Schedule A Form 990

Schedule A Form 990 - Note that all organizations filing form 990 must file schedule o. Some months may have more than one entry due to the size of the download. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations). Open to public go to www.irs.gov/form990 Web schedule a (form 990) 2022 (all organizations must complete this part.) see instructions. The organization is not a private foundation because it is: Web schedule a is required for section 501 (c)3 organizations or section 4947 (a) (1) charitable trusts. The download files are organized by month. “yes,” and if the organization answered “no” to line 12a, then completing schedule d, parts xi and xii is optional : Although there are six parts to the schedule, only certain parts need to be completed based on the organization’s reason for public charity status, indicated in part i.

(for lines 1 through 12, check only one box.) a church, convention of churches, or association of churches described in a school described in (attach schedule e (form 990).) “yes,” and if the organization answered “no” to line 12a, then completing schedule d, parts xi and xii is optional : Open to public go to www.irs.gov/form990 Instructions for these schedules are combined with the schedules. Some months may have more than one entry due to the size of the download. Web schedule a is required for section 501 (c)3 organizations or section 4947 (a) (1) charitable trusts. Although there are six parts to the schedule, only certain parts need to be completed based on the organization’s reason for public charity status, indicated in part i. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or form 990pf. Note that all organizations filing form 990 must file schedule o. On this page you may download the 990 series filings on record for 2021.

Note that all organizations filing form 990 must file schedule o. Some months may have more than one entry due to the size of the download. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or form 990pf. The organization is not a private foundation because it is: Open to public go to www.irs.gov/form990 Although there are six parts to the schedule, only certain parts need to be completed based on the organization’s reason for public charity status, indicated in part i. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. “yes,” and if the organization answered “no” to line 12a, then completing schedule d, parts xi and xii is optional : On this page you may download the 990 series filings on record for 2021. Instructions for these schedules are combined with the schedules.

Form 990 (Schedule J) Compensation Information Form (2015) Free Download

The download files are organized by month. The organization is not a private foundation because it is: Web schedule a is required for section 501 (c)3 organizations or section 4947 (a) (1) charitable trusts. Some months may have more than one entry due to the size of the download. Web nonprofit explorer has organizations claiming tax exemption in each of.

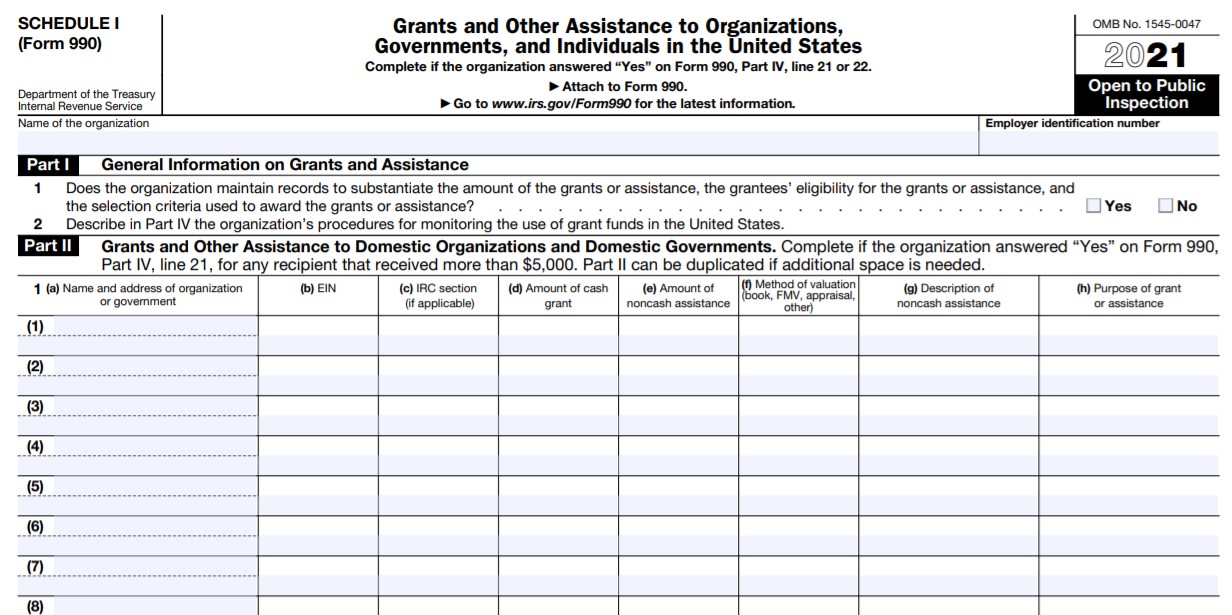

IRS Form 990 Schedule I Instructions Grants & Other Assistance

Some months may have more than one entry due to the size of the download. On this page you may download the 990 series filings on record for 2021. Web the following schedules to form 990, return of organization exempt from income tax, do not have separate instructions. Web schedule a (form 990) 2022 (all organizations must complete this part.).

