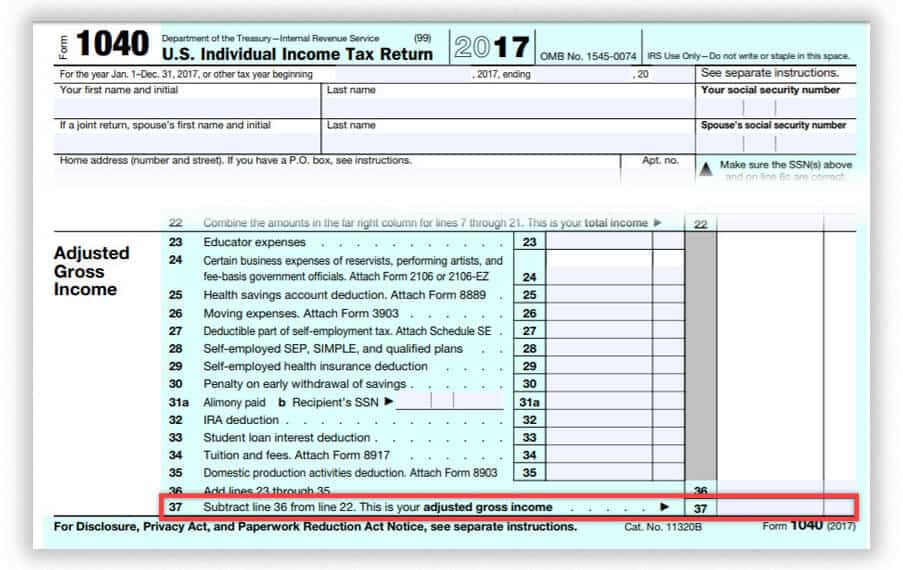

Tax Form For 403B

Tax Form For 403B - Web august 1, 2023 at 5:05 pm · 4 min read. Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Web ordinary dividends are taxed at ordinary income tax rates of up to 37%. If not, you can deduct contributions from your. Your taxable income is less than $100,000. You claim certain tax credits; To determine if a plan offers. Ad see how a 403(b) could help you meet your goals and save for tomorrow. Web provides relief during 2009 for certain 403 (b) plan sponsors from the requirement to adopt a written plan by january 1, 2009. Irs use only—do not write or staple in this.

Plans based on iras (sep, simple ira) do not offer loans. Qualified dividends are taxed at lower capital gains tax rates, which can range from 0%. Irs use only—do not write or staple in this. Web form 1040a may be best for you if: You have capital gain distributions. Your taxable income is less than $100,000. Web • your total taxes after adjustments and nonrefundable credits for the year (form 943, line 13) are less than $2,500 and you’re paying in full with a timely filed return, Web updated january 23, 2023 reviewed by margaret james fact checked by vikki velasquez investopedia / michela buttignol what is a 403 (b) plan? Web august 1, 2023 at 5:05 pm · 4 min read. To determine if a plan offers.

Web ordinary dividends are taxed at ordinary income tax rates of up to 37%. Ad oppenheimerfunds & more fillable forms, register and subscribe now! You have capital gain distributions. If not, you can deduct contributions from your. To determine if a plan offers. The irs commonly finds mistakes in 403(b) plans. Qualified dividends are taxed at lower capital gains tax rates, which can range from 0%. Web updated january 23, 2023 reviewed by margaret james fact checked by vikki velasquez investopedia / michela buttignol what is a 403 (b) plan? Web provides relief during 2009 for certain 403 (b) plan sponsors from the requirement to adopt a written plan by january 1, 2009. Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no.

Student Loans and Adjusted Gross (AGI) Tips for Low Payments

Plans based on iras (sep, simple ira) do not offer loans. You claim certain tax credits; Web • your total taxes after adjustments and nonrefundable credits for the year (form 943, line 13) are less than $2,500 and you’re paying in full with a timely filed return, Web provides relief during 2009 for certain 403 (b) plan sponsors from the.

