Tax Exempt Form Ky

Tax Exempt Form Ky - Ad register and subscribe now to work on your affidavit of exemption & more fillable forms. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web download the taxpayer bill of rights. We ask that you complete the entire form. Web declaration of domicile for purchase of residential utilities. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. Web follow the simple instructions below: Web to claim an exemption from this tax, a customer must provide the required tax exemption form or forms: Web of exemption for materials, machinery and equipment (form 51a159). Use this form to certify your residence as your domicile.

Web of exemption for materials, machinery and equipment (form 51a159). We ask that you complete the entire form. Web follow the simple instructions below: Pdffiller allows users to edit, sign, fill and share all type of documents online. Web yes, the new form for use by residents to declare their eligibility for the residential exemption is the declaration of domicile for purchase of residential utilities, form 51a380. Web to claim an exemption from this tax, a customer must provide the required tax exemption form or forms: Web declaration of domicile for purchase of residential utilities. Several exceptions to the state sales tax are goods and machinery. Ad register and subscribe now to work on your affidavit of exemption & more fillable forms. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms.

Ad register and subscribe now to work on your affidavit of exemption & more fillable forms. Pdffiller allows users to edit, sign, fill and share all type of documents online. Web office of the kentucky secretary of state 700 capital avenue suite 152 frankfort, ky 40601 phone: Web follow the simple instructions below: Web tax exempt bonds; Web download the taxpayer bill of rights. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. Use this form to certify your residence as your domicile. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the kentucky sales tax. We ask that you complete the entire form.

Kentucky Tax Exempt Form Fill Online, Printable, Fillable, Blank

Web download the taxpayer bill of rights. Pdffiller allows users to edit, sign, fill and share all type of documents online. Web to claim an exemption from this tax, a customer must provide the required tax exemption form or forms: Web office of the kentucky secretary of state 700 capital avenue suite 152 frankfort, ky 40601 phone: • if the.