Free Aia Schedule Of Values Form Form Resume Examples 7mk90WmOGY

Although there are six parts to the schedule, only certain parts need to be completed based on the organization’s reason for public charity status, indicated in part i. The download files are organized by month. “yes,” and if the organization answered “no” to line 12a, then completing schedule d, parts xi and xii is optional : Web schedule a (form.

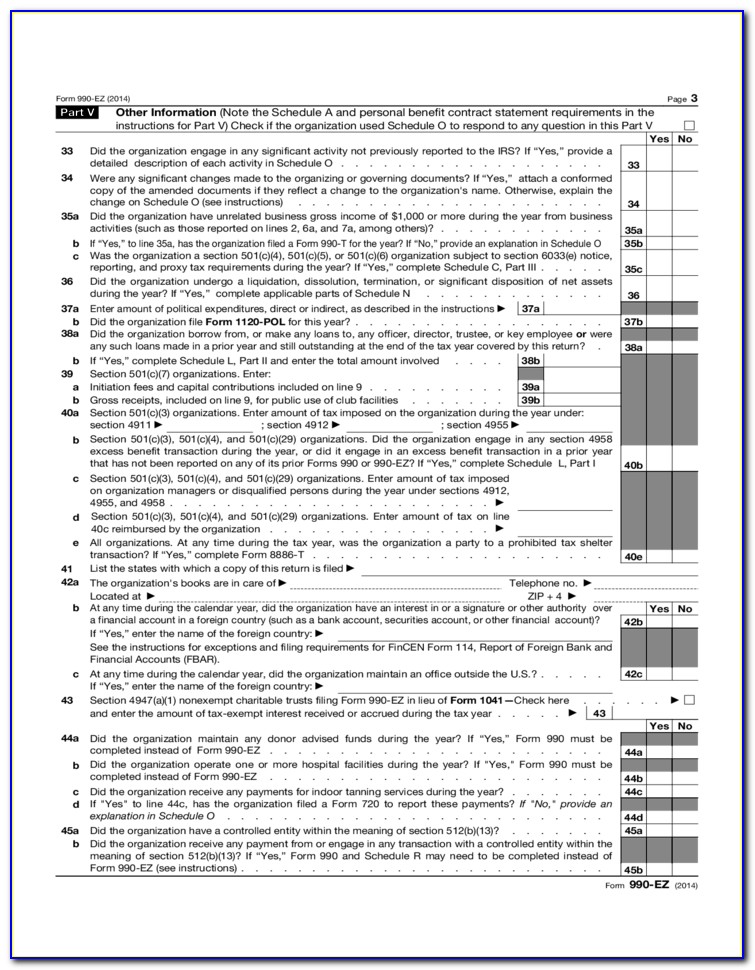

form 990 schedule o Fill Online, Printable, Fillable Blank form990

“yes,” and if the organization answered “no” to line 12a, then completing schedule d, parts xi and xii is optional : The organization is not a private foundation because it is: Web schedule a (form 990) 2022 (all organizations must complete this part.) see instructions. Note that all organizations filing form 990 must file schedule o. Although there are six.

