Texas Vehicle Gift Form

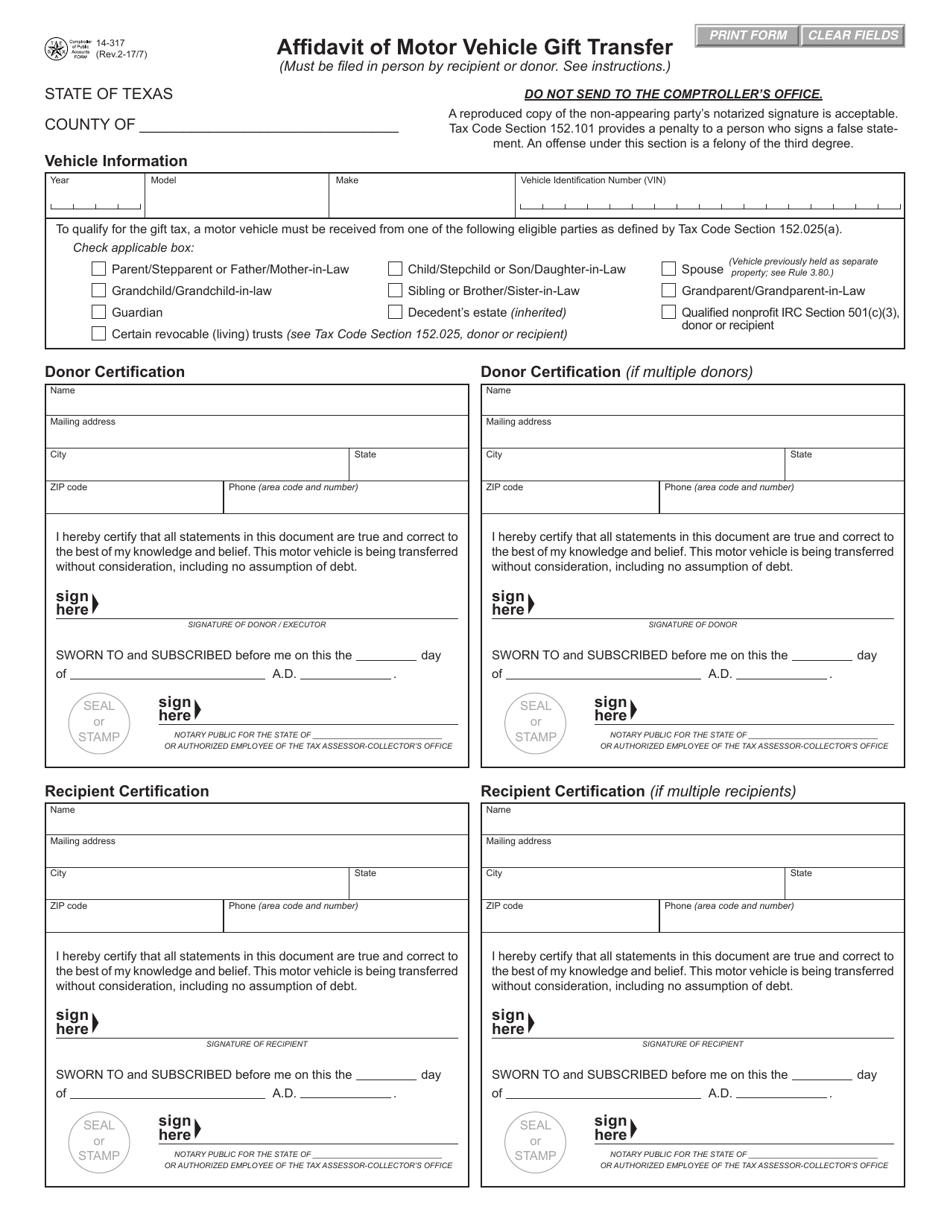

Texas Vehicle Gift Form - Web each of the following transactions is subject to the $10 gift tax: Web the purpose of this afidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. Both the donor and the gift recipient must sign the comptroller's joint affidavit, If inherited, either the recipient or the person authorized to act on behalf of the estate must file the form. Ad customize a legally binding bill of sale agreement in minutes. Web motorists buying or selling a vehicle txdmv will release a new texas temporary tag design on december 9, 2022; Web qualifications to qualify the vehicle must be received from the following eligible parties: More information available here selling a vehicle submit a vehicle transfer notification vehicles are required to be titled in the buyer's name within 30 days from the date of sale. Gift is the transfer of a motor vehicle between eligible parties for no consideration.

If inherited, either the recipient or the person authorized to act on behalf of the estate must file the form. Ad customize a legally binding bill of sale agreement in minutes. More information available here selling a vehicle submit a vehicle transfer notification vehicles are required to be titled in the buyer's name within 30 days from the date of sale. Both the donor and the gift recipient must sign the comptroller's joint affidavit, Gift is the transfer of a motor vehicle between eligible parties for no consideration. Web the purpose of this afidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. Web each of the following transactions is subject to the $10 gift tax: Web motorists buying or selling a vehicle txdmv will release a new texas temporary tag design on december 9, 2022; Web qualifications to qualify the vehicle must be received from the following eligible parties:

Gift is the transfer of a motor vehicle between eligible parties for no consideration. Web qualifications to qualify the vehicle must be received from the following eligible parties: Web the purpose of this afidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. If inherited, either the recipient or the person authorized to act on behalf of the estate must file the form. Ad customize a legally binding bill of sale agreement in minutes. More information available here selling a vehicle submit a vehicle transfer notification vehicles are required to be titled in the buyer's name within 30 days from the date of sale. Both the donor and the gift recipient must sign the comptroller's joint affidavit, Web each of the following transactions is subject to the $10 gift tax: Web motorists buying or selling a vehicle txdmv will release a new texas temporary tag design on december 9, 2022;