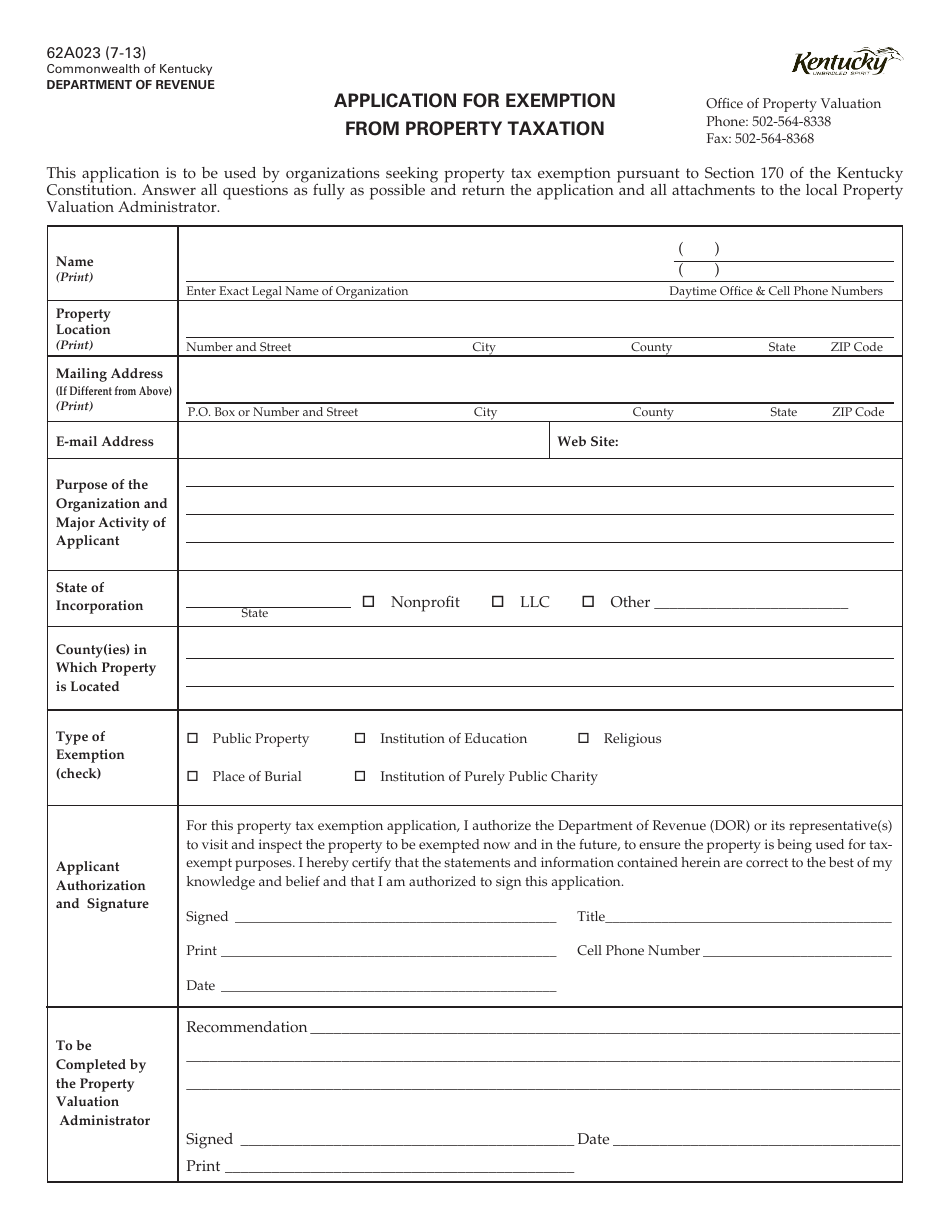

Form 62A023 Download Fillable PDF or Fill Online Application for

Use this form to certify your residence as your domicile. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the kentucky sales tax. Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. The kentucky department of.

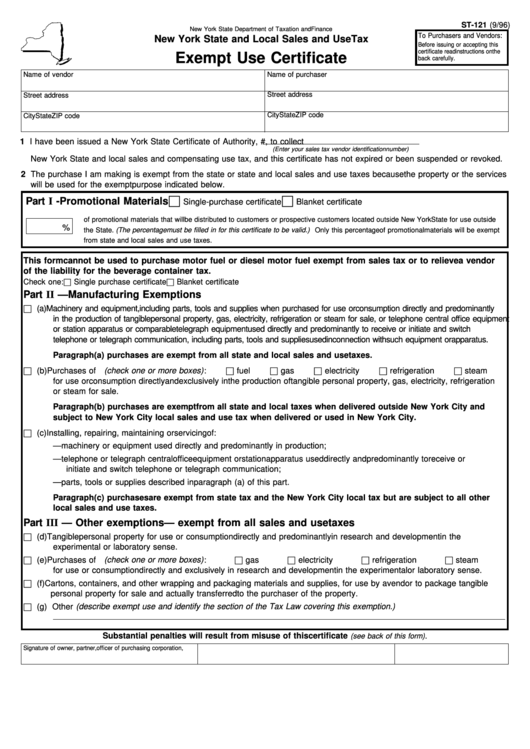

Fillable Form St121 Exempt Use Certificate printable pdf download

Web tax exempt bonds; Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the kentucky sales tax. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Personal property tax exemption form. Pdffiller allows users to edit, sign, fill.

