Tax Form 8833

Tax Form 8833 - Check your federal tax withholding. Web in some cases, u.s. The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return. Don't miss this 50% discount. To enter an amount on line 8 of schedule 1 (form 1040) additional income and adjustments to income to reduce the taxable wage amount from. Taxpayers may have the option of filing irs form 8833 to pay federal taxes at a reduced rate than they otherwise would pay under u.s. Address to mail form to irs: Here’s a quick look at the information. Complete, edit or print tax forms instantly. For more information about identifying numbers, see the.

A reduction or modification in the taxation of gain or loss from the disposition of a. Check your federal tax withholding. Taxpayer wants to rely on an international tax treaty that the united states has entered into regarding tax law, sometimes they have to file an. Tax return and form 8833 if claiming the following treaty benefits: Ad access irs tax forms. Tax return and form 8833 if you claim the following treaty benefits. Get answers to your tax questions. Web you must file a u.s. Web in some cases, u.s. Complete, edit or print tax forms instantly.

Complete, edit or print tax forms instantly. Web get your refund status. If you are located in. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Use this address if you are not enclosing a payment use this. Web in some cases, u.s. Web you must file a u.s. The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return. Web the payee must file a u.s. File your 2290 tax now and receive schedule 1 in minutes.

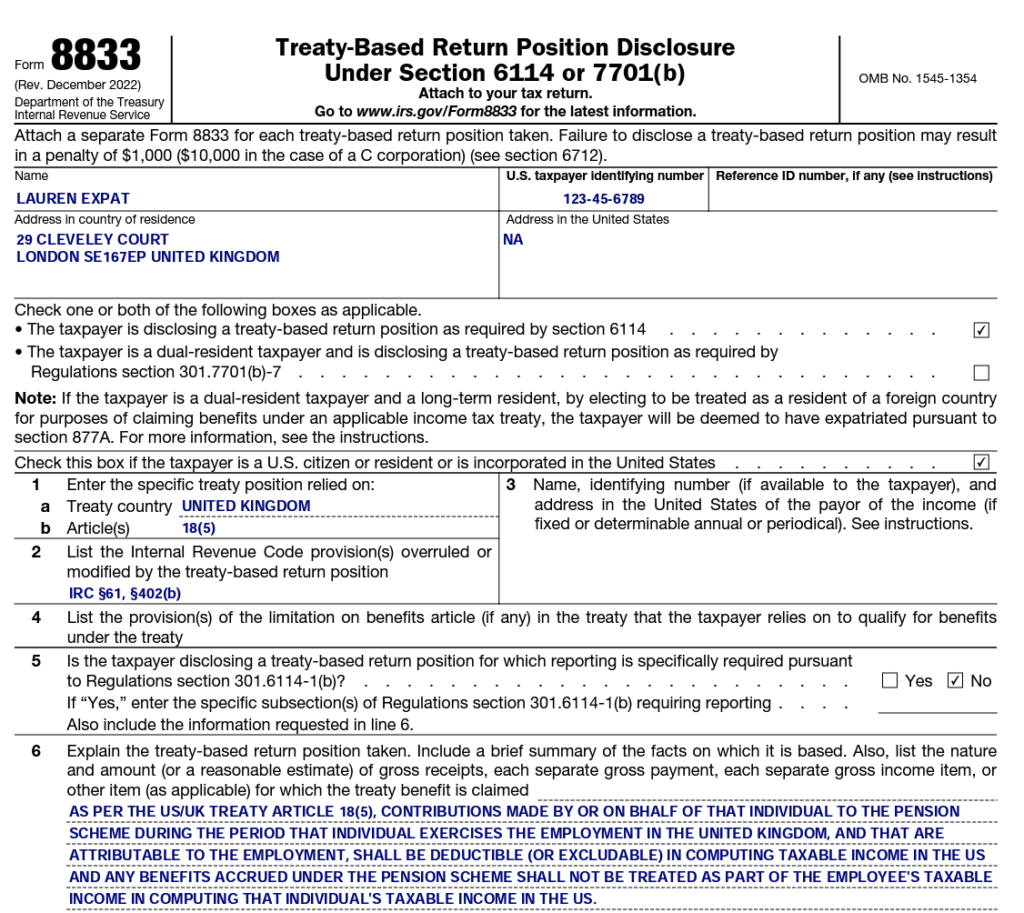

Form 8833 TreatyBased Return Position Disclosure under Section 6114

Get the benefit of tax research and calculation experts with avalara avatax software. Connecticut, delaware, district of columbia, illinois, indiana, kentucky, maine, maryland,. Web form 8833 is used to show the irs that you’re applying a particular tax treaty position correctly. Taxpayer wants to rely on an international tax treaty that the united states has entered into regarding tax law,.

Form 8833 TreatyBased Return Position Disclosure under Section 6114

For more information about identifying numbers, see the. Get the benefit of tax research and calculation experts with avalara avatax software. The irs requires certain taxpayers who want to take a treaty position on their tax returns to submit a form 8833 along with their tax return. Web form 8833 is used to show the irs that you’re applying a.

Tax Treaty Benefits & Form 8833 What You Need to Know (From a CPA!)

Tax return and form 8833 if claiming the following treaty benefits: Don't miss this 50% discount. Web in some cases, u.s. Ad access irs tax forms. Taxpayer wants to rely on an international tax treaty that the united states has entered into regarding tax law, sometimes they have to file an.

U.S. Tax Form 8833 Guidelines Expat US Tax

Check your federal tax withholding. Complete, edit or print tax forms instantly. Web the payee must file a u.s. Address to mail form to irs: Tax return and form 8833 if you claim the following treaty benefits.

Form 8833, TreatyBased Return Position Disclosure Under Section 6114

Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. A reduction or modification in the taxation of gain or loss from the disposition of a. Web in some cases, u.s. Complete, edit or print tax forms instantly. You claim a reduction or modification in the taxation of gain or loss from the disposition of a.

Form 8833 PDF Samples for Online Tax Managing

Ad avalara avatax can help you automate sales tax rate calculation and filing preparation. Check your federal tax withholding. Complete, edit or print tax forms instantly. A reduction or modification in the taxation of gain or loss from the disposition of a. You claim a reduction or modification in the taxation of gain or loss from the disposition of a.

Form 8833 & Tax Treaties Understanding Your US Tax Return

You claim a reduction or modification in the taxation of gain or loss from the disposition of a. Tax return and form 8833 if claiming the following treaty benefits: To enter an amount on line 8 of schedule 1 (form 1040) additional income and adjustments to income to reduce the taxable wage amount from. Ad efile form 2290 tax with.

IRS Form 8833 Download Fillable PDF or Fill Online TreatyBased Return

Connecticut, delaware, district of columbia, illinois, indiana, kentucky, maine, maryland,. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Web the payee must file a u.s. If you are located in. Taxpayers may have the option of filing irs form 8833 to pay federal taxes at a reduced rate than they otherwise would pay under u.s.

Video Form 8833 Tax Treaty Disclosure US Global Tax

Web get your refund status. Ad access irs tax forms. Tax return and form 8833 if you claim the following treaty benefits. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes. Tax return and form 8833 if claiming the following treaty benefits:

Form 8833 & Tax Treaties Understanding Your US Tax Return

Tax return and form 8833 if you claim the following treaty benefits. Get answers to your tax questions. Taxpayer wants to rely on an international tax treaty that the united states has entered into regarding tax law, sometimes they have to file an. Use this address if you are not enclosing a payment use this. Complete, edit or print tax.

The Irs Requires Certain Taxpayers Who Want To Take A Treaty Position On Their Tax Returns To Submit A Form 8833 Along With Their Tax Return.

Get answers to your tax questions. Here’s a quick look at the information. To enter an amount on line 8 of schedule 1 (form 1040) additional income and adjustments to income to reduce the taxable wage amount from. For more information about identifying numbers, see the.

Tax Return And Form 8833 If Claiming The Following Treaty Benefits:

Don't miss this 50% discount. Web what is form 8833? Check your federal tax withholding. Get the benefit of tax research and calculation experts with avalara avatax software.

If You Are Located In.

Web to claim treaty benefits on your tax return, you must file form 8833 to the irs each tax year with your annual filing. Address to mail form to irs: Taxpayers may have the option of filing irs form 8833 to pay federal taxes at a reduced rate than they otherwise would pay under u.s. Ad efile form 2290 tax with ez2290 & get schedule 1 in minutes.

Complete, Edit Or Print Tax Forms Instantly.

Web in some cases, u.s. Use this address if you are not enclosing a payment use this. Web get your refund status. Ad access irs tax forms.