Tiaa Tax Form

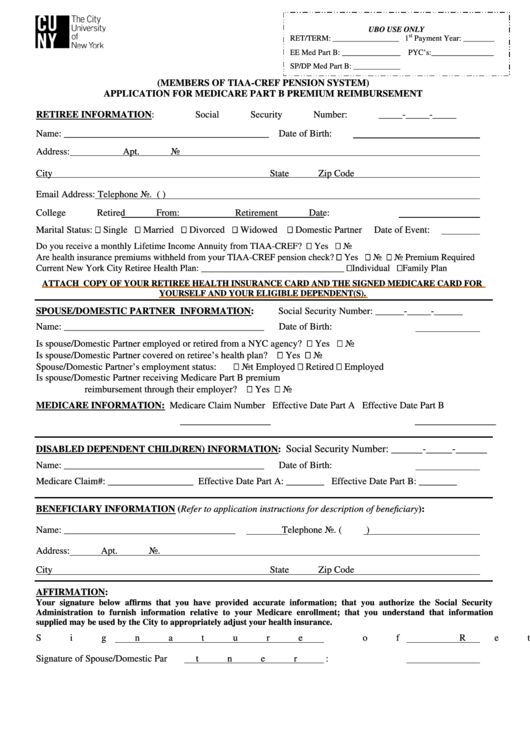

Tiaa Tax Form - If you believe you’ve made a transaction that. Web party(ies) will remain in effect until you direct tiaa to revoke such authorization unless you have provided an expiration date in section 5. Web need to make quick updates or changes to your tiaa bank account? Web 1 best answer. Demand for retireplus has been fueled by its. Web the tax information contained above is not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding tax penalties that may be imposed on the taxpayer. If you did not withdraw money from your retirement account, there is no tax reporting. You may be able to avoid quarterly estimated tax payments by having enough tax withheld from your ira using. Citizens living abroad, except in any u.s. Tiaa reserves the right to revoke.

Let our form finder tool show you the way. Tiaa® has been making retirement accessible for over 100 years. Web here you’ll learn which tax forms are delivered based on account transaction activity and the dates they’ll be made available. Federal law requires tiaa to report deductible and nondeductible contributions, conversions, re. Go to statements and documents opens in a new window to view and print your tax forms; Web need to make quick updates or changes to your tiaa bank account? Web tfdmm f41080 (10/21) return completed form(s) to: Territories, must elect to have taxes withheld. Demand for retireplus has been fueled by its. Go to statements in the tiaa mobile app and download the forms you need;.

Web follow these instructions to find and download your 1099 form. Ad at tiaa® we fight for your ability to retire with dignity and security. Tiaa® has been making retirement accessible for over 100 years. Our forms & applications page make it easy and convenient to manage your. Web it explains the estimated tax requirements and penalties in detail. Web you received form 5498 because we're required by federal law to send you one. Tiaa reserves the right to revoke. Let our form finder tool show you the way. Go to statements and documents opens in a new window to view and print your tax forms; Web make changes to your business banking account, move money, or open a new business account.

ads/responsive.txt Tiaa Cref Minimum Distribution forms New Ancial

Web check our mailing schedule to see when we send tax forms for retirement, brokerage, tiaa bank, home loan, trust and world markets. Our forms & applications page make it easy and convenient to manage your. Web party(ies) will remain in effect until you direct tiaa to revoke such authorization unless you have provided an expiration date in section 5..

TIAA CREF F11270 20142021 Fill and Sign Printable Template Online

Web party(ies) will remain in effect until you direct tiaa to revoke such authorization unless you have provided an expiration date in section 5. Web how do i let tiaa know how much tax to withhold? Click link and log into your online account; Tiaa® has been making retirement accessible for over 100 years. Web here you’ll learn which tax.

Top Tiaa Cref Forms And Templates free to download in PDF format

When you sell mutual fund. Our forms & applications page make it easy and convenient to manage your. Tiaa reserves the right to revoke. Web make changes to your business banking account, move money, or open a new business account. Web need to make quick updates or changes to your tiaa bank account?

