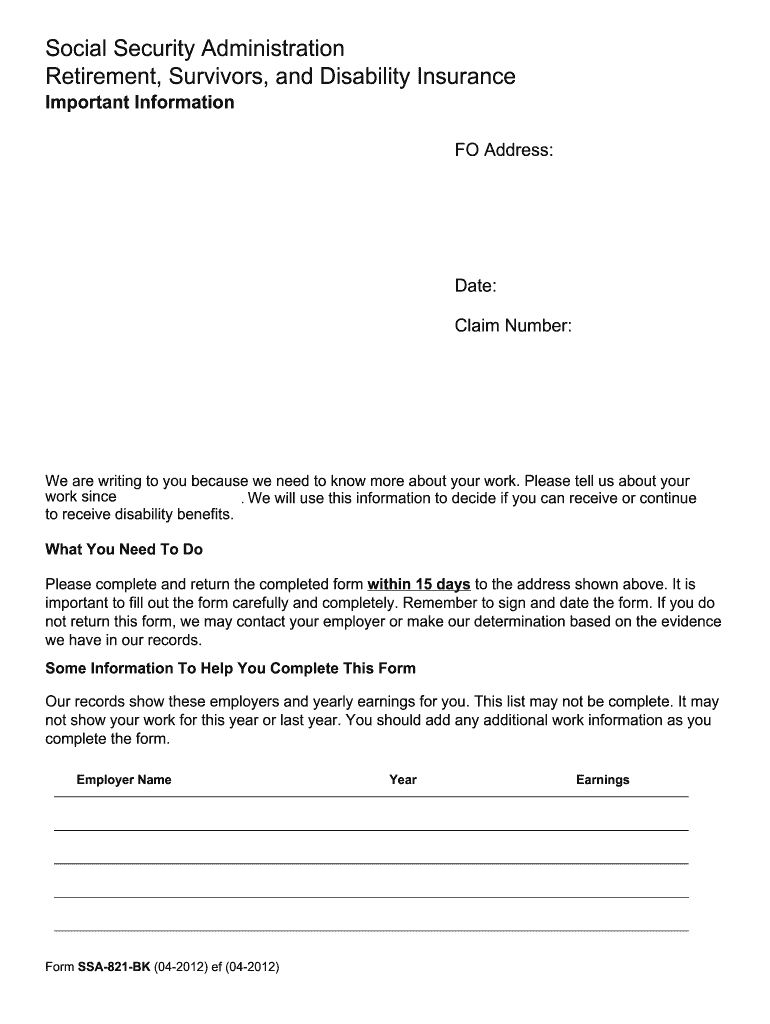

Social Security Form Ssa-821-Bk

Social Security Form Ssa-821-Bk - After you have accessed the. Internal revenue code (irc) requires the social security administration (ssa) to withhold a 30 percent federal income tax. Web being disabled means you are not working. Claim # sections 223 and 1632 of the social security act as amended [42 u.s.c. 423 and 1383a], authorize us to collect this information. So it is entirely appropriate for social security to request the details for any work activity after the alleged onset date. We need to know this information because: Web read about the four steps you'll have to take: You can hit the orange get form now button at the top of the following webpage. Now the local ssa has sent me a form 821 bk.

Blind not blind name of wage earner (if different. Web being disabled means you are not working. Now the local ssa has sent me a form 821 bk. You can hit the orange get form now button at the top of the following webpage. Internal revenue code (irc) requires the social security administration (ssa) to withhold a 30 percent federal income tax. Claim # sections 223 and 1632 of the social security act as amended [42 u.s.c. Web read about the four steps you'll have to take: So it is entirely appropriate for social security to request the details for any work activity after the alleged onset date. After you have accessed the. 423 and 1383a], authorize us to collect this information.

Blind not blind name of wage earner (if different. So it is entirely appropriate for social security to request the details for any work activity after the alleged onset date. Web being disabled means you are not working. After you have accessed the. Now the local ssa has sent me a form 821 bk. You can hit the orange get form now button at the top of the following webpage. Internal revenue code (irc) requires the social security administration (ssa) to withhold a 30 percent federal income tax. 423 and 1383a], authorize us to collect this information. We need to know this information because: Claim # sections 223 and 1632 of the social security act as amended [42 u.s.c.

