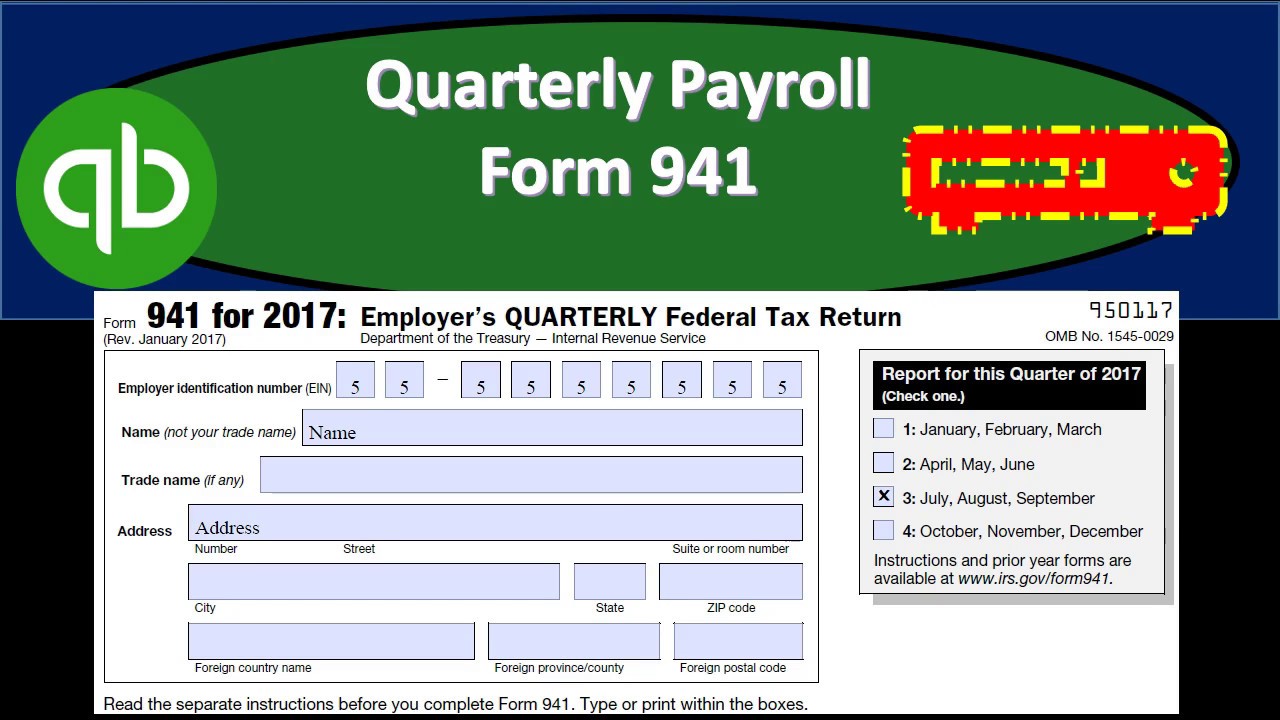

Quickbooks Form 941

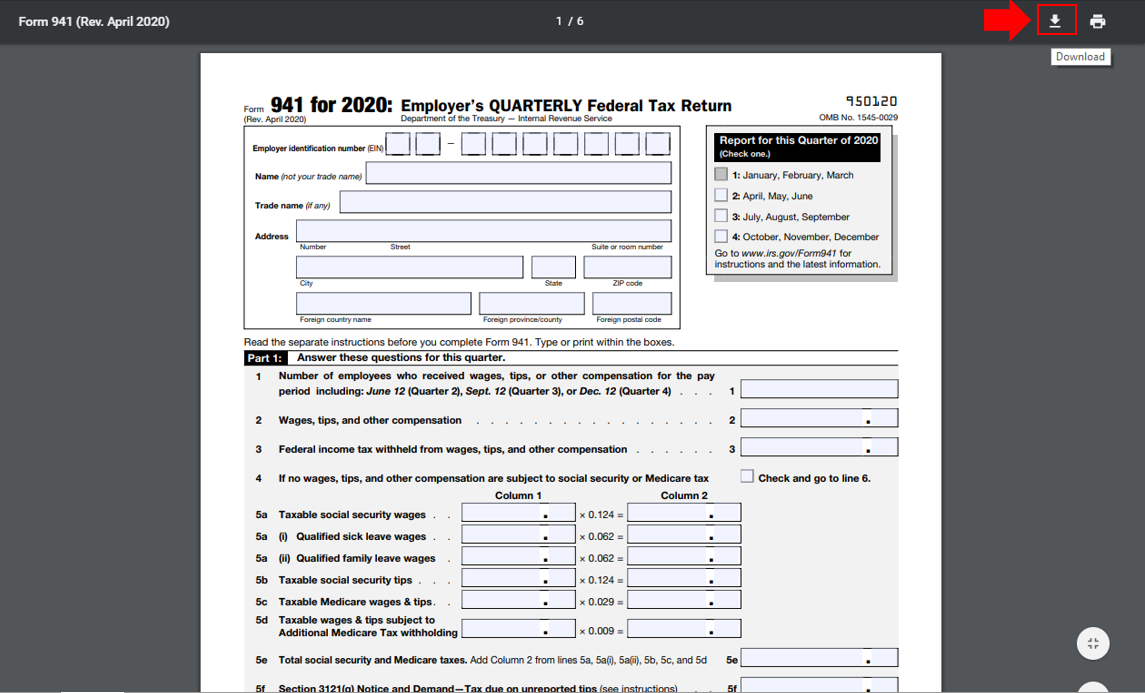

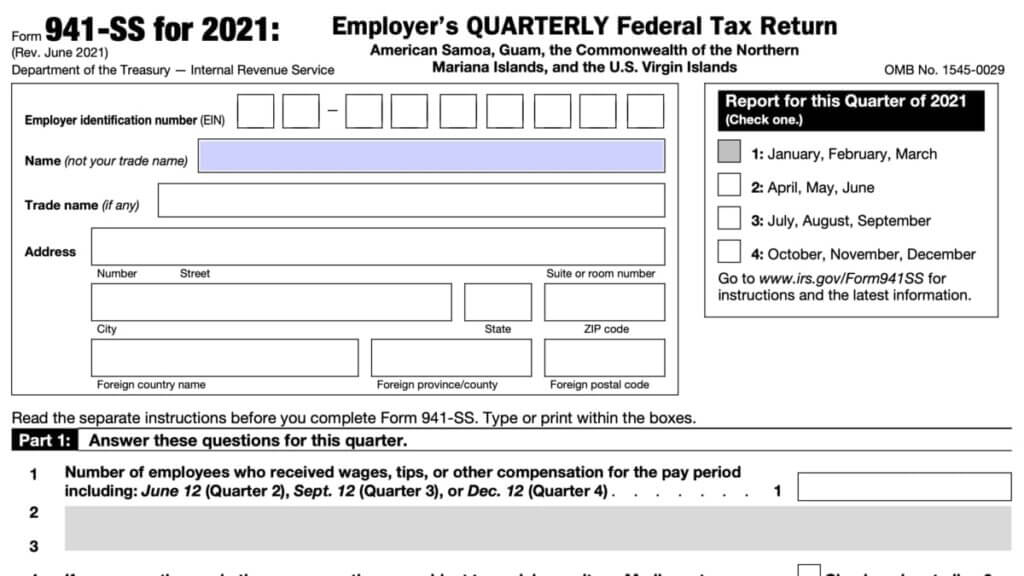

Quickbooks Form 941 - Explore the #1 accounting software for small businesses. Web irs form 941 instructions: In general, employers who withhold federal income tax, social security or medicare taxes must file form 941,. Track everything in one place. Indicate the appropriate tax quarter and year in the quarter and year fields. Web in order to create a 941 report in quickbooks, you have to follow the following steps: Know exactly what you'll pay each month. Web form 941, also known as the employer’s quarterly federal tax return, is a crucial tax return that employers use to report their employees’ wages, tips, and withheld. Employers must file a quarterly form 941 to report wages paid, tips your employees. Let freshbooks crunch the numbers for you

