Schedule B Form 941 Instructions

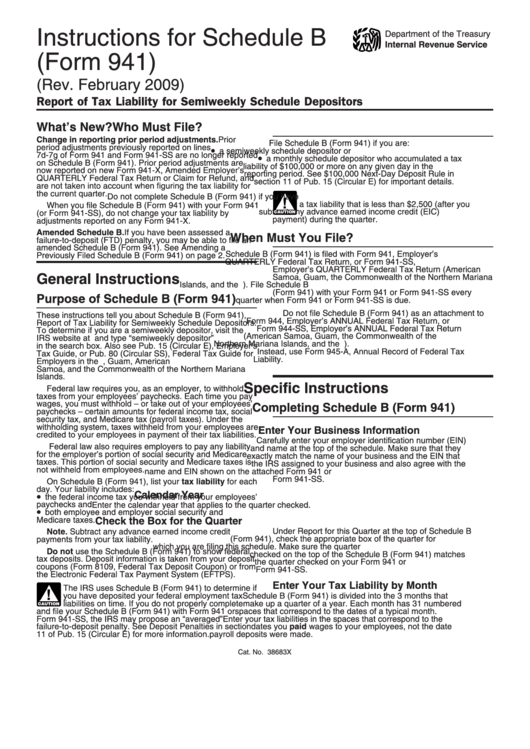

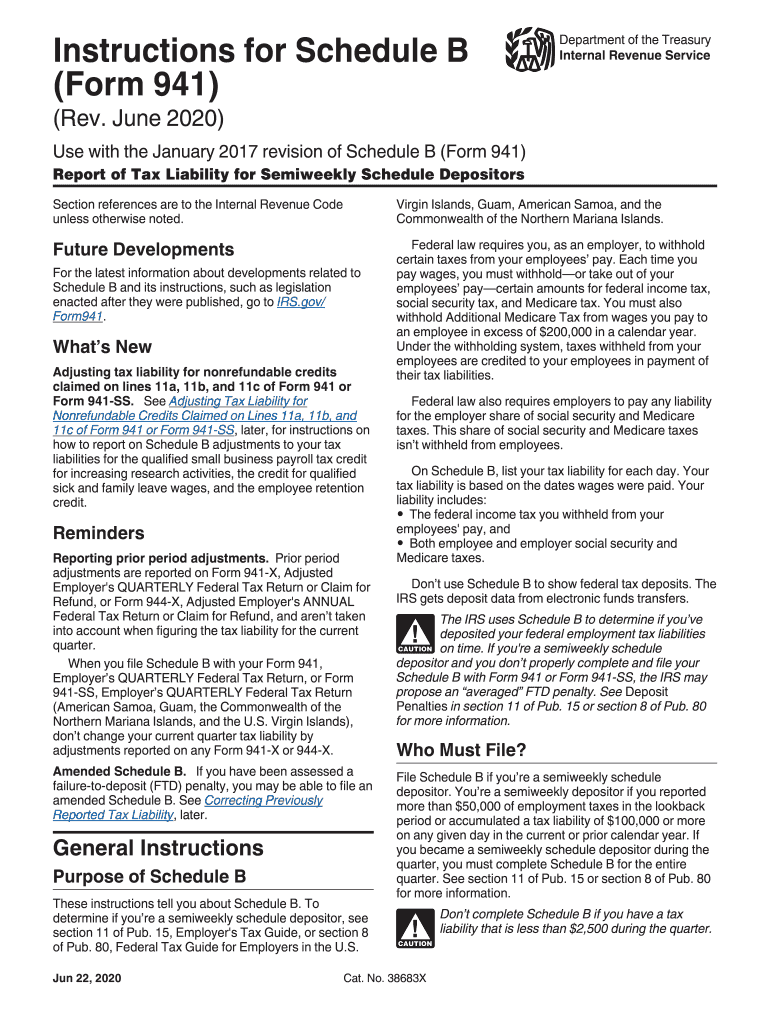

Schedule B Form 941 Instructions - Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Report of tax liability for semiweekly schedule depositors (rev. Explore instructions, filing requirements, and tips. Web the irs released final instructions for form 941 (employer’s quarterly federal tax return), schedule b (report of tax liability for semiweekly schedule depositors), and schedule r (allocation schedule for aggregate form 941 filers). Don’t file schedule b as an attachment to form 944, employer's annual federal tax return. Don't change your tax liability on schedule b (form 941) by. Type or print within the boxes. Web department of the treasury internal revenue service (form 941) (rev. Don't file schedule b (form 941) with your form 941 if you’re a monthly schedule depositor. October, november, december go to www.irs.gov/form941 for instructions and the latest information.

