Tax Exempt Form Ohio 2022

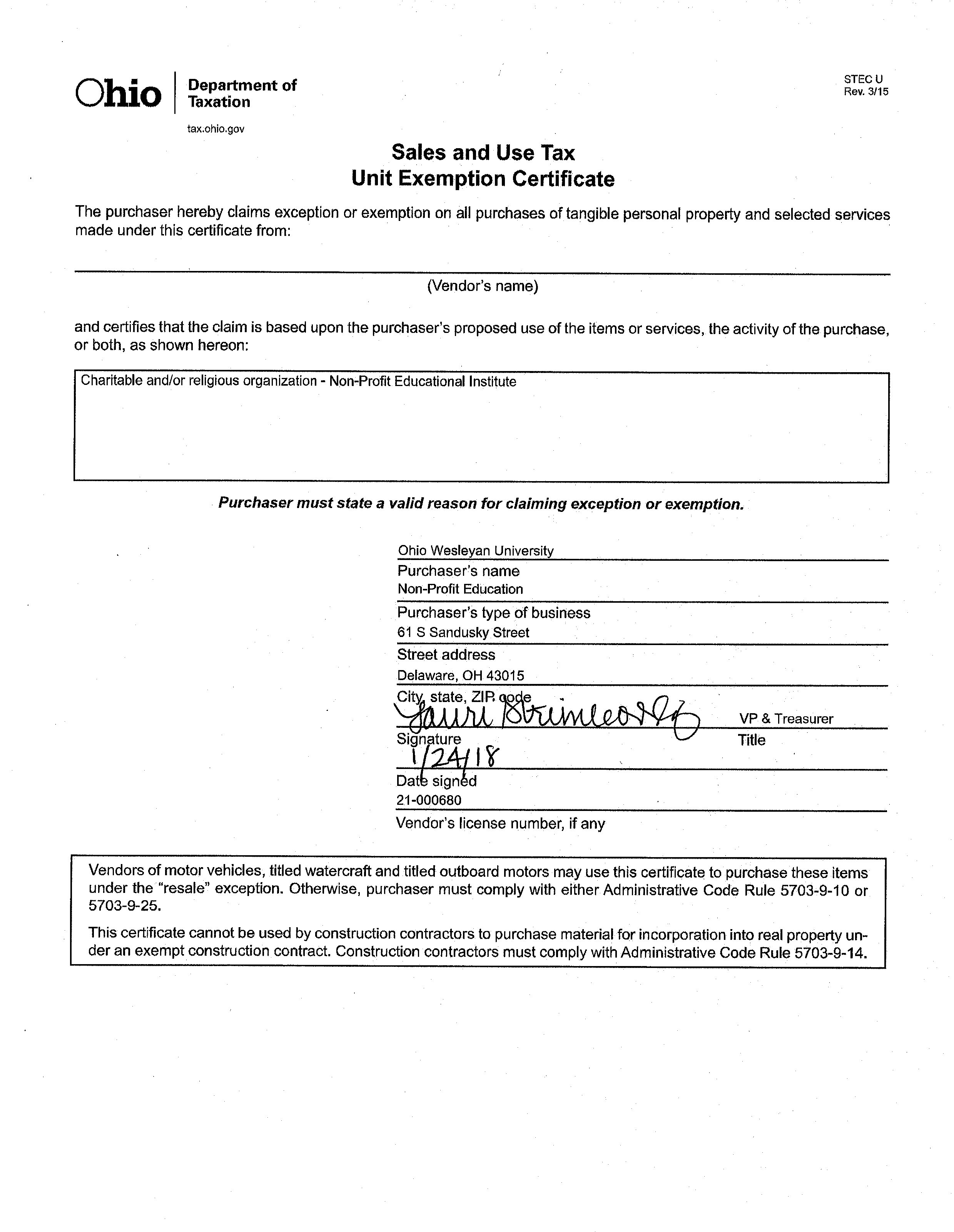

Tax Exempt Form Ohio 2022 - This exemption certificate is used to claim exemption or exception on a single purchase. Select add new from your dashboard and import a file into the system by uploading it from your device or importing it via the cloud,. Web tax exempt bonds; $12,950 for married couples filing separately. Get everything done in minutes. Web tax exempt form ohio. Web up to $40 cash back simply add a document. Web edit ohio tax exempt form. With summary posted at travel website (under news).; Web ohio tax forms 2022 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 49 votes how to fill out and sign printable tax exempt form ohio online?

