Virginia Estimated Tax Form

Virginia Estimated Tax Form - Filing is required only for individuals whose income and net tax due exceed the amounts specified in section i. Web virginia tax individual online account application. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. You must pay at least 90% of your tax liability during the year by having income tax withheld and/or making timely payments of. Web spouse adjustment tax calculator; An authorized person is an individual who is accessing their own. Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to pay underestimated tax. Web tax due returns: Web form 760es is used by individuals to make estimated income tax payments.

Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. Web this includes all payments for estimated taxes, extensions of time to file, and any other amounts due when a return is filed. The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. If you are required to make estimated income tax payments, but do not, you may be liable for an additional charge, which is explained in section viii. Virginia department of taxation, p.o. Voucher number estimated tax for the year amount of this payment payment sign & confirm Web form 760es is used by individuals to make estimated income tax payments. Fix, or correct a return; Web 2021 virginia form 760 *va0760121888* resident income tax return 2601031 file by may 1, 2022 — use black ink rev. Web 760es for taxable year for taxable year voucher numbers do not submit form 760es if no amount is due.

Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to pay underestimated tax. Power of attorney and tax information. The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Virginia department of taxation, p.o. Printable virginia state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Voucher number estimated tax for the year amount of this payment payment sign & confirm Both the irs and state taxing authorities require you pay your taxes throughout the year. The virginia income tax rate for tax year 2022 is progressive from a low of 2% to a high of. Web form 760es is used by individuals to make estimated income tax payments. 07/21 your first name m.i.

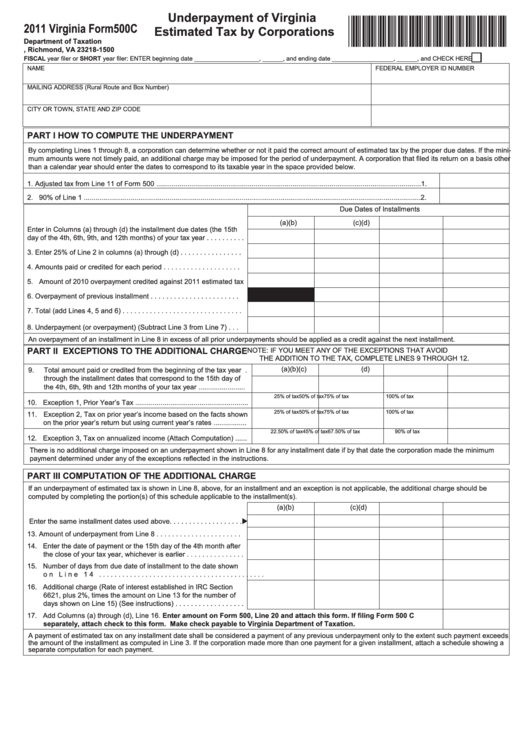

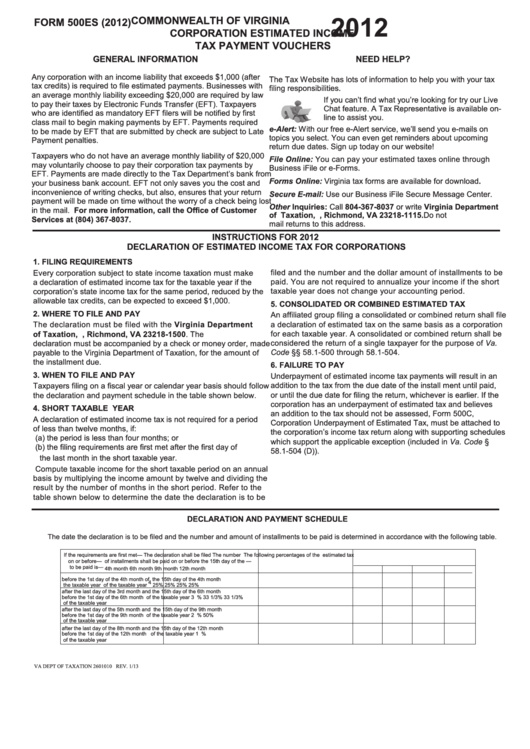

Virginia Form 500c Underpayment Of Virginia Estimated Tax By

(c) you are married, filing separately, and your separate expected virginia adjusted gross income (line 1, estimated income tax worksheet on page 3) is less than $11,950; Web this report will show the difference between the amount of tax the corporation would pay if it filed as part of a unitary combined group and the amount of tax based on.