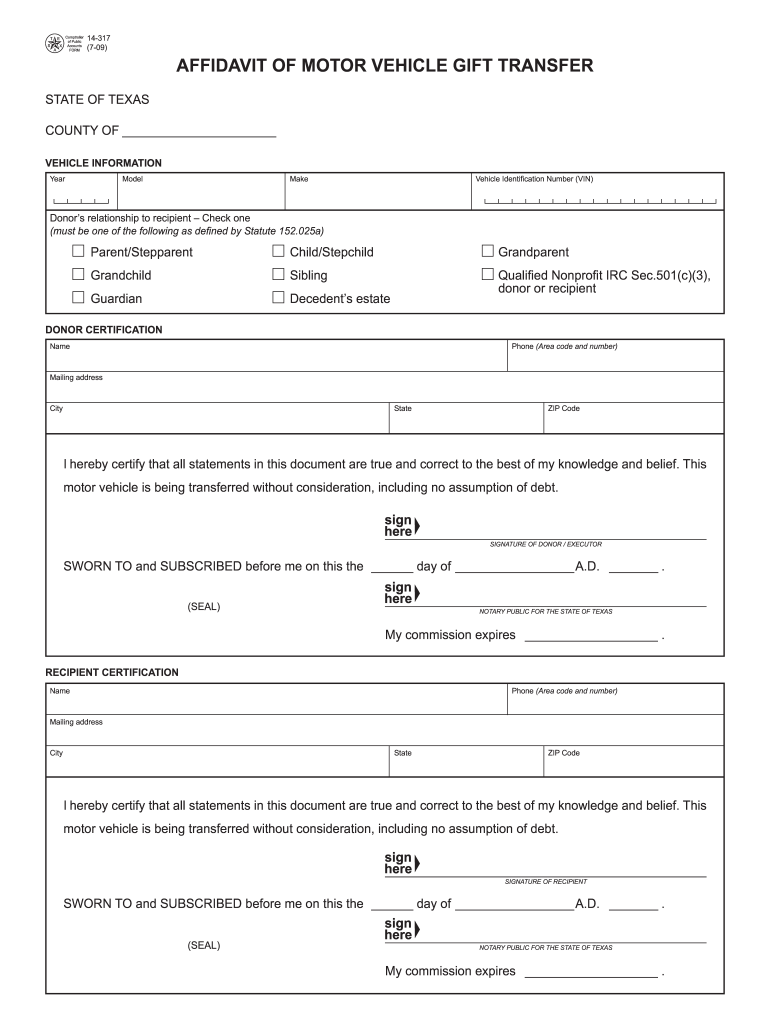

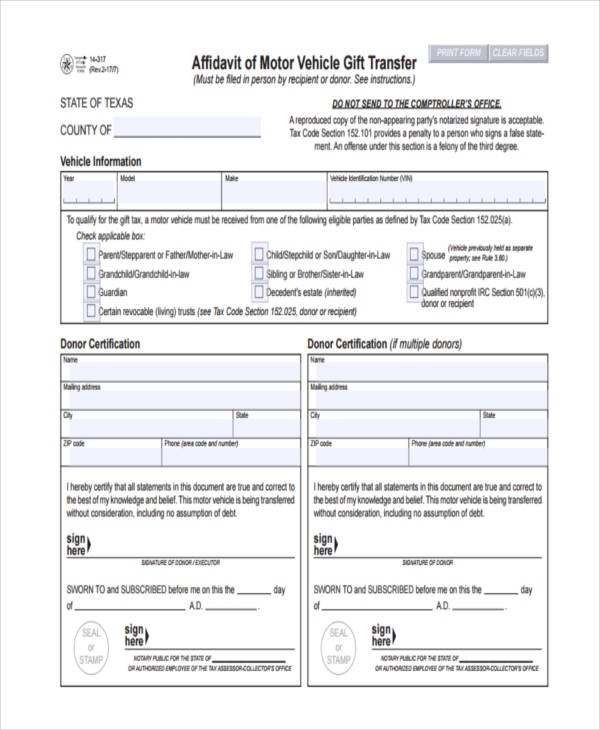

Download Texas Affidavit of Motor Vehicle Gift Transfer for Free

Web the purpose of this afidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. Web each of the following transactions is subject to the $10 gift tax: Gift is the transfer of a motor vehicle between eligible parties for no consideration. If inherited, either the.

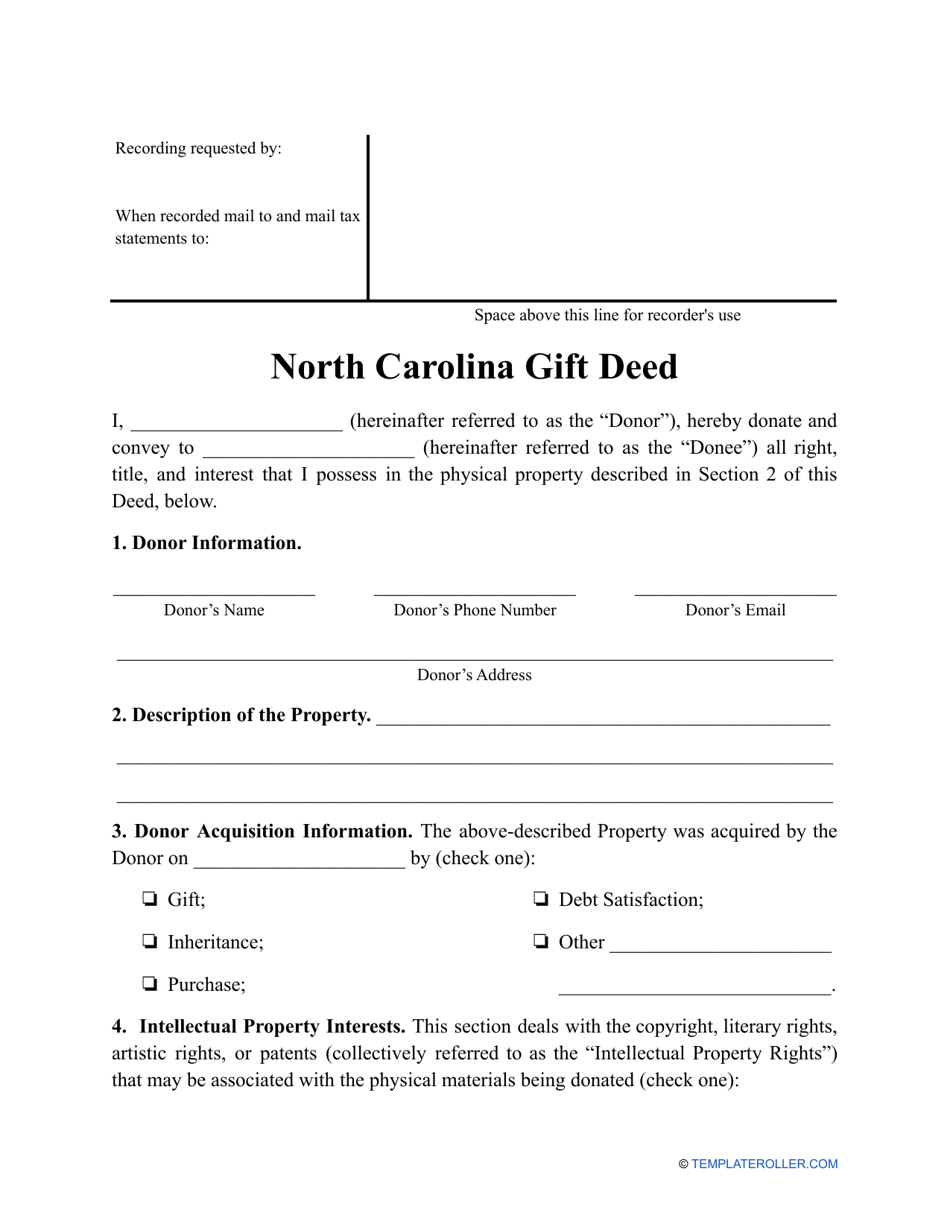

North Carolina Gift Deed Form Download Printable PDF Templateroller

Web motorists buying or selling a vehicle txdmv will release a new texas temporary tag design on december 9, 2022; Ad customize a legally binding bill of sale agreement in minutes. Web each of the following transactions is subject to the $10 gift tax: Both the donor and the gift recipient must sign the comptroller's joint affidavit, If inherited, either.

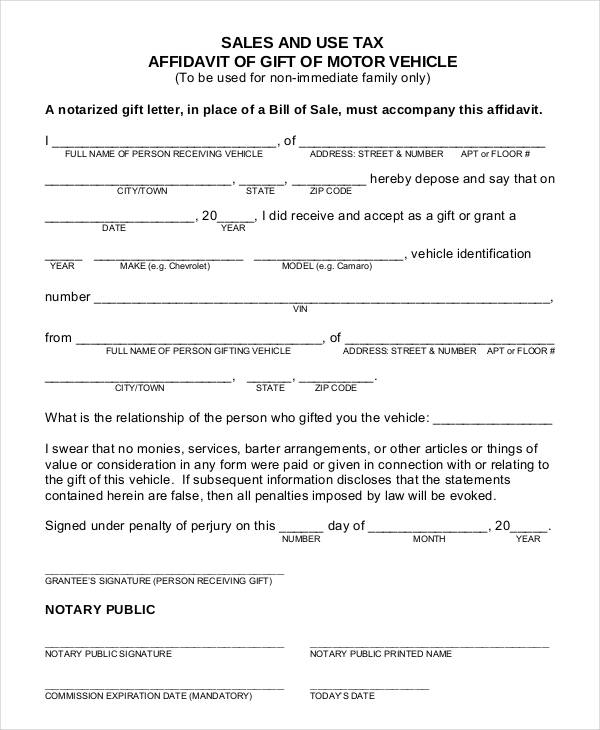

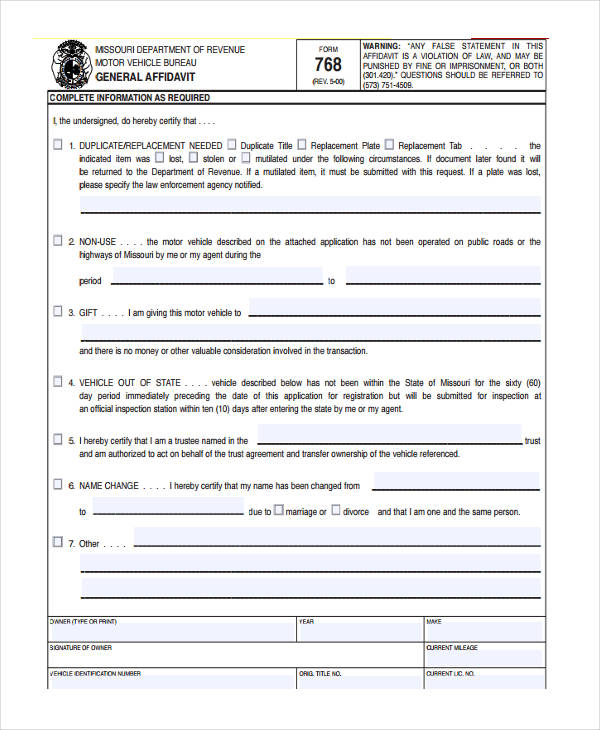

FREE 11+ Vehicle Affidavit Forms in PDF MS Word

Web the purpose of this afidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. Both the donor and the gift recipient must sign the comptroller's joint affidavit, Gift is the transfer of a motor vehicle between eligible parties for no consideration. More information available here.

