Tc 40 Form

Tc 40 Form - Submit page only if data entered. To learn more, go to tap.utah.gov 9999 9 999999999. State refund on federal return. Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by merchants as a proactive way to prevent. Round to 4 decimal places. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. How to obtain income tax and related forms. First state.00 1 enter federal adjusted gross income taxed by both utah and state of: Attach completed schedule to your utah income tax. Name, address, ssn, & residency.

State refund on federal return. Attach completed schedule to your utah income tax. Round to 4 decimal places. Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by merchants as a proactive way to prevent. Submit page only if data entered. How to obtain income tax and related forms. Do not enter a number greater than 1.0000. Web what are the latest claims? First state.00 1 enter federal adjusted gross income taxed by both utah and state of: Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529.

Name, address, ssn, & residency. State refund on federal return. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. First state.00 1 enter federal adjusted gross income taxed by both utah and state of: Submit page only if data entered. Round to 4 decimal places. Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by merchants as a proactive way to prevent. Web what are the latest claims? Web follow these steps to calculate your utah tax: How to obtain income tax and related forms.

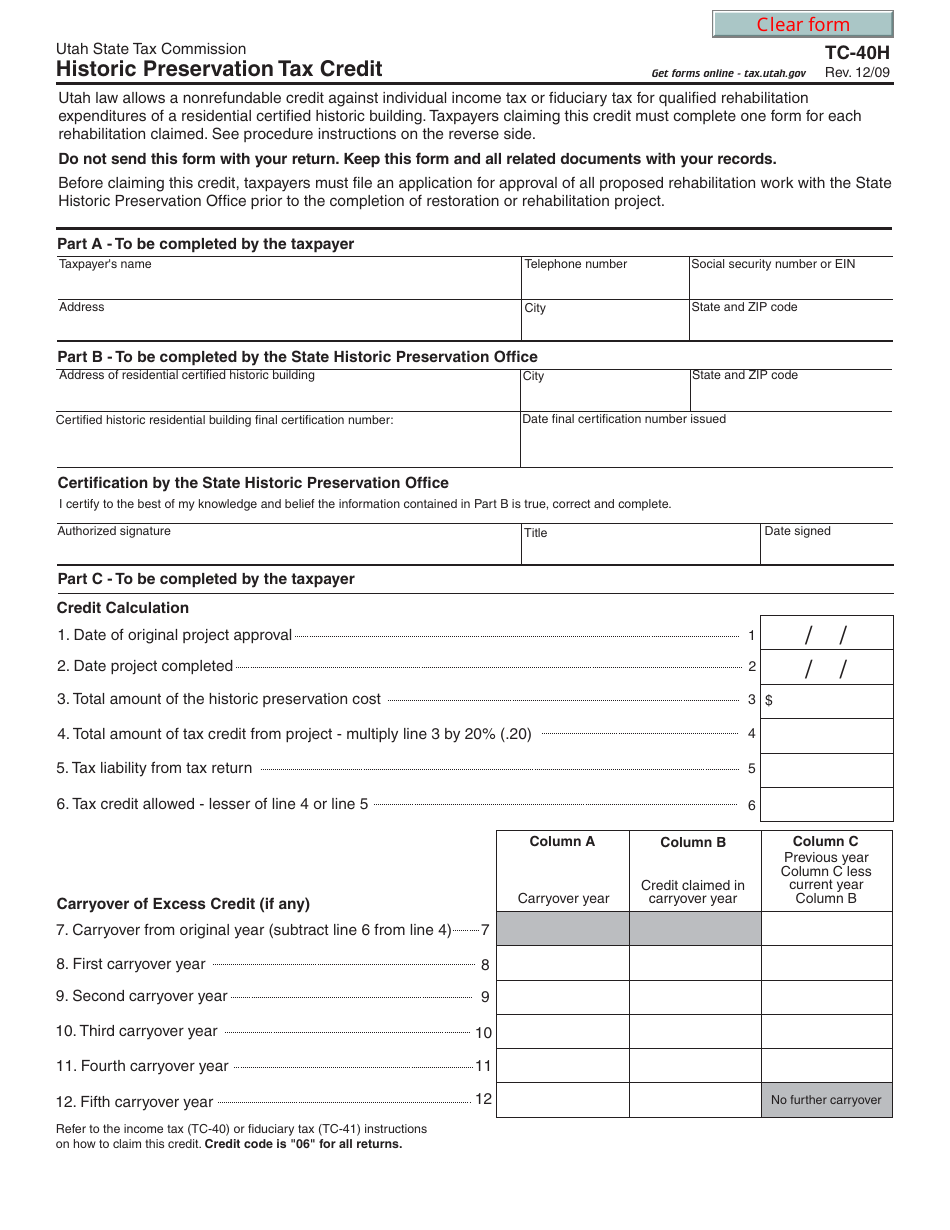

Form TC40H Download Fillable PDF or Fill Online Historic Preservation

Round to 4 decimal places. State refund on federal return. How to obtain income tax and related forms. Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by merchants as a proactive way to prevent. Are filing for a deceased taxpayer, are filing a.