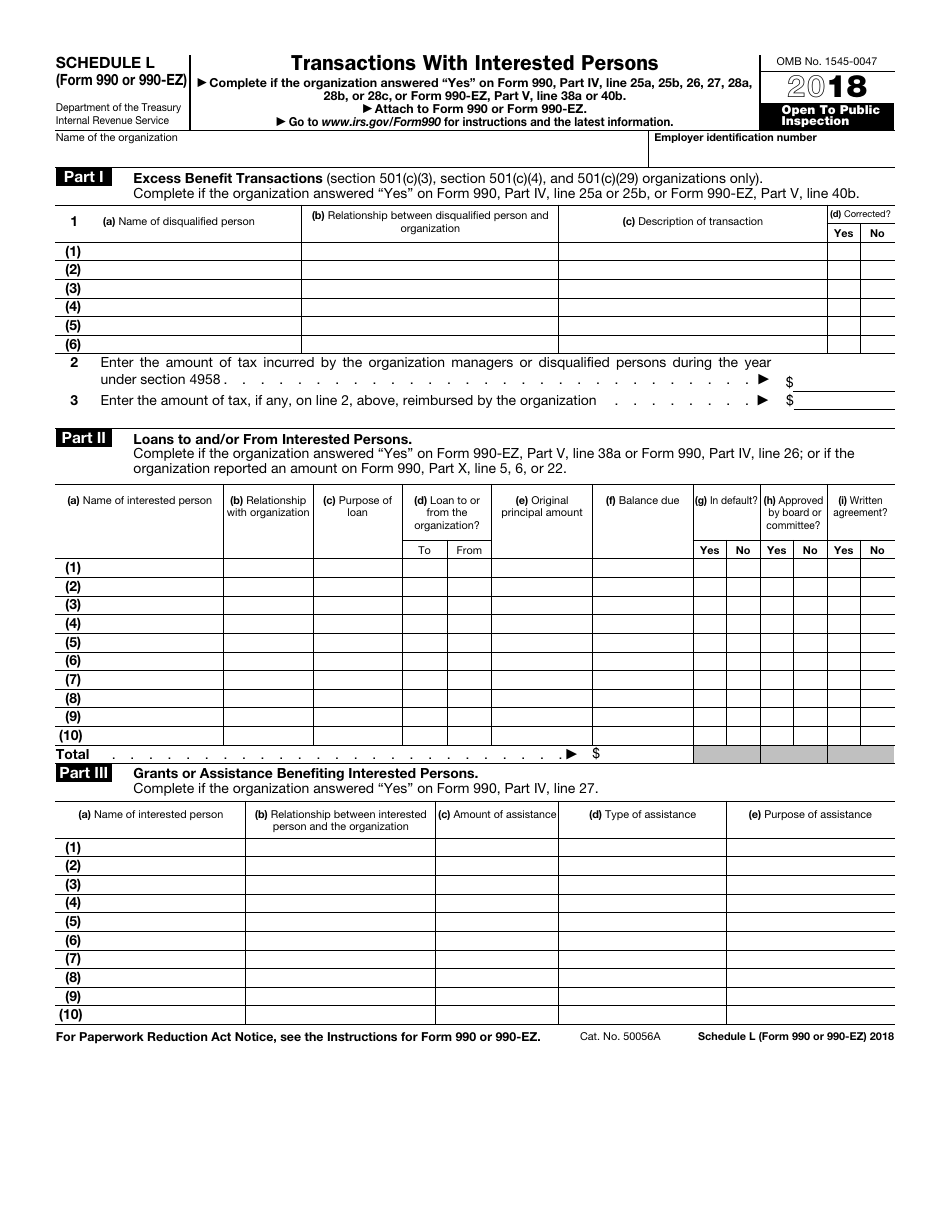

IRS Form 990 (990EZ) Schedule L Download Fillable PDF or Fill Online

The download files are organized by month. Web schedule a (form 990) 2022 (all organizations must complete this part.) see instructions. Although there are six parts to the schedule, only certain parts need to be completed based on the organization’s reason for public charity status, indicated in part i. “yes,” and if the organization answered “no” to line 12a, then.

Form 990 (Schedule H) Hospitals (2014) Free Download

Web schedule a is required for section 501 (c)3 organizations or section 4947 (a) (1) charitable trusts. “yes,” and if the organization answered “no” to line 12a, then completing schedule d, parts xi and xii is optional : Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code,.

