Utah Employee Withholding Form 2023

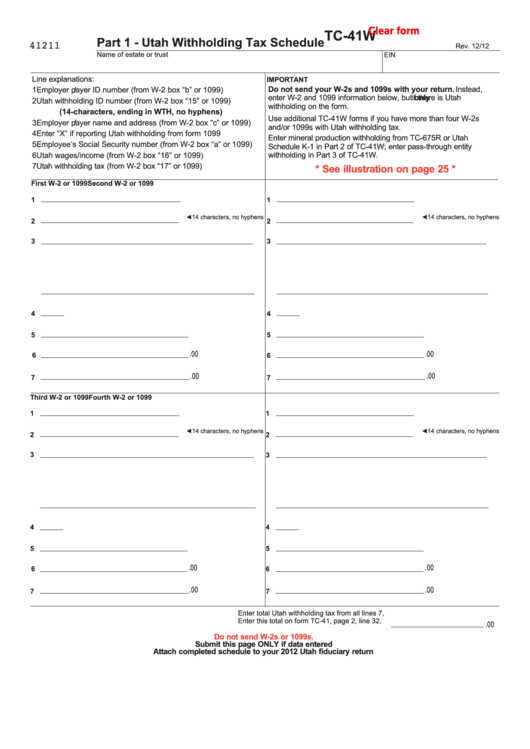

Utah Employee Withholding Form 2023 - 2023 qualified political party declaration of candidacy. Web employees must designate the number of withholding allowances they wish to claim on their paycheck. Web the income tax withholding formula for the state of utah includes the following changes: Web utah withholding tax, 1 of 9 , active utah withholding tax; 2023 employee withholding certificates thomson reuters tax & accounting january 5, 2023 · 5 minute read as we begin 2023, employers may. Follow the detailed instructions to complete and. Web the utah employer contribution rate is calculated annually by the unemployment insurance division. Including federal and state tax rates, withholding forms, and payroll tools. Blank time sheet for finet coding; Main menu, 2 of 9 main menu;

26, 2022, 6:11 pm utah releases 2023 withholding guide, methods unchanged jamie rathjen editor/writer utah’s 2023 withholding guide. Web the utah employer contribution rate is calculated annually by the unemployment insurance division. Web ing tax from employees’ wages, and † utah withholding tax tables for quick lookup. Web utah withholding tax, 1 of 9 , active utah withholding tax; Web employees must designate the number of withholding allowances they wish to claim on their paycheck. Download the current template and save to your computer before using. The income tax rate has changed from 4.95 percent to 4.85 percent. To update, increase or change the number of exemptions you have two. Web your free and reliable utah payroll and tax resource. Web how to file you may file your withholding electronically* through:

Follow the detailed instructions to complete and. Web how to file you may file your withholding electronically* through: 2023 qualified political party declaration of candidacy. Web payroll deductions before taxes. Main menu, 2 of 9 main menu; Web the utah employer contribution rate is calculated annually by the unemployment insurance division. Web utah withholding tax guide: The income tax rate has changed from 4.95 percent to 4.85 percent. Blank time sheet for finet coding; Web utah withholding tax, 1 of 9 , active utah withholding tax;

Utah State Withholding Form 2022

Utah issues revised 2023 income tax withholding guide reflecting lower personal income tax rate. Web the income tax withholding formula for the state of utah includes the following changes: Follow the detailed instructions to complete and. Web utah withholding tax, 1 of 9 , active utah withholding tax; In 2023, more than 68 percent of utah’s employers.

Utah Employee Withholding Tax Form 2023

Web how to file you may file your withholding electronically* through: Web the income tax withholding formula for the state of utah includes the following changes: Deq blank time sheet (deq employees only) fi11 leave donation form; The income tax rate has changed from 4.95 percent to 4.85 percent. Download the current template and save to your computer before using.

