Tax Form 3514

Tax Form 3514 - Web use form ftb 3514 to determine whether you qualify to claim the credit, provide information about your qualifying children, if applicable, and to figure the amount. Web when claiming the california earned income tax credit, form 3514 line 1a asks if the irs has in a previous year disallowed your federal eic. Web if you are claiming the california earned income tax credit (eitc), you must provide your date of birth (dob), and spouse's/rdp's dob if filing jointly, on your california form. More about the california form 3514 ins we last updated california form 3514 ins in. Employee's withholding certificate form 941; Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in missouri during calendar year 2023. Employers engaged in a trade or business who. You do not need a child to qualify, but must file a california income. California usually releases forms for the current tax year between january and april. We last updated california form 3514 ins from the franchise tax board in.

Web the form 3514 requests a business code, business license number and sein. California usually releases forms for the current tax year between january and april. Web if you are claiming the california earned income tax credit (eitc), you must provide your date of birth (dob), and spouse's/rdp's dob if filing jointly, on your california form. Employee's withholding certificate form 941; Web use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if applicable, and to figure the amount. You do not need a child to qualify, but must file a california income tax return to. Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. You do not need a child to qualify, but must file a california income. Web how do i enter a business code on ca state form 3514, when i don't have a federal 1040 sch c? Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due.

Web use form ftb 3514 to determine whether you qualify to claim the credit, provide information about your qualifying children, if applicable, and to figure the amount. For some of the western states, the following addresses were previously used: Web eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if applicable, and to figure the amount. Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web the form 3514 requests a business code, business license number and sein. Web form 3514 california — california earned income tax credit download this form print this form it appears you don't have a pdf plugin for this browser. Web when claiming the california earned income tax credit, form 3514 line 1a asks if the irs has in a previous year disallowed your federal eic. Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be eligible.

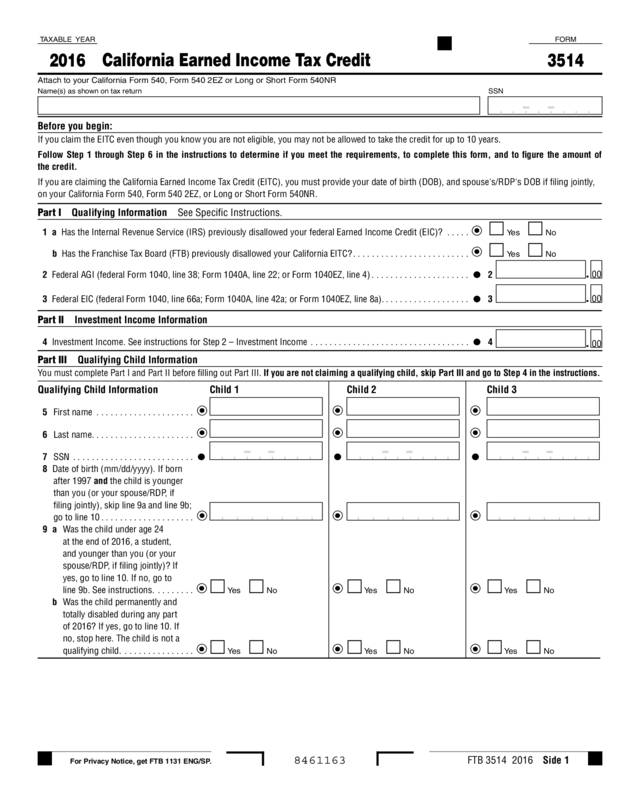

2016 Form 3514 California Earned Tax Credit Edit, Fill, Sign

Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be eligible. On a previous return i had some business income that might have. California usually releases forms for the current tax year between january and april. Web the form 3514 requests a business code, business license number and sein. Web form 3514 california — california.