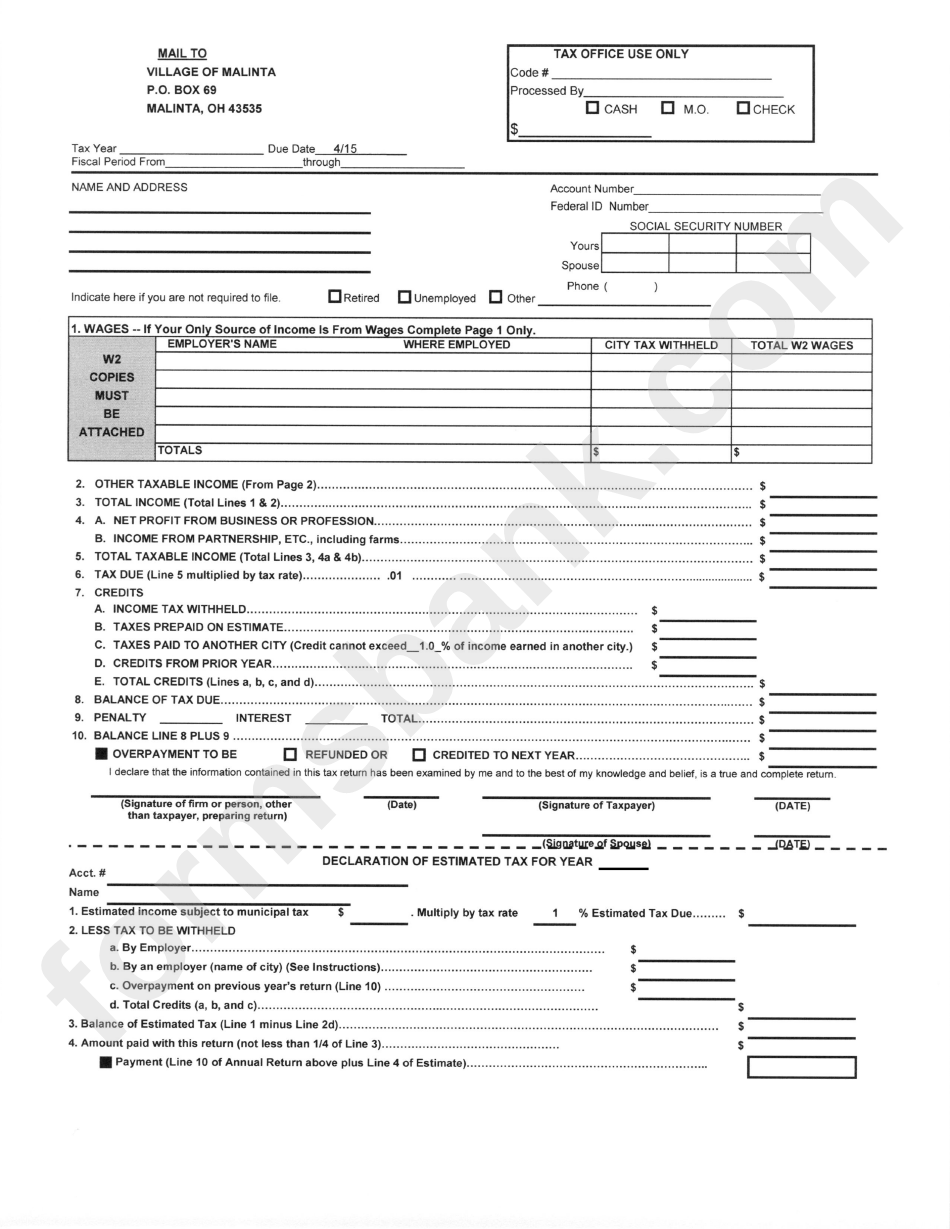

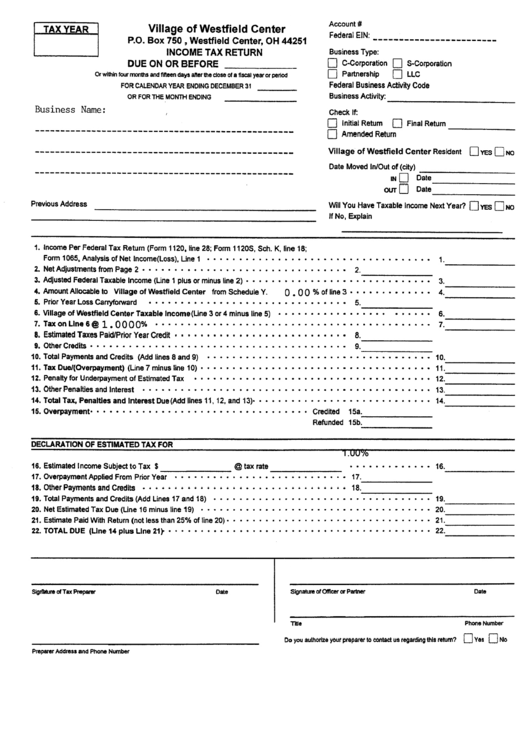

Can help confirm the transaction is not subject to sales tax in a time where the vendor may be. The ohio department of taxation provides a searchable repository of individual tax. Box 9951 canton, ohio 44711 cantonincometax.com you may not. Get everything done in minutes. Web tax exempt form ohio. Web exemption form 2022 (see general information) city of canton income tax department p.o. $19,400 for heads of households. Use the yellow download button to access the exemption form. Web welcome to the ohio department of taxation tax form request service. Other than as noted below, the use of a.

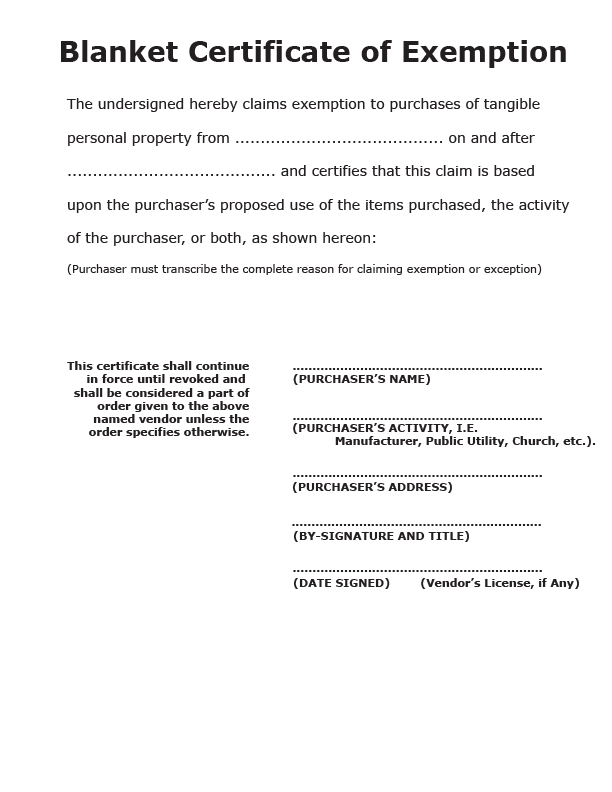

Web however, a sales and use tax blanket exemption certificate. $19,400 for heads of households. Can help confirm the transaction is not subject to sales tax in a time where the vendor may be. Quickly add and underline text, insert pictures, checkmarks, and icons, drop new fillable areas, and rearrange or delete pages from your paperwork. Select add new from your dashboard and import a file into the system by uploading it from your device or importing it via the cloud,. Primary taxpayer's ssn (required) if deceased spouse’s ssn (if filing jointly) if deceased. Web up to $40 cash back simply add a document. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Box 9951 canton, ohio 44711 cantonincometax.com you may not. Web welcome to the ohio department of taxation tax form request service.

Federal Hotel Tax Exempt Form California swissmadedesign

Web department of taxation employee’s withholding exemption certificate it 4 rev. Select add new from your dashboard and import a file into the system by uploading it from your device or importing it via the cloud,. Web tax exempt form ohio. Information needed for requesting a tax form: The ohio department of taxation provides a searchable repository of individual tax.