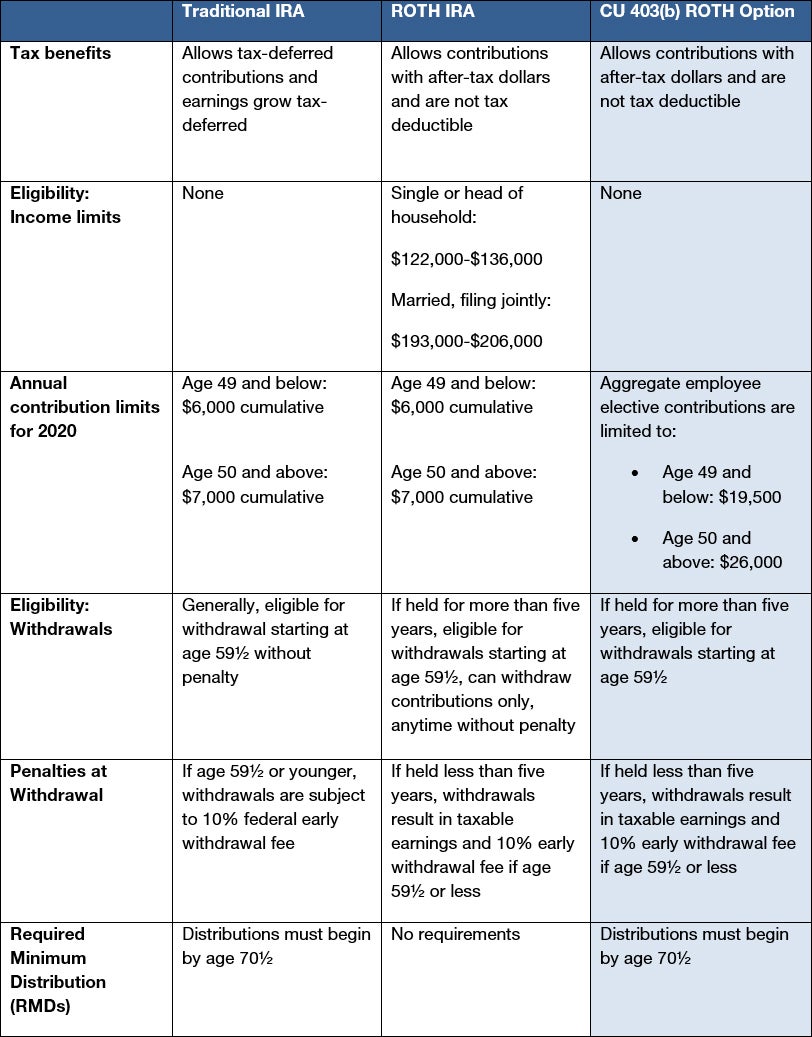

CU’s new 403(b) ROTH option enables aftertax savings for retirement

You have capital gain distributions. Your taxable income is less than $100,000. Web august 1, 2023 at 5:05 pm · 4 min read. Web ordinary dividends are taxed at ordinary income tax rates of up to 37%. Irs use only—do not write or staple in this.

What is a 403(b)? Michigan Retirement Investment Consortium

If not, you can deduct contributions from your. Web 403(b) plan it’s important to know the tax rules that apply to a 403(b) plan to help you get the maximum benefit from your plan. Web form 1040a may be best for you if: Web ordinary dividends are taxed at ordinary income tax rates of up to 37%. Web updated january.