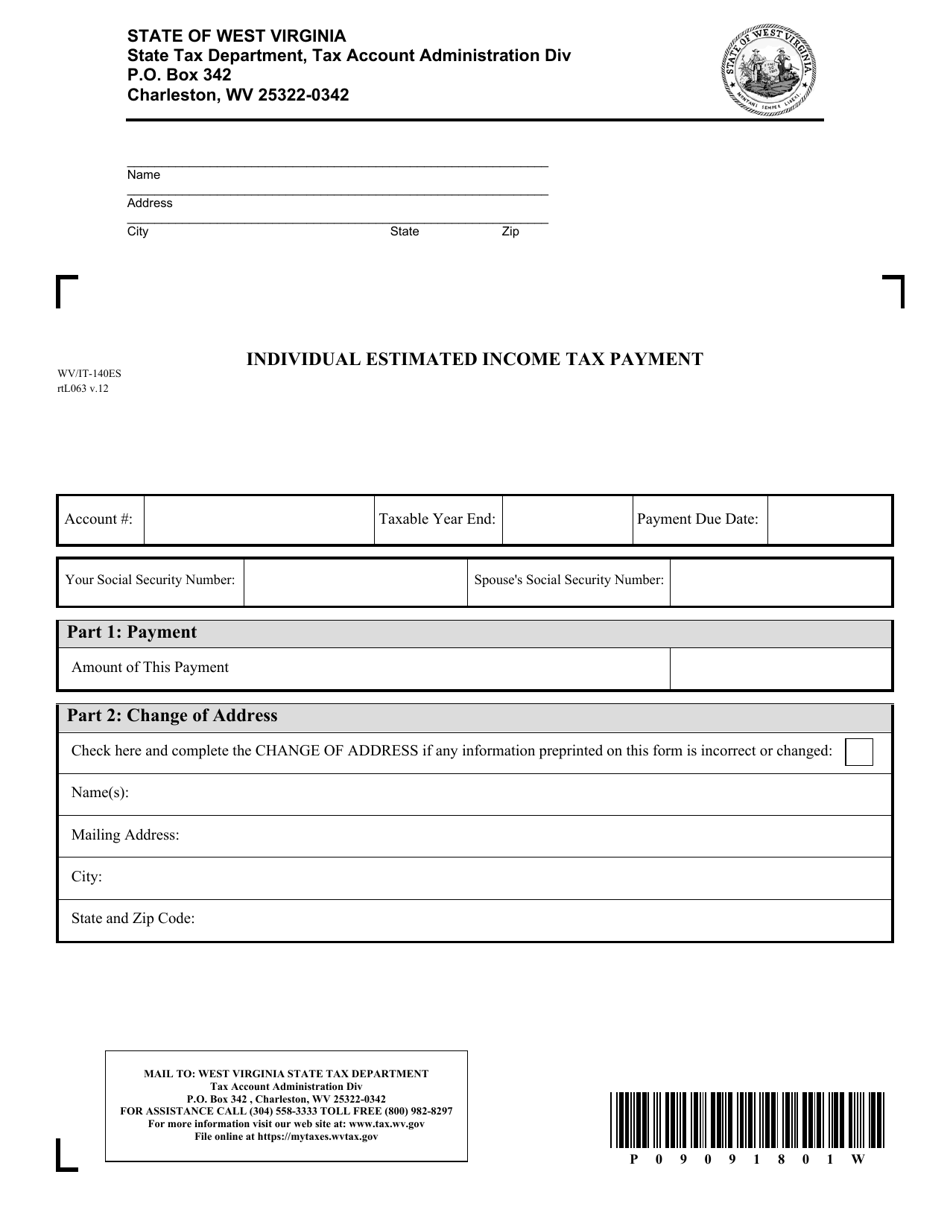

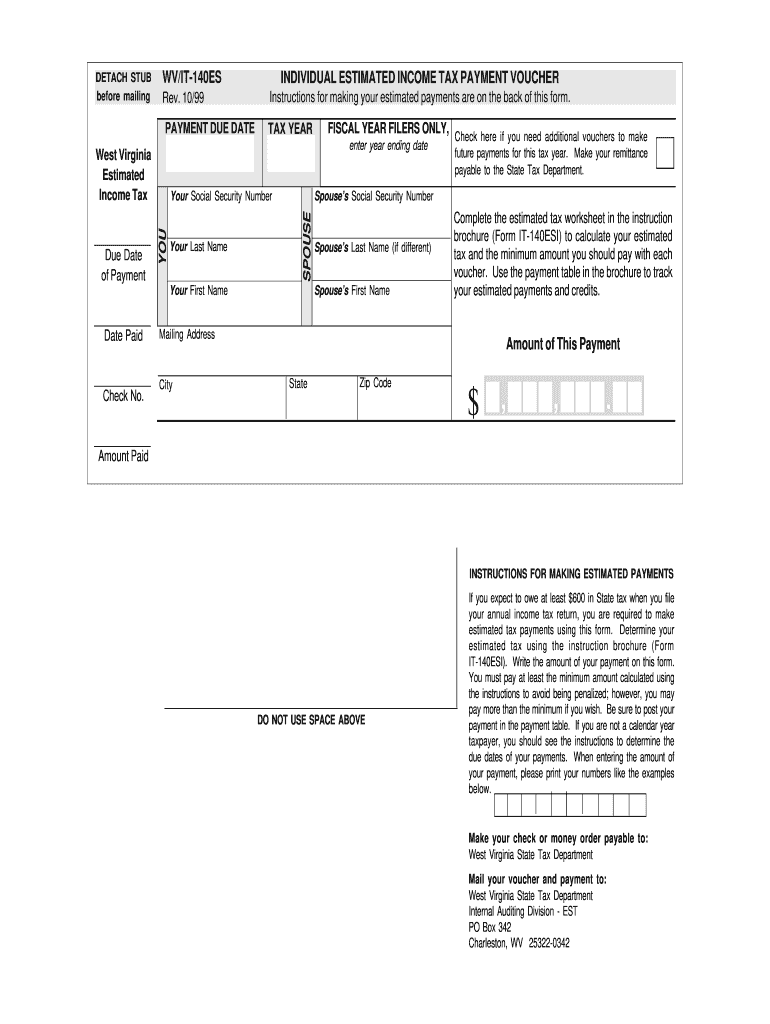

Form WV/IT140ES Fill Out, Sign Online and Download Printable PDF

Voucher number estimated tax for the year amount of this payment payment sign & confirm Last name including suffix spouse’s first name (joint returns only)m.i. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Fix, or correct a return; 1st quarter (q1) 2nd quarter (q2) 3rd quarter (q3) 4th quarter (q4).

