Schedule A Form 990 Ez

Schedule A Form 990 Ez - Web go to www.irs.gov/form990ez for instructions and the latest information. Enter amount of tax imposed on organization managers or. Complete, edit or print tax forms instantly. If you checked 12d of part i, complete sections a and d, and complete part v.). Also known as a public charity status and public support form, it is attached to form 990 or. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Complete, edit or print tax forms instantly. Go to www.irs.gov/form990 for the. Instructions for these schedules are. The information provided will enable you to file a more complete return and reduce the.

Get ready for tax season deadlines by completing any required tax forms today. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Web go to www.irs.gov/form990ez for instructions and the latest information. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. For other organizations that file. Instructions for these schedules are. Complete, edit or print tax forms instantly. Web create my document a schedule a form is used by the internal revenue service. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19. Also known as a public charity status and public support form, it is attached to form 990 or.

Enter amount of tax imposed on organization managers or. Ad access irs tax forms. Also known as a public charity status and public support form, it is attached to form 990 or. The information provided will enable you to file a more complete return and reduce the. If you checked 12d of part i, complete sections a and d, and complete part v.). Complete, edit or print tax forms instantly. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Ad access irs tax forms. Go to www.irs.gov/form990 for the. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions.

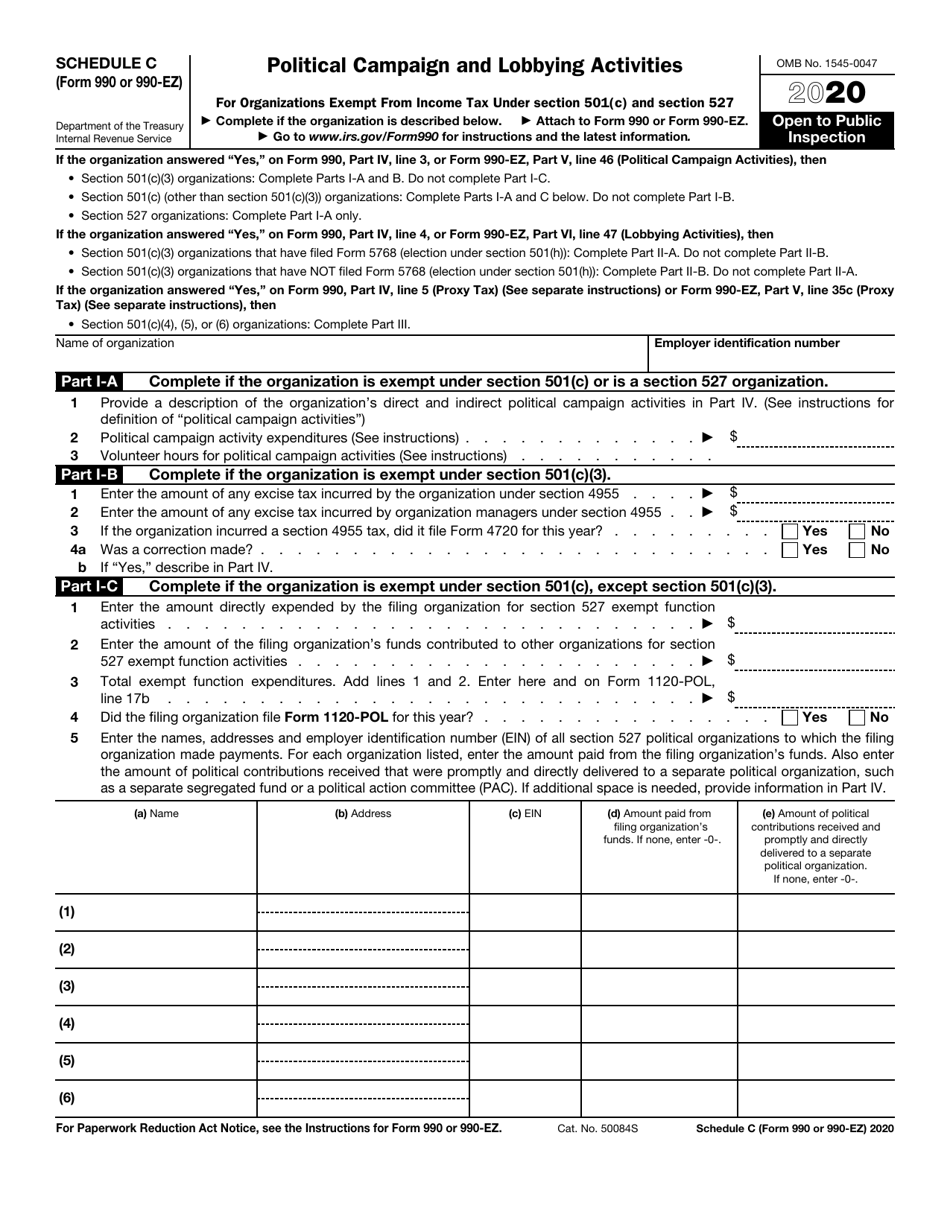

IRS Form 990 (990EZ) Schedule C Download Fillable PDF or Fill Online

Enter amount of tax imposed on organization managers or. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web go to www.irs.gov/form990ez for instructions and the latest information. Ad access irs tax.

