W 4 Form Michigan

W 4 Form Michigan - This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated michigan form 4 in february 2023 from the michigan department of treasury. If you fail or refuse to submit this certificate, your employer must withhold tax from your. If too little is withheld, you will generally owe tax when you file your tax return. Web business tax forms 2021 withholding tax forms important note tax forms are tax year specific. Web 2017 individual income tax 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms. Any altering of a form to change a tax year or any reported tax period outside of. Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. Web instructions included on form: This form is for income earned in tax year 2022, with tax returns due in april.

Web 2017 individual income tax 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms. This form is for income earned in tax year 2022, with tax returns due in april. New hire operations center, p.o. If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here. If too little is withheld, you will generally owe tax when you file your tax return. This form is for income earned in tax year 2022, with tax returns due in april. You must complete boxes 1 thru 6, sign and date this form. Payroll department is closed to the public until further notice (posted 4/13/20) 2023 tax information. Web fluid time reporting—learn more. Web business tax forms 2021 withholding tax forms important note tax forms are tax year specific.

Any altering of a form to change a tax year or any. Web business tax forms 2021 withholding tax forms important note tax forms are tax year specific. Complete lines 10 and 11 before. Instructions for completing the 8233. Web 2017 individual income tax 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms. Web (a) other income (not from jobs). Click on employee self service login. Sales and other dispositions of capital assets: Access the wolverine access web site; New hire operations center, p.o.