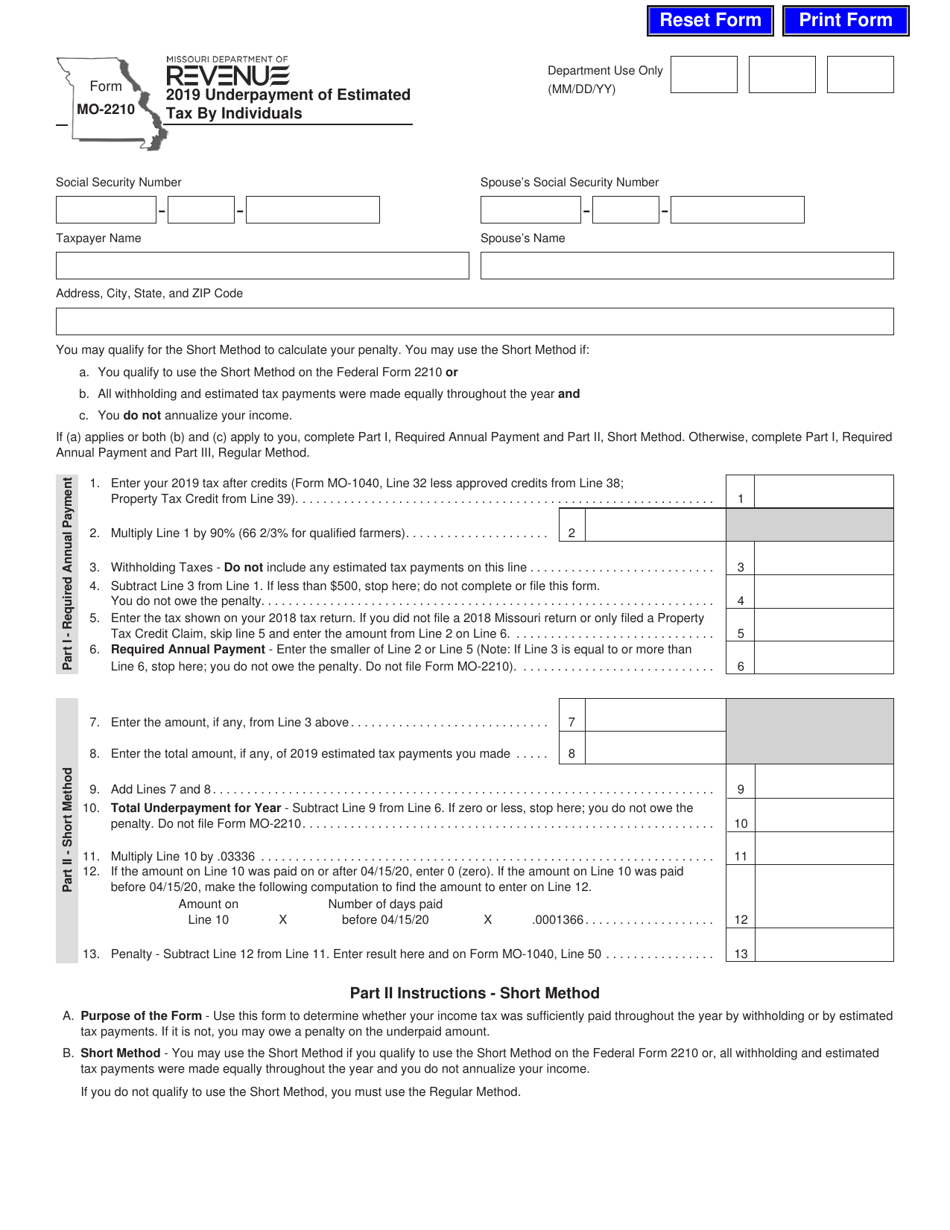

Penalty For Underpayment Of Estimated Tax Virginia TAXIRIN

You must pay at least 90% of your tax liability during the year by having income tax withheld and/or making timely payments of. Estimated income tax payments must be made in full on or before may 1, 2020, or in equal installments on or before may 1, 2020, june 15, 2020, september 15, 2020, and january 15, 2021. While most.