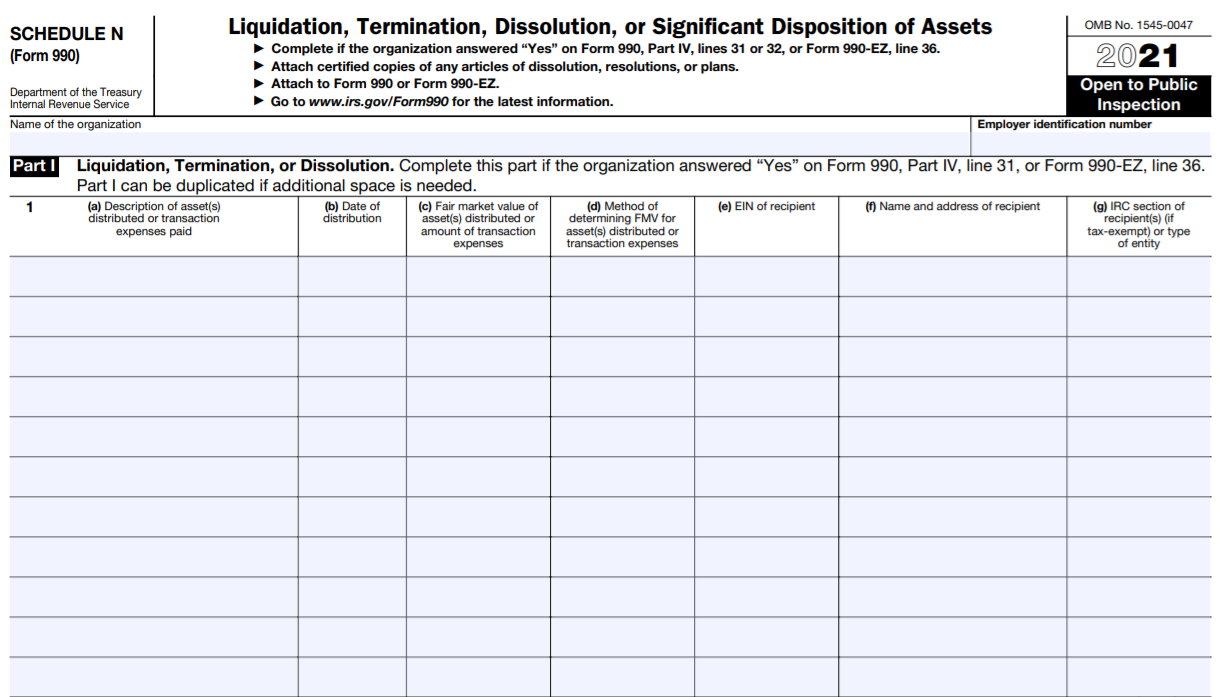

IRS Form 990/990EZ Schedule N Instructions Liquidation, Termination

For other organizations that file. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. Go to www.irs.gov/form990 for the. If you checked 12d of part i, complete sections a and d, and complete part v.). Get ready for tax season deadlines by completing any required tax forms today.

