Tax Form For Backdoor Roth

Tax Form For Backdoor Roth - Roth ira income limits in 2022 and 2023 filing status If there's a balance in the ira, there could be a taxable event when you convert. Now that we have walked through the steps, let’s look at an example of how to report a backdoor roth ira contribution. Web a backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. (or code 7 if your age is over 59 ½) in the year you make your roth conversion. Web the backdoor roth ira strategy lets you circumvent these limits, although it does involve making additional tax payments. Web there are 2 ways to set up a backdoor roth ira: Contributing directly to a roth ira is restricted if your income is beyond certain limits, but there are no income limits for conversions. Web the backdoor roth ira strategy is a legal way to get around the income limits that usually prevent high earners from owning roth iras. Web as you'll see on form 8606 itself (link opens a pdf), whenever you contribute to a nondeductible ira, you have to report your contribution to the irs.

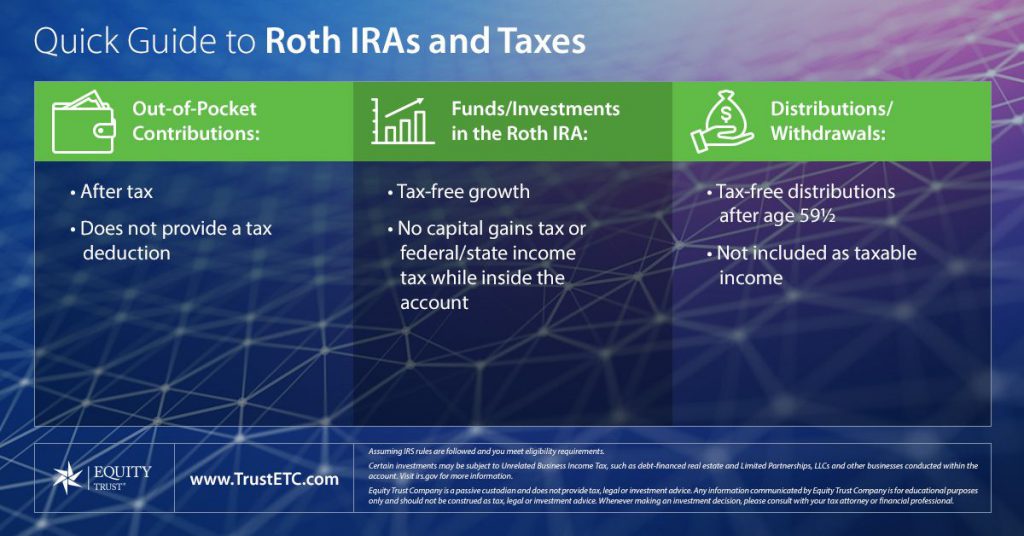

Web we recommend keeping form 5498 for your records, but you don’t need to report form 5498 in your tax filing. If there's a balance in the ira, there could be a taxable event when you convert. Contribute money to an ira, and then roll over the money to a roth ira. That allows the irs to track your tax. Web the backdoor roth ira strategy is a legal way to get around the income limits that usually prevent high earners from owning roth iras. Web as you'll see on form 8606 itself (link opens a pdf), whenever you contribute to a nondeductible ira, you have to report your contribution to the irs. (or code 7 if your age is over 59 ½) in the year you make your roth conversion. Web the backdoor roth ira strategy lets you circumvent these limits, although it does involve making additional tax payments. Roth ira income limits in 2022 and 2023 filing status Contributing directly to a roth ira is restricted if your income is beyond certain limits, but there are no income limits for conversions.

