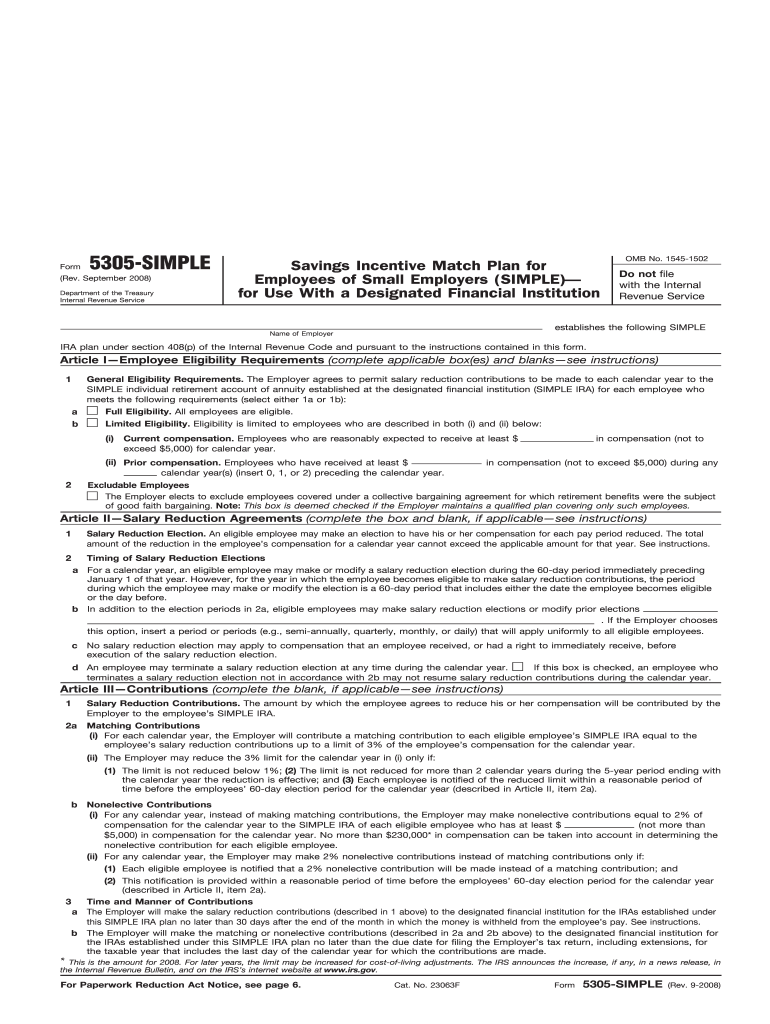

Simple Ira Form 5305

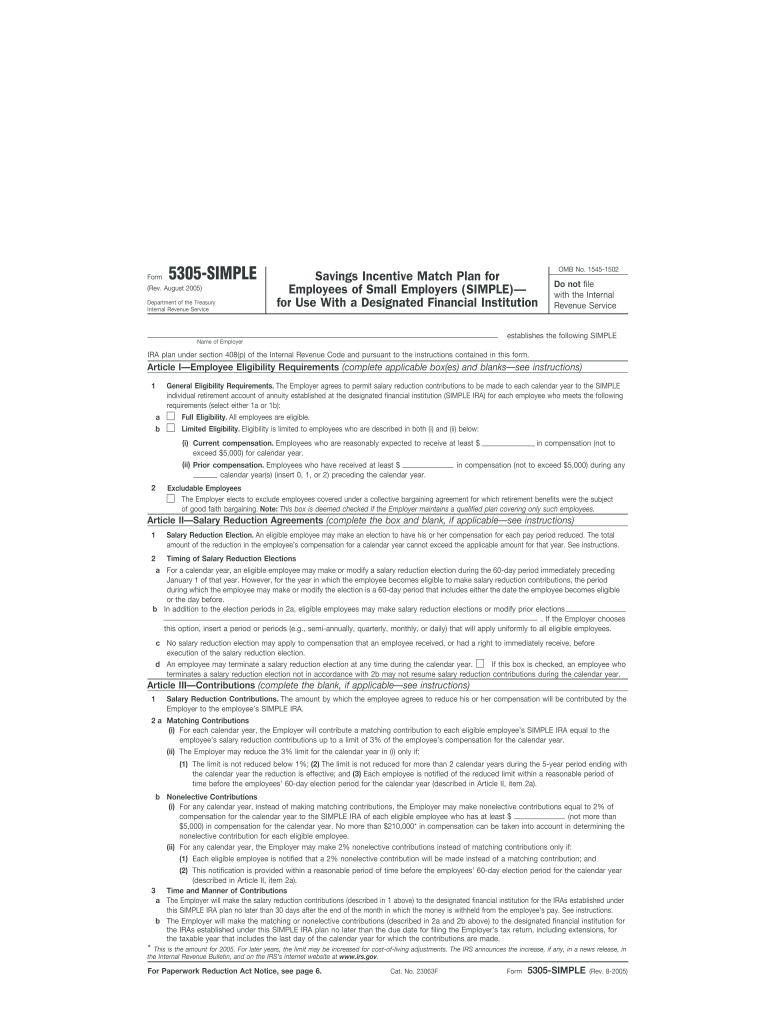

Simple Ira Form 5305 - March 2002) do not file with the internal department of the treasury revenue service internal revenue service establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. A simple individual retirement account (simple ira) is established after the form is fully executed by both the individual (participant) and the custodian. Plan adoption agreement (pdf) company profile form (pdf) Each form is a simple ira plan document. Set up your new plan. Fidelity simple ira plan agreement (pdf) fidelity funding account agreement (pdf) in order to set up your plan, you will need to print, complete and sign the following documents: However, only articles i through vii have been reviewed by the irs. Open your plan print, read, and retain copies of the following documents: Contact a retirement plan professional or a representative of a financial institution that offers retirement plans. Eligible employees can fund their own simple ira accounts through regular salary deferrals and employers make additional contributions.

Fidelity simple ira plan agreement (pdf) fidelity funding account agreement (pdf) in order to set up your plan, you will need to print, complete and sign the following documents: Open your plan print, read, and retain copies of the following documents: Key things to know 2. However, only articles i through vii have been reviewed by the irs. Set up individual accounts within the plan. Eligible employees can fund their own simple ira accounts through regular salary deferrals and employers make additional contributions. Each form is a simple ira plan document. Set up your new plan. Keep it for your records.* 2. A simple individual retirement account (simple ira) is established after the form is fully executed by both the individual (participant) and the custodian.