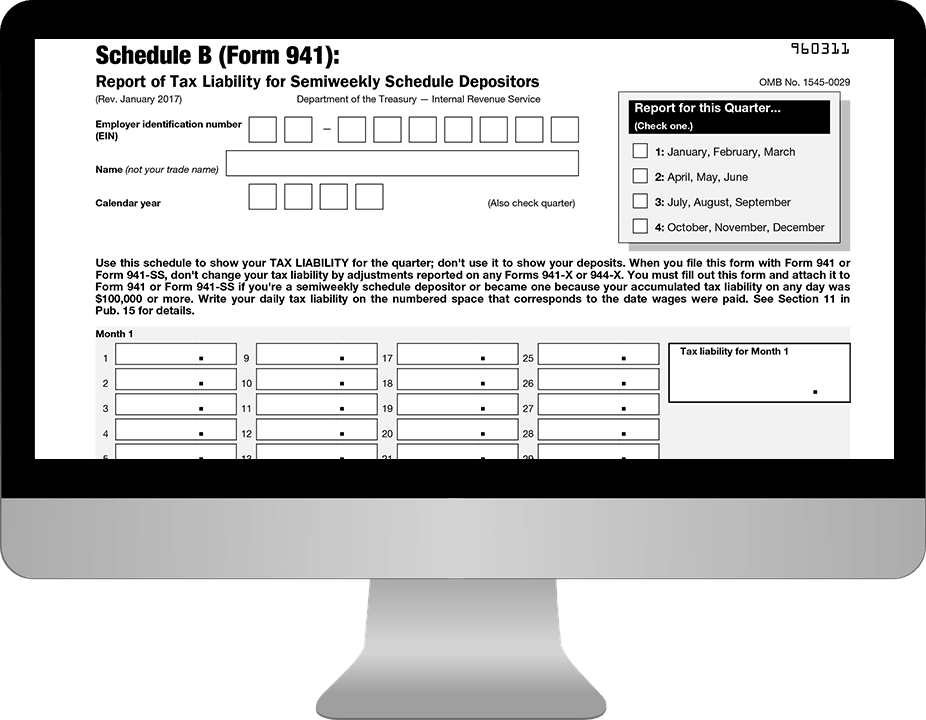

It also reports the employer's share of social security and medicare taxes withheld during the. Be it wages, salaries, bonuses, tips, and other variables. Schedule b accompanies form 941, it’s a daily report of the employer's tax liability for federal income tax withheld from employees. Form 941 here’s a simple tax guide to help you understand form 941 schedule b. Type or print within the boxes. Web schedule b is filed with form 941. Don't file schedule b (form 941) with your form 941 if you’re a monthly schedule depositor. Individual tax return form 1040 instructions; Web you must complete schedule b (form 941) and submit it with your form 941. Web the irs released final instructions for form 941 (employer’s quarterly federal tax return), schedule b (report of tax liability for semiweekly schedule depositors), and schedule r (allocation schedule for aggregate form 941 filers).

Web popular forms & instructions; Web you must complete schedule b (form 941) and submit it with your form 941. January 2017) department of the treasury — internal revenue service 960311 omb no. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Read the separate instructions before you complete form 941. This will help taxpayers feel more prepared when it is. What is irs form 941 schedule b? Employers are required to withhold a certain amount from their employee’s pay. Report of tax liability for semiweekly schedule depositors (rev. It also reports the employer's share of social security and medicare taxes withheld during the.

IRS Form 941 Schedule B 2023

Web department of the treasury internal revenue service (form 941) (rev. Type or print within the boxes. Web schedule b is filed with form 941. Form 941 here’s a simple tax guide to help you understand form 941 schedule b. Employers are required to withhold a certain amount from their employee’s pay.

How to File Schedule B for Form 941

Therefore, the due date of schedule b is the same as the due date for the applicable form 941. January 2017) department of the treasury — internal revenue service 960311 omb no. Web schedule b (form 941): October, november, december go to www.irs.gov/form941 for instructions and the latest information. Be it wages, salaries, bonuses, tips, and other variables.

Form 941 Employer's Quarterly Federal Tax Return Form 941 Employer…

Report of tax liability for semiweekly schedule depositors (rev. Web schedule b is filed with form 941. Schedule b accompanies form 941, it’s a daily report of the employer's tax liability for federal income tax withheld from employees. Don't file schedule b (form 941) with your form 941 if you’re a monthly schedule depositor. This will help taxpayers feel more.