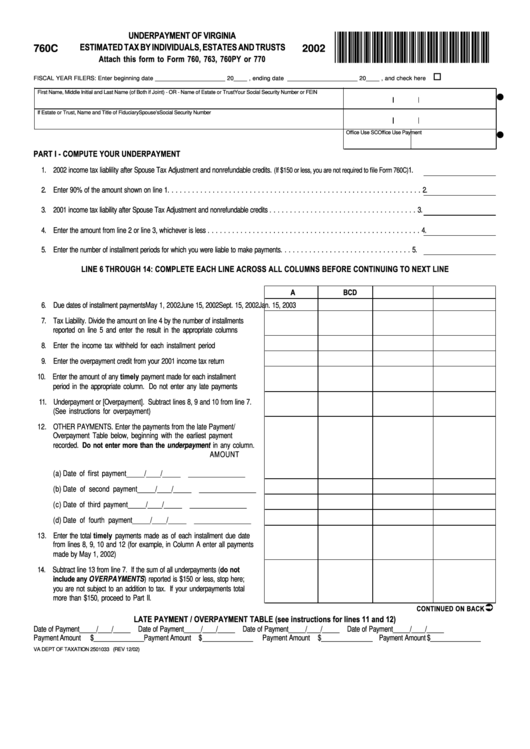

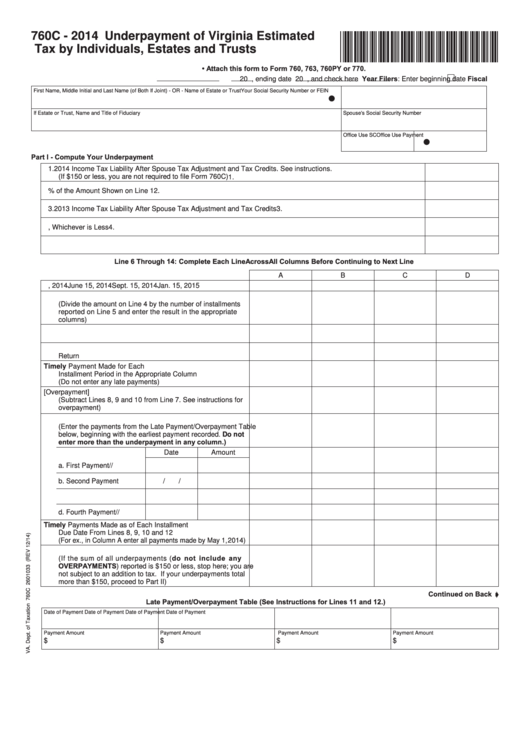

Form 760c Underpayment Of Virginia Estimated Tax By Individuals

Web this report will show the difference between the amount of tax the corporation would pay if it filed as part of a unitary combined group and the amount of tax based on how they currently file. Virginia department of taxation, p.o. Estates, trusts, and the deceased. Last name including suffix spouse’s first name (joint returns only)m.i. Virginia state income.

1040 Form 2021

Details on how to only prepare and print a virginia 2022 tax return. The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. This commonwealth of virginia system belongs to the department of taxation (virginia tax) and is intended for use by authorized persons to interact with virginia tax in.

1999 Form WV DoR WV/IT140ES Fill Online, Printable, Fillable, Blank

Web tax due returns: Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to pay underestimated tax. You must file this form with your employer when your employment begins. Virginia state income tax forms for tax year 2022 (jan. 1st quarter (q1) 2nd quarter (q2) 3rd.

Form 500es Commonwealth Of Virginia Corporation Estimated Tax

Power of attorney and tax information. An authorized person is an individual who is accessing their own. If you are required to make estimated income tax payments, but do not, you may be liable for an additional charge, which is explained in section viii. File your state tax return. (c) you are married, filing separately, and your separate expected virginia.

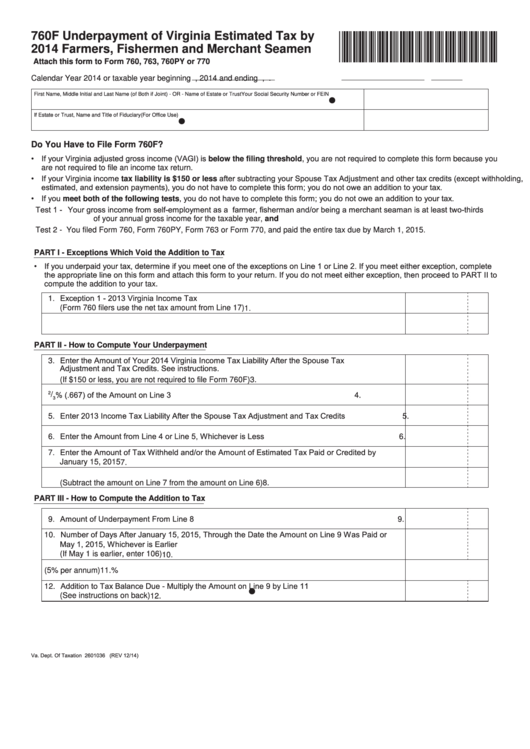

Fillable Form 760f Underpayment Of Virginia Estimated Tax By Farmers

If you are required to make estimated income tax payments, but do not, you may be liable for an additional charge, which is explained in section viii. To receive the status of your filed income tax refund, enter your social security number and the expected refund amount (to the nearest dollar) for the tax year you select on this refund.