However, only articles i through vii have been reviewed by the irs. Fidelity simple ira plan agreement (pdf) fidelity funding account agreement (pdf) in order to set up your plan, you will need to print, complete and sign the following documents: Contact a retirement plan professional or a representative of a financial institution that offers retirement plans. Open your plan print, read, and retain copies of the following documents: March 2002) do not file with the internal department of the treasury revenue service internal revenue service establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. Plan adoption agreement (pdf) company profile form (pdf) Each form is a simple ira plan document. Set up individual accounts within the plan. Eligible employees can fund their own simple ira accounts through regular salary deferrals and employers make additional contributions. More flexibility and more options.

How a SEP IRA Works Contributions, Benefits, Obligations and IRS Form

Each form is a simple ira plan document. Fidelity simple ira plan agreement (pdf) fidelity funding account agreement (pdf) in order to set up your plan, you will need to print, complete and sign the following documents: Keep it for your records.* 2. However, only articles i through vii have been reviewed by the irs. Key things to know 2.

Sample 5305 Simple Fill Online, Printable, Fillable, Blank PDFfiller

More flexibility and more options. Keep it for your records.* 2. Contact a retirement plan professional or a representative of a financial institution that offers retirement plans. Fidelity simple ira plan agreement (pdf) fidelity funding account agreement (pdf) in order to set up your plan, you will need to print, complete and sign the following documents: Plan adoption agreement (pdf).

What Is A Simple IRA, And Is Right For Your Retirement? Vertical

You adopt the simple ira plan when you have completed all appropriate boxes and blanks on the form and you (and the designated financial institution, if any) have signed it. Each form is a simple ira plan document. March 2002) do not file with the internal department of the treasury revenue service internal revenue service establishes the following simple ira.