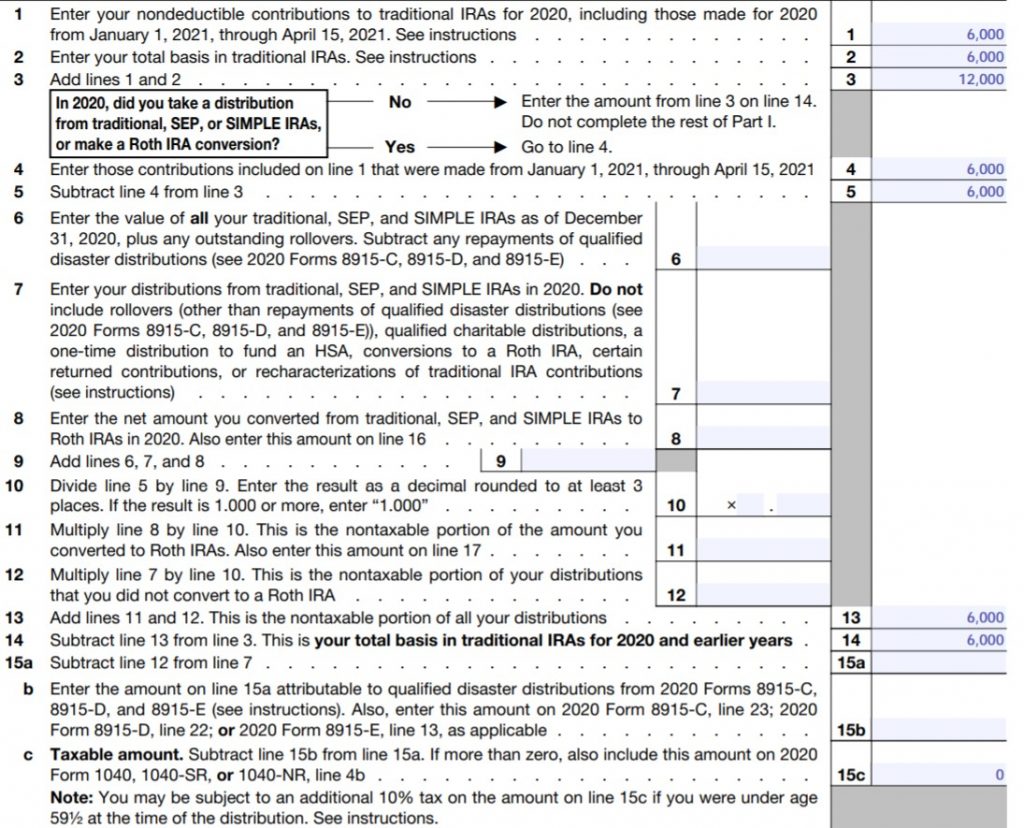

Web the backdoor roth ira strategy is a legal way to get around the income limits that usually prevent high earners from owning roth iras. For more information on backdoor roth, see backdoor roth: This form is used for all deductible ira contributions, ira distributions, and ira conversions. That allows the irs to track your tax. Web a backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. Web to file taxes for your backdoor roth ira, fill out and file irs form 8606 when you file your annual tax return. For this strategy to work, you should contribute to a traditional ira with no balance. Web as you'll see on form 8606 itself (link opens a pdf), whenever you contribute to a nondeductible ira, you have to report your contribution to the irs. Contributing directly to a roth ira is restricted if your income is beyond certain limits, but there are no income limits for conversions. Web there are 2 ways to set up a backdoor roth ira:

Backdoor IRA Gillingham CPA

Now that we have walked through the steps, let’s look at an example of how to report a backdoor roth ira contribution. This form is used for all deductible ira contributions, ira distributions, and ira conversions. Web we recommend keeping form 5498 for your records, but you don’t need to report form 5498 in your tax filing. For more information.

Fixing Backdoor Roth IRAs The FI Tax Guy

That allows the irs to track your tax. Contributing directly to a roth ira is restricted if your income is beyond certain limits, but there are no income limits for conversions. For this strategy to work, you should contribute to a traditional ira with no balance. The backdoor roth ira strategy is not a tax dodge—in. Web as you'll see.