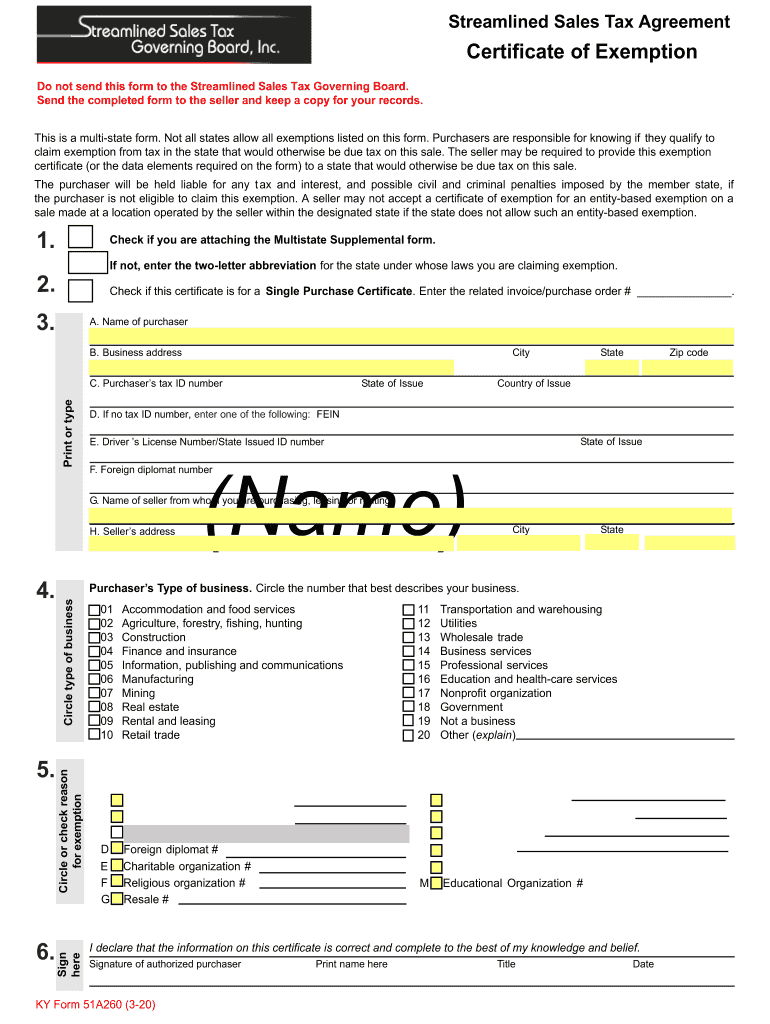

2020 Form KY 51A260 Fill Online, Printable, Fillable, Blank pdfFiller

Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. • if the statutory requirements are met, you will be permitted to make purchases of tangible personal. Use this form to certify your residence as your domicile. The kentucky department of revenue conducts work under the authority of the finance and administration.

