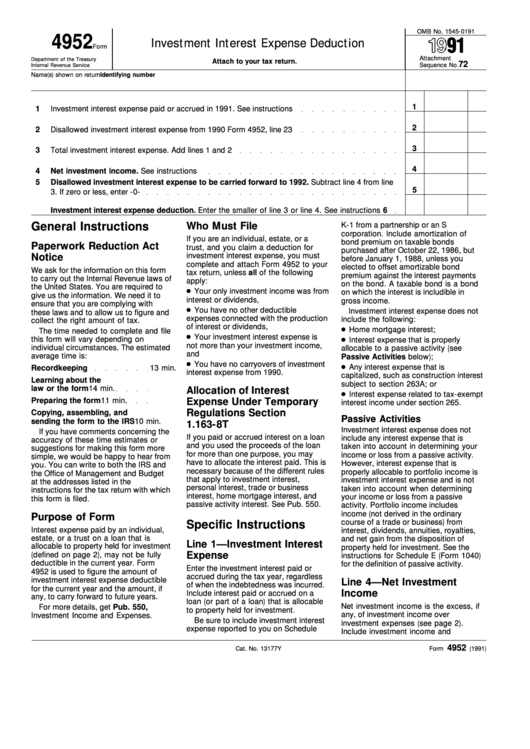

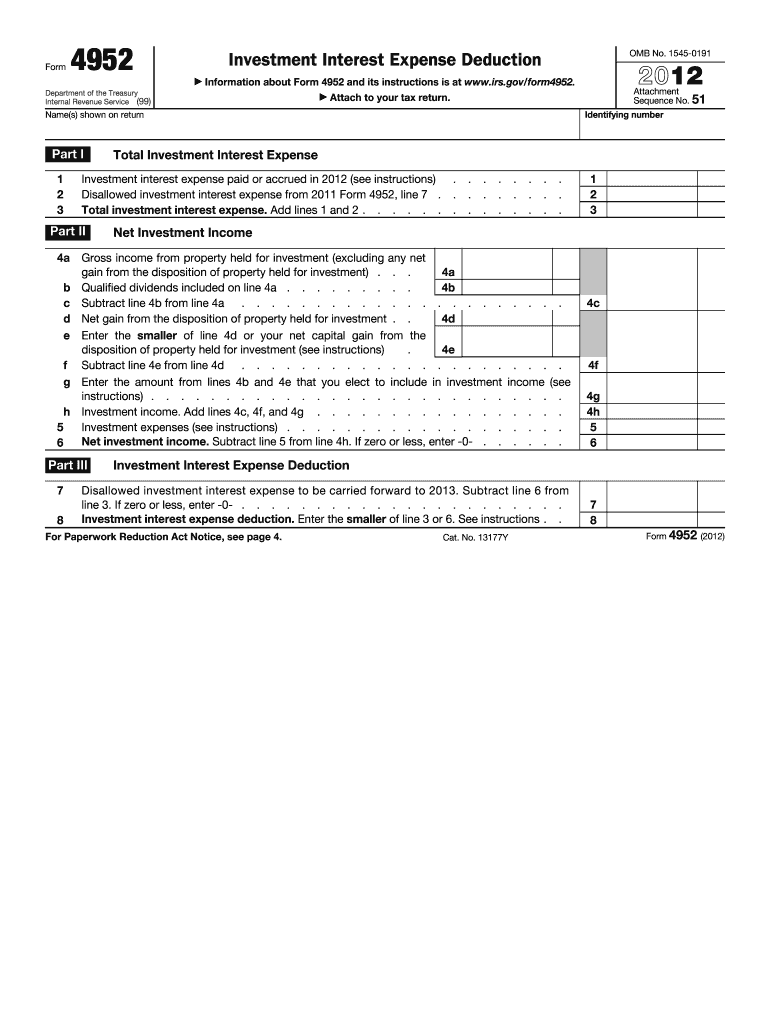

Tax Form 4952

Tax Form 4952 - Ad fill, sign, email irs 4952 & more fillable forms, register and subscribe now! Web who must file irs form 4952? Web the internal revenue service (irs) distributes form 4952: Web use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future years. Web form 4952 is a tax document used by the internal revenue service (irs) in the united states. Web i am looking for a payment address to mail a payment with an irs notice i received (form cp2000), and live in ct. The irs will contact your employer or payer and request the missing form. Web how does gross income from property held for investment (form 4952, line 4a) calculate? Ultratax cs includes the following as gross income from property held for. $250.00 we applied $500.00 of your 2016 form 1040 overpayment to an amount owed for 2015.