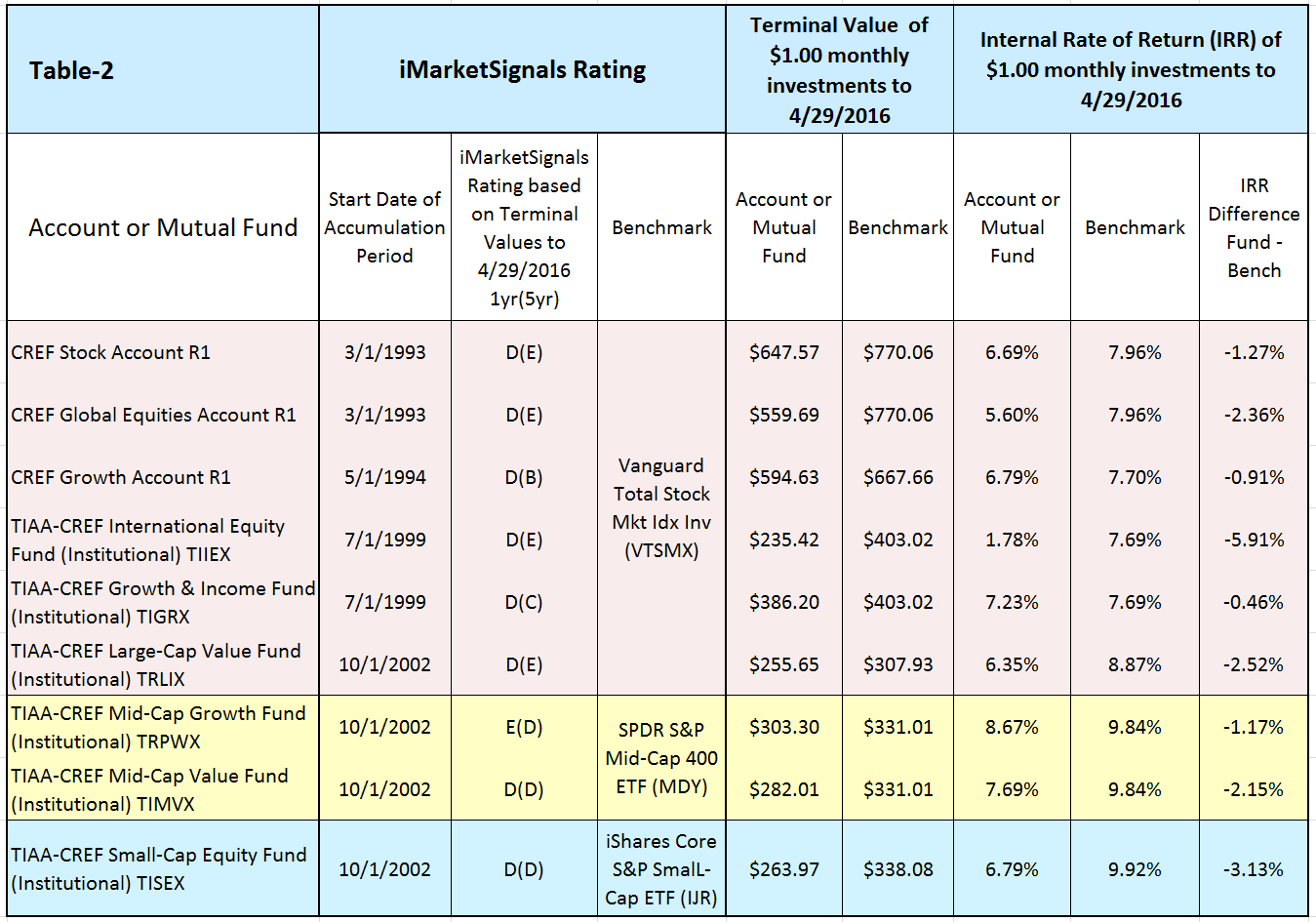

TIAACREF Actively Managed Equity Funds Did Not Add Value For Investors

When you sell mutual fund. Web invested in one or more mutual funds. Web you received form 5498 because we're required by federal law to send you one. Web check our mailing schedule to see when we send tax forms for retirement, brokerage, tiaa bank, home loan, trust and world markets. Tiaa® has been making retirement accessible for over 100.