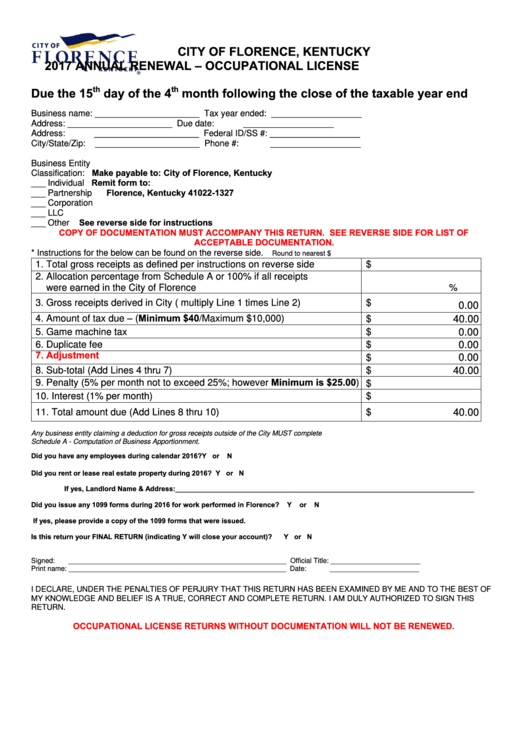

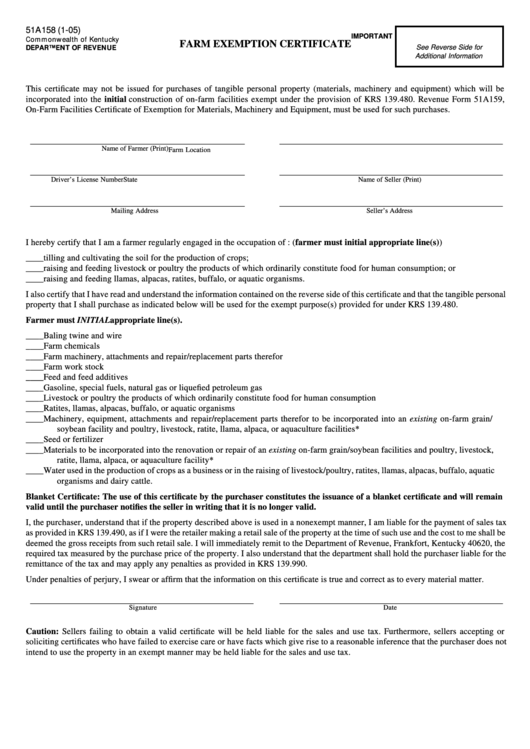

Kentucky Sales Tax Farm Exemption Form Fill Online, Printable

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the kentucky sales tax. Ad register and subscribe now to work on your affidavit of exemption & more fillable forms. Web download the taxpayer bill of rights. Pdffiller allows users to edit, sign, fill and share.

Ky Revenue Form 51a126

Personal property tax exemption form. Web declaration of domicile for purchase of residential utilities. Use this form to certify your residence as your domicile. Ad register and subscribe now to work on your affidavit of exemption & more fillable forms. Web tax exempt bonds;

Form 51a158 Farm Exemption Certificate printable pdf download

Web of exemption for materials, machinery and equipment (form 51a159). Use this form to certify your residence as your domicile. We ask that you complete the entire form. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the kentucky sales tax. Web download the taxpayer.

Ky Church Tax Exempt Form Universal Network

Fill out appropriate tax exempt documents below: Pdffiller allows users to edit, sign, fill and share all type of documents online. Personal property tax exemption form. Web to claim an exemption from this tax, a customer must provide the required tax exemption form or forms: Ad register and subscribe now to work on your affidavit of exemption & more fillable.

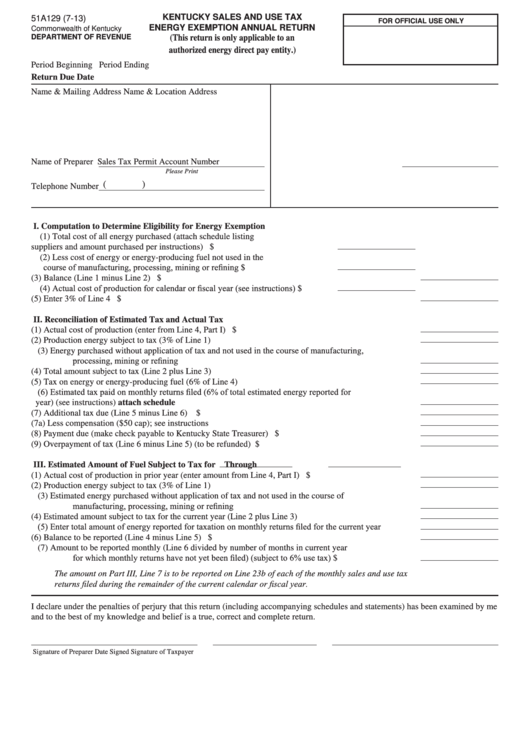

Fillable Form 51a129 Kentucky Sales And Use Tax Energy Exemption

Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. Fill out appropriate tax exempt documents below: Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the kentucky sales tax. Ad register and subscribe now to work.

