Travis County Property Tax Protest Form

Travis County Property Tax Protest Form - Web for travis county homeowners: Make sure you list facts and data as to why you believe the assessed value is incorrect. Web the travis central appraisal district (tcad) is responsible for listing property and ownership information, estimating values, providing plat maps, and assisting taxpayers with the protest process. Web property tax protest will protest your travis central appraisal district's proposed 2022 market value to the travis appraisal review board. In travis, williamson and hays counties, may 15 is the deadline for most property owners to file a notice of protest of your appraised value. However, the tcad website is down as of april 15 due to too many people accessing the website after. Learn more calendar_today make an appointment no_sim go paperless assignment take our satisfication survey these options are only available for some services question_answer. How do i change the address or ownership records for a property? Keep reading to learn more about our services. Web state law requires your appraisal district to determine the market value of your home on jan.

A property owner or an owner’s designated agent can use. Learn more calendar_today make an appointment no_sim go paperless assignment take our satisfication survey these options are only available for some services question_answer. February 23, 2023 in texas, the 10% homestead cap is a limit on the amount that taxable value can increase for a primary residence in any one year. Application for a homestead exemption. Residence homestead exemption application travis central appraisal district name and/or address correction form Web property owners have the right to protest actions concerning their property tax appraisals. If you need assistance with setting up an account or logging in, please contact our customer service department for assistance. After you have filed, it can take several months for the. Online protest forms can be filed at www.traviscad.org/efile. Web visit the travis central appraisal district forms database for other property tax forms including:

By mail download this form, fill it out, and mail it to the address below. How do i change the address or ownership records for a property? Web visit the travis central appraisal district forms database for other property tax forms including: The travis central appraisal district offers property owners the opportunity to complete several forms online, including: There are two ways to protest your property tax values. Lessees contractually obligated to reimburse a property owner for property taxes may be entitled to protest as. • the appraised (market) value of your property; You can also file online to protest your travis county property tax. Sign up here to reduce your taxes and put money back in your pocket. Application for a homestead exemption.

Travis County Property Tax Protest Discount Property Taxes

Web travis county tax office property tax, appraised value protests the travis central appraisal district (tcad) is responsible for listing property and ownership information, estimating value, providing plat maps, and assisting taxpayers with the protest process. Web get in line now (residential & bpp) residential properties bpp need help? Learn more calendar_today make an appointment no_sim go paperless assignment take.

Travis County Property Tax Deferral PROFRTY

Web 2022 2021 2020 2019 how does the 10% homestead cap value work in texas? Managing your protest online double click a. A property owner or an owner’s designated agent can use. Residence homestead exemption application travis central appraisal district name and/or address correction form Web property tax protest will protest your travis central appraisal district's proposed 2022 market value.

Protesting Your Property Taxes in Travis County

Web a property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code section 41.41. You can also file online to protest your travis county property tax. In travis, williamson and hays counties, may 15 is the deadline for most property owners to file a notice.

Travis County Property Tax Protest Discount Property Taxes

Web statement of inability to pay court costs. Web state law requires your appraisal district to determine the market value of your home on jan. A tax lien automatically attaches to your property to secure tax payments, late penalties and interest. Web property owners have the right to protest actions concerning their property tax appraisals. Web filing a protest.

Travis County Property Tax Liens PRORFETY

This form is for use by a property owner to offer and submit evidence and/or argument for an appraisal review board (arb) protest hearing by telephone conference call, videoconference or written affidavit pursuant to tax code. In travis, williamson and hays counties, may 15 is the deadline for most property owners to file a notice of protest of your appraised.

Everything You Need to Know About Travis County Property Tax

This form is for use by a property owner to offer and submit evidence and/or argument for an appraisal review board (arb) protest hearing by telephone conference call, videoconference or written affidavit pursuant to tax code. If you need assistance with setting up an account or logging in, please contact our customer service department for assistance. A tax lien automatically.

Travis County Property Tax Protest Discount Property Taxes

February 23, 2023 in texas, the 10% homestead cap is a limit on the amount that taxable value can increase for a primary residence in any one year. If you know what service you need, use the main menu on the left. Web the tax office collects fees for a variety of state and local government agencies and proudly registers.