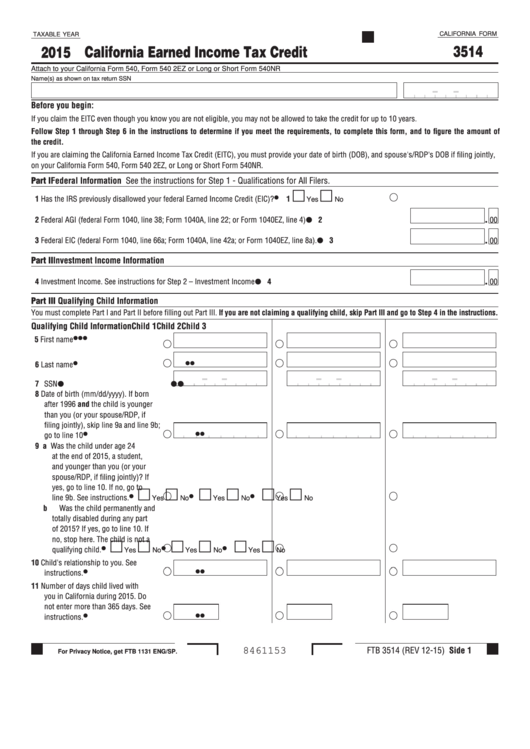

Form 3514 California Earned Tax Credit 2015 printable pdf

Employers engaged in a trade or business who. Web when claiming the california earned income tax credit, form 3514 line 1a asks if the irs has in a previous year disallowed your federal eic. For some of the western states, the following addresses were previously used: Web if you are claiming the california earned income tax credit (eitc), you must.

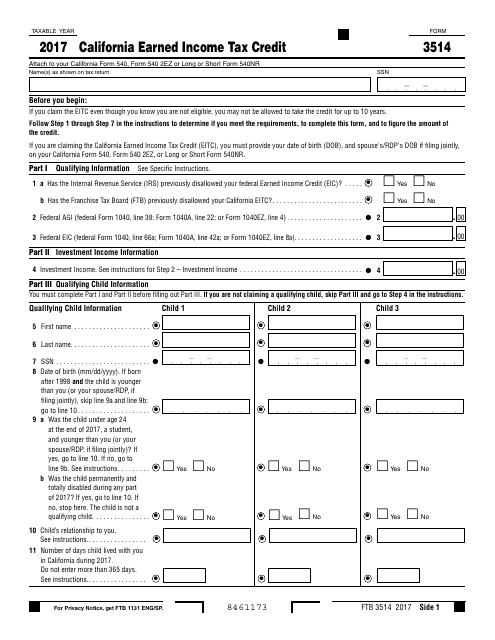

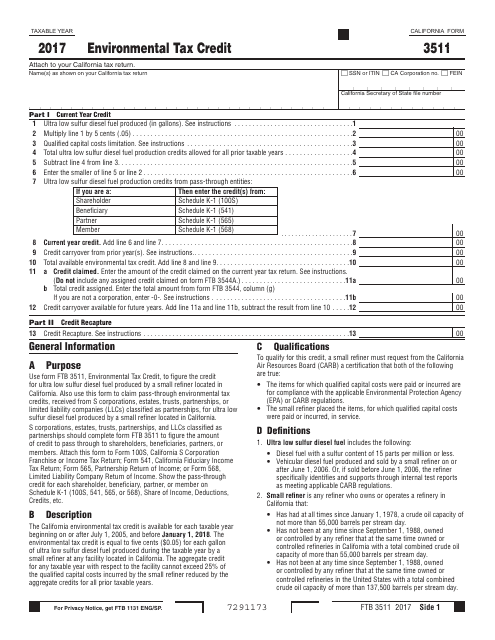

Form FTB 3514 Download Fillable PDF 2017, California Earned Tax

Department of the treasury |. Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web use form ftb 3514 to determine whether you qualify to claim the credit, provide information about your qualifying children, if applicable, and to figure the amount. Web the form 3514 requests a business.

2016 Form 3514 California Earned Tax Credit Edit, Fill, Sign

Department of the treasury |. Web use form ftb 3514 to determine whether you qualify to claim the eitc, yctc, and fytc, provide information about your qualifying children, if applicable, and to figure the amount. On a previous return i had some business income that might have. You do not need a child to qualify, but must file a california.