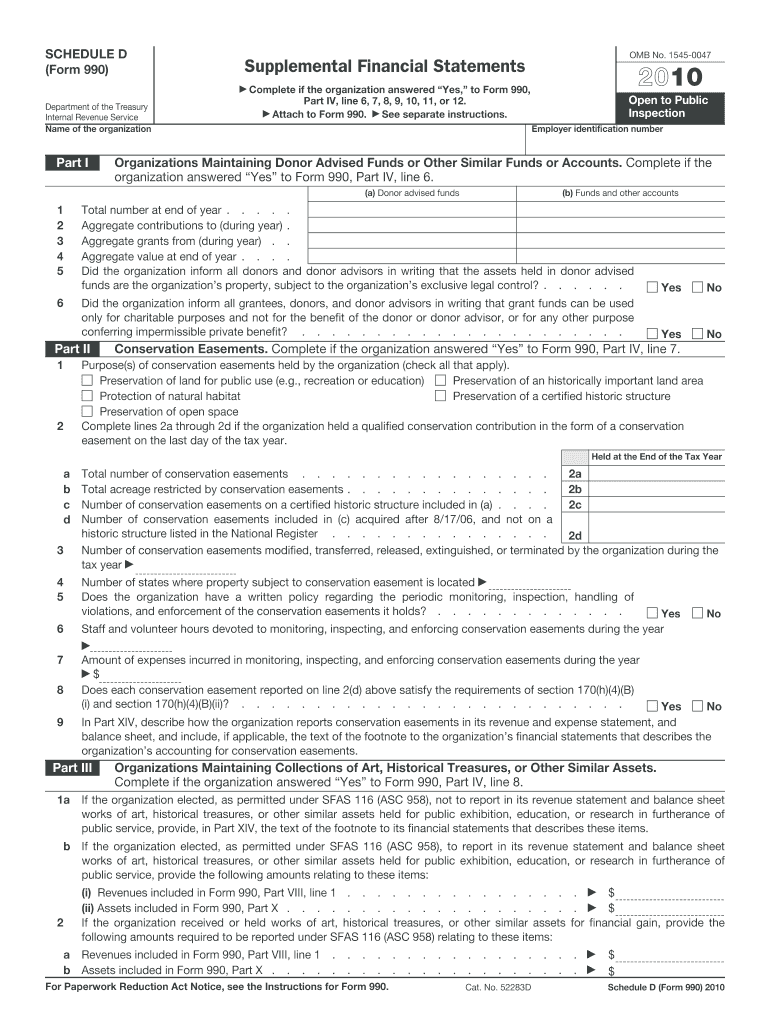

Form 990 Schedule D Fill Out and Sign Printable PDF Template signNow

The download files are organized by month. Instructions for these schedules are combined with the schedules. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or form 990pf. “yes,” and if the organization answered “no” to line 12a,.

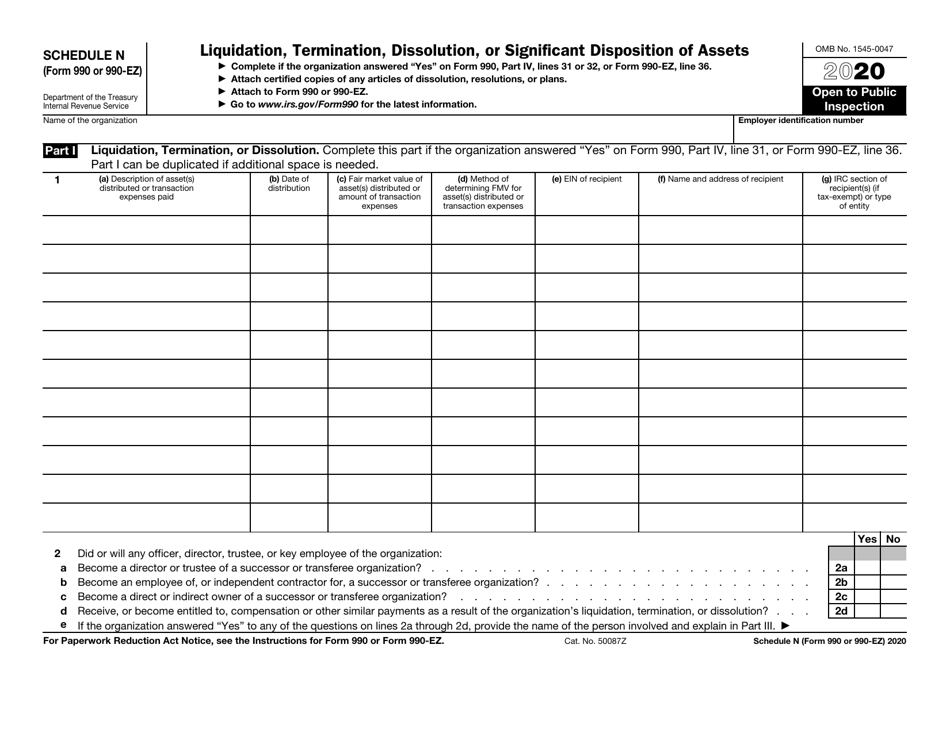

IRS Form 990 (990EZ) Schedule N Download Fillable PDF or Fill Online

Open to public go to www.irs.gov/form990 Web schedule a (form 990) 2022 (all organizations must complete this part.) see instructions. Although there are six parts to the schedule, only certain parts need to be completed based on the organization’s reason for public charity status, indicated in part i. Note that all organizations filing form 990 must file schedule o. Some.