Form 14317 Download Fillable PDF or Fill Online Affidavit of Motor

More information available here selling a vehicle submit a vehicle transfer notification vehicles are required to be titled in the buyer's name within 30 days from the date of sale. Gift is the transfer of a motor vehicle between eligible parties for no consideration. Both the donor and the gift recipient must sign the comptroller's joint affidavit, Web qualifications to.

Gift Affidavit Form Texas Free Download

Web qualifications to qualify the vehicle must be received from the following eligible parties: Both the donor and the gift recipient must sign the comptroller's joint affidavit, More information available here selling a vehicle submit a vehicle transfer notification vehicles are required to be titled in the buyer's name within 30 days from the date of sale. Web each of.

Texas Motor Vehicle Transfer Fill Online, Printable, Fillable, Blank

More information available here selling a vehicle submit a vehicle transfer notification vehicles are required to be titled in the buyer's name within 30 days from the date of sale. Web motorists buying or selling a vehicle txdmv will release a new texas temporary tag design on december 9, 2022; Gift is the transfer of a motor vehicle between eligible.

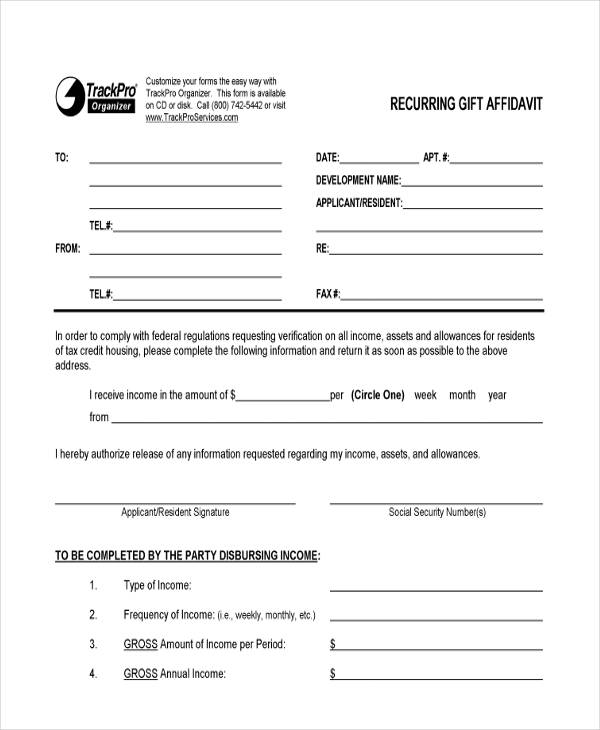

FREE 11+ Gift Affidavit Forms in PDF MS Word

Web each of the following transactions is subject to the $10 gift tax: More information available here selling a vehicle submit a vehicle transfer notification vehicles are required to be titled in the buyer's name within 30 days from the date of sale. Web qualifications to qualify the vehicle must be received from the following eligible parties: If inherited, either.

FREE 11+ Gift Affidavit Forms in PDF MS Word

Web qualifications to qualify the vehicle must be received from the following eligible parties: Ad customize a legally binding bill of sale agreement in minutes. More information available here selling a vehicle submit a vehicle transfer notification vehicles are required to be titled in the buyer's name within 30 days from the date of sale. If inherited, either the recipient.

Texas Department Of Motor Vehicles Affidavit Of Motor Vehicle Gift

Ad customize a legally binding bill of sale agreement in minutes. Web the purpose of this afidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. Web qualifications to qualify the vehicle must be received from the following eligible parties: More information available here selling a.

Gift Affidavit Form Texas Bios Pics

Ad customize a legally binding bill of sale agreement in minutes. Both the donor and the gift recipient must sign the comptroller's joint affidavit, Web each of the following transactions is subject to the $10 gift tax: Web qualifications to qualify the vehicle must be received from the following eligible parties: Gift is the transfer of a motor vehicle between.

Web Each Of The Following Transactions Is Subject To The $10 Gift Tax:

Ad customize a legally binding bill of sale agreement in minutes. Gift is the transfer of a motor vehicle between eligible parties for no consideration. Web the purpose of this afidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. If inherited, either the recipient or the person authorized to act on behalf of the estate must file the form.

Web Qualifications To Qualify The Vehicle Must Be Received From The Following Eligible Parties:

Both the donor and the gift recipient must sign the comptroller's joint affidavit, More information available here selling a vehicle submit a vehicle transfer notification vehicles are required to be titled in the buyer's name within 30 days from the date of sale. Web motorists buying or selling a vehicle txdmv will release a new texas temporary tag design on december 9, 2022;