Make Backdoor Roth Easy On Your Tax Return

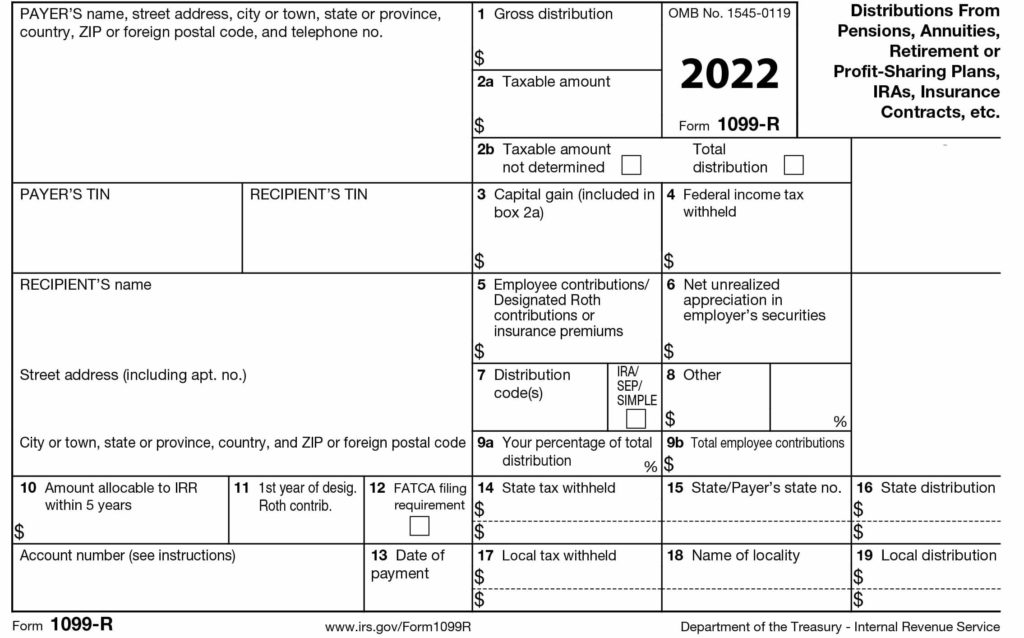

Web to file taxes for your backdoor roth ira, fill out and file irs form 8606 when you file your annual tax return. For more information on backdoor roth, see backdoor roth: Roth ira income limits in 2022 and 2023 filing status (or code 7 if your age is over 59 ½) in the year you make your roth conversion..

Sacramento Advisor Tax Free Roth IRA

Contribute money to an ira, and then roll over the money to a roth ira. Web the backdoor roth ira strategy lets you circumvent these limits, although it does involve making additional tax payments. Web we recommend keeping form 5498 for your records, but you don’t need to report form 5498 in your tax filing. Web a backdoor roth ira.

Make Backdoor Roth Easy On Your Tax Return

Web we recommend keeping form 5498 for your records, but you don’t need to report form 5498 in your tax filing. Web as you'll see on form 8606 itself (link opens a pdf), whenever you contribute to a nondeductible ira, you have to report your contribution to the irs. Web a backdoor roth ira allows you to get around income.

What is a Backdoor Roth IRA Conversion? Equity Trust

(or code 7 if your age is over 59 ½) in the year you make your roth conversion. Web we recommend keeping form 5498 for your records, but you don’t need to report form 5498 in your tax filing. Now that we have walked through the steps, let’s look at an example of how to report a backdoor roth ira.

Considering a Backdoor Roth Contribution? Don’t Form 8606!

Web the backdoor roth ira strategy lets you circumvent these limits, although it does involve making additional tax payments. (or code 7 if your age is over 59 ½) in the year you make your roth conversion. That allows the irs to track your tax. Web the backdoor roth ira strategy is a legal way to get around the income.

Fixing Backdoor Roth IRAs The FI Tax Guy

Web as you'll see on form 8606 itself (link opens a pdf), whenever you contribute to a nondeductible ira, you have to report your contribution to the irs. Web a backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. That allows the irs to track your tax. Now that we.

SplitYear Backdoor Roth IRAs The FI Tax Guy

This form is used for all deductible ira contributions, ira distributions, and ira conversions. Web the backdoor roth ira strategy is a legal way to get around the income limits that usually prevent high earners from owning roth iras. Contributing directly to a roth ira is restricted if your income is beyond certain limits, but there are no income limits.

Make Backdoor Roth Easy On Your Tax Return

Web it's a backdoor way of moving money into a roth ira, which is accomplished by making nondeductible contributions—or contributions on which you do not take a tax deduction—to a traditional ira and then converting those funds into a roth ira. Web there are 2 ways to set up a backdoor roth ira: For more information on backdoor roth, see.

Web We Recommend Keeping Form 5498 For Your Records, But You Don’t Need To Report Form 5498 In Your Tax Filing.

Web to file taxes for your backdoor roth ira, fill out and file irs form 8606 when you file your annual tax return. Now that we have walked through the steps, let’s look at an example of how to report a backdoor roth ira contribution. That allows the irs to track your tax. If there's a balance in the ira, there could be a taxable event when you convert.

Web The Backdoor Roth Ira Strategy Is A Legal Way To Get Around The Income Limits That Usually Prevent High Earners From Owning Roth Iras.

This form is used for all deductible ira contributions, ira distributions, and ira conversions. Web there are 2 ways to set up a backdoor roth ira: Web a backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. Web as you'll see on form 8606 itself (link opens a pdf), whenever you contribute to a nondeductible ira, you have to report your contribution to the irs.

Contribute Money To An Ira, And Then Roll Over The Money To A Roth Ira.

For this strategy to work, you should contribute to a traditional ira with no balance. The backdoor roth ira strategy is not a tax dodge—in. Web the backdoor roth ira strategy lets you circumvent these limits, although it does involve making additional tax payments. For more information on backdoor roth, see backdoor roth:

Contributing Directly To A Roth Ira Is Restricted If Your Income Is Beyond Certain Limits, But There Are No Income Limits For Conversions.

Web it's a backdoor way of moving money into a roth ira, which is accomplished by making nondeductible contributions—or contributions on which you do not take a tax deduction—to a traditional ira and then converting those funds into a roth ira. (or code 7 if your age is over 59 ½) in the year you make your roth conversion. Roth ira income limits in 2022 and 2023 filing status