Fill Free fillable TIAACREF FUNDS ACCOUNT APPLICATION Please send

When you sell mutual fund. Web party(ies) will remain in effect until you direct tiaa to revoke such authorization unless you have provided an expiration date in section 5. Tiaa® has been making retirement accessible for over 100 years. Web how do i let tiaa know how much tax to withhold? Web yes, you may obtain a duplicate tax form.

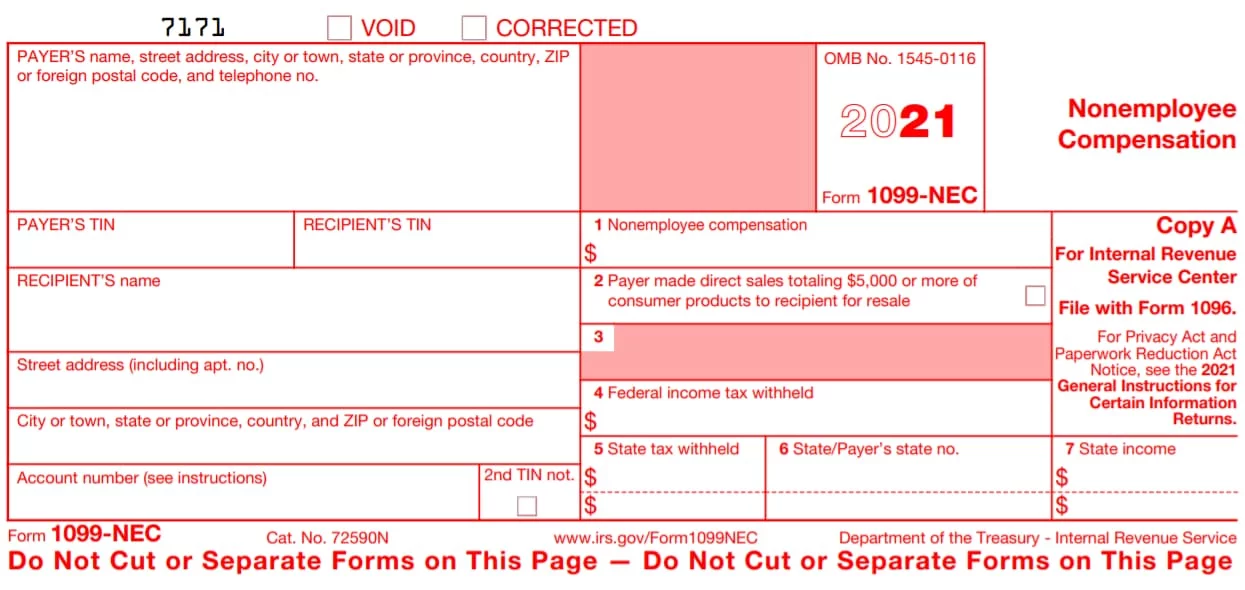

1099 Form Independent Contractor Pdf Form 1099 Nec Form Pros / Some

Web tfdmm f41080 (10/21) return completed form(s) to: Federal law requires tiaa to report deductible and nondeductible contributions, conversions, re. Web 1 best answer. Web need to make quick updates or changes to your tiaa bank account? If you believe you’ve made a transaction that.

TIAACREF FUNDS IRA DISTRIBUTION FORM

Demand for retireplus has been fueled by its. Tiaa® has been making retirement accessible for over 100 years. Web follow these instructions to find and download your 1099 form. Web yes, you may obtain a duplicate tax form in one of the following ways: If you believe you’ve made a transaction that.

Tiaa Form F11380 Fill and Sign Printable Template Online US Legal Forms

Go to statements and documents opens in a new window to view and print your tax forms; Tiaa® has been making retirement accessible for over 100 years. Web how do i let tiaa know how much tax to withhold? Web go to statements and documents opens in a news window to view and print your tax forms; Territories, must elect.

