Schedule M-3 Form 1120

Schedule M-3 Form 1120 - For instructions and the latest information. Web where to file. December 2019) department of the treasury internal revenue service. Go to www.irs.gov/form1120f for instructions and the latest information. Net income (loss) reconciliation for corporations with total assets of $10 million or more.

December 2019) department of the treasury internal revenue service. For instructions and the latest information. Go to www.irs.gov/form1120f for instructions and the latest information. Web where to file. Net income (loss) reconciliation for corporations with total assets of $10 million or more.

For instructions and the latest information. December 2019) department of the treasury internal revenue service. Web where to file. Go to www.irs.gov/form1120f for instructions and the latest information. Net income (loss) reconciliation for corporations with total assets of $10 million or more.

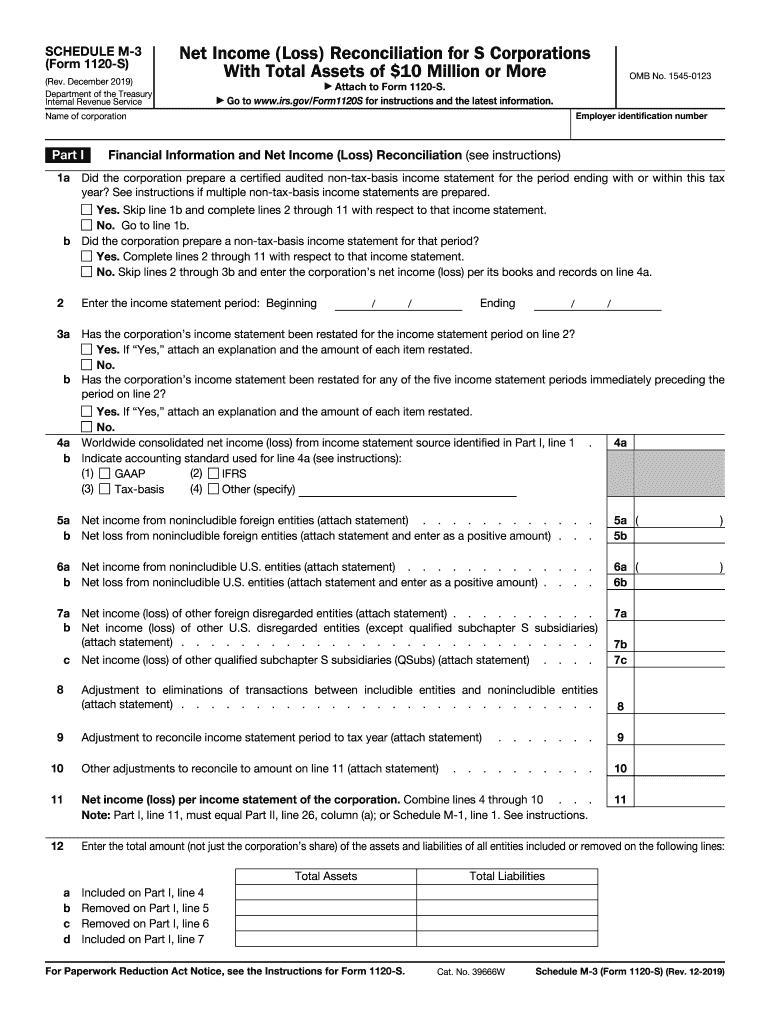

Form 1120S (Schedule M3) Net (Loss) Reconciliation for S

Go to www.irs.gov/form1120f for instructions and the latest information. For instructions and the latest information. Net income (loss) reconciliation for corporations with total assets of $10 million or more. Web where to file. December 2019) department of the treasury internal revenue service.

Form 1120S (Schedule M3) Net (Loss) Reconciliation for S

Web where to file. Net income (loss) reconciliation for corporations with total assets of $10 million or more. December 2019) department of the treasury internal revenue service. For instructions and the latest information. Go to www.irs.gov/form1120f for instructions and the latest information.