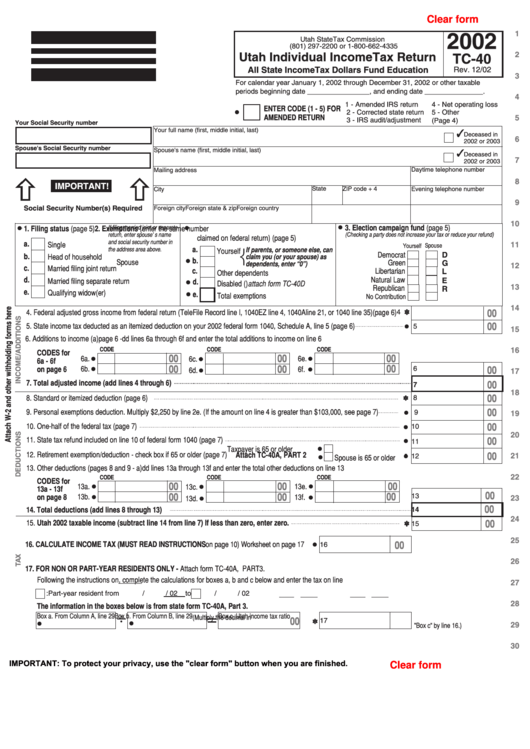

Fillable Form Tc40 Utah Individual Tax Return 2002

Submit page only if data entered. Round to 4 decimal places. Attach completed schedule to your utah income tax. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. How to obtain income tax and related forms.

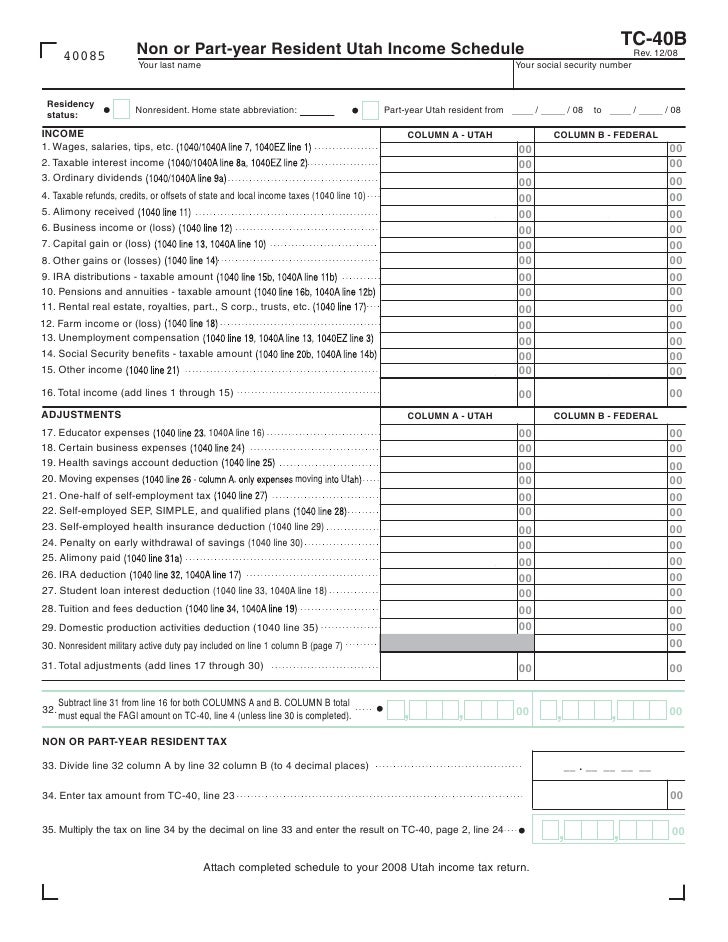

tax.utah.gov forms current tc tc40bplain

State refund on federal return. To learn more, go to tap.utah.gov 9999 9 999999999. Web follow these steps to calculate your utah tax: Do not enter a number greater than 1.0000. Submit page only if data entered.