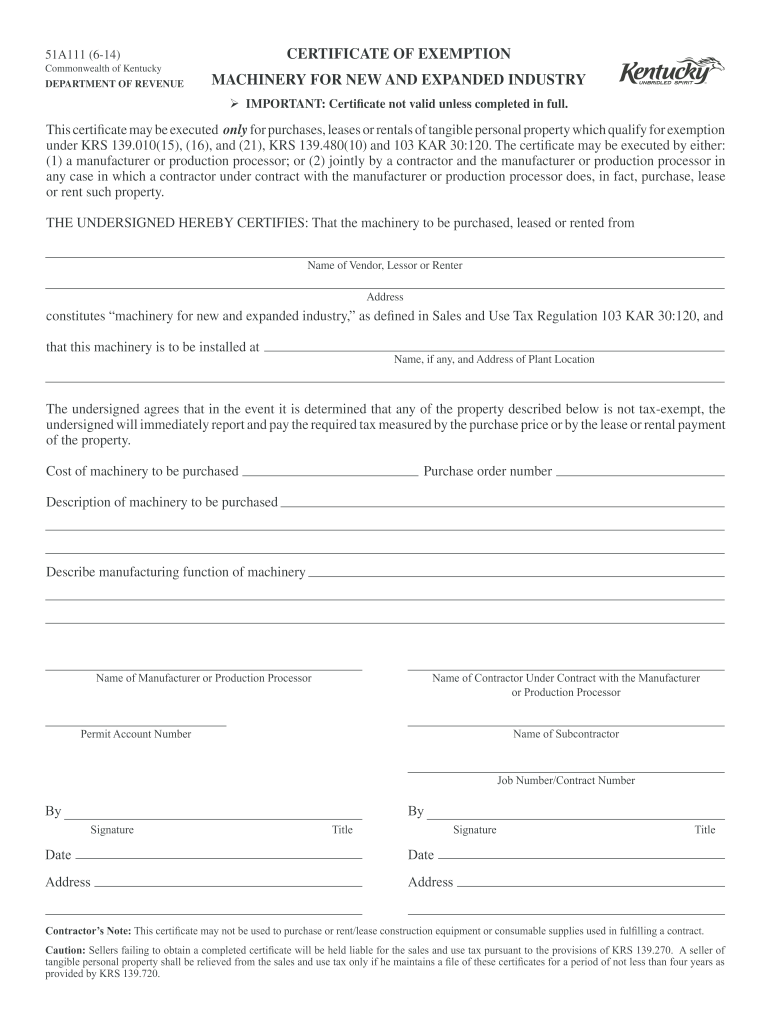

Form 51A111 Fill Out and Sign Printable PDF Template signNow

Web download the taxpayer bill of rights. Several exceptions to the state sales tax are goods and machinery. Web to claim an exemption from this tax, a customer must provide the required tax exemption form or forms: The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Web a sales tax exemption certificate can.

Web Yes, The New Form For Use By Residents To Declare Their Eligibility For The Residential Exemption Is The Declaration Of Domicile For Purchase Of Residential Utilities, Form 51A380.

We ask that you complete the entire form. Several exceptions to the state sales tax are goods and machinery. Personal property tax exemption form. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the kentucky sales tax.

Web A Sales Tax Exemption Certificate Can Be Used By Businesses (Or In Some Cases, Individuals) Who Are Making Purchases That Are Exempt From The Kentucky Sales Tax.

Web tax exempt bonds; Web follow the simple instructions below: Ad register and subscribe now to work on your affidavit of exemption & more fillable forms. Pdffiller allows users to edit, sign, fill and share all type of documents online.

Web Of Exemption For Materials, Machinery And Equipment (Form 51A159).

• if the statutory requirements are met, you will be permitted to make purchases of tangible personal. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Fill out appropriate tax exempt documents below: Web download the taxpayer bill of rights.

Web Declaration Of Domicile For Purchase Of Residential Utilities.

Web to claim an exemption from this tax, a customer must provide the required tax exemption form or forms: Web the application for the agriculture exemption number, form 51a800, is available at www.revenue.ky.gov under sales tax forms. Web office of the kentucky secretary of state 700 capital avenue suite 152 frankfort, ky 40601 phone: Use this form to certify your residence as your domicile.