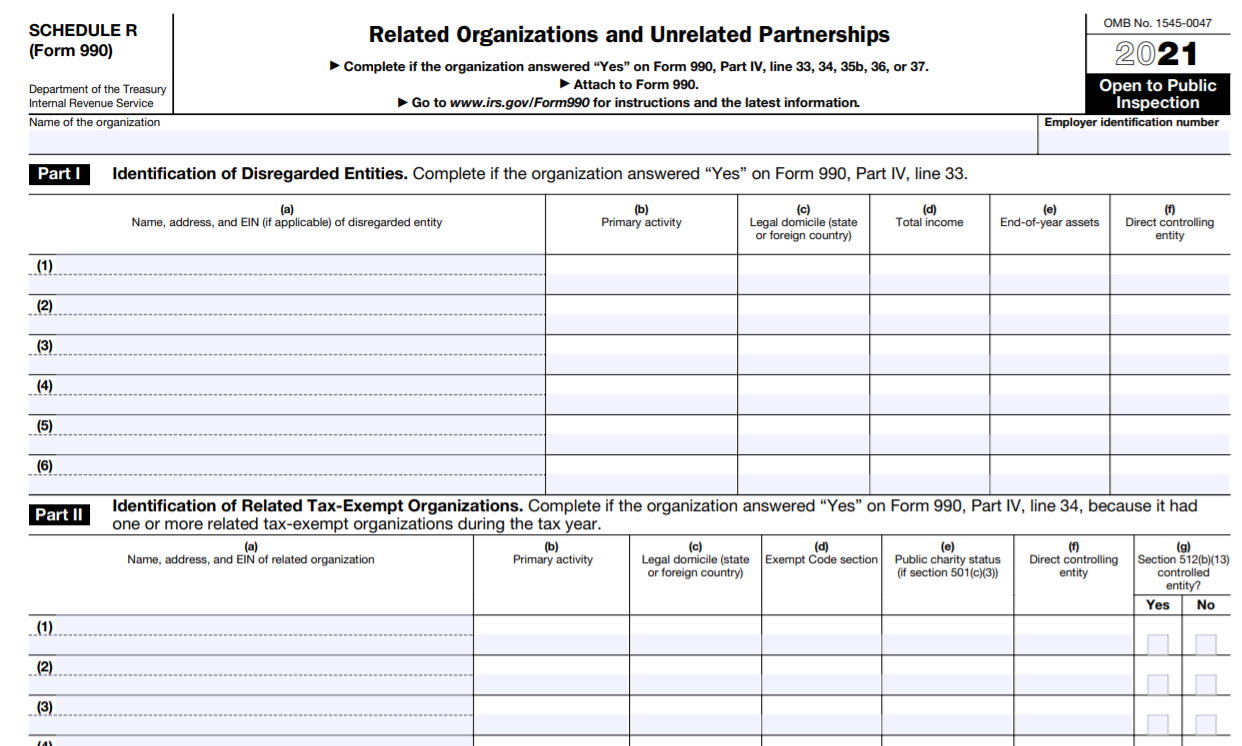

IRS Form 990 Schedule R Instructions Related Organizations and

On this page you may download the 990 series filings on record for 2021. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or form 990pf. The download files are organized by month. “yes,” and if the organization.

Online IRS Form 990 (Schedule I) 2018 2019 Fillable and Editable

The organization is not a private foundation because it is: Web schedule a is required for section 501 (c)3 organizations or section 4947 (a) (1) charitable trusts. Note that all organizations filing form 990 must file schedule o. Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code,.

Web The Following Schedules To Form 990, Return Of Organization Exempt From Income Tax, Do Not Have Separate Instructions.

Web schedule a is required for section 501 (c)3 organizations or section 4947 (a) (1) charitable trusts. Web schedule a (form 990) 2022 (all organizations must complete this part.) see instructions. Open to public go to www.irs.gov/form990 (for lines 1 through 12, check only one box.) a church, convention of churches, or association of churches described in a school described in (attach schedule e (form 990).)

“Yes,” And If The Organization Answered “No” To Line 12A, Then Completing Schedule D, Parts Xi And Xii Is Optional :

Note that all organizations filing form 990 must file schedule o. On this page you may download the 990 series filings on record for 2021. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations). Web nonprofit explorer has organizations claiming tax exemption in each of the 27 subsections of the 501(c) section of the tax code, and which have filed a form 990, form 990ez or form 990pf.

Instructions For These Schedules Are Combined With The Schedules.

The organization is not a private foundation because it is: Although there are six parts to the schedule, only certain parts need to be completed based on the organization’s reason for public charity status, indicated in part i. The download files are organized by month. Some months may have more than one entry due to the size of the download.