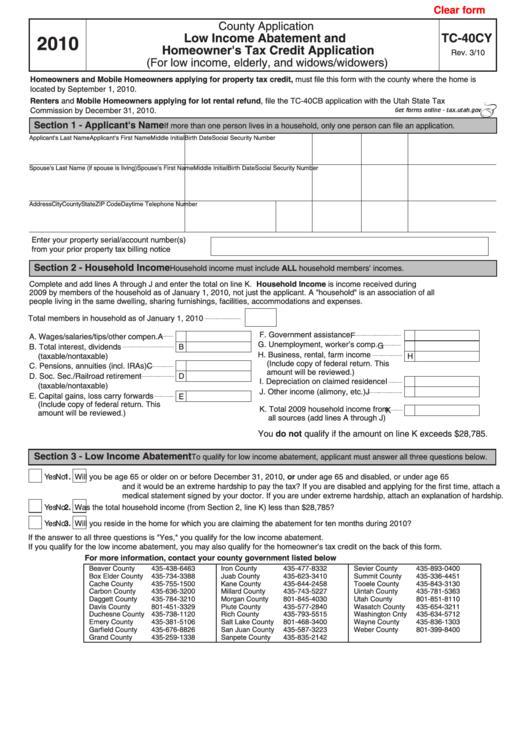

Fillable Form Tc40cy Low Abatement And Homeowner'S Tax Credit

How to obtain income tax and related forms. Round to 4 decimal places. Attach completed schedule to your utah income tax. State refund on federal return. First state.00 1 enter federal adjusted gross income taxed by both utah and state of:

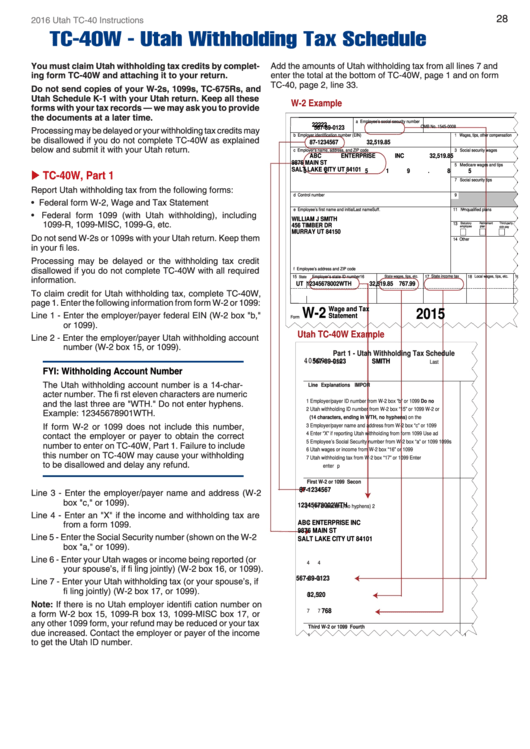

Form Tc40 Individual Tax Instructions 2016 printable pdf download

Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by merchants as a proactive way to prevent. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Web.

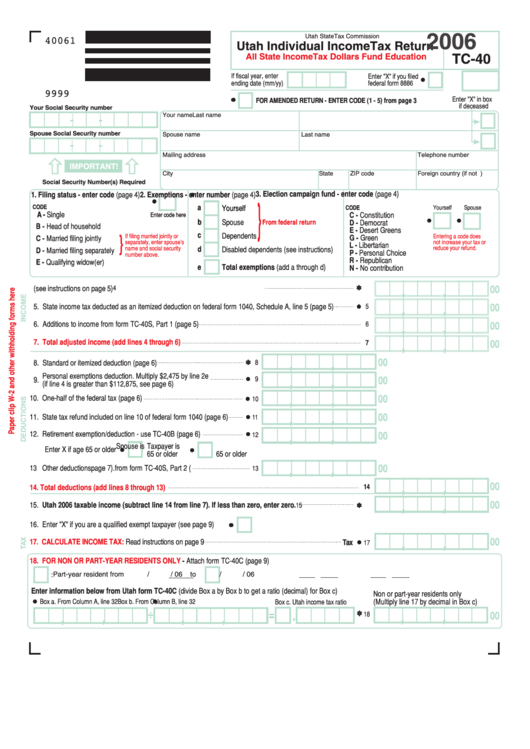

Form Tc40 Utah Individual Tax Return 2006 printable pdf

Round to 4 decimal places. Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by merchants as a proactive way to prevent. First state.00 1 enter federal adjusted gross income taxed by both utah and state of: Attach completed schedule to your utah income.