Ohio hotel tax exempt form Fill out & sign online DocHub

Web welcome to the ohio department of taxation tax form request service. • individual income tax (it 1040) • school district income tax (sd 100) hiodepartment of taxation tax. Other than as noted below, the use of a. Primary taxpayer's ssn (required) if deceased spouse’s ssn (if filing jointly) if deceased. Web however, a sales and use tax blanket exemption.

Printable Tax Exempt Form Master of Documents

Web welcome to the ohio department of taxation tax form request service. Web exemption form 2022 (see general information) city of canton income tax department p.o. Quickly add and underline text, insert pictures, checkmarks, and icons, drop new fillable areas, and rearrange or delete pages from your paperwork. Web up to $40 cash back simply add a document. Other than.

Tax Form B / Due dates for tax forms & applications. gafist

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Box 9951 canton, ohio 44711 cantonincometax.com you may not. Primary taxpayer's ssn (required) if deceased spouse’s ssn (if filing jointly) if deceased. Web edit ohio tax exempt form. Web department of taxation employee’s withholding exemption certificate it 4 rev.

Tax Return Form State Of Ohio printable pdf download

Select add new from your dashboard and import a file into the system by uploading it from your device or importing it via the cloud,. Web welcome to the ohio department of taxation tax form request service. Other than as noted below, the use of a. Use the yellow download button to access the exemption form. Information needed for requesting.

Ohio Farm Sales Tax Exemption Form Tax

$19,400 for heads of households. This exemption certificate is used to claim exemption or exception on a single purchase. Primary taxpayer's ssn (required) if deceased spouse’s ssn (if filing jointly) if deceased. Web tax exempt form ohio. The ohio department of taxation provides a searchable repository of individual tax.

ohio tax exempt form Fill out & sign online DocHub

With summary posted at travel website (under news).; Information needed for requesting a tax form: Web welcome to the ohio department of taxation tax form request service. Web tax exempt form ohio. Web exemption form 2022 (see general information) city of canton income tax department p.o.

20202022 Form PA DoR REV1220 AS Fill Online, Printable, Fillable

Web the deduction set by the irs for 2022 is: Web ohio tax forms 2022 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 49 votes how to fill out and sign printable tax exempt form ohio online? Web welcome to the ohio department of taxation tax form request service. Web.

Online Tax Online Tax Exempt Form

Web edit ohio tax exempt form. Select add new from your dashboard and import a file into the system by uploading it from your device or importing it via the cloud,. 12/20 submit form it 4 to your employer on or before the start date of employment so your. Check out how easy it is to complete and esign documents.

Tax Exempt Form Ohio Fill Online, Printable, Fillable, Blank pdfFiller

Web the deduction set by the irs for 2022 is: Web tax exempt form ohio. Web ohio tax forms 2022 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 49 votes how to fill out and sign printable tax exempt form ohio online? Access the forms you need to file taxes.

$12,950 For Married Couples Filing Separately.

Web however, a sales and use tax blanket exemption certificate. Web 2022 instructions for filing original and amended: Access the forms you need to file taxes or do business in ohio. Web welcome to the ohio department of taxation tax form request service.

Get Everything Done In Minutes.

Box 9951 canton, ohio 44711 cantonincometax.com you may not. Web tax exempt form ohio. Web exemption form 2022 (see general information) city of canton income tax department p.o. With summary posted at travel website (under news).;

Web Ohio Tax Forms 2022 Rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 Satisfied 49 Votes How To Fill Out And Sign Printable Tax Exempt Form Ohio Online?

• individual income tax (it 1040) • school district income tax (sd 100) hiodepartment of taxation tax. Web department of taxation employee’s withholding exemption certificate it 4 rev. Quickly add and underline text, insert pictures, checkmarks, and icons, drop new fillable areas, and rearrange or delete pages from your paperwork. Web tax exempt bonds;

Use The Yellow Download Button To Access The Exemption Form.

Web the following forms are authorized by the ohio department of taxation for use by ohio consumers when making exempt purchases. This exemption certificate is used to claim exemption or exception on a single purchase. Web up to $40 cash back simply add a document. 12/20 submit form it 4 to your employer on or before the start date of employment so your.