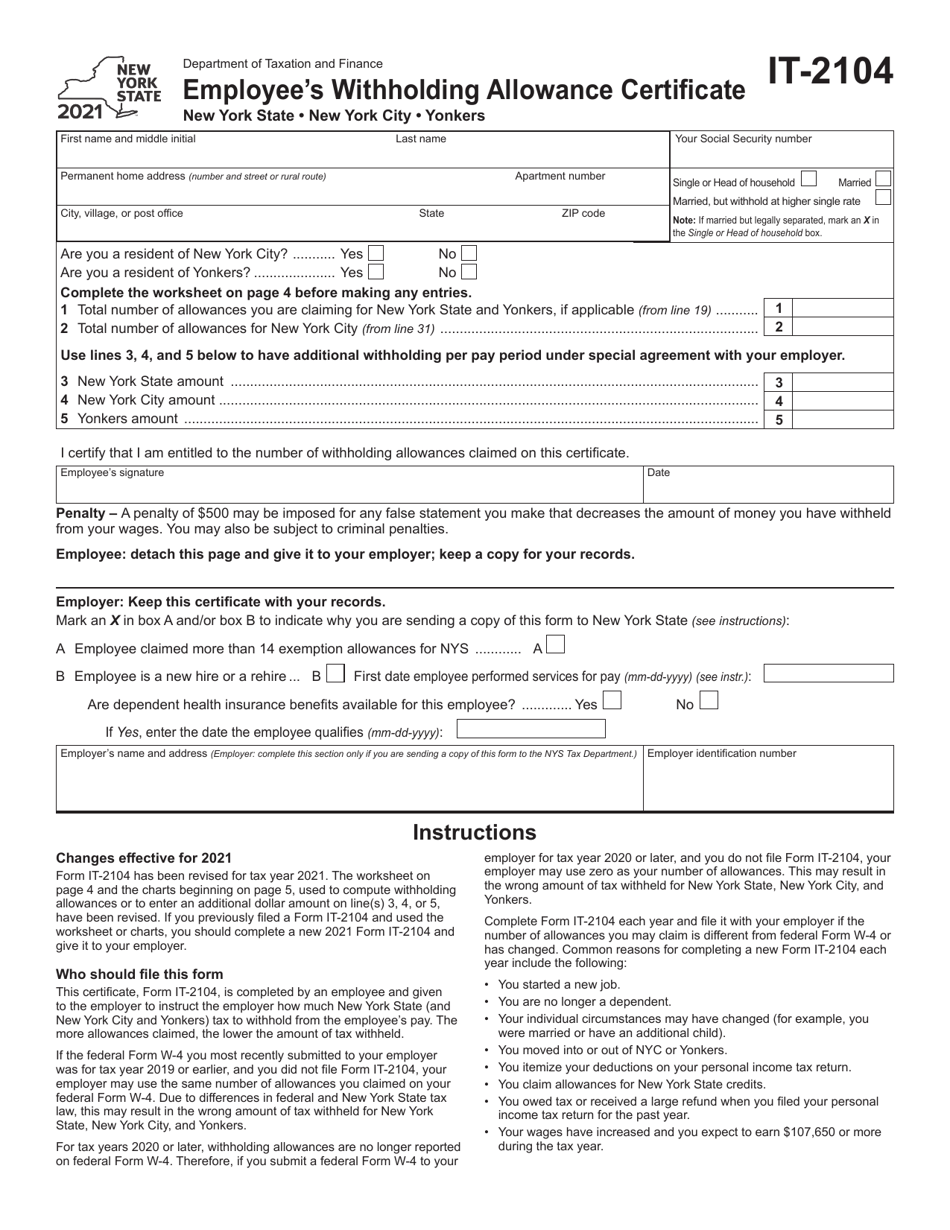

Form IT2104 Download Fillable PDF or Fill Online Employee's

Including federal and state tax rates, withholding forms, and payroll tools. Deq blank time sheet (deq employees only) fi11 leave donation form; Web the utah employer contribution rate is calculated annually by the unemployment insurance division. Main menu, 2 of 9 main menu; 2023 employee withholding certificates thomson reuters tax & accounting january 5, 2023 · 5 minute read as.

Arkansas Employee Tax Withholding Form 2023

Web employees must designate the number of withholding allowances they wish to claim on their paycheck. Follow the detailed instructions to complete and. Web the utah employer contribution rate is calculated annually by the unemployment insurance division. Download the current template and save to your computer before using. Main menu, 2 of 9 main menu;

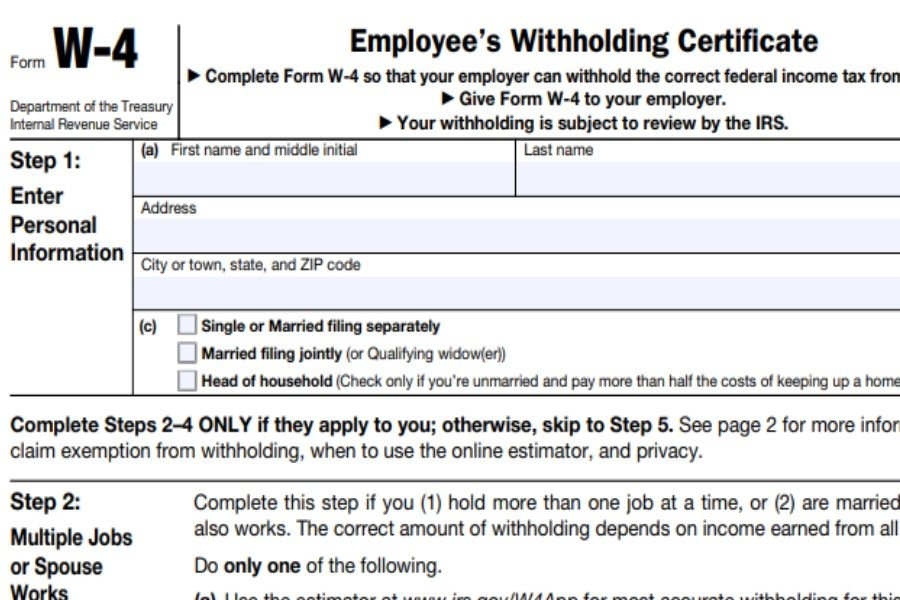

Employee Withholding Form 2021 W4 Form 2021

Web employees must designate the number of withholding allowances they wish to claim on their paycheck. 2023 qualified political party declaration of candidacy. 2023 unaffiliated certificate of nomination. Web the utah employer contribution rate is calculated annually by the unemployment insurance division. Main menu, 2 of 9 main menu;

8 Form Utah Ten Reasons Why You Shouldn’t Go To 8 Form Utah On Your Own

Utah issues revised 2023 income tax withholding guide reflecting lower personal income tax rate. Web employees must designate the number of withholding allowances they wish to claim on their paycheck. Web payroll deductions before taxes. Web the income tax withholding formula for the state of utah includes the following changes: 2023 employee withholding certificates thomson reuters tax & accounting january.