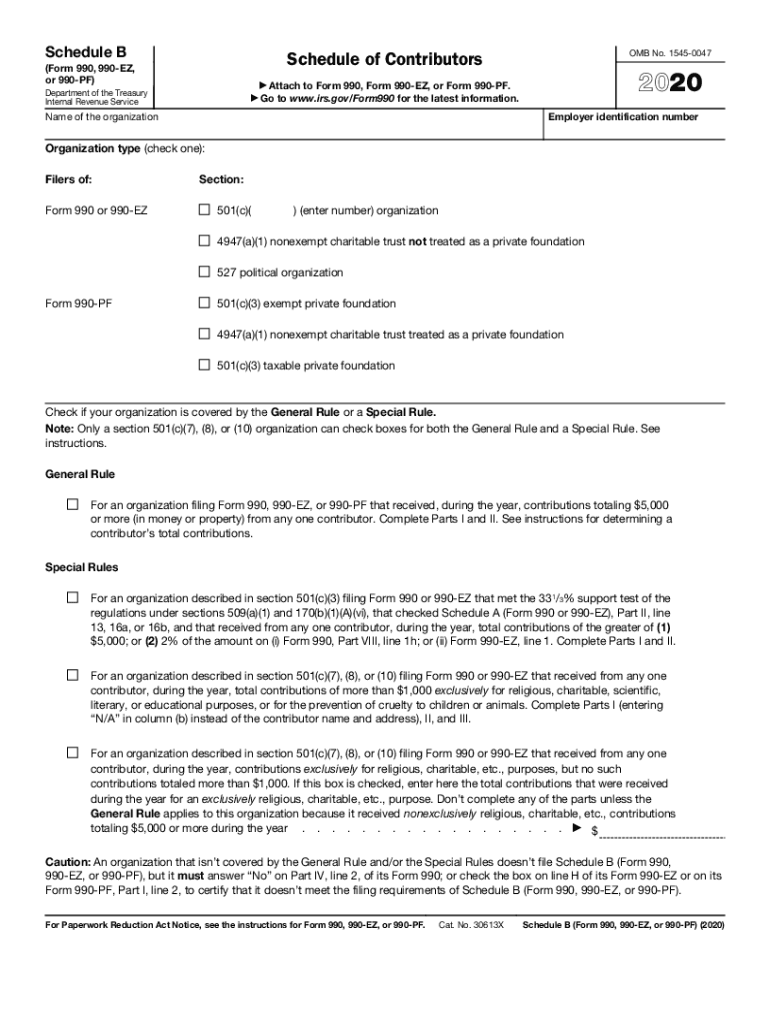

How To Fill Out Form 990 Ez 2020 Blank Sample to Fill out Online in PDF

Also known as a public charity status and public support form, it is attached to form 990 or. For other organizations that file. Go to www.irs.gov/form990 for the. Ad access irs tax forms. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19.

990 T Printable Irs Forms 2019 Fill Out Digital PDF Sample

Web schedule a (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3). Complete, edit or print tax forms instantly. The information provided will enable you to file a more complete return and reduce the. If you checked 12d of part i, complete sections a and d,.

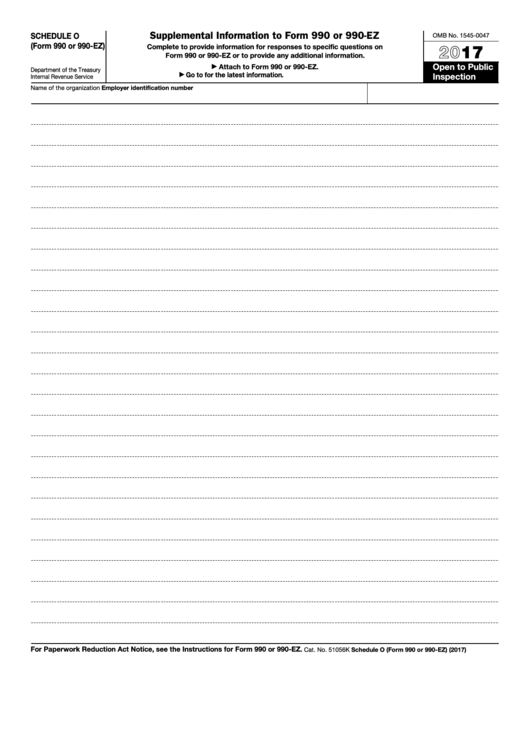

form 990 schedule o Fill Online, Printable, Fillable Blank form990

Web go to www.irs.gov/form990ez for instructions and the latest information. If you checked 12d of part i, complete sections a and d, and complete part v.). Get ready for tax season deadlines by completing any required tax forms today. The information provided will enable you to file a more complete return and reduce the. Complete, edit or print tax forms.

Form 990 (Schedule R) 2019 Blank Sample to Fill out Online in PDF

Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Web create my document a schedule a form is used by the internal revenue service. Complete, edit or print tax forms instantly. Ad access irs tax forms. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19.

IRS Form 990EZ 2018 2019 Printable & Fillable Sample in PDF

Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Instructions for these schedules are. Enter amount of tax imposed on organization managers or. For organizations with gross receipts greater than $100,000, we have a sliding scale fee structure starting at $41. For other organizations that file.

IRS Instructions Schedule A (990 Or 990EZ) 20202022 Fill out Tax

Ad access irs tax forms. Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. For other organizations that file. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web go to www.irs.gov/form990ez for instructions and the latest information.

199N E Postcard Fill Out and Sign Printable PDF Template signNow

Enter amount of tax imposed on organization managers or. The information provided will enable you to file a more complete return and reduce the. Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

Fillable Schedule O (Form 990 Or 990Ez) Supplemental Information To

For other organizations that file. Also known as a public charity status and public support form, it is attached to form 990 or. The information provided will enable you to file a more complete return and reduce the. Web schedule a (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization.

For Organizations With Gross Receipts Greater Than $100,000, We Have A Sliding Scale Fee Structure Starting At $41.

Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Web if yes, complete schedule l, part i section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Complete, edit or print tax forms instantly.

If You Checked 12D Of Part I, Complete Sections A And D, And Complete Part V.).

Web schedule a (form 990) department of the treasury internal revenue service public charity status and public support complete if the organization is a section 501(c)(3). Go to www.irs.gov/form990 for the. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. The information provided will enable you to file a more complete return and reduce the.

Instructions For These Schedules Are.

Complete, edit or print tax forms instantly. Enter amount of tax imposed on organization managers or. Ad access irs tax forms. Also known as a public charity status and public support form, it is attached to form 990 or.

For Other Organizations That File.

Web go to www.irs.gov/form990ez for instructions and the latest information. Web create my document a schedule a form is used by the internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. At a minimum, the schedule must be used to answer form 990, part vi, lines 11b and 19.