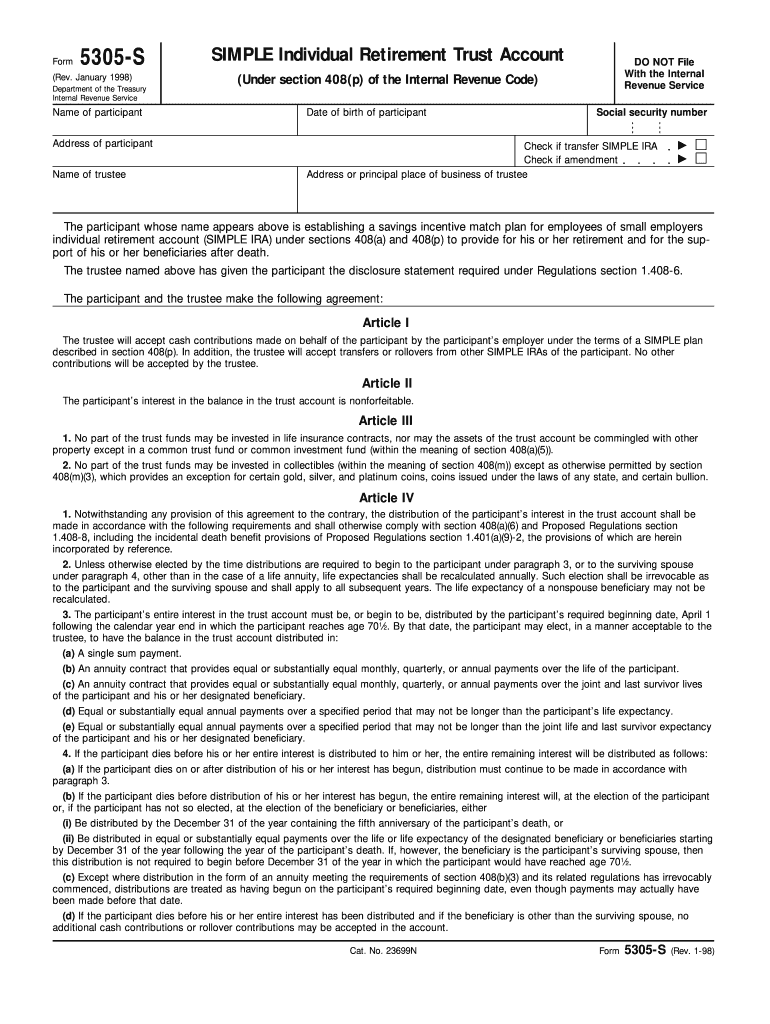

Form 5305SA Simple Individual Retirement Custodial Account (2012

Fidelity simple ira plan agreement (pdf) fidelity funding account agreement (pdf) in order to set up your plan, you will need to print, complete and sign the following documents: Each form is a simple ira plan document. Set up individual accounts within the plan. A simple individual retirement account (simple ira) is established after the form is fully executed by.

Form 5305SA Simple Individual Retirement Custodial Account (2012

Each form is a simple ira plan document. Set up your new plan. Keep it for your records.* 2. Contact a retirement plan professional or a representative of a financial institution that offers retirement plans. Fidelity simple ira plan agreement (pdf) fidelity funding account agreement (pdf) in order to set up your plan, you will need to print, complete and.

Foresters Financial 5305 Simple Fill Out and Sign Printable PDF

Each form is a simple ira plan document. A simple individual retirement account (simple ira) is established after the form is fully executed by both the individual (participant) and the custodian. Set up your new plan. Key things to know 2. However, only articles i through vii have been reviewed by the irs.