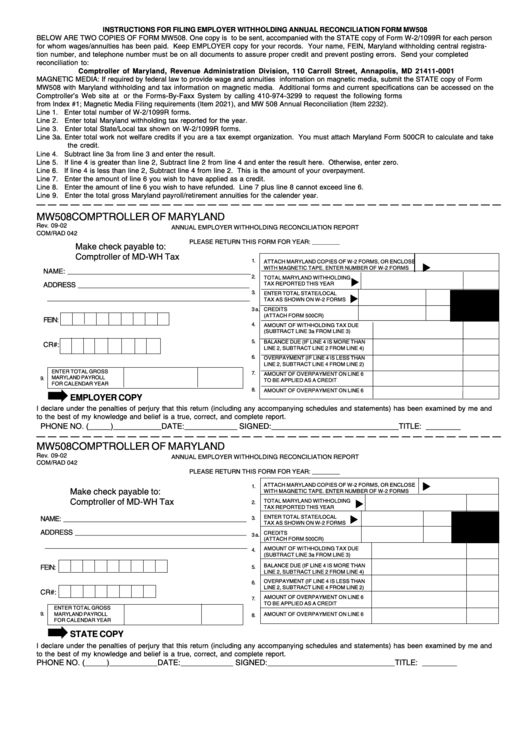

Maryland Withholding Form 2021 2022 W4 Form

Web your free and reliable utah payroll and tax resource. Web ing tax from employees’ wages, and † utah withholding tax tables for quick lookup. In 2023, more than 68 percent of utah’s employers. Web the utah employer contribution rate is calculated annually by the unemployment insurance division. Blank time sheet for finet coding;

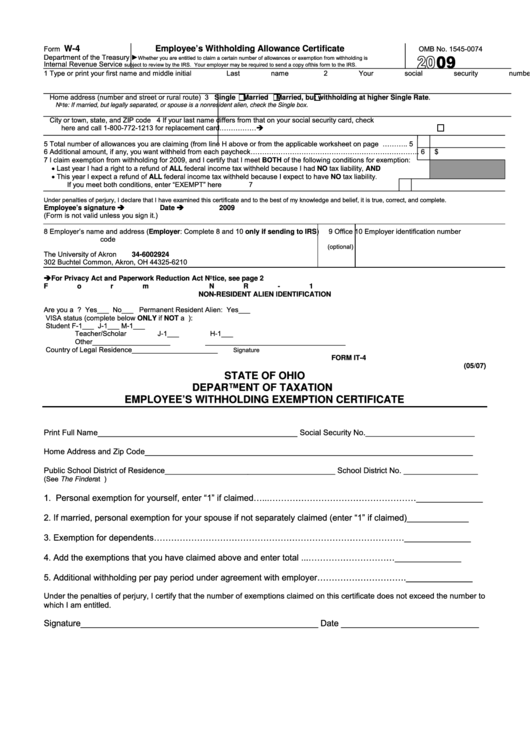

Ohio Withholding Form W 4 2022 W4 Form

Follow the detailed instructions to complete and. The income tax rate has changed from 4.95 percent to 4.85 percent. Web 51 rows utah withholding tax template: Web utah withholding tax guide: Including federal and state tax rates, withholding forms, and payroll tools.