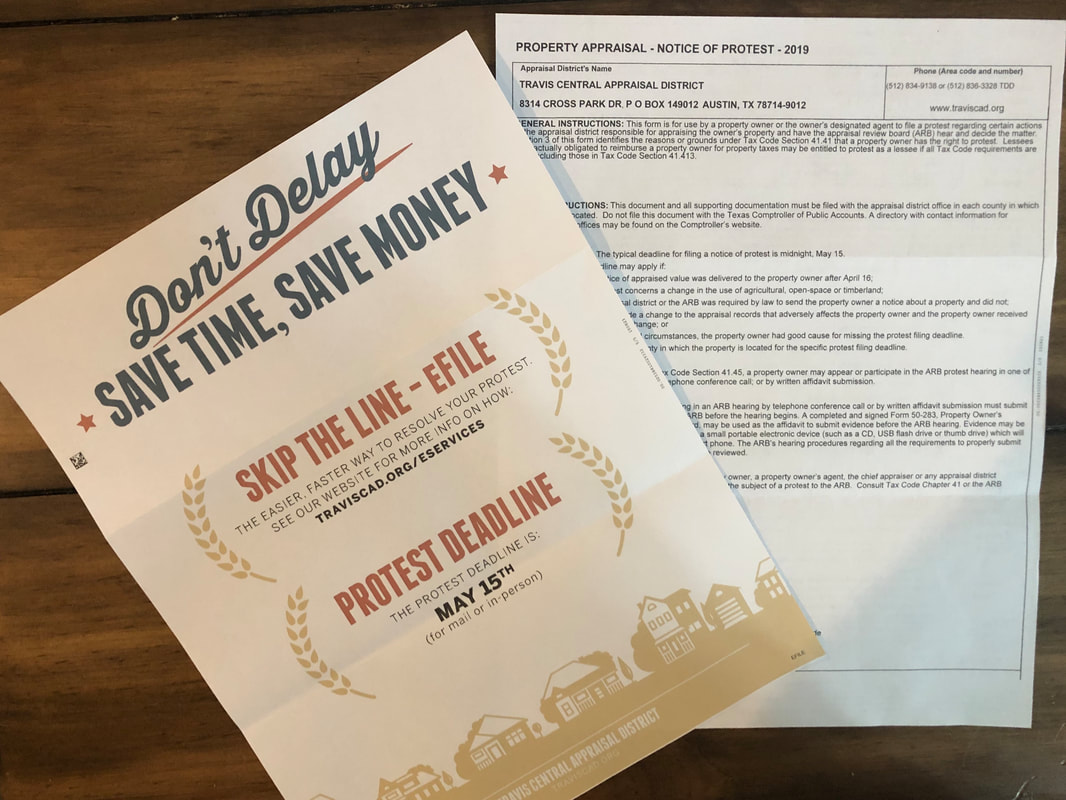

What a Mess! 2019 Travis County Property Tax Protest YouTube

Web a property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code section 41.41. Web property owners have the right to protest actions concerning their property tax appraisals. Make sure you list facts and data as to why you believe the assessed value is incorrect..

Fill Free fillable forms Travis County Information Technology Services

Sign up here to reduce your taxes and put money back in your pocket. Web state law requires your appraisal district to determine the market value of your home on jan. • the unequal value of your property compared with other. Keep reading to learn more about our services. However, the tcad website is down as of april 15 due.

Travis County Property Tax Protest Discount Property Taxes

Web get in line now (residential & bpp) residential properties bpp need help? Contact us or check out the videos below to learn more about navigating the protest process through our online portal. Web though you could learn how to appeal property taxes yourself—filing forms, faxing in appraisals, submitting evidence, and attending appraisal review board hearings and judicial appeals—there’s a.

Web 2022 2021 2020 2019 How Does The 10% Homestead Cap Value Work In Texas?

Web for travis county homeowners: Application for a homestead exemption. Web a property owner or an owner’s designated agent can use this form to file a protest with the appraisal review board (arb) pursuant to tax code section 41.41. Get comps & evidence packet now!

After You Have Filed, It Can Take Several Months For The.

February 23, 2023 in texas, the 10% homestead cap is a limit on the amount that taxable value can increase for a primary residence in any one year. Web the tax office collects fees for a variety of state and local government agencies and proudly registers voters in travis county! Web how do i protest my property taxes? Web the travis central appraisal district (tcad) is responsible for listing property and ownership information, estimating values, providing plat maps, and assisting taxpayers with the protest process.

Web Value Protests Learn About Property Tax Appraised Value Protests.

Web property tax protest will protest your travis central appraisal district's proposed 2022 market value to the travis appraisal review board. Online protest forms can be filed at www.traviscad.org/efile. There are two ways to protest your property tax values. How do i change the address or ownership records for a property?

Web Filing A Protest.

• the unequal value of your property compared with other. By mail download this form, fill it out, and mail it to the address below. Web state law requires your appraisal district to determine the market value of your home on jan. Web though you could learn how to appeal property taxes yourself—filing forms, faxing in appraisals, submitting evidence, and attending appraisal review board hearings and judicial appeals—there’s a much easier way to protest your travis county property tax.