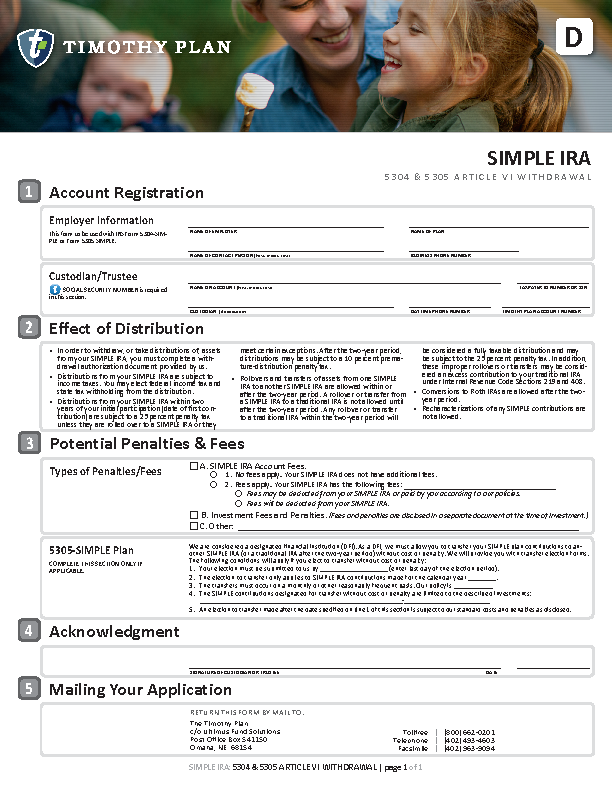

Timothy Plan® Applications for investing

Eligible employees can fund their own simple ira accounts through regular salary deferrals and employers make additional contributions. You adopt the simple ira plan when you have completed all appropriate boxes and blanks on the form and you (and the designated financial institution, if any) have signed it. March 2002) do not file with the internal department of the treasury.

Simple Ira August 5305 Form Fill Out and Sign Printable PDF Template

Key things to know 2. Each form is a simple ira plan document. Keep it for your records.* 2. Set up your new plan. You adopt the simple ira plan when you have completed all appropriate boxes and blanks on the form and you (and the designated financial institution, if any) have signed it.

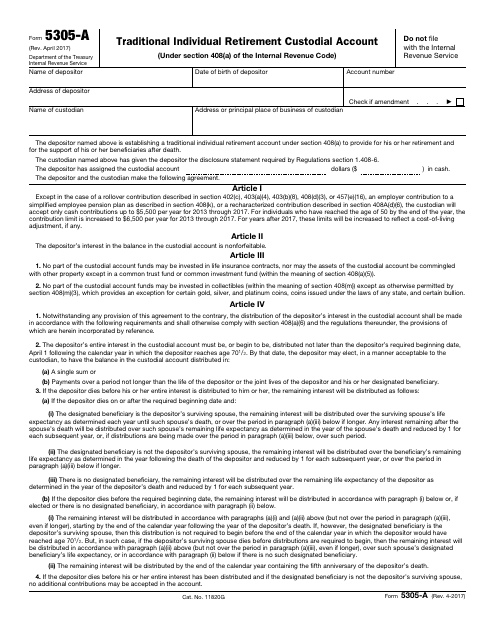

IRS Form 5305A Download Fillable PDF or Fill Online Traditional

Plan adoption agreement (pdf) company profile form (pdf) Each form is a simple ira plan document. You adopt the simple ira plan when you have completed all appropriate boxes and blanks on the form and you (and the designated financial institution, if any) have signed it. Open your plan print, read, and retain copies of the following documents: Key things.

Fill Free fillable Form 5305SIMPLE Savings Incentive Match Plan PDF form

Contact a retirement plan professional or a representative of a financial institution that offers retirement plans. Open your plan print, read, and retain copies of the following documents: Fidelity simple ira plan agreement (pdf) fidelity funding account agreement (pdf) in order to set up your plan, you will need to print, complete and sign the following documents: You adopt the.

Contact A Retirement Plan Professional Or A Representative Of A Financial Institution That Offers Retirement Plans.

A simple individual retirement account (simple ira) is established after the form is fully executed by both the individual (participant) and the custodian. You adopt the simple ira plan when you have completed all appropriate boxes and blanks on the form and you (and the designated financial institution, if any) have signed it. More flexibility and more options. Key things to know 2.

Set Up Your New Plan.

Set up individual accounts within the plan. Eligible employees can fund their own simple ira accounts through regular salary deferrals and employers make additional contributions. Open your plan print, read, and retain copies of the following documents: Fidelity simple ira plan agreement (pdf) fidelity funding account agreement (pdf) in order to set up your plan, you will need to print, complete and sign the following documents:

Keep It For Your Records.* 2.

March 2002) do not file with the internal department of the treasury revenue service internal revenue service establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. However, only articles i through vii have been reviewed by the irs. Plan adoption agreement (pdf) company profile form (pdf) Each form is a simple ira plan document.