941 form 2020 schedule b Fill Online, Printable, Fillable Blank

Don't change your tax liability on schedule b (form 941) by. Web the irs released final instructions for form 941 (employer’s quarterly federal tax return), schedule b (report of tax liability for semiweekly schedule depositors), and schedule r (allocation schedule for aggregate form 941 filers). Web you must complete schedule b (form 941) and submit it with your form 941..

Instructions For Schedule B (Form 941) Report Of Tax Liability For

October, november, december go to www.irs.gov/form941 for instructions and the latest information. Web schedule b (form 941): It also reports the employer's share of social security and medicare taxes withheld during the. Don't change your tax liability on schedule b (form 941) by. Don’t file schedule b as an attachment to form 944, employer's annual federal tax return.

IRS Instructions 941 Schedule B 2020 Fill and Sign Printable

This will help taxpayers feel more prepared when it is. Employers are required to withhold a certain amount from their employee’s pay. The second quarter form 941 and its schedules, when applicable, are due july 31 (august. Schedule b accompanies form 941, it’s a daily report of the employer's tax liability for federal income tax withheld from employees. Don't change.

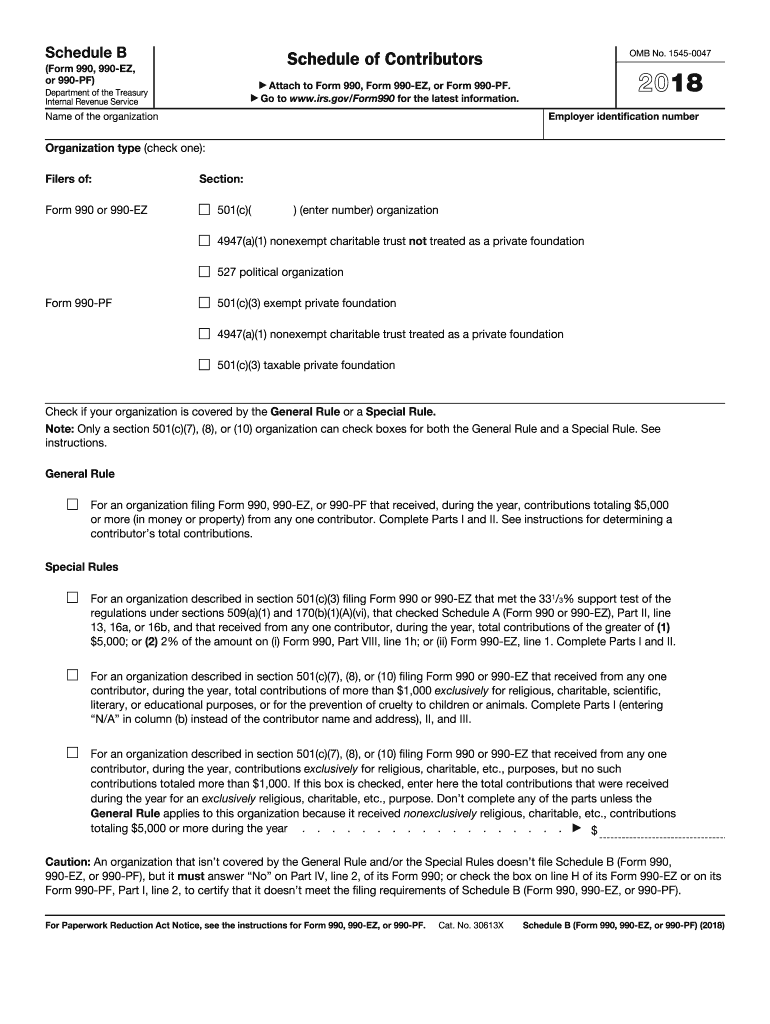

Form 990 Schedule O Fill Out and Sign Printable PDF Template signNow

Web you must complete schedule b (form 941) and submit it with your form 941. Form 941 here’s a simple tax guide to help you understand form 941 schedule b. Don’t file schedule b as an attachment to form 944, employer's annual federal tax return. Don't change your tax liability on schedule b (form 941) by. Schedule b accompanies form.

