Shopify 1099 K Form

Shopify 1099 K Form - When you sell something using shopify, this gets recorded on your shopify. Web this is what shopify does every year. In the shopify payments section, click manage. You’ll also want to find an accounting. Under payout account in the payout details section, click change bank. On this page determine your tax liability register for taxes set up your. Web from your shopify admin, go to settings > payments. Web click on “view payouts” under shopify payments. 200 separate payments for goods or services in a calendar year, and $20,000 usd in. I too have been on chats ect trying to get my information straight since july of last year and no one answers.

Web this is what shopify does every year. 200 separate payments for goods or services in a calendar year, and $20,000 usd in. Credit, debit or stored value cards such as gift cards (payment cards) payment apps or online. Web so i'm assuming you still have not recieved your 1099. When you sell something using shopify, this gets recorded on your shopify. Under payout account in the payout details section, click change bank. In the shopify payments section, click manage. Web from your shopify admin, go to settings > payments. Web click on “view payouts” under shopify payments. On this page determine your tax liability register for taxes set up your.

Credit, debit or stored value cards such as gift cards (payment cards) payment apps or online. I too have been on chats ect trying to get my information straight since july of last year and no one answers. When you sell something using shopify, this gets recorded on your shopify. Web so i'm assuming you still have not recieved your 1099. 200 separate payments for goods or services in a calendar year, and $20,000 usd in. You receive more than 20,000 usd in gross. Last year it was the same story, we are such a big company we have to issue so many of these we have to file an. This form will show how much total revenue you. Under payout account in the payout details section, click change bank. Web click on “view payouts” under shopify payments.

Finding And FilIng Your Shopify 1099K Made Easy

Last year it was the same story, we are such a big company we have to issue so many of these we have to file an. Web sales channels, payments apps, and shop apis. In the shopify payments section, click manage. On this page determine your tax liability register for taxes set up your. Web so i'm assuming you still.

Solved 1099k doesn’t include PayPal transactions Shopify Community

You’ll also want to find an accounting. Web so i'm assuming you still have not recieved your 1099. 200 separate payments for goods or services in a calendar year, and $20,000 usd in. When you sell something using shopify, this gets recorded on your shopify. I too have been on chats ect trying to get my information straight since july.

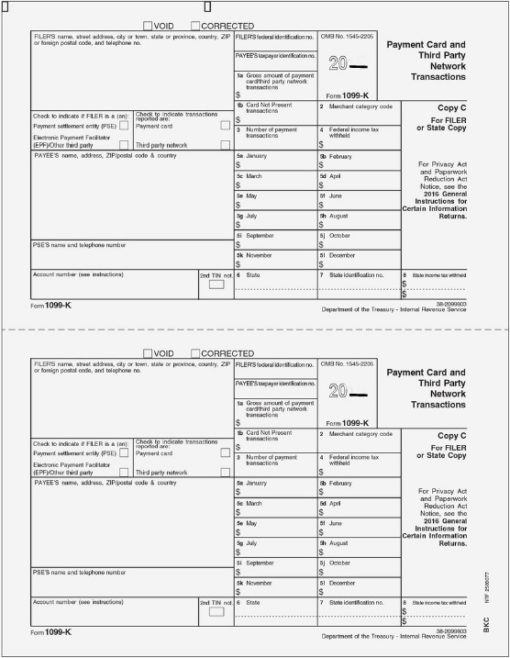

1099K Form Copy C Filer Discount Tax Forms

On this page determine your tax liability register for taxes set up your. Web so i'm assuming you still have not recieved your 1099. Credit, debit or stored value cards such as gift cards (payment cards) payment apps or online. Web this is what shopify does every year. This form will show how much total revenue you.

How I had my first QUARTER MILLION Dollar Year! Follow

200 separate payments for goods or services in a calendar year, and $20,000 usd in. On this page determine your tax liability register for taxes set up your. You receive more than 20,000 usd in gross. It means if any shopify store. I too have been on chats ect trying to get my information straight since july of last year.

