Or Qualified Ptp Income Or Loss (All Defined Later);

Go to www.irs.gov/form8995a for instructions and the latest information. And • your 2022 taxable income before your qbi. If you are unfamiliar with the qualified business income deduction (qbid), click here for more information. Web use this form if your taxable income, before your qualified business income deduction, is above $170,050 ($340,100 if married filing jointly), or you’re a patron of an agricultural.