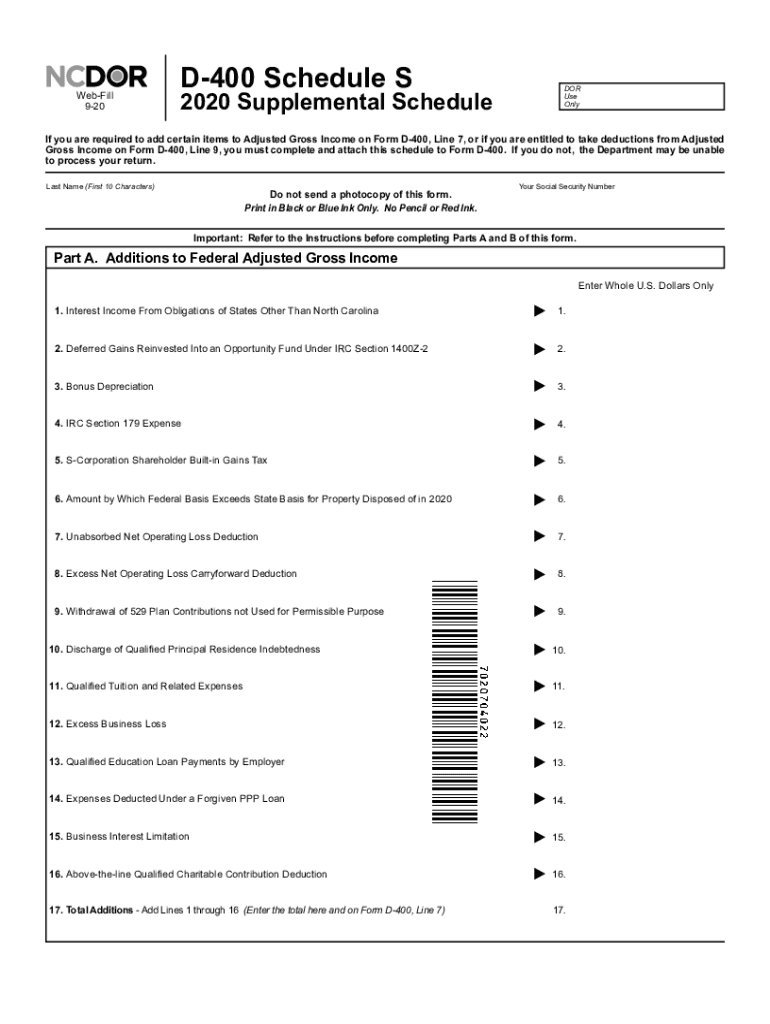

400 Schedule S Fill Out and Sign Printable PDF Template signNow

Read the separate instructions before you complete form 941. Web popular forms & instructions; (check one.) employer identification number (ein) — 1: Web the irs released final instructions for form 941 (employer’s quarterly federal tax return), schedule b (report of tax liability for semiweekly schedule depositors), and schedule r (allocation schedule for aggregate form 941 filers). Web department of the.

Fillable Form 941 for 2021 Create IRS 941 Form Fillable 2021

Be it wages, salaries, bonuses, tips, and other variables. Explore instructions, filing requirements, and tips. Web popular forms & instructions; Don't change your tax liability on schedule b (form 941) by. Therefore, the due date of schedule b is the same as the due date for the applicable form 941.

Fillable Form 941 Schedule B 2020 Download Printable 941 for Free

Report of tax liability for semiweekly schedule depositors (rev. Read the separate instructions before you complete form 941. Web the irs released final instructions for form 941 (employer’s quarterly federal tax return), schedule b (report of tax liability for semiweekly schedule depositors), and schedule r (allocation schedule for aggregate form 941 filers). Therefore, the due date of schedule b is.

Web The Irs Released Final Instructions For Form 941 (Employer’s Quarterly Federal Tax Return), Schedule B (Report Of Tax Liability For Semiweekly Schedule Depositors), And Schedule R (Allocation Schedule For Aggregate Form 941 Filers).

Schedule b accompanies form 941, it’s a daily report of the employer's tax liability for federal income tax withheld from employees. Web schedule b is filed with form 941. Web popular forms & instructions; Web schedule b (form 941):

Form 941 Here’s A Simple Tax Guide To Help You Understand Form 941 Schedule B.

Be it wages, salaries, bonuses, tips, and other variables. Read the separate instructions before you complete form 941. January 2017) department of the treasury — internal revenue service 960311 omb no. Don’t file schedule b as an attachment to form 944, employer's annual federal tax return.

(Check One.) Employer Identification Number (Ein) — 1:

Type or print within the boxes. Don't change your tax liability on schedule b (form 941) by. Don't file schedule b (form 941) with your form 941 if you’re a monthly schedule depositor. Web you must complete schedule b (form 941) and submit it with your form 941.

Therefore, The Due Date Of Schedule B Is The Same As The Due Date For The Applicable Form 941.

October, november, december go to www.irs.gov/form941 for instructions and the latest information. The second quarter form 941 and its schedules, when applicable, are due july 31 (august. June 2020) use with the january 2017 revision of schedule b (form 941) report of tax liability for semiweekly schedule depositors section references are to the internal revenue code unless otherwise noted. Report of tax liability for semiweekly schedule depositors (rev.