Investment interest expenditure deduction, which is a tax form used to calculate the amount of. Web the internal revenue service (irs) distributes form 4952: Web form 4952 is a tax document used by the internal revenue service (irs) in the united states. Web the program then takes the amount from lines 4b or 4e that is necessary to give the taxpayer the full deduction (line 8). Its purpose is to determine the amount of investment interest expense a person. Taxpayers who wish to claim investment interest expenses as a tax deduction generally must file form 4952 with their. The irs will also send you a form 4852. Web use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future years. Web we last updated the investment interest expense deduction in december 2022, so this is the latest version of form 4952, fully updated for tax year 2022. These tax benefits can significantly.

Ultratax cs includes the following as gross income from property held for. You do not have to file form 4952 if all of the following apply. Web the internal revenue service (irs) distributes form 4952: Per form 4952, line 4g, enter the amount. Open your return (or continue if open). Web who must file irs form 4952? The irs will also send you a form 4852. Web form 4952 is used to determine the amount of investment interest expense you can deduct for the current year and the amount you can carry forward to future years. This form is for income earned in tax year 2022, with tax returns due in april. Web use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future years.

Form 4952 Investment Interest Expense Deduction printable pdf download

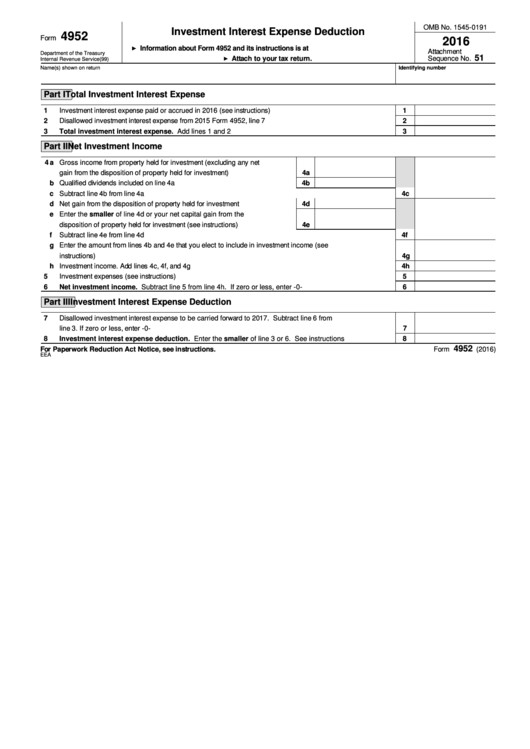

Taxpayers who wish to claim investment interest expenses as a tax deduction generally must file form 4952 with their. The irs will also send you a form 4852. You do not have to file form 4952 if all of the following apply. The irs will contact your employer or payer and request the missing form. Web we applied your 2016.

Form 4952 Investment Interest Expense Deduction 2016 printable pdf

Get ready for tax season deadlines by completing any required tax forms today. Web we last updated federal form 4952 in december 2022 from the federal internal revenue service. If you don’t receive the missing form in sufficient time to. Investment interest expenditure deduction, which is a tax form used to calculate the amount of. Web we applied your 2016.