Utah Tc 40 2011 Form 2011 Fill out Tax Template Online US Legal Forms

Name, address, ssn, & residency. Round to 4 decimal places. How to obtain income tax and related forms. Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by merchants as a proactive way to prevent. Are filing for a deceased taxpayer, are filing a.

Sony TC40 Wiring

Name, address, ssn, & residency. Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Do not enter a number greater than 1.0000. Round to 4 decimal places. To learn more, go to tap.utah.gov 9999 9 999999999.

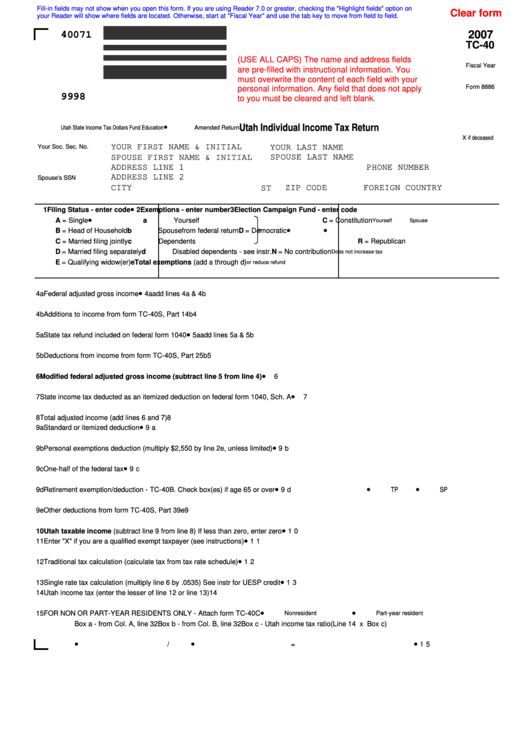

Fillable Form Tc40 Utah Individual Tax Return 2007

Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want to deposit into a my529. Round to 4 decimal places. First state.00 1 enter federal adjusted gross income taxed by both utah and state of: To learn more, go to tap.utah.gov 9999 9 999999999. State refund on federal return.

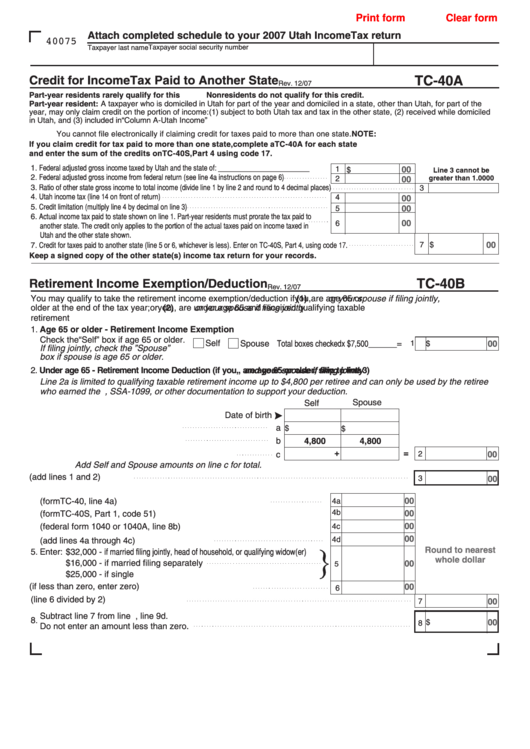

Fillable Form Tc40a Credit For Tax Paid To Another State

Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by merchants as a proactive way to prevent. Web what are the latest claims? Are filing for a deceased taxpayer, are filing a fiscal year return, filed irs form 8886, are making voluntary contributions, want.

Are Filing For A Deceased Taxpayer, Are Filing A Fiscal Year Return, Filed Irs Form 8886, Are Making Voluntary Contributions, Want To Deposit Into A My529.

Web follow these steps to calculate your utah tax: Do not enter a number greater than 1.0000. How to obtain income tax and related forms. Submit page only if data entered.

First State.00 1 Enter Federal Adjusted Gross Income Taxed By Both Utah And State Of:

Web tc40 data is a good tool for you to use when trying to improve your internal fraud prevention measures, but it is often misused by merchants as a proactive way to prevent. To learn more, go to tap.utah.gov 9999 9 999999999. Attach completed schedule to your utah income tax. Round to 4 decimal places.

Web What Are The Latest Claims?

Name, address, ssn, & residency. State refund on federal return.