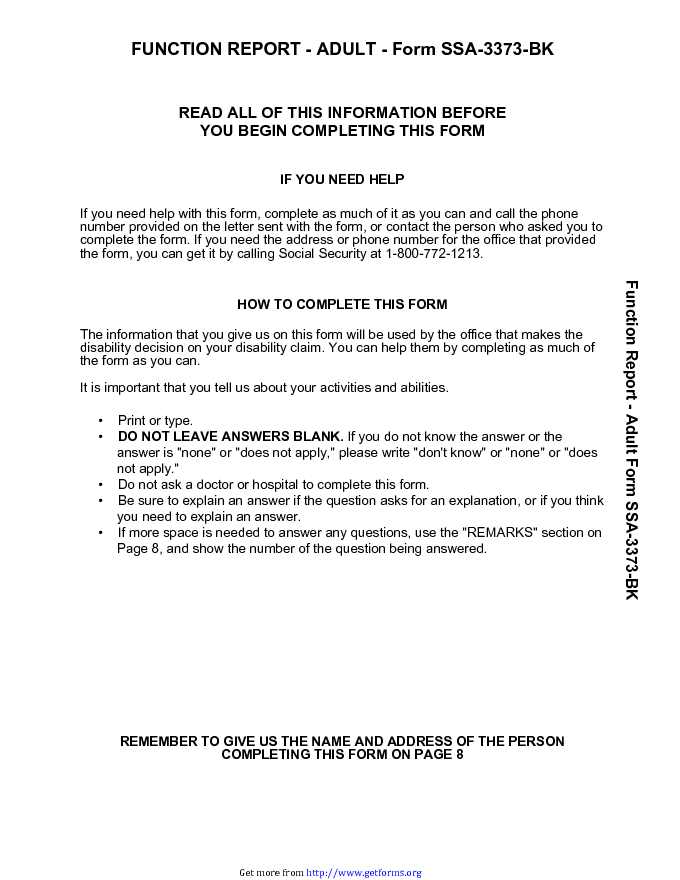

Form SS5FS download Social Security Form for free PDF or Word

Blind not blind name of wage earner (if different. Claim # sections 223 and 1632 of the social security act as amended [42 u.s.c. We need to know this information because: After you have accessed the. 423 and 1383a], authorize us to collect this information.

Printable Form Ssa 821 Master of Documents

Internal revenue code (irc) requires the social security administration (ssa) to withhold a 30 percent federal income tax. Blind not blind name of wage earner (if different. Web being disabled means you are not working. Now the local ssa has sent me a form 821 bk. Claim # sections 223 and 1632 of the social security act as amended [42.

Fill Free fillable Form SSA821BK work activity report employee

So it is entirely appropriate for social security to request the details for any work activity after the alleged onset date. Web being disabled means you are not working. Blind not blind name of wage earner (if different. Web read about the four steps you'll have to take: Now the local ssa has sent me a form 821 bk.

Fill Free fillable forms for the U.S. Social Security Administration

We need to know this information because: You can hit the orange get form now button at the top of the following webpage. Claim # sections 223 and 1632 of the social security act as amended [42 u.s.c. Blind not blind name of wage earner (if different. After you have accessed the.

Breanna Form 2458 Social Security

423 and 1383a], authorize us to collect this information. So it is entirely appropriate for social security to request the details for any work activity after the alleged onset date. Internal revenue code (irc) requires the social security administration (ssa) to withhold a 30 percent federal income tax. We need to know this information because: Web read about the four.