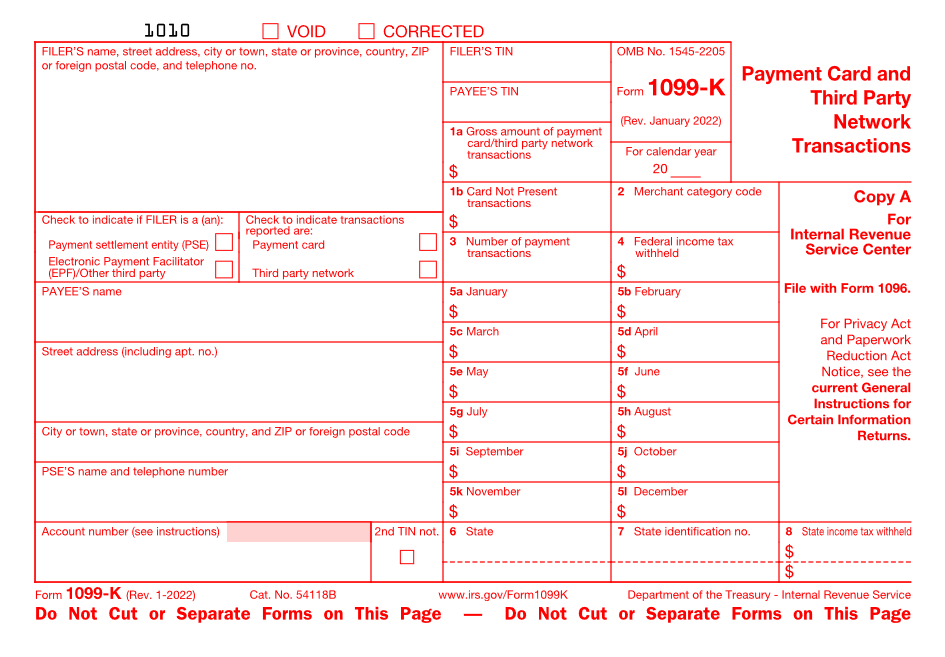

Are You Ready for New 1099K Rules? CPA Practice Advisor

Under payout account in the payout details section, click change bank. Web this is what shopify does every year. It means if any shopify store. Last year it was the same story, we are such a big company we have to issue so many of these we have to file an. When you receive this form, you need.

What Is an IRS 1099 Form? Purpose and How To File (2023)

You’ll also want to find an accounting. You receive more than 20,000 usd in gross. 200 separate payments for goods or services in a calendar year, and $20,000 usd in. Last year it was the same story, we are such a big company we have to issue so many of these we have to file an. Under payout account in.

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

This form will show how much total revenue you. You’ll also want to find an accounting. Web this is what shopify does every year. When you receive this form, you need. Web so i'm assuming you still have not recieved your 1099.

Understanding Your Form 1099K FAQs for Merchants Clearent

In the shopify payments section, click manage. Under payout account in the payout details section, click change bank. Web sales channels, payments apps, and shop apis. I too have been on chats ect trying to get my information straight since july of last year and no one answers. Web so i'm assuming you still have not recieved your 1099.

How Form 1099K Affects Your Business

Web click on “view payouts” under shopify payments. Web this is what shopify does every year. You receive more than 20,000 usd in gross. Web so i'm assuming you still have not recieved your 1099. In the shopify payments section, click manage.

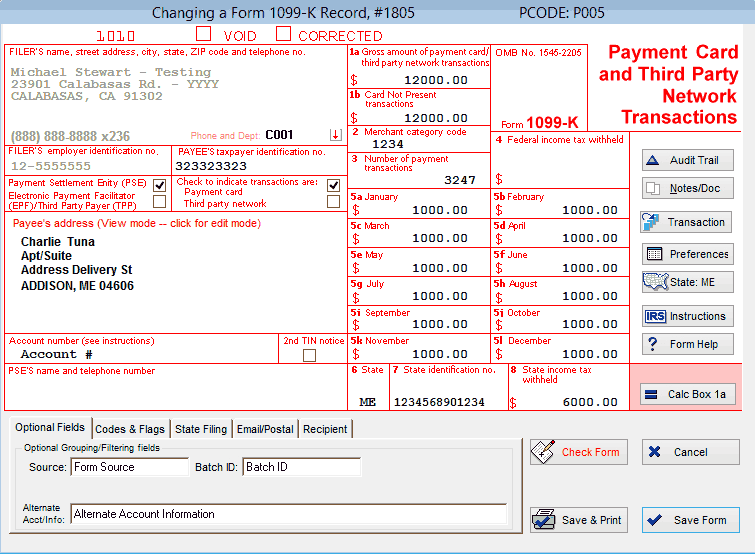

1099K Software for 1099K Reporting Print & eFile 1099K

It means if any shopify store. I too have been on chats ect trying to get my information straight since july of last year and no one answers. 200 separate payments for goods or services in a calendar year, and $20,000 usd in. Web so i'm assuming you still have not recieved your 1099. When you sell something using shopify,.

Last Year It Was The Same Story, We Are Such A Big Company We Have To Issue So Many Of These We Have To File An.

Web so i'm assuming you still have not recieved your 1099. You receive more than 20,000 usd in gross. Web this is what shopify does every year. When you receive this form, you need.

Web From Your Shopify Admin, Go To Settings > Payments.

200 separate payments for goods or services in a calendar year, and $20,000 usd in. This form will show how much total revenue you. It means if any shopify store. In the shopify payments section, click manage.

Under Payout Account In The Payout Details Section, Click Change Bank.

Web sales channels, payments apps, and shop apis. When you sell something using shopify, this gets recorded on your shopify. Credit, debit or stored value cards such as gift cards (payment cards) payment apps or online. On this page determine your tax liability register for taxes set up your.

I Too Have Been On Chats Ect Trying To Get My Information Straight Since July Of Last Year And No One Answers.

Web click on “view payouts” under shopify payments. You’ll also want to find an accounting.

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://images.squarespace-cdn.com/content/v1/56f9ad715f43a6d77cb2536a/1553021637842-T52O55S3Z3ILYDIS44PS/ke17ZwdGBToddI8pDm48kCpGfv303rFPf_R2MmpjQDgUqsxRUqqbr1mOJYKfIPR7LoDQ9mXPOjoJoqy81S2I8N_N4V1vUb5AoIIIbLZhVYxCRW4BPu10St3TBAUQYVKcmomqGy8QKumd8_Xi9pibUHb-95JWteCRKkaNKL5Nmf61lF01BYr72PFdZDEdDuE_/what+is+a+1099-k)