Fillable Form 760c Underpayment Of Virginia Estimated Tax By

Filing is required only for individuals whose income and net tax due exceed the amounts specified in section i. File your state tax return. Web spouse adjustment tax calculator; An authorized person is an individual who is accessing their own. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn money that is.

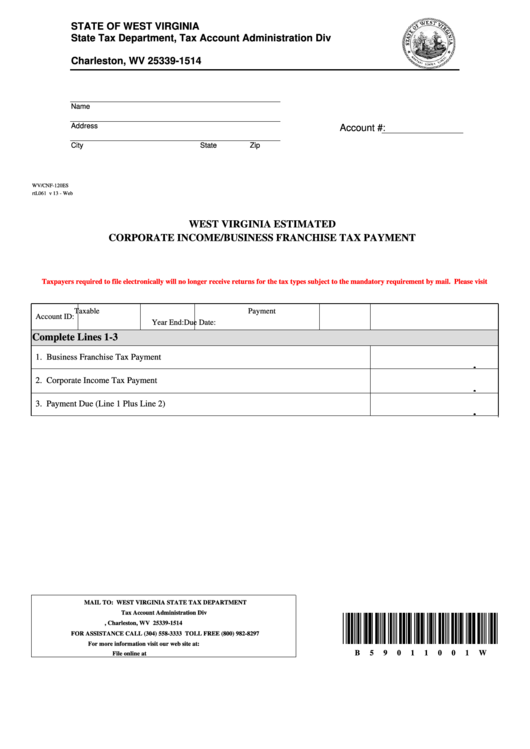

Fillable Form Wv/cnf120es West Virginia Estimated Corporate

Web form 760es is a virginia individual income tax form. Virginia state income tax forms for tax year 2022 (jan. Web this includes all payments for estimated taxes, extensions of time to file, and any other amounts due when a return is filed. Web when to file make estimated payments online or file form 760es payment voucher 1 by may.

Voucher Number Estimated Tax For The Year Amount Of This Payment Payment Sign & Confirm

Or (d) your expected estimated tax liability exceeds your withholding and tax credits by $150 or less. An authorized person is an individual who is accessing their own. Both the irs and state taxing authorities require you pay your taxes throughout the year. Web when to file make estimated payments online or file form 760es payment voucher 1 by may 1, 2020.

Power Of Attorney And Tax Information.

Estimated income tax payments must be made in full on or before may 1, 2020, or in equal installments on or before may 1, 2020, june 15, 2020, september 15, 2020, and january 15, 2021. Web this includes all payments for estimated taxes, extensions of time to file, and any other amounts due when a return is filed. Web virginia state income tax form 760 must be postmarked by may 1, 2023 in order to avoid penalties and late fees. Fix, or correct a return;

Virginia State Income Tax Forms For Tax Year 2022 (Jan.

To receive the status of your filed income tax refund, enter your social security number and the expected refund amount (to the nearest dollar) for the tax year you select on this refund status form. Last name including suffix spouse’s first name (joint returns only)m.i. (c) you are married, filing separately, and your separate expected virginia adjusted gross income (line 1, estimated income tax worksheet on page 3) is less than $11,950; Web virginia tax individual online account application.

If You Are Required To Make Estimated Income Tax Payments, But Do Not, You May Be Liable For An Additional Charge, Which Is Explained In Section Viii.

Details on how to only prepare and print a virginia 2022 tax return. This commonwealth of virginia system belongs to the department of taxation (virginia tax) and is intended for use by authorized persons to interact with virginia tax in order to submit and retrieve confidential tax information. Web this report will show the difference between the amount of tax the corporation would pay if it filed as part of a unitary combined group and the amount of tax based on how they currently file. Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to pay underestimated tax.