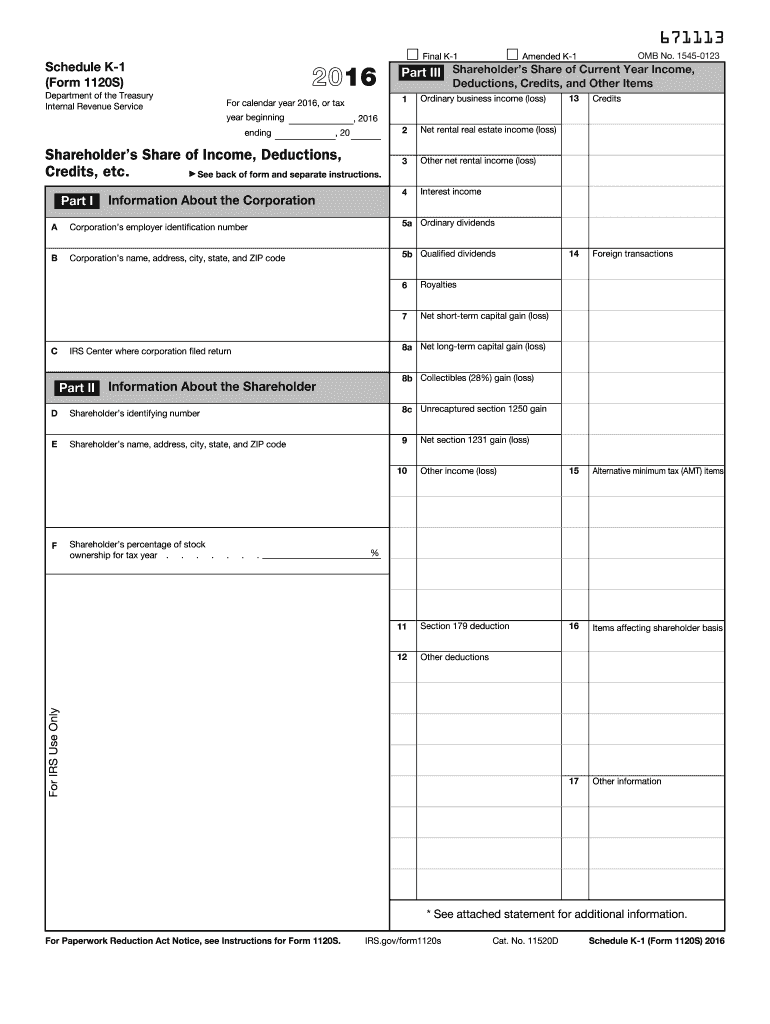

IRS 1120S Schedule K1 2016 Fill out Tax Template Online US Legal

Get ready for tax season deadlines by completing any required tax forms today. Investment interest expenditure deduction, which is a tax form used to calculate the amount of. Web how does gross income from property held for investment (form 4952, line 4a) calculate? These tax benefits can significantly. Ultratax cs includes the following as gross income from property held for.