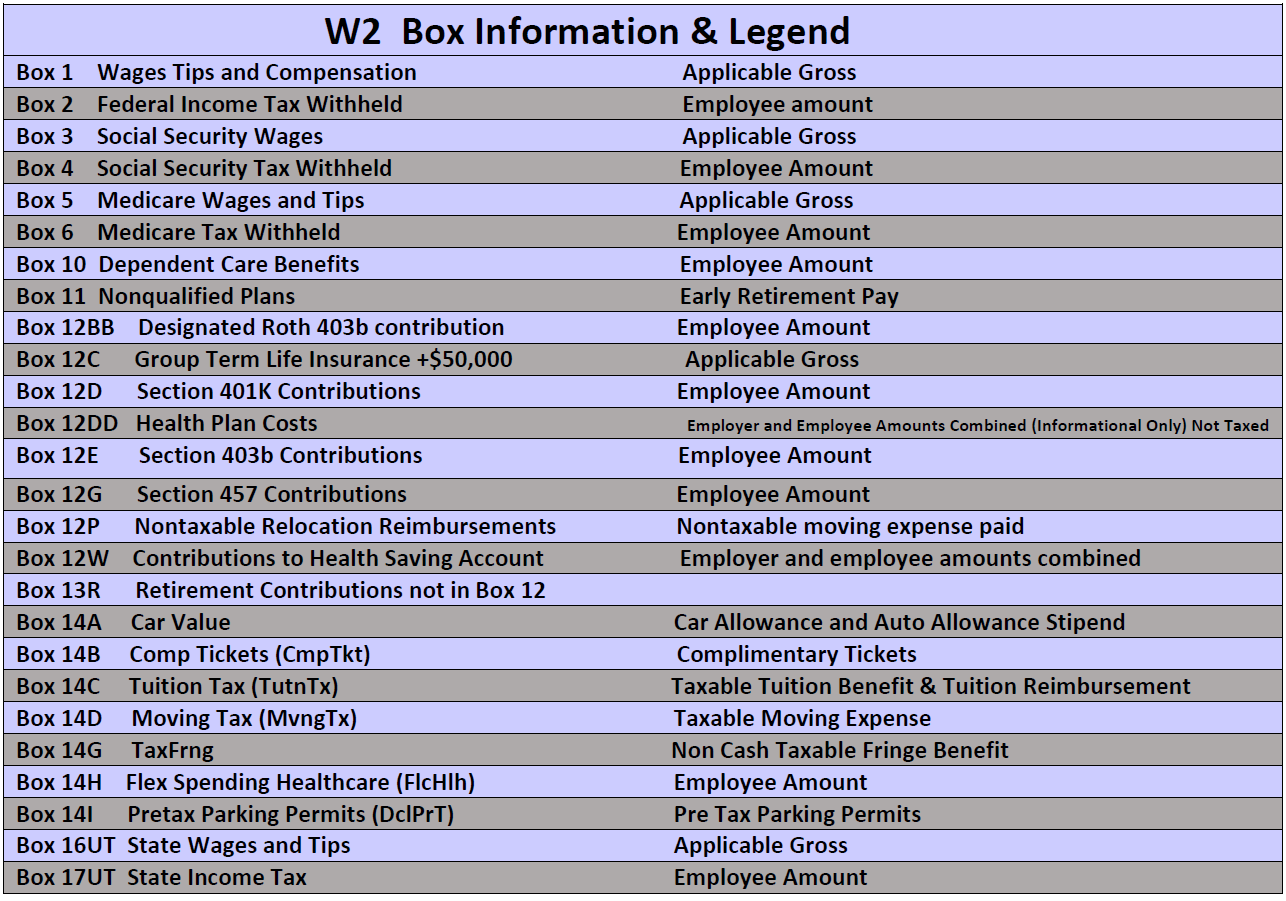

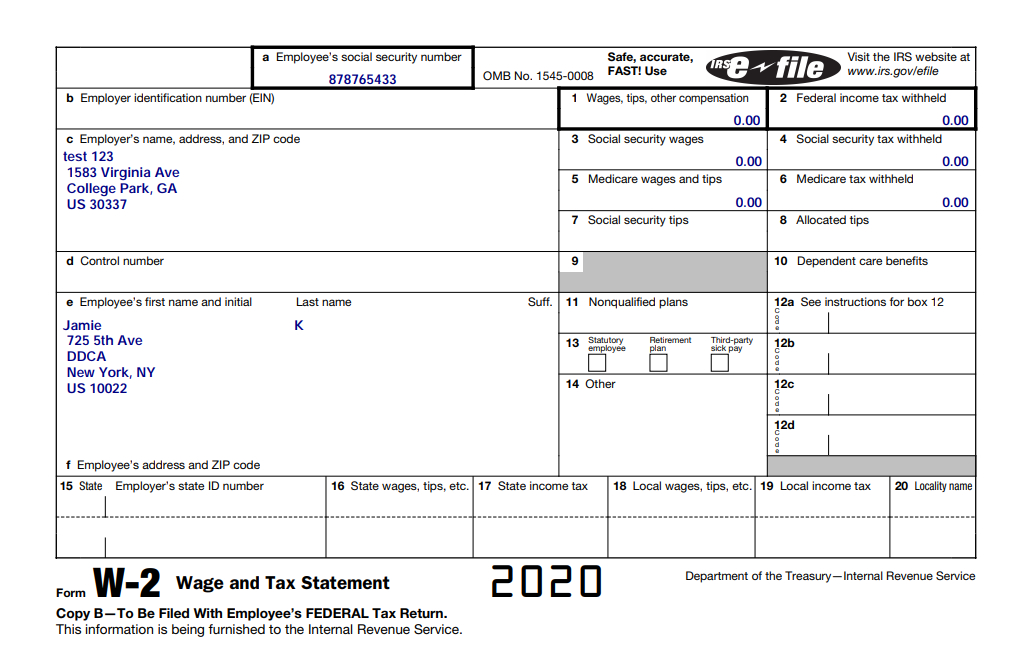

How to Download employee W2 withholding form using Deskera People?

2023 unaffiliated certificate of nomination. Main menu, 2 of 9 main menu; Web ing tax from employees’ wages, and † utah withholding tax tables for quick lookup. The utah state tax commission has updated. Web how to file you may file your withholding electronically* through:

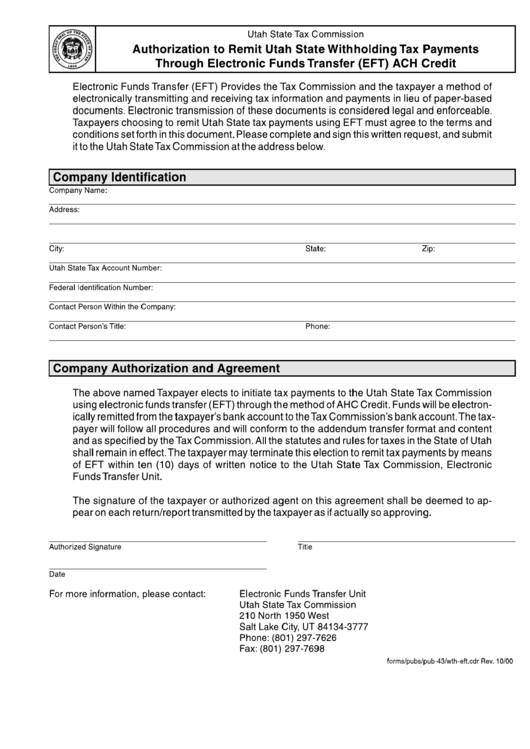

Utah State Tax Withholding Form 2022

Web ing tax from employees’ wages, and † utah withholding tax tables for quick lookup. The income tax rate has changed from 4.95 percent to 4.85 percent. The income tax withholding formula for the state of utah includes the following changes: Web utah withholding tax, 1 of 9 , active utah withholding tax; In 2023, more than 68 percent of.

2023 Qualified Political Party Declaration Of Candidacy.

2023 employee withholding certificates thomson reuters tax & accounting january 5, 2023 · 5 minute read as we begin 2023, employers may. Web your free and reliable utah payroll and tax resource. Web ing tax from employees’ wages, and † utah withholding tax tables for quick lookup. Web utah withholding tax, 1 of 9 , active utah withholding tax;

Web The Utah Employer Contribution Rate Is Calculated Annually By The Unemployment Insurance Division.

Silver lake, big cottonwood canyon, by colton matheson forms &. Web the income tax withholding formula for the state of utah includes the following changes: Blank time sheet for finet coding; Including federal and state tax rates, withholding forms, and payroll tools.

Deq Blank Time Sheet (Deq Employees Only) Fi11 Leave Donation Form;

Utah issues revised 2023 income tax withholding guide reflecting lower personal income tax rate. Web payroll deductions before taxes. Web 51 rows utah withholding tax template: 26, 2022, 6:11 pm utah releases 2023 withholding guide, methods unchanged jamie rathjen editor/writer utah’s 2023 withholding guide.

Web Employees Must Designate The Number Of Withholding Allowances They Wish To Claim On Their Paycheck.

Web follow these steps to complete and submit your return: In 2023, more than 68 percent of utah’s employers. Follow the detailed instructions to complete and. The utah state tax commission has updated.