Tax Form 5472

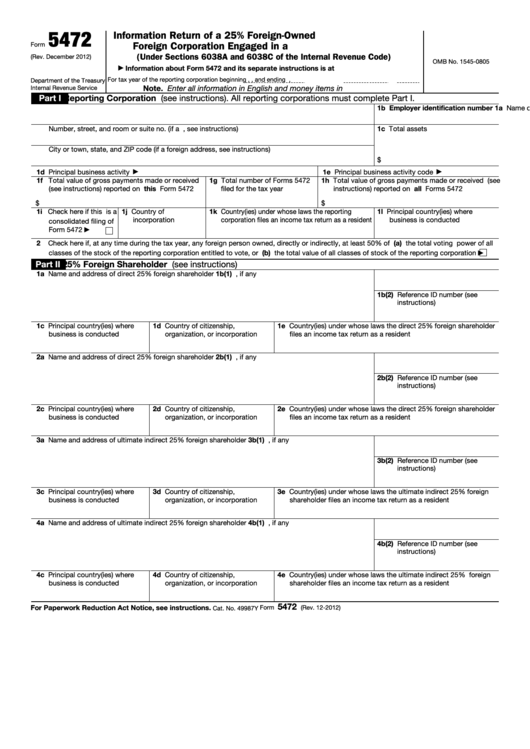

Tax Form 5472 - Web what is form 5472? Person (which can include either individuals or businesses) that owns at least 25% of company stock, or December 2022) department of the treasury internal revenue service. Must ensure compliance with all applicable u.s. These entities are required to file form 5472 annually and provide information about their ownership structures and transactions, including changes made to the ownership of the business. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party. A reporting corporation is either: Corporation or a foreign corporation engaged in a u.s. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues, beginning 90 days after the irs notifies the taxpayer of the.

Corporation or a foreign corporation engaged in a u.s. Corporation or a foreign corporation engaged in a u.s. Web what is form 5472? Persons who own entities in the u.s. Web information about form 5472, including recent updates, related forms, and instructions on how to file. De that fails to timely file form 5472 or files a substantially incomplete form 5472. Must ensure compliance with all applicable u.s. Web internal revenue service form 5472 is an informational form that discloses the transactions during the tax year of a reporting corporation (the us taxpayer) with a foreign or domestic related party. Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party. A reporting corporation is either:

A reporting corporation is either: December 2022) department of the treasury internal revenue service. Trade or business (under sections 6038a and 6038c of the internal revenue code) go to. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues, beginning 90 days after the irs notifies the taxpayer of the. Corporations file form 5472 to provide information required under sections 6038a and 6038c when reportable transactions. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over a u.s. De that fails to timely file form 5472 or files a substantially incomplete form 5472. Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party. Web what is form 5472? Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party.

Completing US Tax Forms Form 5472 ForeignOwned Disregarded Entities

These entities are required to file form 5472 annually and provide information about their ownership structures and transactions, including changes made to the ownership of the business. Must ensure compliance with all applicable u.s. Trade or business (under sections 6038a and 6038c of the internal revenue code) go to. Web use form 5472 to provide information required under sections 6038a.

Tax Form 5472

Must ensure compliance with all applicable u.s. Corporation or a foreign corporation engaged in a u.s. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Web what is form 5472? Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over.

IRS Form 5472 File taxes for offshore LLCs How To Guide

Corporations file form 5472 to provide information required under sections 6038a and 6038c when reportable transactions. A reporting corporation is either: Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party. Persons who own entities in the u.s..

Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]

Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over a u.s. These entities are required to file form 5472 annually and provide information about their ownership structures and transactions, including changes made to the ownership of the business. Must ensure compliance with all applicable u.s. For.

Form 5472 2022 IRS Forms

Persons who own entities in the u.s. December 2022) department of the treasury internal revenue service. Corporations file form 5472 to provide information required under sections 6038a and 6038c when reportable transactions. Corporation or a foreign corporation engaged in a u.s. Web what is form 5472?

Demystifying IRS Form 5472 SF Tax Counsel

Web what is form 5472? De that fails to timely file form 5472 or files a substantially incomplete form 5472. Trade or business (under sections 6038a and 6038c of the internal revenue code) go to. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month.

Fillable Form 5472 Information Return Of A 25 ForeignOwned U.s

Web internal revenue service form 5472 is an informational form that discloses the transactions during the tax year of a reporting corporation (the us taxpayer) with a foreign or domestic related party. December 2022) department of the treasury internal revenue service. Persons who own entities in the u.s. For instructions and the latest information. Web use form 5472 to provide.

What Is Form 5472? Milikowsky Tax Law

Web information about form 5472, including recent updates, related forms, and instructions on how to file. Persons who own entities in the u.s. Web what is form 5472? Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party..

Saving Taxes and International Tax Plan Form 5472 YouTube

Persons who own entities in the u.s. Corporation or a foreign corporation engaged in a u.s. Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party. Person (which can include either individuals or businesses) that owns at least.

Fill Free fillable IRS PDF forms

Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party. Web a failure to timely file a form 5472 is subject to a $25,000 penalty per information return, plus an additional $25,000 for each month the failure continues,.

Web A Failure To Timely File A Form 5472 Is Subject To A $25,000 Penalty Per Information Return, Plus An Additional $25,000 For Each Month The Failure Continues, Beginning 90 Days After The Irs Notifies The Taxpayer Of The.

De that fails to timely file form 5472 or files a substantially incomplete form 5472. For instructions and the latest information. Web use form 5472 to provide information required under sections 6038a and 6038c when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party. Corporations file form 5472 to provide information required under sections 6038a and 6038c when reportable transactions.

Web Use Form 5472 To Provide Information Required Under Sections 6038A And 6038C When Reportable Transactions Occur During The Tax Year Of A Reporting Corporation With A Foreign Or Domestic Related Party.

Persons who own entities in the u.s. Must ensure compliance with all applicable u.s. A reporting corporation is either: December 2022) department of the treasury internal revenue service.

Web What Is Form 5472?

Web information about form 5472, including recent updates, related forms, and instructions on how to file. Web internal revenue service form 5472 is an informational form that discloses the transactions during the tax year of a reporting corporation (the us taxpayer) with a foreign or domestic related party. These entities are required to file form 5472 annually and provide information about their ownership structures and transactions, including changes made to the ownership of the business. Corporation or a foreign corporation engaged in a u.s.

Person (Which Can Include Either Individuals Or Businesses) That Owns At Least 25% Of Company Stock, Or

Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over a u.s. Trade or business (under sections 6038a and 6038c of the internal revenue code) go to. Corporation or a foreign corporation engaged in a u.s.

![Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]](https://globalisationguide.org/wp-content/uploads/2020/04/irs-form-5472-disregarded-entity.jpg)