Turbotax Form 990

Turbotax Form 990 - Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Read the irs instructions for 990 forms. 2 hours ago 0 12 reply. Since the payment from the ira is not a personal expense, it is not reportable anywhere on. Request for transcript of tax return. Web required filing (form 990 series) see the form 990 filing thresholds page to determine which forms an organization must file. Ceo, board chair, and board of directors information; Web the irs requires all u.s. If this organization has filed. Web 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public.

Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web up to three years of forms 990; For a look at what you'll find on these documents, view these samples: Web the irs requires all u.s. Web form 990 is an annual information return required to be filed with the irs by most organizations exempt from income tax under section 501(a), and certain political organizations and nonexempt charitable trusts. The following links can offer additional information. If this organization has filed. Web form 990 resources and tools. In a nutshell, the form gives the irs an overview of the organization's activities, governance and detailed financial information. Below are some ways you can get an organization's 990s.

Ceo, board chair, and board of directors information; Form 990 is used to report certain income in an ira account.this form is not supported by the tt program. Web form 990 resources and tools. Web 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form as it may be made public. Request for taxpayer identification number (tin) and certification. The following links can offer additional information. Since the payment from the ira is not a personal expense, it is not reportable anywhere on. Request for transcript of tax return. Revenue and expense data for the current fiscal year; You can download the fillable pdf form from the irs.

TURBOTAX Logical Progression of Where Ordinary AND Capital Gains

Claim a refund shown on form 2439 i check if a 501(c)(3) organization filing a consolidated return with a 501(c)(2) titleholding corporation. Web updated may 25, 2023. 2 hours ago 0 12 reply. Request for taxpayer identification number (tin) and certification. For prior year forms, use the prior year search tool on the irs forms, instructions & publications page.

TurboTax Deluxe 2014 Fed + State + Fed Efile Tax Software

For prior year forms, use the prior year search tool on the irs forms, instructions & publications page. Sponsoring organizations of donor advised funds organizations that operate a hospital facility Instructions for form 990, return of organization exempt from income tax; Additional information see form 990 resources and tools for more information on annual filing requirements I would recommend contacting.

form 2106 turbotax Fill Online, Printable, Fillable Blank

Web updated may 25, 2023. Form 990 also includes a section for the organization to outline its accomplishments in the previous year to justify. Responses to frequently asked questions about 990s can be found in our knowledge portal. Web form 990 is an annual information return required to be filed with the irs by most organizations exempt from income tax.

Pin by Sandy HansenMaciejewski on Dog Related Tax return, Tax, Tax forms

Organizations that use form 990 are federal. Web required filing (form 990 series) see the form 990 filing thresholds page to determine which forms an organization must file. I would recommend contacting a local professional. For prior year forms, use the prior year search tool on the irs forms, instructions & publications page. Web up to three years of forms.

TurboTax makes filing (almost) fun Inside Design Blog

2 hours ago 0 12 reply. For a look at what you'll find on these documents, view these samples: Organizations that use form 990 are federal. Web no, unfortunately, turbotax does not support form 990 and its variants. For prior year forms, use the prior year search tool on the irs forms, instructions & publications page.

Don’t to File Form 990 Charity Lawyer Blog Nonprofit Law

For a look at what you'll find on these documents, view these samples: Additional information see form 990 resources and tools for more information on annual filing requirements Organizations that use form 990 are federal. Request for taxpayer identification number (tin) and certification. Form 990 is used to report certain income in an ira account.this form is not supported by.

form 2555 turbotax Fill Online, Printable, Fillable Blank irsform

Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web form 990 resources and tools. You can download the fillable pdf form from the irs. 2 hours ago 0 12 reply. Form 990 is used to report certain income in an ira account.this form is not.

Nonprofit software improves Form 990 processes

Go to www.irs.gov/form990 for instructions and the latest information. Since the payment from the ira is not a personal expense, it is not reportable anywhere on. In a nutshell, the form gives the irs an overview of the organization's activities, governance and detailed financial information. Web no, unfortunately, turbotax does not support form 990 and its variants. Web required filing.