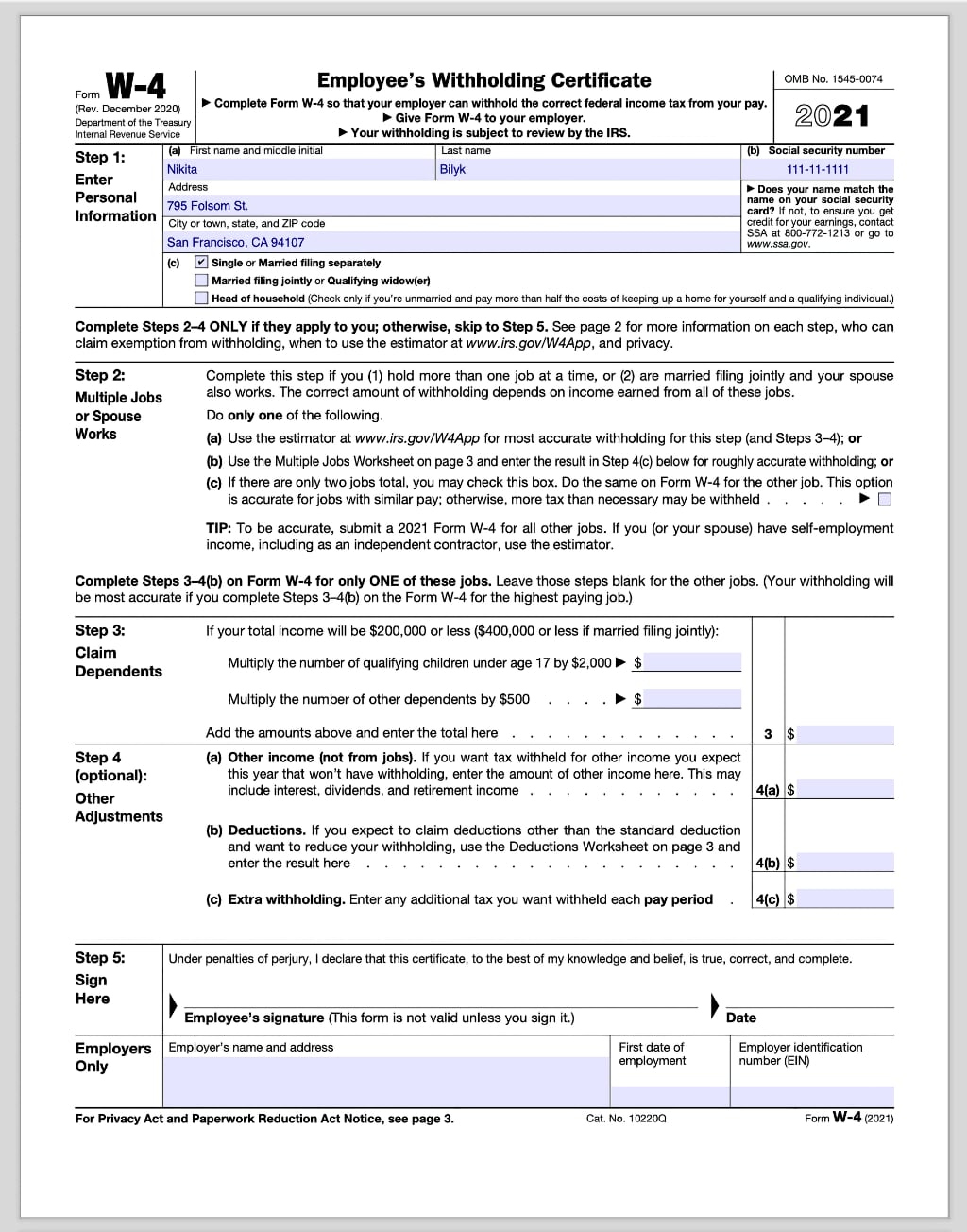

Michigan W 4 2021 2022 W4 Form

If too little is withheld, you will generally owe tax when you file your tax return. If you fail or refuse to submit this certificate, your employer must withhold tax from your. Sales and other dispositions of capital assets: This form is for income earned in tax year 2022, with tax returns due in april. Complete lines 10 and 11.

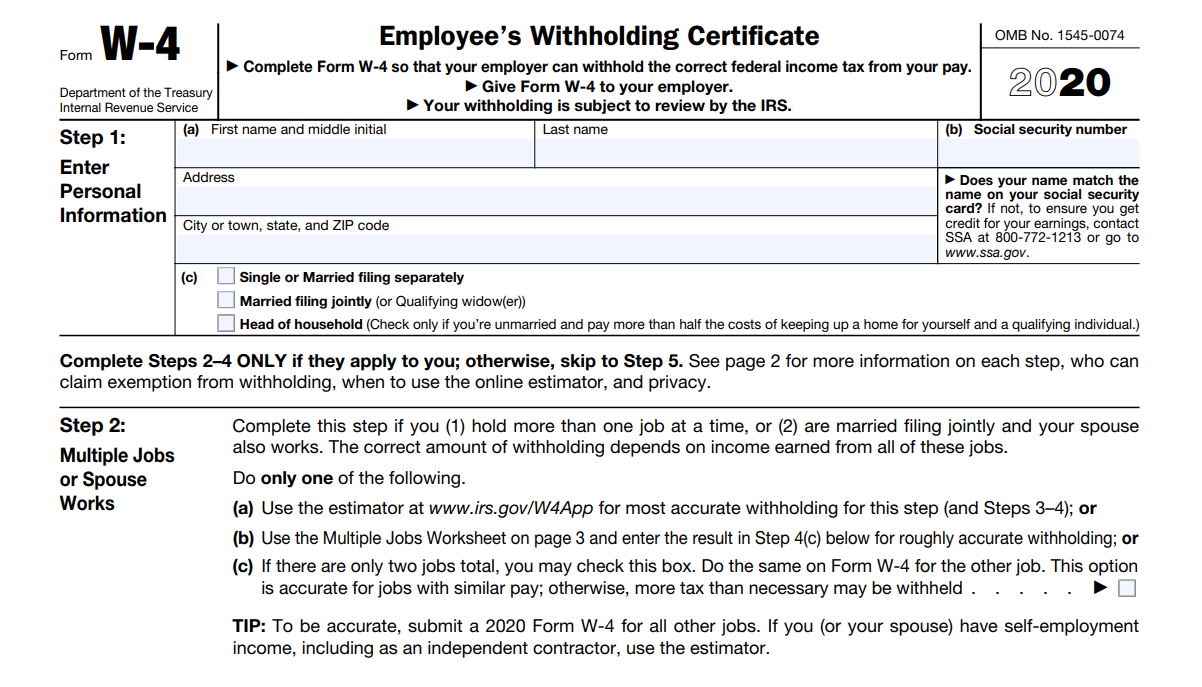

W4 Form 2020 W4 Forms TaxUni

Web (a) other income (not from jobs). Any altering of a form to change a tax year or any reported tax period outside of. Click on employee self service login. Payroll department is closed to the public until further notice (posted 4/13/20) 2023 tax information. Web business tax forms 2021 withholding tax forms important note tax forms are tax year.

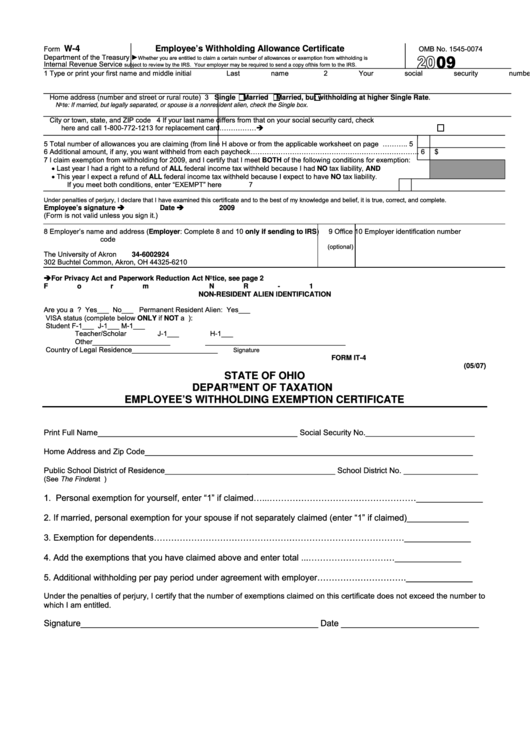

Ohio Withholding Form W 4 2022 W4 Form

Web city tax withholding (w4) forms if you live or work in a taxing city listed below, you are required to complete and submit the appropriate city tax withholding form. Sales and other dispositions of capital assets: Web (a) other income (not from jobs). If too little is withheld, you will generally owe tax when you file your tax return..

Form Mi 1041 Fill Out and Sign Printable PDF Template signNow

Any altering of a form to change a tax year or any reported tax period outside of. Web fluid time reporting—learn more. Any altering of a form to change a tax year or any. This form is for income earned in tax year 2022, with tax returns due in april. Payroll department is closed to the public until further notice.

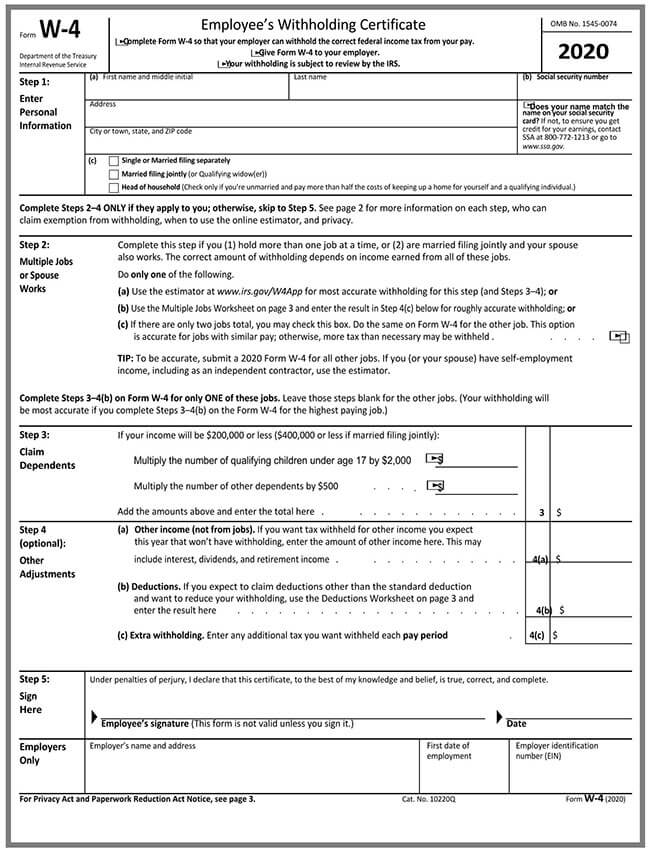

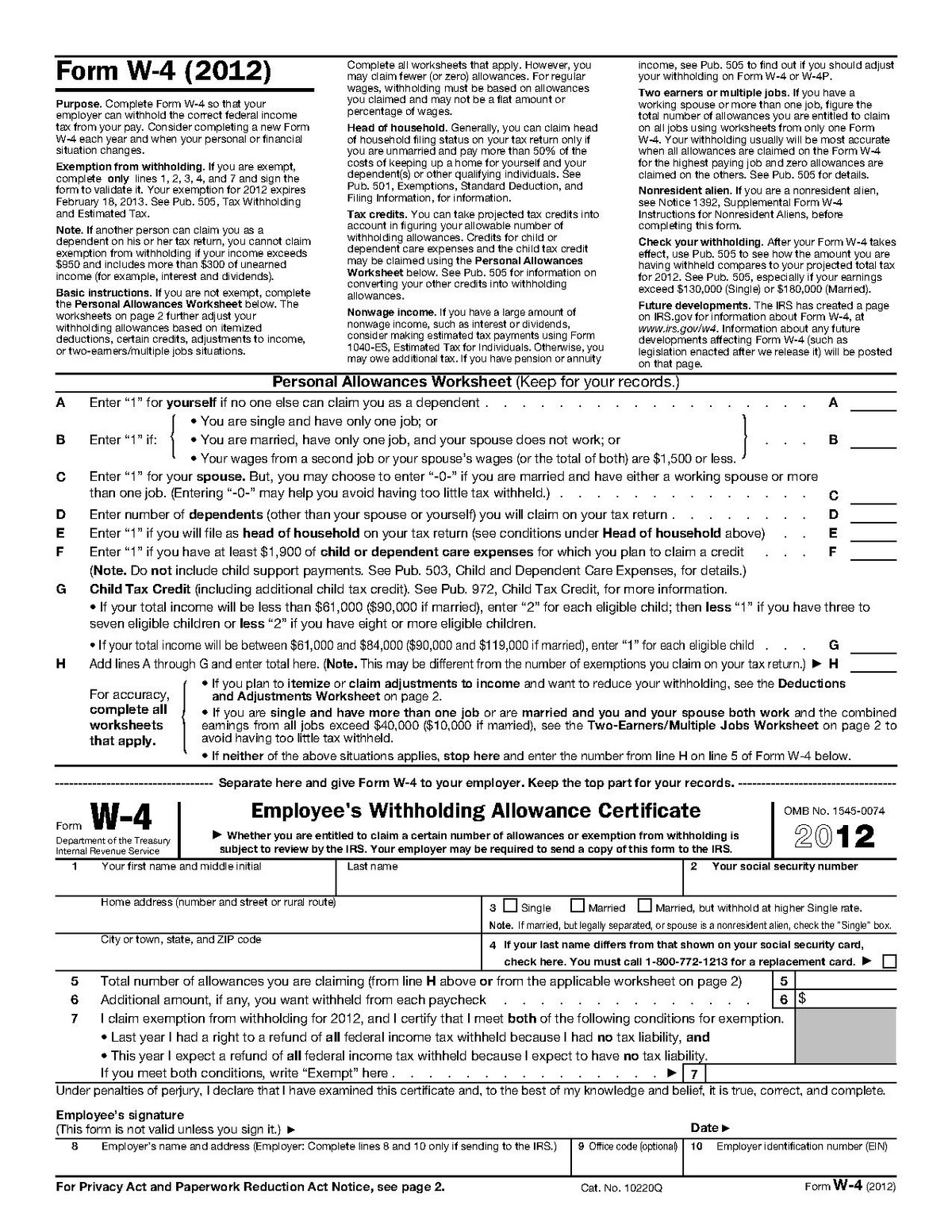

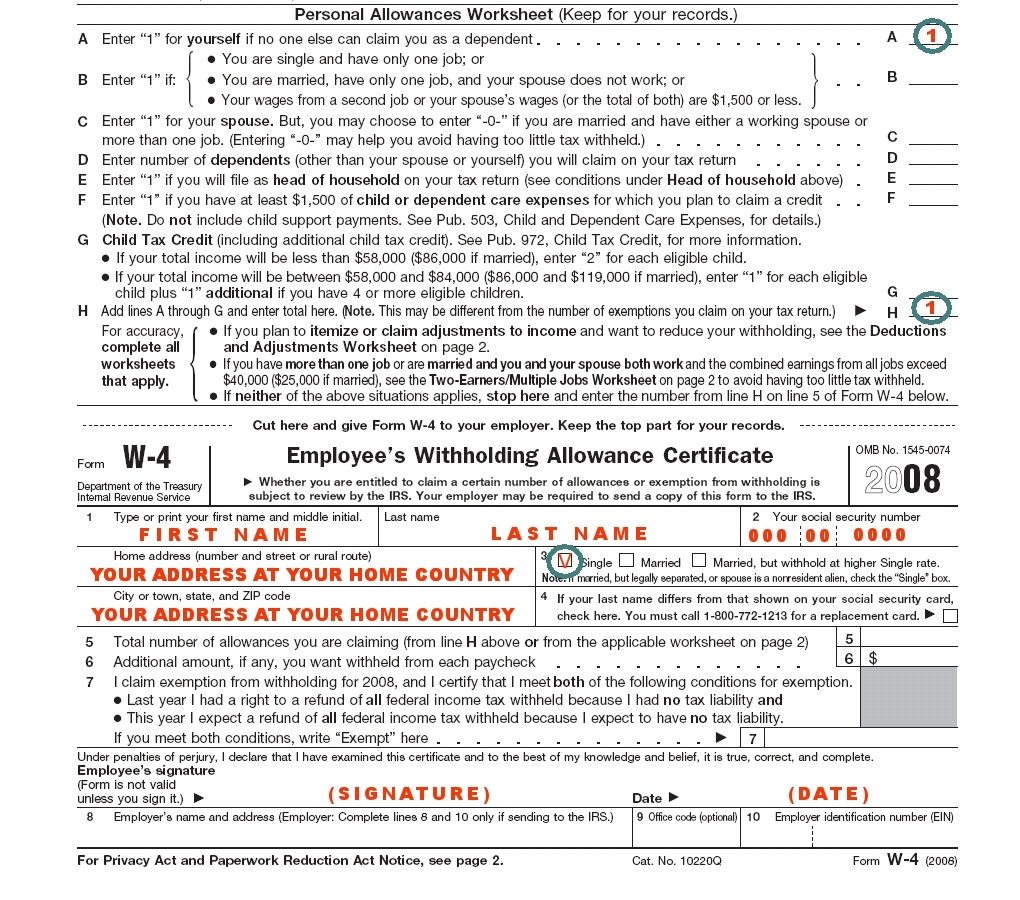

How to Fill a W4 Form (with Guide)

If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here. You must complete boxes 1 thru 6, sign and date this form. Web city tax withholding (w4) forms if you live or work in a taxing city listed below, you are required to complete and submit the.

How to Complete the W4 Tax Form The Way

You must complete boxes 1 thru 6, sign and date this form. Web 2017 individual income tax 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms. This form is for income earned in tax year 2022, with tax returns due in april. Web business tax forms 2021 withholding.

Download Michigan Form MIW4 for Free FormTemplate

This form is for income earned in tax year 2022, with tax returns due in april. If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here. Web form with the michigan department of treasury. Any altering of a form to change a tax year or any reported.

How To Correctly Fill Out Your W4 Form Youtube Free Printable W 4

Any altering of a form to change a tax year or any. Complete lines 10 and 11 before. Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. You must complete boxes 1 thru 6, sign and date this form. Web instructions included on form:

How to Fill Out the W4 Form Pocket Sense

Sales and other dispositions of capital assets: Access the wolverine access web site; If you fail or refuse to submit this certificate, your employer must withhold tax from your. Complete lines 10 and 11 before. Web (a) other income (not from jobs).

Sample W 4 Form W4 Form 2021 Printable

Sales and other dispositions of capital assets: New hire operations center, p.o. Instructions for completing the 8233. This form is for income earned in tax year 2022, with tax returns due in april. This form is for income earned in tax year 2022, with tax returns due in april.

Web Fluid Time Reporting—Learn More.

Sales and other dispositions of capital assets: Web instructions included on form: Click on employee self service login. Web form with the michigan department of treasury.

Access The Wolverine Access Web Site;

Web (a) other income (not from jobs). New hire operations center, p.o. This form is for income earned in tax year 2022, with tax returns due in april. If you fail or refuse to submit this certificate, your employer must withhold tax from your.

Web City Tax Withholding (W4) Forms If You Live Or Work In A Taxing City Listed Below, You Are Required To Complete And Submit The Appropriate City Tax Withholding Form.

You must complete boxes 1 thru 6, sign and date this form. Web we last updated michigan form 4 in february 2023 from the michigan department of treasury. If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here. Web 2017 individual income tax 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms.

Complete Lines 10 And 11 Before.

Web business tax forms 2023 withholding tax forms important note tax forms are tax year specific. This form is for income earned in tax year 2022, with tax returns due in april. Instructions for completing the 8233. If too little is withheld, you will generally owe tax when you file your tax return.