Form 1120 Fill Out and Sign Printable PDF Template signNow

Net income (loss) reconciliation for corporations with total assets of $10 million or more. December 2019) department of the treasury internal revenue service. For instructions and the latest information. Go to www.irs.gov/form1120f for instructions and the latest information. Web where to file.

Form 1120PC (Schedule M3) Net Reconciliation for U.S

For instructions and the latest information. Net income (loss) reconciliation for corporations with total assets of $10 million or more. Go to www.irs.gov/form1120f for instructions and the latest information. Web where to file. December 2019) department of the treasury internal revenue service.

Form 1120S (Schedule M3) Net (Loss) Reconciliation for S

Go to www.irs.gov/form1120f for instructions and the latest information. For instructions and the latest information. December 2019) department of the treasury internal revenue service. Net income (loss) reconciliation for corporations with total assets of $10 million or more. Web where to file.

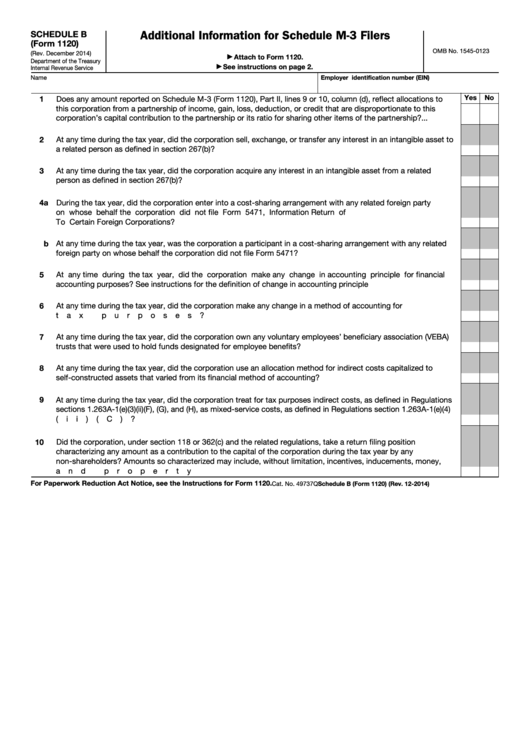

Fillable Form 1120 Additional Information For Schedule M3 Filers

Net income (loss) reconciliation for corporations with total assets of $10 million or more. December 2019) department of the treasury internal revenue service. For instructions and the latest information. Go to www.irs.gov/form1120f for instructions and the latest information. Web where to file.

Form 8916A Supplemental Attachment to Schedule M3 (2014) Free Download

Go to www.irs.gov/form1120f for instructions and the latest information. For instructions and the latest information. December 2019) department of the treasury internal revenue service. Net income (loss) reconciliation for corporations with total assets of $10 million or more. Web where to file.

20192021 Form IRS 1120S Schedule M3 Fill Online, Printable

December 2019) department of the treasury internal revenue service. Net income (loss) reconciliation for corporations with total assets of $10 million or more. Go to www.irs.gov/form1120f for instructions and the latest information. Web where to file. For instructions and the latest information.

Form 1120L (Schedule M3) Net Reconciliation for U.S. Life

December 2019) department of the treasury internal revenue service. Web where to file. For instructions and the latest information. Net income (loss) reconciliation for corporations with total assets of $10 million or more. Go to www.irs.gov/form1120f for instructions and the latest information.

Form 1120PC U.S. Property and Company Tax Return (2015) Free

For instructions and the latest information. Net income (loss) reconciliation for corporations with total assets of $10 million or more. Web where to file. December 2019) department of the treasury internal revenue service. Go to www.irs.gov/form1120f for instructions and the latest information.

Net Income (Loss) Reconciliation For Corporations With Total Assets Of $10 Million Or More.

Go to www.irs.gov/form1120f for instructions and the latest information. December 2019) department of the treasury internal revenue service. For instructions and the latest information. Web where to file.