Web print the federal 941, check the box on line 16, and enter the date final wages were paid, indicating that your business has closed and that you do not need to file returns in the. Web i am attempting to file my 941 in quickbooks desktop version. Web first, complete form 8655 reporting agent authorization. Don't use an earlier revision to report taxes for 2023. Go to the reports menu. It must be filed at least quarterly and sometimes. Indicate the appropriate tax quarter and year in the quarter and year fields. I keep getting this error: Let freshbooks crunch the numbers for you Web if you file those in quickbooks desktop, you can follow the steps below to see those federal 941 from the 4th quarter of 2021.

In general, employers who withhold federal income tax, social security or medicare taxes must file form 941,. Web january 10, 2022 02:29 pm yes, @payroll941. Web form 941 hello, we use desktop quickbooks pro 2018 and online payroll. Web form 941, also known as the employer’s quarterly federal tax return, is a crucial tax return that employers use to report their employees’ wages, tips, and withheld. Spend less time on tax compliance with an avalara avatax plug in for quickbooks. Indicate the appropriate tax quarter and year in the quarter and year fields. (22108) form 941 for reporting agents (available for. Web in order to create a 941 report in quickbooks, you have to follow the following steps: Let freshbooks crunch the numbers for you Web form 941 and schedule b (form 941) form 941x, adjusted employer's quarterly federal tax return, has been updated.

Re Trying to file 941 but getting 'No Employees p... Page 3

Web form 941 and schedule b (form 941) form 941, employer's quarterly federal tax return, has been updated. Don't use an earlier revision to report taxes for 2023. Select back to form to get back to the main. Track everything in one place. Web in order to create a 941 report in quickbooks, you have to follow the following steps:

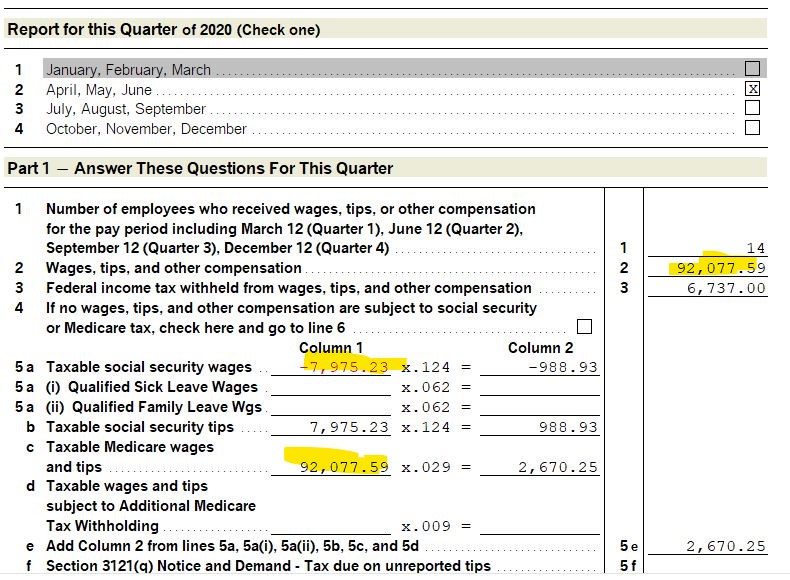

Form 941 3Q 2020

Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Hit on more payroll reports in excel. Pay as you go, cancel any time. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number. Web irs form 941 instructions:

QuickBooks form 941 error Fix with Following Guide by sarahwatsonsus

Sign into quickbooks → go to “taxes” → click “payroll tax” → select “quarterly forms” → choose the 941 form → click the period. Go to the reports menu. Web first, complete form 8655 reporting agent authorization. Web to find your form 941: Employers must file a quarterly form 941 to report wages paid, tips your employees.

Where Is Form 941 In Quickbooks?

Web form 941, also known as the employer’s quarterly federal tax return, is a crucial tax return that employers use to report their employees’ wages, tips, and withheld. Web form 941 for 2023: Web in order to create a 941 report in quickbooks, you have to follow the following steps: Web you can pull up a tax worksheet from quickbooks.

2020 QB Desktop Payroll Reports (Form 941) Populat... QuickBooks

Web form 941 for 2023: Employers must file a quarterly form 941 to report wages paid, tips your employees. Select back to form to get back to the main. Don't use an earlier revision to report taxes for 2023. Web form 941 and schedule b (form 941) form 941, employer's quarterly federal tax return, has been updated.

QuickBooks TipHow To Add a Logo and Customize Your Forms QuickBooks

Click on reports at the top menu bar. Employers must file a quarterly form 941 to report wages paid, tips your employees. We have been contacted by the irs that haven't received any 941 reportings since. Web you can pull up a tax worksheet from quickbooks for the details. Select back to form to get back to the main.

PPT How can you Fix 941 forms in Quickbooks desktop? PowerPoint

Web form 941 is only filed if you are a business paying employees and withholding taxes from their paychecks. Web form 941, also known as the employer’s quarterly federal tax return, is a crucial tax return that employers use to report their employees’ wages, tips, and withheld. March 2023) employer’s quarterly federal tax return department of the treasury — internal.

11 Form In Quickbooks Seven Things You Should Do In 11 Form In

At this time, the irs. Select back to form to get back to the main. Sign into quickbooks → go to “taxes” → click “payroll tax” → select “quarterly forms” → choose the 941 form → click the period. Hit on more payroll reports in excel. Ad manage all your business expenses in one place with quickbooks®.

What Employers Need to Know about 941 Quarterly Tax Return?

Web form 941 and schedule b (form 941) form 941x, adjusted employer's quarterly federal tax return, has been updated. At this time, the irs. Sign into quickbooks → go to “taxes” → click “payroll tax” → select “quarterly forms” → choose the 941 form → click the period. Hit on more payroll reports in excel. Track everything in one place.

QuickBooks 941 Feature Creates Tax Form 941 Fast Video YouTube

At this time, the irs. Select back to form to get back to the main. It must be filed at least quarterly and sometimes. Web form 941 and schedule b (form 941) form 941x, adjusted employer's quarterly federal tax return, has been updated. Know exactly what you'll pay each month.

Web Irs Form 941 Instructions:

Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Know exactly what you'll pay each month. Click on reports at the top menu bar. Web if you file those in quickbooks desktop, you can follow the steps below to see those federal 941 from the 4th quarter of 2021.

Web Print The Federal 941, Check The Box On Line 16, And Enter The Date Final Wages Were Paid, Indicating That Your Business Has Closed And That You Do Not Need To File Returns In The.

I keep getting this error: Web you can pull up a tax worksheet from quickbooks for the details. Web form 941, also known as the employer’s quarterly federal tax return, is a crucial tax return that employers use to report their employees’ wages, tips, and withheld. Select employees & payroll, then click more payroll reports in.

Select Either Form 941 Or 944 In The Tax Reports Section Of Print Reports.

The process to pay and file quickbooks form 941 manually how to print form 941 from. Pay as you go, cancel any time. Let freshbooks crunch the numbers for you Select any any line or box for irs instructions and quickbooks information and troubleshooting steps.

March 2023) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal Revenue Service Employer Identification Number.

At this time, the irs. Web form 941 and schedule b (form 941) form 941x, adjusted employer's quarterly federal tax return, has been updated. Spend less time on tax compliance with an avalara avatax plug in for quickbooks. Web first, complete form 8655 reporting agent authorization.