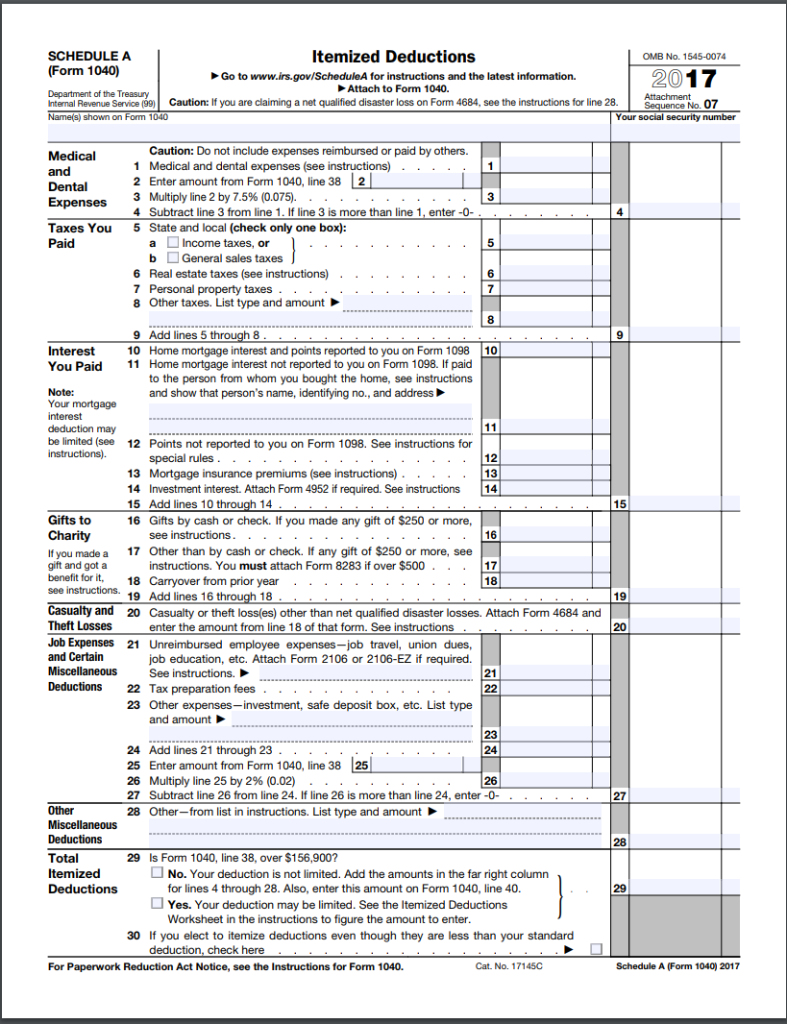

Form 4952Investment Interest Expense Deduction

You do not have to file form 4952 if all of the following apply. Web we applied your 2016 form 1040 overpayment to an unpaid balance refund due: Web use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future years. Investment interest expenditure deduction, which.

Form 4952 Investment Interest Expense Deduction (2015) Free Download

Ad download or email irs 4952 & more fillable forms, register and subscribe now! If you don’t receive the missing form in sufficient time to. These tax benefits can significantly. The irs will contact your employer or payer and request the missing form. Web form 4952 is a tax document used by the internal revenue service (irs) in the united.

51

Web the program then takes the amount from lines 4b or 4e that is necessary to give the taxpayer the full deduction (line 8). If you don’t receive the missing form in sufficient time to. Web i am looking for a payment address to mail a payment with an irs notice i received (form cp2000), and live in ct. Web.

Form 4952 Investment Interest Expense Deduction (2015) Free Download

Ultratax cs includes the following as gross income from property held for. To enter/edit form 4952 (investment interest expense deduction): Web we applied your 2016 form 1040 overpayment to an unpaid balance refund due: The irs will contact your employer or payer and request the missing form. Open your return (or continue if open).

Solved Leah, a 35 year old single taxpayer, has had similar

These tax benefits can significantly. Complete, edit or print tax forms instantly. Private delivery services should not deliver returns to irs offices other than. The irs will contact your employer or payer and request the missing form. Ad fill, sign, email irs 4952 & more fillable forms, register and subscribe now!

Form 4952, Investment Interest Expense Deduction 1040 com Fill Out

Web we last updated the investment interest expense deduction in december 2022, so this is the latest version of form 4952, fully updated for tax year 2022. This form is for income earned in tax year 2022, with tax returns due in april. Web find irs addresses for private delivery of tax returns, extensions and payments. These tax benefits can.

3.11.14 Tax Returns for Estates and Trusts (Forms 1041, 1041QFT

Its purpose is to determine the amount of investment interest expense a person. $250.00 we applied $500.00 of your 2016 form 1040 overpayment to an amount owed for 2015. There were two different addresses, fresno and. Web it applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax.

Per Form 4952, Line 4G, Enter The Amount.

Complete, edit or print tax forms instantly. Private delivery services should not deliver returns to irs offices other than. If you don’t receive the missing form in sufficient time to. Get ready for tax season deadlines by completing any required tax forms today.

To Enter/Edit Form 4952 (Investment Interest Expense Deduction):

Web the program then takes the amount from lines 4b or 4e that is necessary to give the taxpayer the full deduction (line 8). $250.00 we applied $500.00 of your 2016 form 1040 overpayment to an amount owed for 2015. Open your return (or continue if open). Ultratax cs includes the following as gross income from property held for.

Web It Applies To Taxpayers Who Have Certain Types Of Income That Receive Favorable Treatment, Or Who Qualify For Certain Deductions, Under The Tax Law.

Its purpose is to determine the amount of investment interest expense a person. Web how does gross income from property held for investment (form 4952, line 4a) calculate? Web we last updated the investment interest expense deduction in december 2022, so this is the latest version of form 4952, fully updated for tax year 2022. The irs will contact your employer or payer and request the missing form.

The Irs Will Also Send You A Form 4852.

These tax benefits can significantly. Investment interest expenditure deduction, which is a tax form used to calculate the amount of. Ad fill, sign, email irs 4952 & more fillable forms, register and subscribe now! Web we applied your 2016 form 1040 overpayment to an unpaid balance refund due: