Virginia State Tax Exemption Form

Virginia State Tax Exemption Form - Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. Are issued a certificate of exemption by virginia tax. Address _____ number and street or rural route city, town, or post office state zip code. Web virginia allows an exemption of $930* for each of the following: Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. For use by the commonwealth of virginia, a political subdivision of the commonwealth of virginia, or the united states. Web apply for the exemption with virginia tax; Web find forms & instructions by category. You must file this form with your employer when your employment begins. Taxformfinder has an additional 135 virginia income tax forms that you may need, plus all federal income tax forms.

Purchases of prepared or catered meals and food are also covered by this exemption. Taxformfinder has an additional 135 virginia income tax forms that you may need, plus all federal income tax forms. You must file this form with your employer when your employment begins. Web find forms & instructions by category. Are issued a certificate of exemption by virginia tax. View all 136 virginia income tax forms form sources: Web file now with turbotax related virginia individual income tax forms: For use by the commonwealth of virginia, a political subdivision of the commonwealth of virginia, or the united states. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim.

Each filer is allowed one personal exemption. View all 136 virginia income tax forms form sources: Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. Web and use tax certificate of exemption. Corporation and pass through entity tax. To _____ date _____ name of supplier. When using the spouse tax adjustment, each spouse must claim his or her own personal exemption. You must file this form with your employer when your employment begins. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. _____ name of dealer _____ number and street or rural route city, town, or post office state zip code

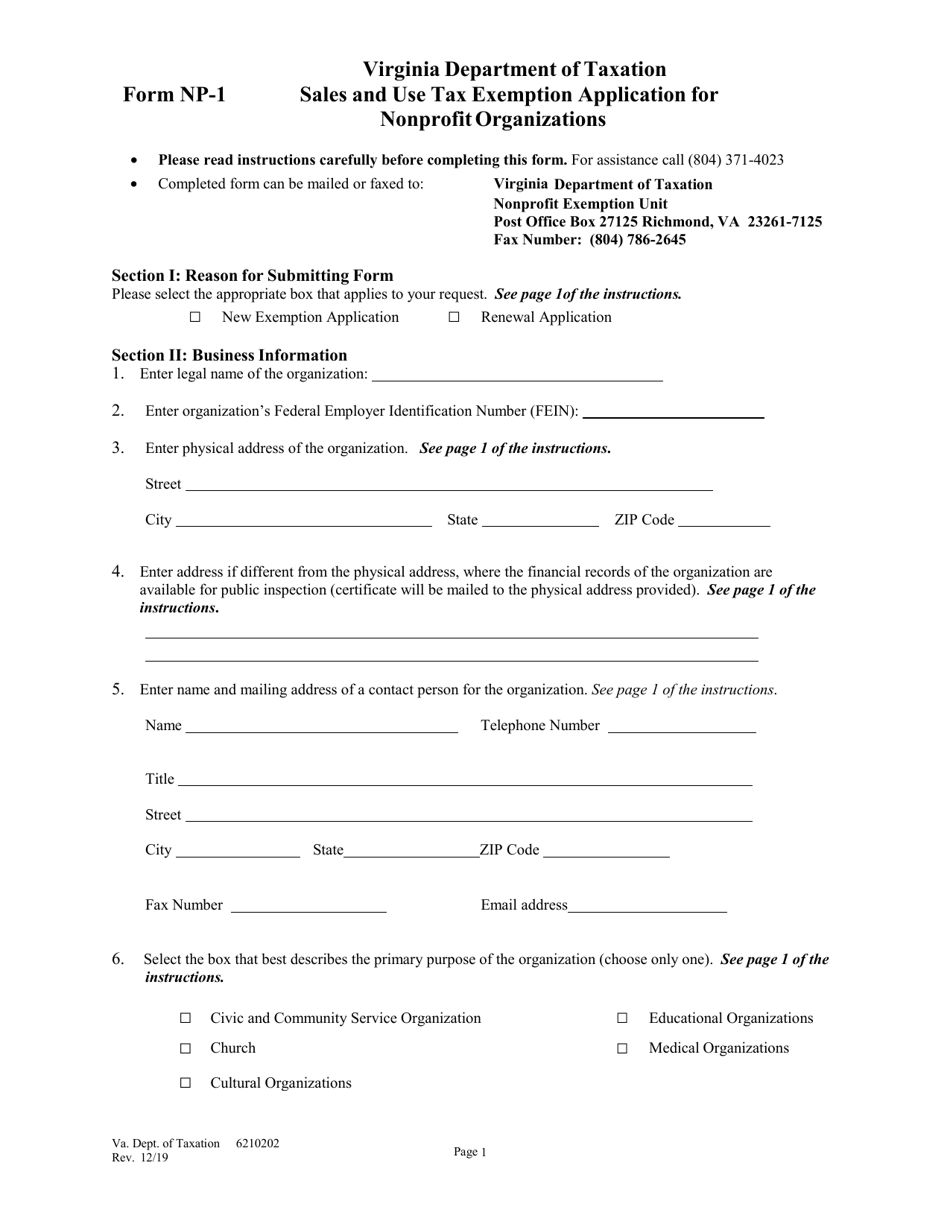

Form NP1 Download Fillable PDF or Fill Online Sales and Use Tax

Taxformfinder has an additional 135 virginia income tax forms that you may need, plus all federal income tax forms. Web find forms & instructions by category. Purchases of prepared or catered meals and food are also covered by this exemption. Web apply for the exemption with virginia tax; Corporation and pass through entity tax.

Louisiana Hotel Tax Exempt Form 2020 Fill and Sign Printable Template

You must file this form with your employer when your employment begins. Web apply for the exemption with virginia tax; Web virginia allows an exemption of $930* for each of the following: Corporation and pass through entity tax. _____ name of dealer _____ number and street or rural route city, town, or post office state zip code

Virginia Form VA4 Download Free & Premium Templates, Forms & Samples

View all 136 virginia income tax forms form sources: Web and use tax certificate of exemption. Purchases of prepared or catered meals and food are also covered by this exemption. Each filer is allowed one personal exemption. Address _____ number and street or rural route city, town, or post office state zip code.

Virginia Tax Exemption Form

Web virginia allows an exemption of $930* for each of the following: Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. You must file this form with your employer when your employment begins. Web find forms & instructions by category. For use by.

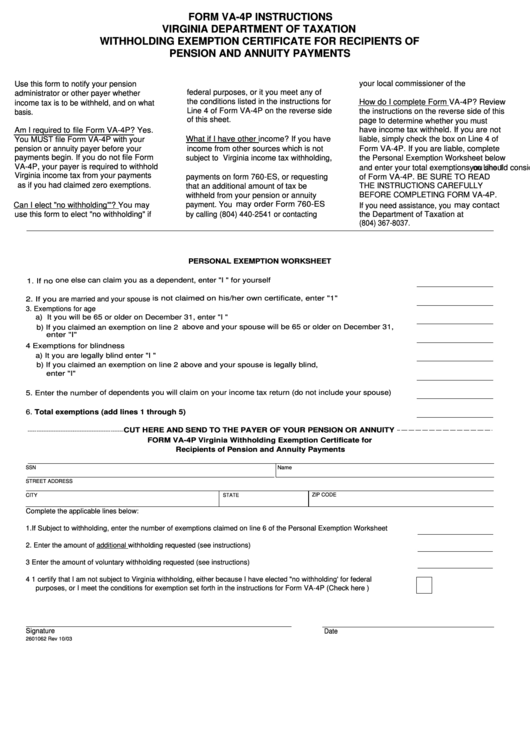

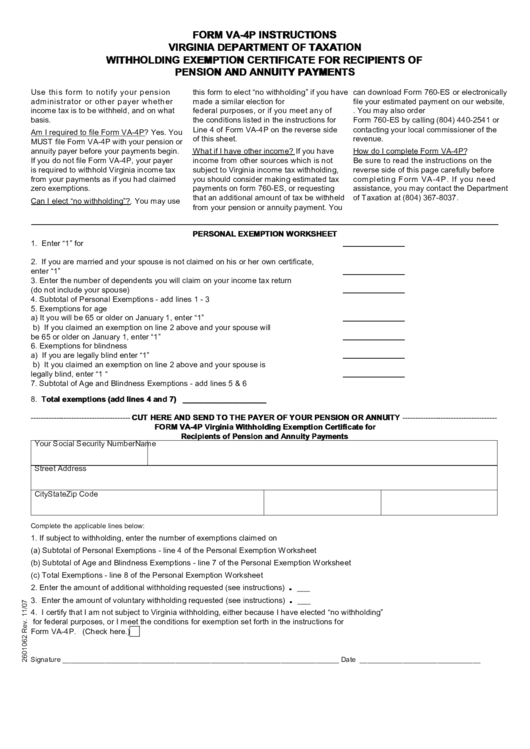

Fillable Form Va4p Virginia Withholding Exemption Certificate For

When using the spouse tax adjustment, each spouse must claim his or her own personal exemption. Web virginia allows an exemption of $930* for each of the following: Are issued a certificate of exemption by virginia tax. For married couples, each spouse is entitled to an exemption. You must file this form with your employer when your employment begins.

How to get a Sales Tax Certificate of Exemption in Virginia

Purchases of prepared or catered meals and food are also covered by this exemption. _____ name of dealer _____ number and street or rural route city, town, or post office state zip code Web apply for the exemption with virginia tax; To _____ date _____ name of supplier. For married couples, each spouse is entitled to an exemption.

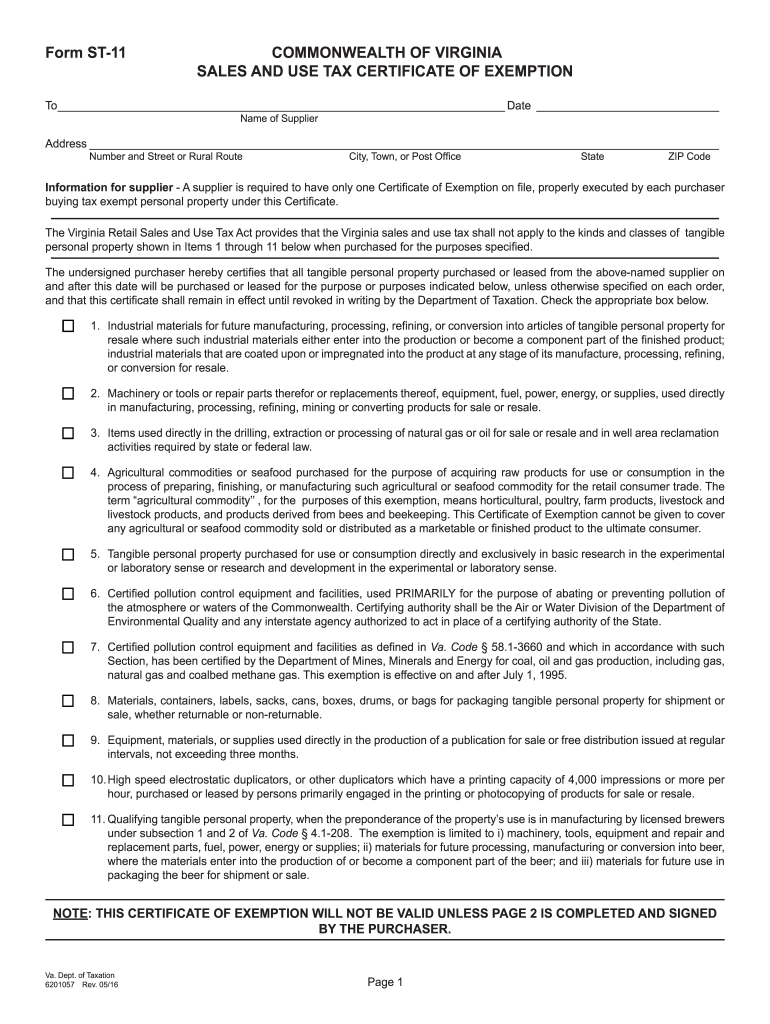

Virginia Sales Tax Exemption Form St 11 Fill Out and Sign Printable

Purchases of prepared or catered meals and food are also covered by this exemption. To _____ date _____ name of supplier. View all 136 virginia income tax forms form sources: Web file now with turbotax related virginia individual income tax forms: For married couples, each spouse is entitled to an exemption.

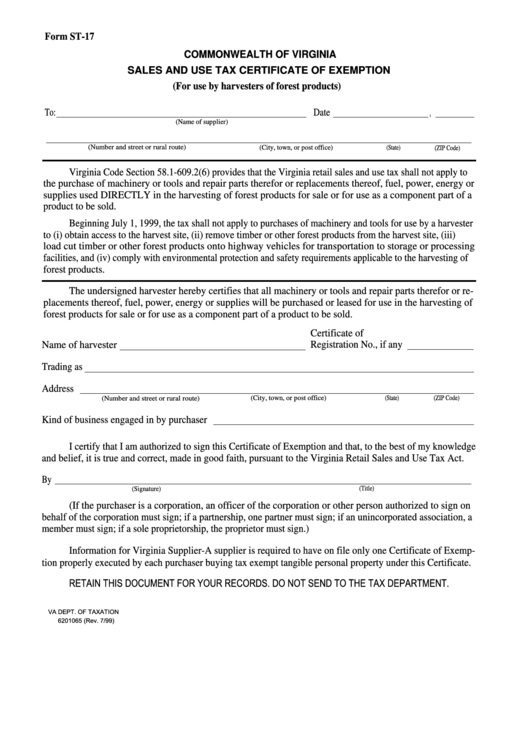

Fillable Form St17 Commonwealth Of Virginia Sales And Use Tax

Corporation and pass through entity tax. To _____ date _____ name of supplier. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. When using the spouse tax adjustment, each spouse must claim his or her own personal exemption. Web use this form to.

Fillable Form Va4p Virginia Withholding Exemption Certificate For

Web file now with turbotax related virginia individual income tax forms: _____ name of dealer _____ number and street or rural route city, town, or post office state zip code Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. Web virginia allows an.

VA Tax Exemption Form Use Tax Packaging And Labeling

Each filer is allowed one personal exemption. Address _____ number and street or rural route city, town, or post office state zip code. When using the spouse tax adjustment, each spouse must claim his or her own personal exemption. Web apply for the exemption with virginia tax; Taxformfinder has an additional 135 virginia income tax forms that you may need,.

Web Virginia Allows An Exemption Of $930* For Each Of The Following:

Web find forms & instructions by category. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. You must file this form with your employer when your employment begins. For married couples, each spouse is entitled to an exemption.

View All 136 Virginia Income Tax Forms Form Sources:

Web file now with turbotax related virginia individual income tax forms: _____ name of dealer _____ number and street or rural route city, town, or post office state zip code Web apply for the exemption with virginia tax; Taxformfinder has an additional 135 virginia income tax forms that you may need, plus all federal income tax forms.

Purchases Of Prepared Or Catered Meals And Food Are Also Covered By This Exemption.

Are issued a certificate of exemption by virginia tax. Web and use tax certificate of exemption. For use by the commonwealth of virginia, a political subdivision of the commonwealth of virginia, or the united states. To _____ date _____ name of supplier.

Each Filer Is Allowed One Personal Exemption.

Address _____ number and street or rural route city, town, or post office state zip code. You must file this form with your employer when your employment begins. Web use this form to notify your employer whether you are subject to virginia income tax withholding and how many exemptions you are allowed to claim. Corporation and pass through entity tax.