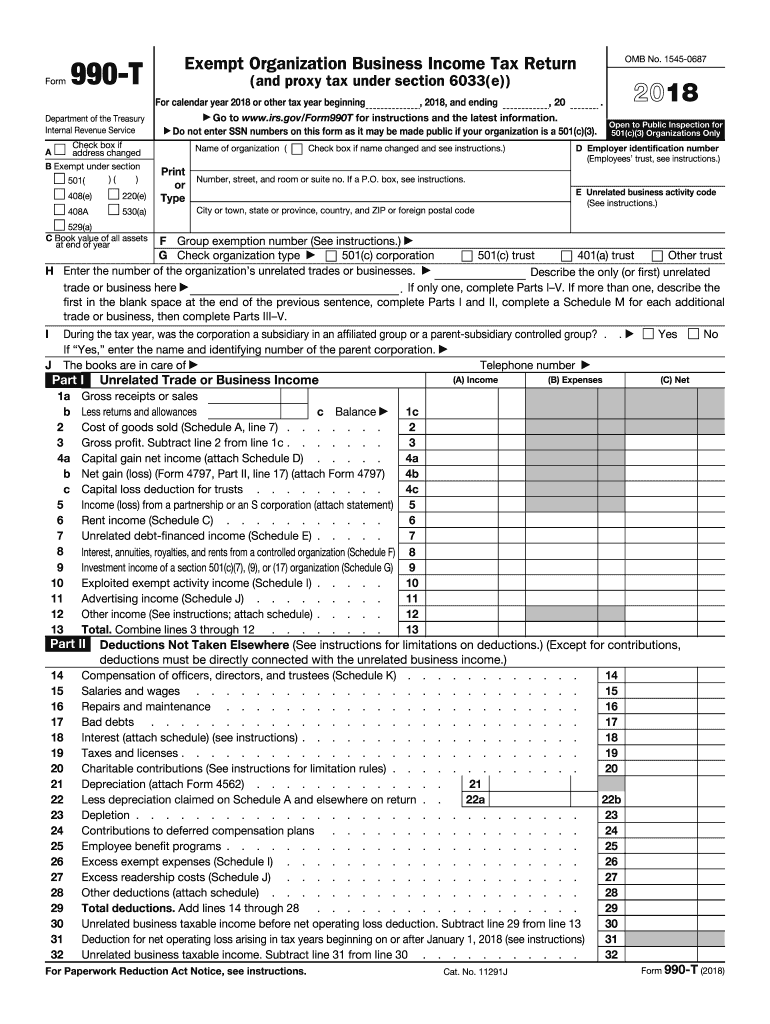

990 t Fill out & sign online DocHub

Claim a refund shown on form 2439 i check if a 501(c)(3) organization filing a consolidated return with a 501(c)(2) titleholding corporation. Below are some ways you can get an organization's 990s. Additional information see form 990 resources and tools for more information on annual filing requirements Form 990 also includes a section for the organization to outline its accomplishments.

How To Delete 1099 Form On Turbotax Armando Friend's Template

Additional information see form 990 resources and tools for more information on annual filing requirements I would recommend contacting a local professional. Revenue and expense data for the current fiscal year; For prior year forms, use the prior year search tool on the irs forms, instructions & publications page. Certain exempt organizations file this form to provide the irs with.

If This Organization Has Filed.

Certain exempt organizations file this form to provide the irs with the information required by section 6033. Web form 990 resources and tools. Claim a refund shown on form 2439 i check if a 501(c)(3) organization filing a consolidated return with a 501(c)(2) titleholding corporation. Web form 990 (officially, the return of organization exempt from income tax [1]) is a united states internal revenue service form that provides the public with financial information about a nonprofit organization.

You Can Download The Fillable Pdf Form From The Irs.

Web up to three years of forms 990; Request for taxpayer identification number (tin) and certification. For a look at what you'll find on these documents, view these samples: In a nutshell, the form gives the irs an overview of the organization's activities, governance and detailed financial information.

Web No, Turbotax Doesn't Support Form 990, But You Can Download It From The Irs:

Web information about form 990, return of organization exempt from income tax, including recent updates, related forms and instructions on how to file. Web claim credit from form 8941. I would recommend contacting a local professional. Go to www.irs.gov/form990 for instructions and the latest information.

Web The Irs Requires All U.s.

Instructions for form 990, return of organization exempt from income tax; Web required filing (form 990 series) see the form 990 filing thresholds page to determine which forms an organization must file. The following links can offer additional information. Below are some ways you can get an organization's 990s.