Fill Free fillable TIAA CREF Rollover Form F10462 trans exch 1912

Web how do i let tiaa know how much tax to withhold? Territories, must elect to have taxes withheld. Web 1 best answer. Let our form finder tool show you the way. Web tfdmm f41080 (10/21) return completed form(s) to:

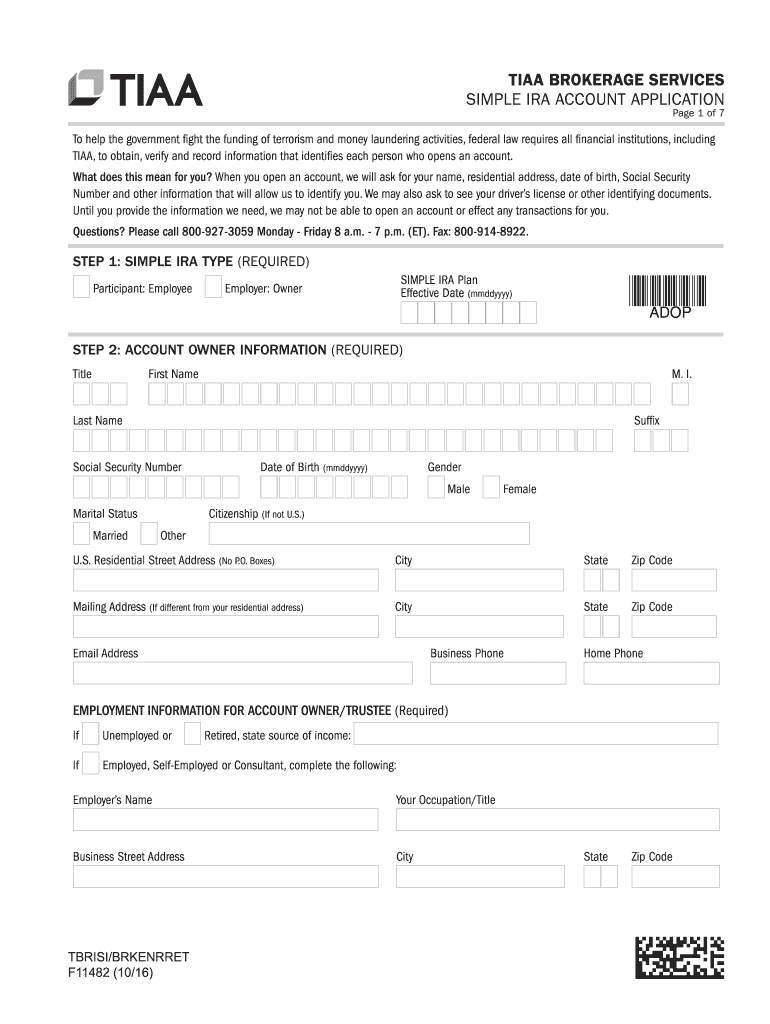

TIAA F11482 2016 Fill and Sign Printable Template Online US Legal Forms

If you believe you’ve made a transaction that. Ad at tiaa® we fight for your ability to retire with dignity and security. Web follow these instructions to find and download your 1099 form. Tiaa® has been making retirement accessible for over 100 years. Web you received form 5498 because we're required by federal law to send you one.

Territories, Must Elect To Have Taxes Withheld.

Demand for retireplus has been fueled by its. Web it explains the estimated tax requirements and penalties in detail. When you sell mutual fund. Web make changes to your business banking account, move money, or open a new business account.

Web You Received Form 5498 Because We're Required By Federal Law To Send You One.

Web 1 best answer. Web invested in one or more mutual funds. Web party(ies) will remain in effect until you direct tiaa to revoke such authorization unless you have provided an expiration date in section 5. Web tfdmm f41080 (10/21) return completed form(s) to:

Why Don't I Have Any Tax Forms Available?.

If you believe you’ve made a transaction that. Web go to statements and documents opens in a news window to view and print your tax forms; Tiaa® has been making retirement accessible for over 100 years. Web how do i let tiaa know how much tax to withhold?

Go To Statements In The Tiaa Mobile App And Download The Forms You Need;.

This is why there were no documents to. Citizens living abroad, except in any u.s. Web yes, you may obtain a duplicate tax form in one of the following ways: You may be able to avoid quarterly estimated tax payments by having enough tax withheld from your ira using.