California Earned Tax Credit Worksheet 2017

More about the california form 3514 ins we last updated california form 3514 ins in. Employers engaged in a trade or business who. Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web how do i enter a business code on ca state form 3514, when i don't.

공사계획(변경) 승인신청서 샘플, 양식 다운로드

Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in missouri during.

how to remove form 3514 TurboTax Support

Web use form ftb 3514 to determine whether you qualify to claim the credit, provide information about your qualifying children, if applicable, and to figure the amount. Web eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web these where to file addresses are to be used only by taxpayers and tax professionals.

California Tax Table 540 2ez Review Home Decor

Department of the treasury |. You do not need a child to qualify, but must file a california income tax return to. Web eitc reduces your california tax obligation, or allows a refund if no california tax is due. More about the california form 3514 ins we last updated california form 3514 ins in. If you don't have a sein.

Tax Credits Aid Californians Now; Minimum Wage Hike Set

Employers engaged in a trade or business who. You do not need a child to qualify, but must file a california income. You do not need a child to qualify, but must file a california income tax return to. On a previous return i had some business income that might have. Web these where to file addresses are to be.

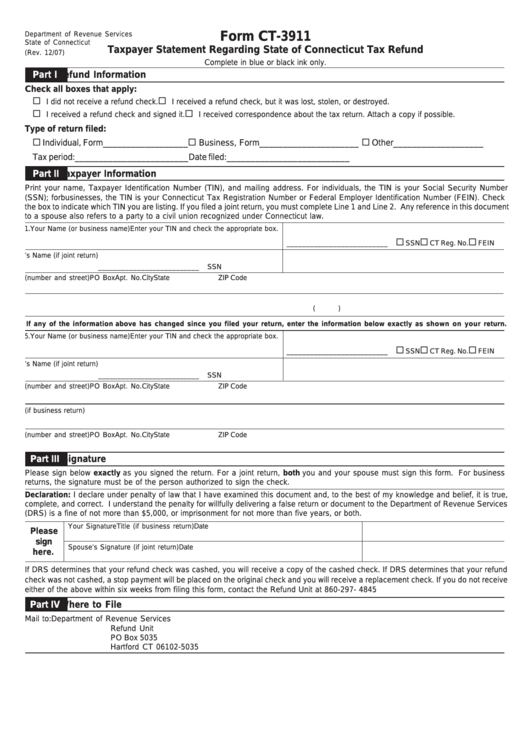

Fillable Form Ct3911 Taxpayer Statement Regarding State Of

Web when claiming the california earned income tax credit, form 3514 line 1a asks if the irs has in a previous year disallowed your federal eic. You do not need a child to qualify, but must file a california income. Employers engaged in a trade or business who. If you don't have a sein or business license number, then you.

If You Don't Have A Sein Or Business License Number, Then You Should Be Able To Leave.

Web the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. Web these where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in missouri during calendar year 2023. You do not need a child to qualify, but must file a california income tax return to. Employee's withholding certificate form 941;

California Usually Releases Forms For The Current Tax Year Between January And April.

Employers engaged in a trade or business who. Web please use the link below to download , and you can print it directly from your computer. Web eitc reduces your california tax obligation, or allows a refund if no california tax is due. Effective january 1, 2021, taxpayers who have an individual taxpayer identification number (itin) may be eligible.

Web Use Form Ftb 3514 To Determine Whether You Qualify To Claim The Credit, Provide Information About Your Qualifying Children, If Applicable, And To Figure The Amount.

Web form 3514 california — california earned income tax credit download this form print this form it appears you don't have a pdf plugin for this browser. We last updated california form 3514 ins from the franchise tax board in. Department of the treasury |. Web when claiming the california earned income tax credit, form 3514 line 1a asks if the irs has in a previous year disallowed your federal eic.

More About The California Form 3514 Ins We Last Updated California Form 3514 Ins In.

Web 603 rows the ca eitc reduces your california tax obligation, or allows a refund if no california tax is due. For some of the western states, the following addresses were previously used: On a previous return i had some business income that might have. Web the form 3514 requests a business code, business license number and sein.