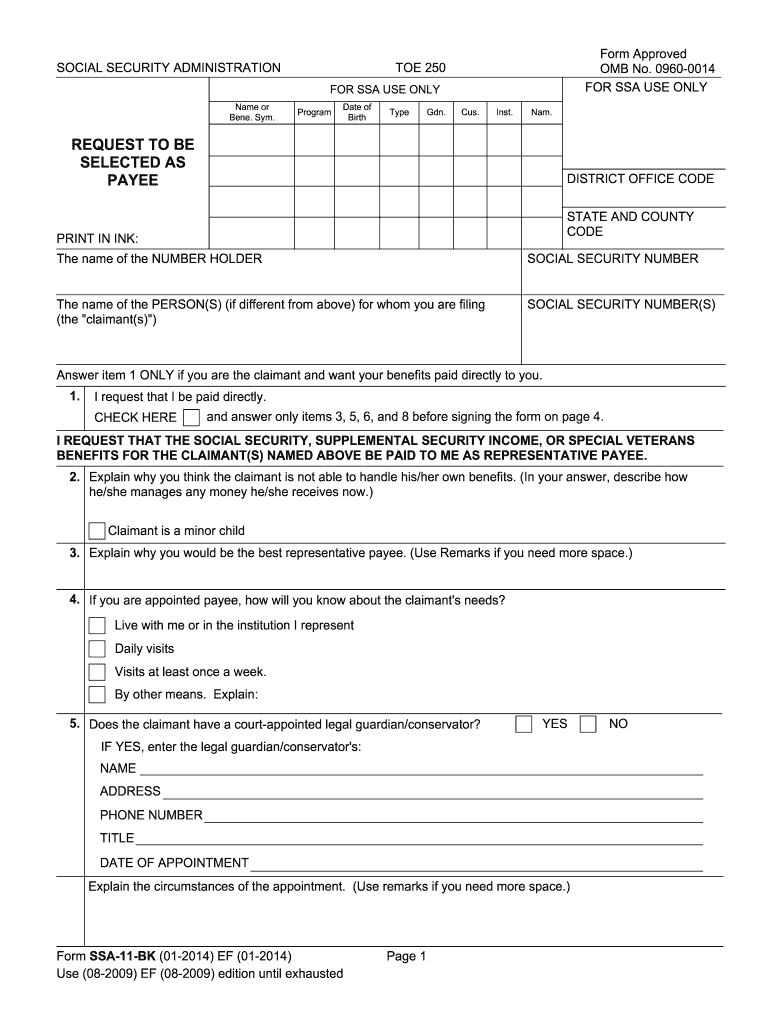

2014 Form SSA11BK Fill Online, Printable, Fillable, Blank pdfFiller

Blind not blind name of wage earner (if different. Web read about the four steps you'll have to take: You can hit the orange get form now button at the top of the following webpage. Claim # sections 223 and 1632 of the social security act as amended [42 u.s.c. Now the local ssa has sent me a form 821.

Fill Free fillable Form SSA821BK work activity report employee

After you have accessed the. So it is entirely appropriate for social security to request the details for any work activity after the alleged onset date. Web being disabled means you are not working. You can hit the orange get form now button at the top of the following webpage. Claim # sections 223 and 1632 of the social security.

Fill Free fillable forms for the U.S. Social Security Administration

We need to know this information because: Blind not blind name of wage earner (if different. After you have accessed the. Web read about the four steps you'll have to take: You can hit the orange get form now button at the top of the following webpage.

2012 Form SSA821BK Fill Online, Printable, Fillable, Blank pdfFiller

You can hit the orange get form now button at the top of the following webpage. 423 and 1383a], authorize us to collect this information. Internal revenue code (irc) requires the social security administration (ssa) to withhold a 30 percent federal income tax. Web being disabled means you are not working. Blind not blind name of wage earner (if different.

Form SSA821BK Get Prepared to Report Your Work Activity to the SSA

We need to know this information because: You can hit the orange get form now button at the top of the following webpage. Blind not blind name of wage earner (if different. Web read about the four steps you'll have to take: So it is entirely appropriate for social security to request the details for any work activity after the.

After You Have Accessed The.

Now the local ssa has sent me a form 821 bk. We need to know this information because: Web being disabled means you are not working. 423 and 1383a], authorize us to collect this information.

Blind Not Blind Name Of Wage Earner (If Different.

So it is entirely appropriate for social security to request the details for any work activity after the alleged onset date. Internal revenue code (irc) requires the social security administration (ssa) to withhold a 30 percent federal income tax. Claim # sections 223 and 1632 of the social security act as amended [42 u.s.c. Web read about the four steps you'll have to take: