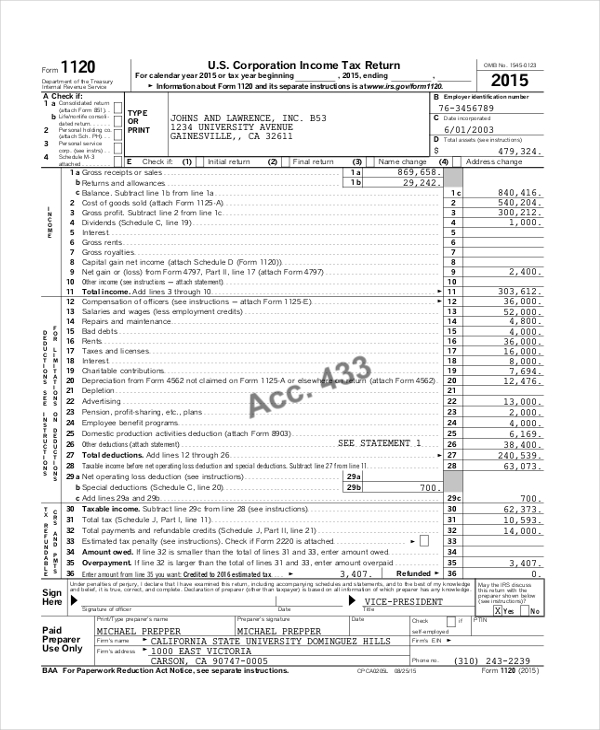

Schedule J Form 1120

Schedule J Form 1120 - Get ready for this year's tax season quickly and safely with pdffiller! Web up to $40 cash back fill sample 1120 filled out unclefed instantly, edit online. Web up to $40 cash back easily complete a printable irs 1040 schedule j form 2021 online. Aug 21, 2023 — use the same instructions for schedule j as provided in the 2023 form 1040a instructions. Ad easy guidance & tools for c corporation tax returns. Web schedule j 1120 form: Dividends, inclusions, and special deductions. A foreign corporation is any corporation. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or.

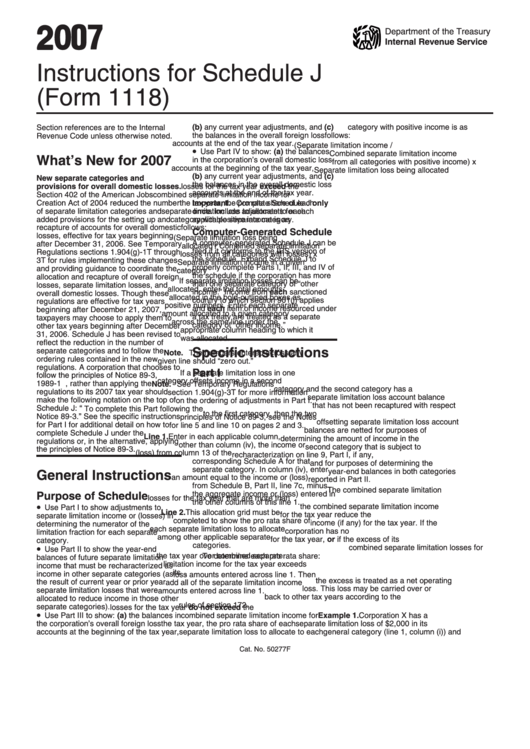

Aug 21, 2023 — use the same instructions for schedule j as provided in the 2023 form 1040a instructions. Ad easy guidance & tools for c corporation tax returns. Web recapture overall foreign losses that reduced u.s. Web up to $40 cash back fill sample 1120 filled out unclefed instantly, edit online. Web what is the purpose of schedule j? Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Enter the total amount you received during this tax period from a. Create a blank & editable. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or. Web up to $40 cash back easily complete a printable irs 1040 schedule j form 2021 online.

Web recapture overall foreign losses that reduced u.s. Web what is the purpose of schedule j? For tax years beginning after december 31, 2022, the inflation reduction act of 2022 (ira) imposes a corporate. To do this, treat a portion of the current year separate limitation. Get the free sample 1120 filled out 2011 form. Web up to $40 cash back easily complete a printable irs 1040 schedule j form 2021 online. A foreign corporation is any corporation. Get ready for this year's tax season quickly and safely with pdffiller! Dividends, inclusions, and special deductions. Web up to $40 cash back fill sample 1120 filled out unclefed instantly, edit online.

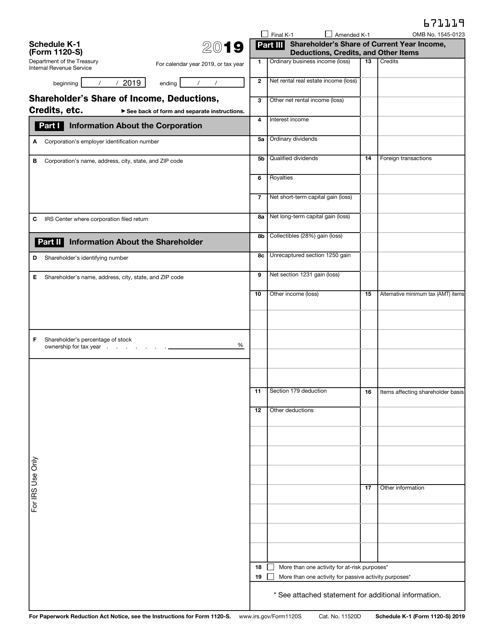

IRS Form 1120S Schedule K1 Download Fillable PDF or Fill Online

Create a blank & editable. Web irs schedule j 1120 form: Members of a controlled group (form 1120 only). Web recapture overall foreign losses that reduced u.s. Enter the total amount you received during this tax period from a.

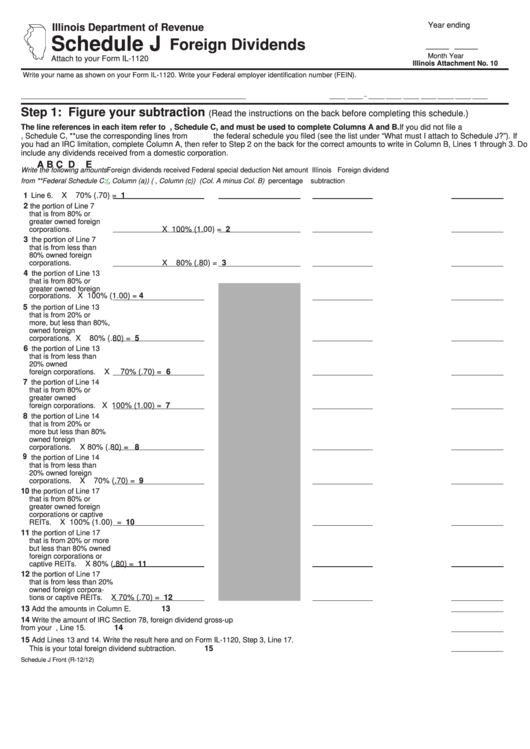

Schedule J Attach To Your Form Il1120 Foreign Dividends printable

Ad easy guidance & tools for c corporation tax returns. Web recapture overall foreign losses that reduced u.s. Sign, fax and printable from pc, ipad, tablet or mobile. To do this, treat a portion of the current year separate limitation. Create a blank & editable.

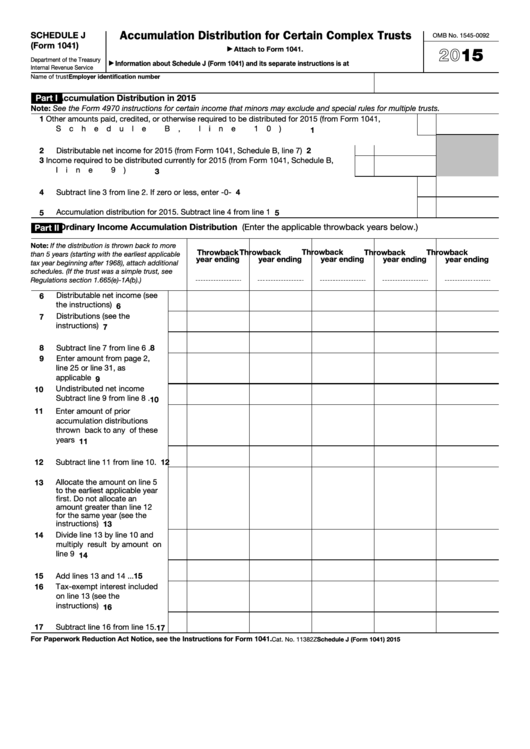

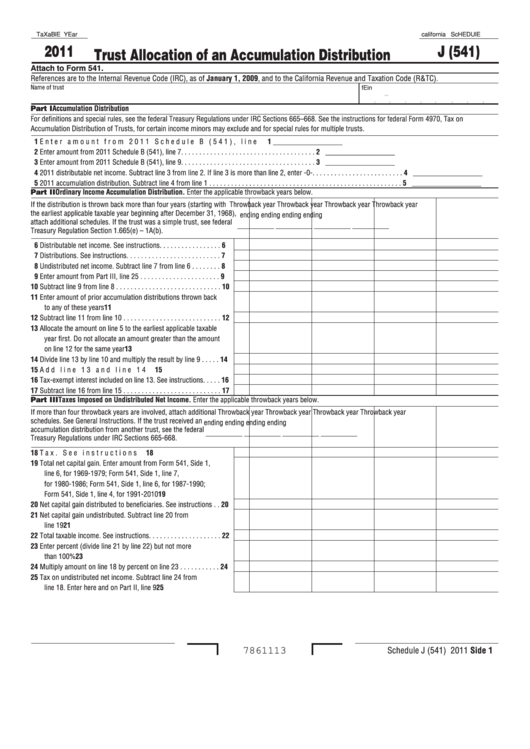

Fillable Schedule J (Form 1041) Accumulation Distribution For Certain

Get ready for this year's tax season quickly and safely with pdffiller! Ad easy guidance & tools for c corporation tax returns. Web up to $40 cash back easily complete a printable irs 1040 schedule j form 2021 online. Source income in prior tax years (section 904 (f) (1)). A foreign corporation is any corporation.

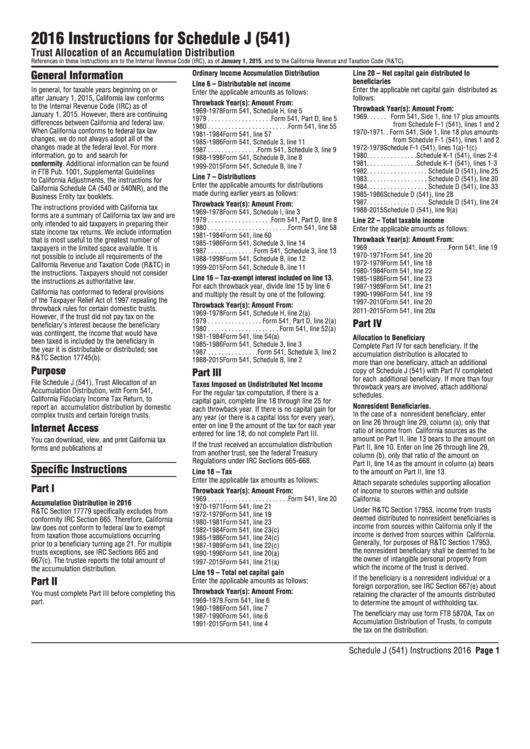

Instructions For Schedule J (Form 541) 2016 printable pdf download

Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or. Ad easy guidance & tools for c corporation tax returns. Web up to $40 cash back fill sample 1120 filled out unclefed instantly, edit online..

2017 schedule j form 990 Fill Online, Printable, Fillable Blank

Get ready for this year's tax season quickly and safely with pdffiller! A member of a controlled group,. Web irs schedule j 1120 form: A foreign corporation is any corporation. Dividends, inclusions, and special deductions.

Fillable California Schedule J (Form 541) Trust Allocation Of An

Sign, fax and printable from pc, ipad, tablet or mobile. To do this, treat a portion of the current year separate limitation. A foreign corporation is any corporation. A member of a controlled group,. Aug 21, 2023 — use the same instructions for schedule j as provided in the 2023 form 1040a instructions.

Form 1120 Schedule J Instructions

Members of a controlled group (form 1120 only). Enter the total amount you received during this tax period from a. Web up to $40 cash back easily complete a printable irs 1040 schedule j form 2021 online. For tax years beginning after december 31, 2022, the inflation reduction act of 2022 (ira) imposes a corporate. Lines 1 and 2, form.

FREE 17+ Sample Schedule Forms in PDF MS Word Excel

Create a blank & editable. Web irs schedule j 1120 form: A foreign corporation is any corporation. Web what is the purpose of schedule j? Dividends, inclusions, and special deductions.