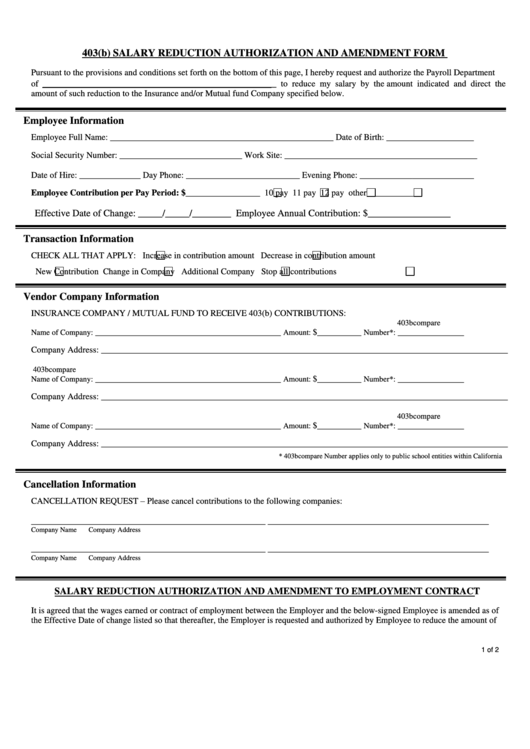

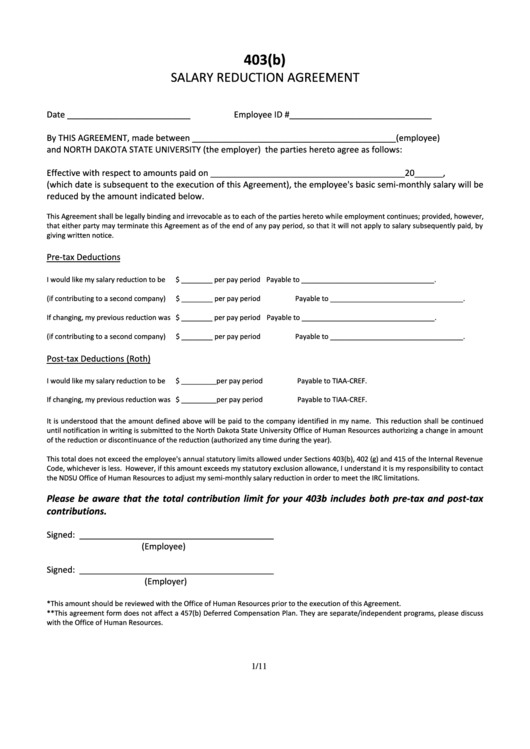

Fillable 403(B) Salary Reduction Authorization And Amendment Form

Irs use only—do not write or staple in this. Web form 1040a may be best for you if: Your taxable income is less than $100,000. Plans based on iras (sep, simple ira) do not offer loans. Qualified dividends are taxed at lower capital gains tax rates, which can range from 0%.

TAX IRA, 403B & 401K accounts! Classic Round Sticker Zazzle

Qualified dividends are taxed at lower capital gains tax rates, which can range from 0%. If not, you can deduct contributions from your. To determine if a plan offers. You claim certain tax credits; Web form 1040a may be best for you if:

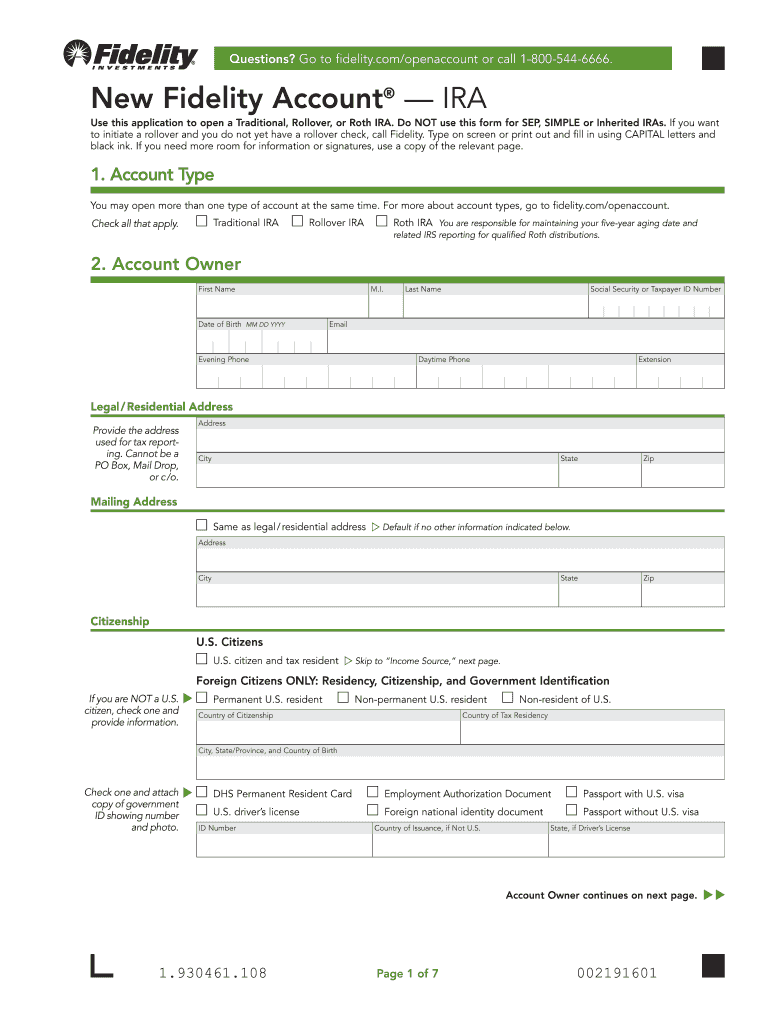

Fidelity Application Form Fill Online, Printable, Fillable, Blank

Web form 1040a may be best for you if: Web 403(b) plan it’s important to know the tax rules that apply to a 403(b) plan to help you get the maximum benefit from your plan. Web • your total taxes after adjustments and nonrefundable credits for the year (form 943, line 13) are less than $2,500 and you’re paying in.

