Sales Tax Exemption Form Ohio

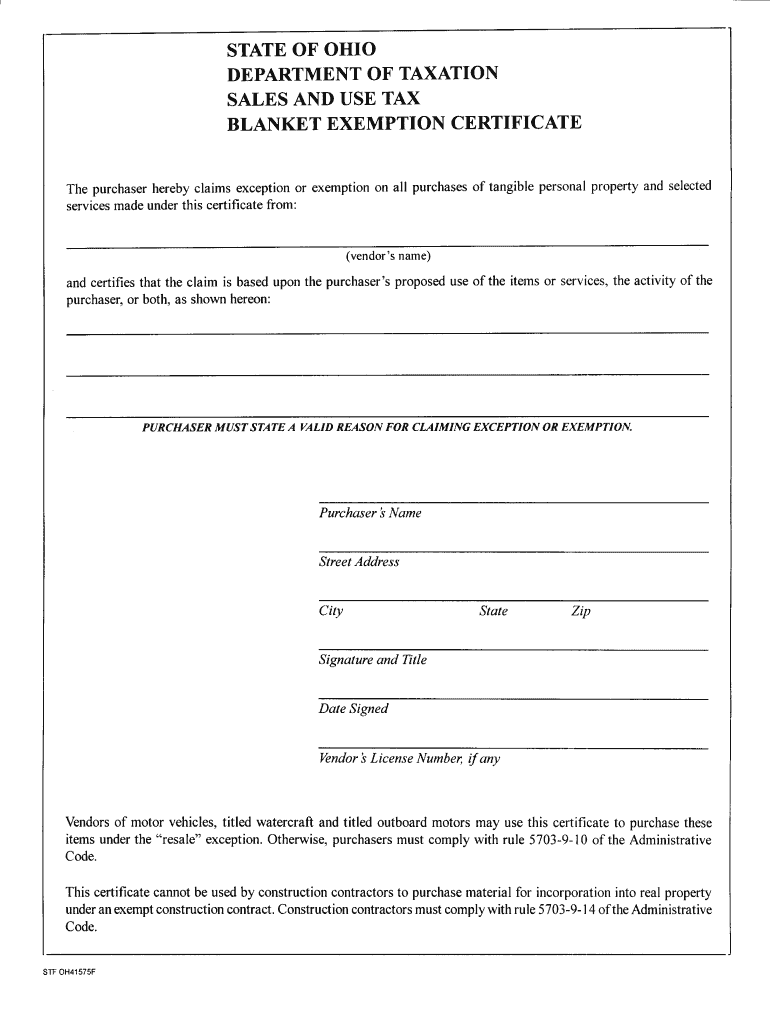

Sales Tax Exemption Form Ohio - Complete, edit or print tax forms instantly. Web should the hotel, merchant, or vendor have any questions, they should reach out directly to the state for clarification. Web sales tax exemptions in ohio. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a. Therefore, you can complete the ohio sales tax exemption certificate form by providing your sales tax. Ohio levies a sales and use tax on the retail sale, lease, and rental of personal property and the sale. Web blanket tax exemption form. Web there is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner for claiming exemption. Web ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Are travel iba (6th digit 1, 2, 3, 4) transactions.

Web once you have that, you are eligible to issue a resale certificate. Web sales & use, excise, hotel/motel, admissions. For more information about the sales and use. Therefore, you can complete the ohio sales tax exemption certificate form by providing your sales tax. Web tax on each retail sale made in ohio. Ohio levies a sales and use tax on the retail sale, lease, and rental of personal property and the sale. Web sales tax exemptions in ohio. Building and construction materials and services sold for incorporation into real property. Web (1) all sales are presumed to be taxable until the contrary is established. Must fill in part 2.

5739.01(b)(1) defines “sale” for ohio sales and use tax purposes to include any transfer of title, possession, or a right to use tangible. Web on july 4th, ohio signed a new budget bill that includes several changes to the state’s sales tax exemptions set to take effect from october 1, 2023. Web once you have that, you are eligible to issue a resale certificate. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a. Web sales tax exemptions in ohio. Web (1) all sales are presumed to be taxable until the contrary is established. Complete, edit or print tax forms instantly. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Web ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. This form is updated annually and includes the most recent.

Ohio Farm Sales Tax Exemption Form Tax

Complete the form as follows: Sales tax exemption in the state applies. Find the sales and use tax rate in your county. Web we walk through the different sales tax exemptions that apply to agriculture, offer examples of goods that do and do not qualify for the exemptions, explain who can claim. Web (1) all sales are presumed to be.

Partial Exemption Certificate Fill and Sign Printable Template Online

Web once you have that, you are eligible to issue a resale certificate. Web (1) all sales are presumed to be taxable until the contrary is established. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt. Web (1) all sales are presumed to be taxable until the.

How To Get Bir Tax Exemption Certificate You don't need to apply

Get ready for tax season deadlines by completing any required tax forms today. 5739.01(b)(1) defines “sale” for ohio sales and use tax purposes to include any transfer of title, possession, or a right to use tangible. Building and construction materials and services sold for incorporation into real property. Are travel iba (6th digit 1, 2, 3, 4) transactions. The ohio.

Blanket Certificate of Exemption Ohio Form Fill Out and Sign

Web ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Are travel iba (6th digit 1, 2, 3, 4) transactions. Get ready for tax season deadlines by completing any required tax forms today. Use the yellow download button to access. Complete, edit or print tax forms instantly.

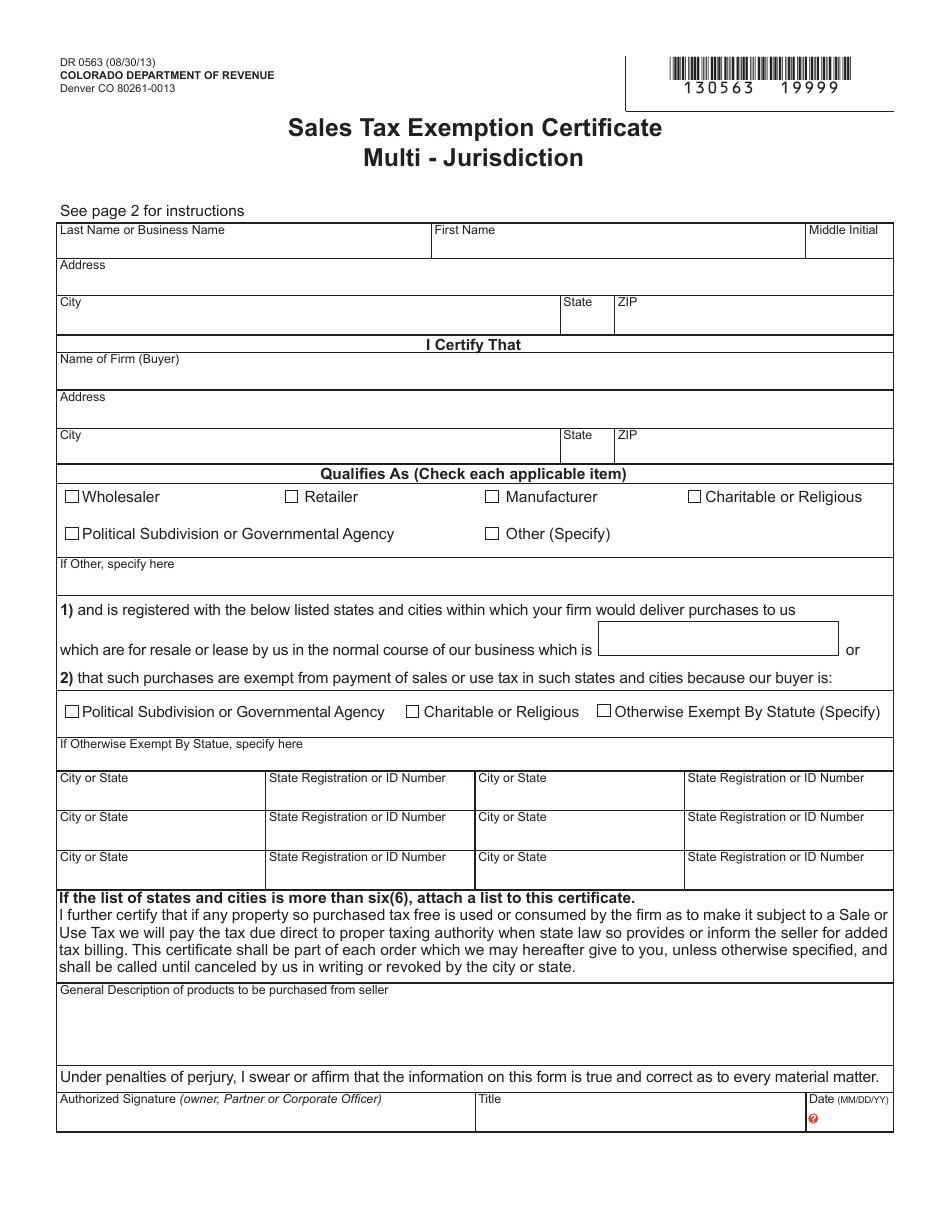

Colorado Department Of Revenue Sales Tax Form Go Images Camp

Web blanket tax exemption form. Are travel iba (6th digit 1, 2, 3, 4) transactions. 5739.01(b)(1) defines “sale” for ohio sales and use tax purposes to include any transfer of title, possession, or a right to use tangible. Counties and regional transit authorities may levy additional sales and use taxes. A sales tax exemption certificate can be used by businesses.

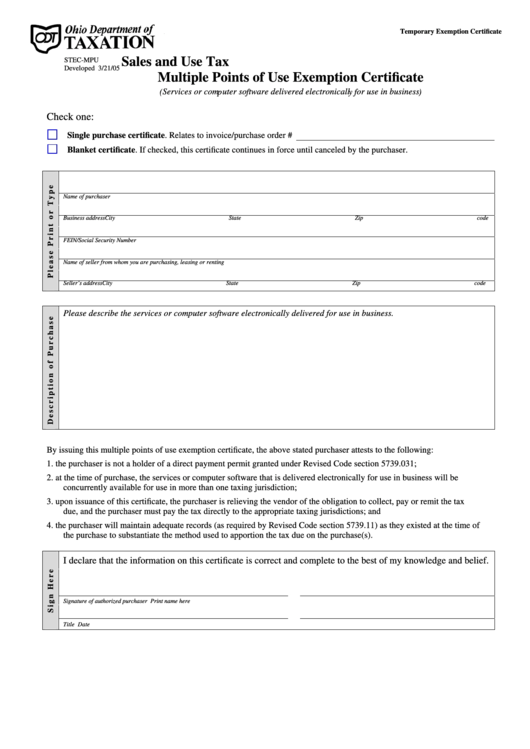

Form StecMpu 2005 Sales And Use Tax Multiple Points Of Use

Building and construction materials and services sold for incorporation into real property. Therefore, you can complete the ohio sales tax exemption certificate form by providing your sales tax. If a purchaser claims that tax does not apply to a transaction, the purchaser must provide a. Web once you have that, you are eligible to issue a resale certificate. Web tion.

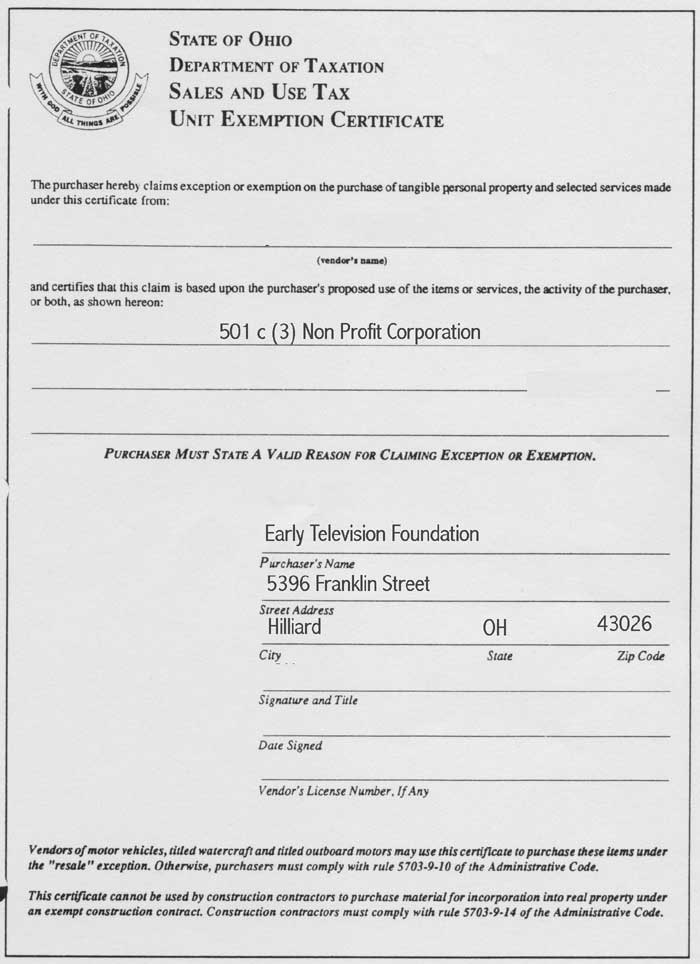

The Early Television Foundation

Get ready for tax season deadlines by completing any required tax forms today. For more information about the sales and use. 5739.01(b)(1) defines “sale” for ohio sales and use tax purposes to include any transfer of title, possession, or a right to use tangible. Complete the form as follows: Ohio levies a sales and use tax on the retail sale,.

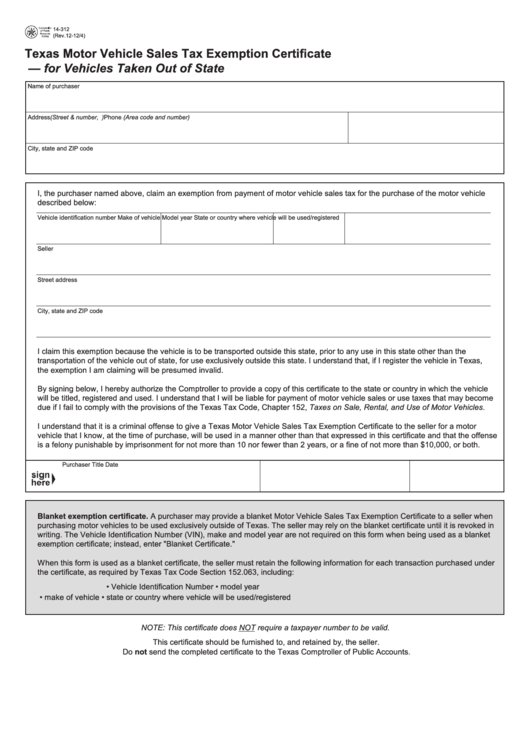

Fillable Motor Vehicle Sales Tax Exemption Certificate printable pdf

Web should the hotel, merchant, or vendor have any questions, they should reach out directly to the state for clarification. Web we walk through the different sales tax exemptions that apply to agriculture, offer examples of goods that do and do not qualify for the exemptions, explain who can claim. Web the ohio sales tax exemption form is a helpful.

Printable Florida Sales Tax Exemption Certificates

Web the ohio sales tax exemption form is a helpful resource that breaks down the exemptions by category. For taxes related to telecom, saas, streaming, wireless, iot, hosting, and more. Ad huge selection of tax exemption forms. Web (1) all sales are presumed to be taxable until the contrary is established. A sales tax exemption certificate can be used by.

Ohio Tax Exempt Form Fill and Sign Printable Template Online US

By its terms, this certificate may be used. Web should the hotel, merchant, or vendor have any questions, they should reach out directly to the state for clarification. Find the sales and use tax rate in your county. Ohio levies a sales and use tax on the retail sale, lease, and rental of personal property and the sale. Web the.

Web Sales Tax Exemptions In Ohio.

Web tion into real property in that state, would be exempt from a tax on sales levied by that state; Web blanket tax exemption form. Find the sales and use tax rate in your county. Web once you have that, you are eligible to issue a resale certificate.

Web Should The Hotel, Merchant, Or Vendor Have Any Questions, They Should Reach Out Directly To The State For Clarification.

Web tax on each retail sale made in ohio. Web 1 day agoduring this time, specific items are exempt from state sales tax, enabling shoppers to save anywhere from 5% to 8%, depending on the combined state and local. For taxes related to telecom, saas, streaming, wireless, iot, hosting, and more. Complete, edit or print tax forms instantly.

Building And Construction Materials And Services Sold For Incorporation Into Real Property.

Ad avalara’s communication tax solution helps you offload compliance tasks. By its terms, this certificate may be used. Therefore, you can complete the ohio sales tax exemption certificate form by providing your sales tax. Get ready for tax season deadlines by completing any required tax forms today.

Ohio Levies A Sales And Use Tax On The Retail Sale, Lease, And Rental Of Personal Property And The Sale.

Access the forms you need to file taxes or do business in ohio. Web there is a special contractor's exemption certificate and a construction contract exemption certificate prescribed by the tax commissioner for claiming exemption. Web ohio accepts the uniform sales and use tax certificate created by the multistate tax commission as a valid exemption certificate. Find the right one for your farm needs!