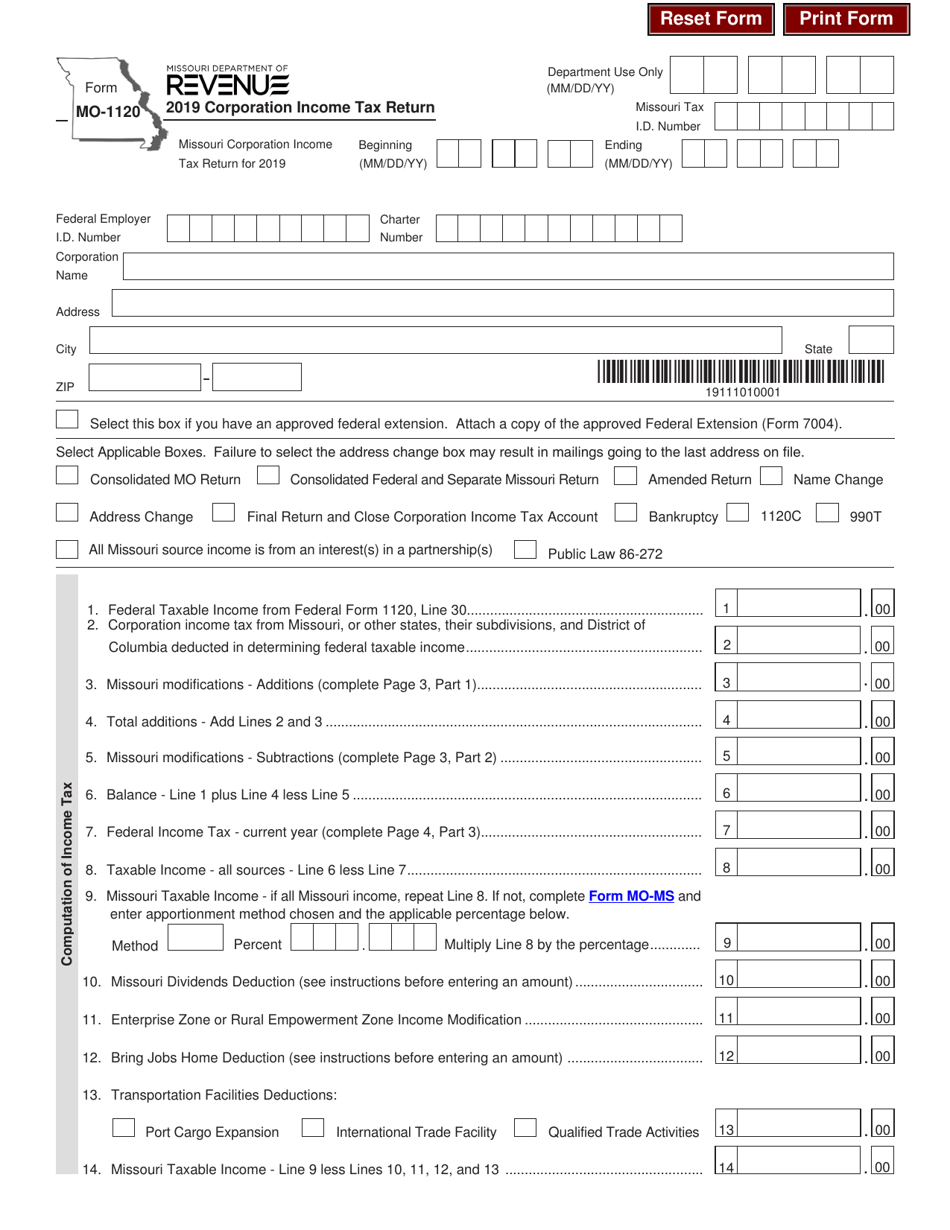

Form MO1120 Download Fillable PDF or Fill Online Corporation

A foreign corporation is any corporation. Aug 21, 2023 — use the same instructions for schedule j as provided in the 2023 form 1040a instructions. Web what is the purpose of schedule j? Ad easy guidance & tools for c corporation tax returns. Source income in prior tax years (section 904 (f) (1)).

Get The Free Sample 1120 Filled Out 2011 Form.

Members of a controlled group (form 1120 only). Web what is the purpose of schedule j? Web up to $40 cash back fill sample 1120 filled out unclefed instantly, edit online. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120!

Web Irs Schedule J 1120 Form:

Create a blank & editable. Get ready for this year's tax season quickly and safely with pdffiller! To do this, treat a portion of the current year separate limitation. Source income in prior tax years (section 904 (f) (1)).

Aug 21, 2023 — Use The Same Instructions For Schedule J As Provided In The 2023 Form 1040A Instructions.

Web recapture overall foreign losses that reduced u.s. Lines 1 and 2, form 1120. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or. For tax years beginning after december 31, 2022, the inflation reduction act of 2022 (ira) imposes a corporate.

Enter The Total Amount You Received During This Tax Period From A.

Web schedule j 1120 form: A foreign corporation is any corporation. Sign, fax and printable from pc, ipad, tablet or mobile. A member of a controlled group,.