Roth 403B Rules Pocket Sense

Web 403(b) plan it’s important to know the tax rules that apply to a 403(b) plan to help you get the maximum benefit from your plan. Web updated january 23, 2023 reviewed by margaret james fact checked by vikki velasquez investopedia / michela buttignol what is a 403 (b) plan? Web ordinary dividends are taxed at ordinary income tax rates.

Form 403(B) Salary Reduction Agreement printable pdf download

Web • your total taxes after adjustments and nonrefundable credits for the year (form 943, line 13) are less than $2,500 and you’re paying in full with a timely filed return, Web form 1040a may be best for you if: Web provides relief during 2009 for certain 403 (b) plan sponsors from the requirement to adopt a written plan by.

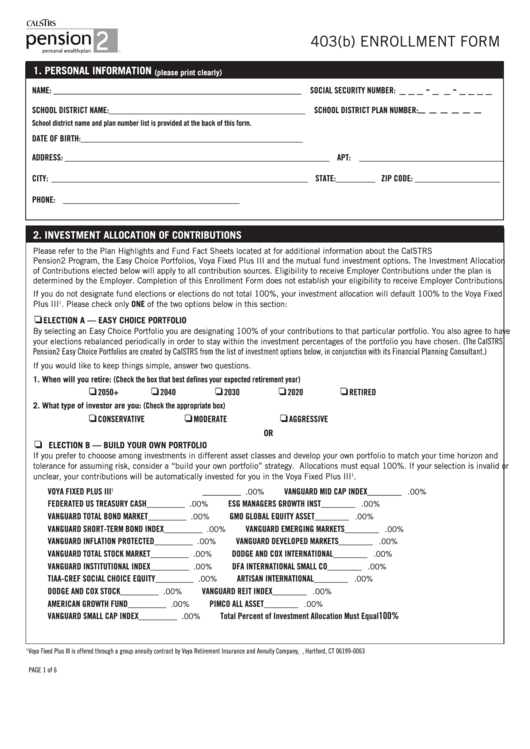

Fillable Calstrs 403(B) Enrollment Form printable pdf download

You have capital gain distributions. Web updated january 23, 2023 reviewed by margaret james fact checked by vikki velasquez investopedia / michela buttignol what is a 403 (b) plan? Plans based on iras (sep, simple ira) do not offer loans. To determine if a plan offers. Irs use only—do not write or staple in this.

Form 403 Fill Out and Sign Printable PDF Template signNow

Web updated january 23, 2023 reviewed by margaret james fact checked by vikki velasquez investopedia / michela buttignol what is a 403 (b) plan? Ad oppenheimerfunds & more fillable forms, register and subscribe now! Individual income tax return 2021 department of the treasury—internal revenue service (99) omb no. Web august 1, 2023 at 5:05 pm · 4 min read. You.

Individual Income Tax Return 2021 Department Of The Treasury—Internal Revenue Service (99) Omb No.

Irs use only—do not write or staple in this. To determine if a plan offers. Qualified dividends are taxed at lower capital gains tax rates, which can range from 0%. Your taxable income is less than $100,000.

Plans Based On Iras (Sep, Simple Ira) Do Not Offer Loans.

Ad see how a 403(b) could help you meet your goals and save for tomorrow. Ad oppenheimerfunds & more fillable forms, register and subscribe now! You claim certain tax credits; Web provides relief during 2009 for certain 403 (b) plan sponsors from the requirement to adopt a written plan by january 1, 2009.

You Have Capital Gain Distributions.

If not, you can deduct contributions from your. Web • your total taxes after adjustments and nonrefundable credits for the year (form 943, line 13) are less than $2,500 and you’re paying in full with a timely filed return, The irs commonly finds mistakes in 403(b) plans. Web august 1, 2023 at 5:05 pm · 4 min read.

Web Ordinary Dividends Are Taxed At Ordinary Income Tax Rates Of Up To 37%.

Web 403(b) plan it’s important to know the tax rules that apply to a 403(b) plan to help you get the maximum benefit from your plan. Web form 1040a may be best for you if: Web updated january 23, 2023 reviewed by margaret james fact checked by vikki velasquez investopedia / michela buttignol what is a 403 (b) plan?