W2 Form For Nanny

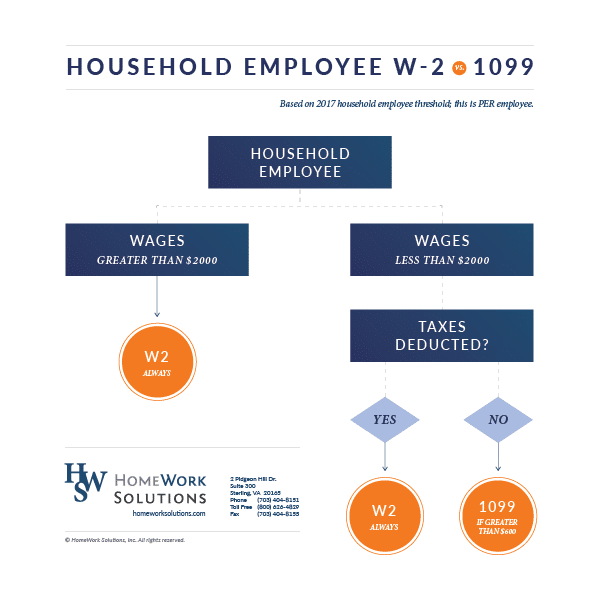

W2 Form For Nanny - Your home address as the work is. You are legally required to withhold fica taxes if you paid your nanny. Web an employer learning whether to file a nanny 1099 or w2 must pay a nanny tax if they pay a household employee $2,300 or more in a calendar year. Your nanny’s social security number (ssn). 31 of the following tax year. Web if the nanny will be a “w2 employee” (obligating the employer to follow tax codes such as withholding social security and medicare taxes), then mark the first. Mar 19, 2019 | hiring an employee, household payroll & taxes,. For 2022, the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave. Care.com® homepay℠ can help you manage your nanny taxes. The nanny tax also relates to.

The nanny tax also relates to. Web live news, investigations, opinion, photos and video by the journalists of the new york times from more than 150 countries around the world. Your home address as the work is. The january 31 date is the ‘mail by’ date. Web if the caregiver employee is a family member, the employer may not owe employment taxes even though the employer needs to report the caregiver's. Your nanny’s social security number (ssn). You are legally required to withhold fica taxes if you paid your nanny. Web w2 forms for nannies jan 8, 2014 | household payroll & taxes, tax & wage laws tax season is in full swing, and many household employers may have questions. Web if the nanny will be a “w2 employee” (obligating the employer to follow tax codes such as withholding social security and medicare taxes), then mark the first. For 2022, the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave.

Mar 19, 2019 | hiring an employee, household payroll & taxes,. If you don't already have an ein, you can apply for. For 2022, the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave. The january 31 date is the ‘mail by’ date. Web if the caregiver employee is a family member, the employer may not owe employment taxes even though the employer needs to report the caregiver's. 31 of the following tax year. The irs specifically asks that you allow the employer until february 15 before you report it missing. Ad homepay℠ can handle all of your nanny payroll and tax obligations. Web live news, investigations, opinion, photos and video by the journalists of the new york times from more than 150 countries around the world. Your home address as the work is.

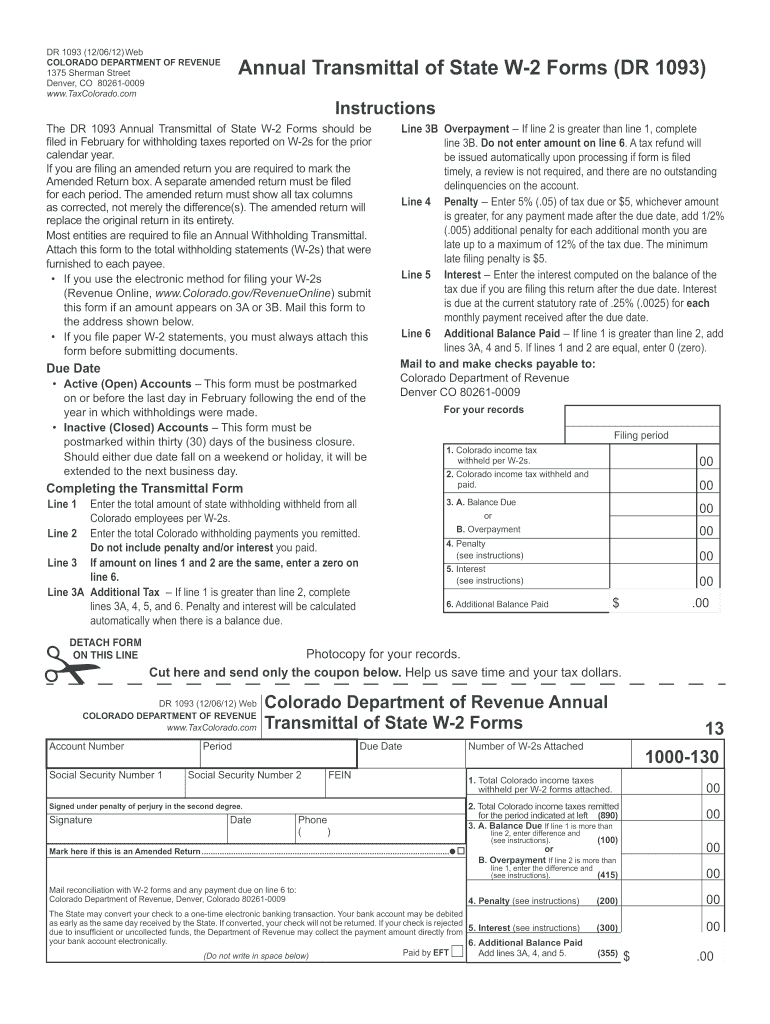

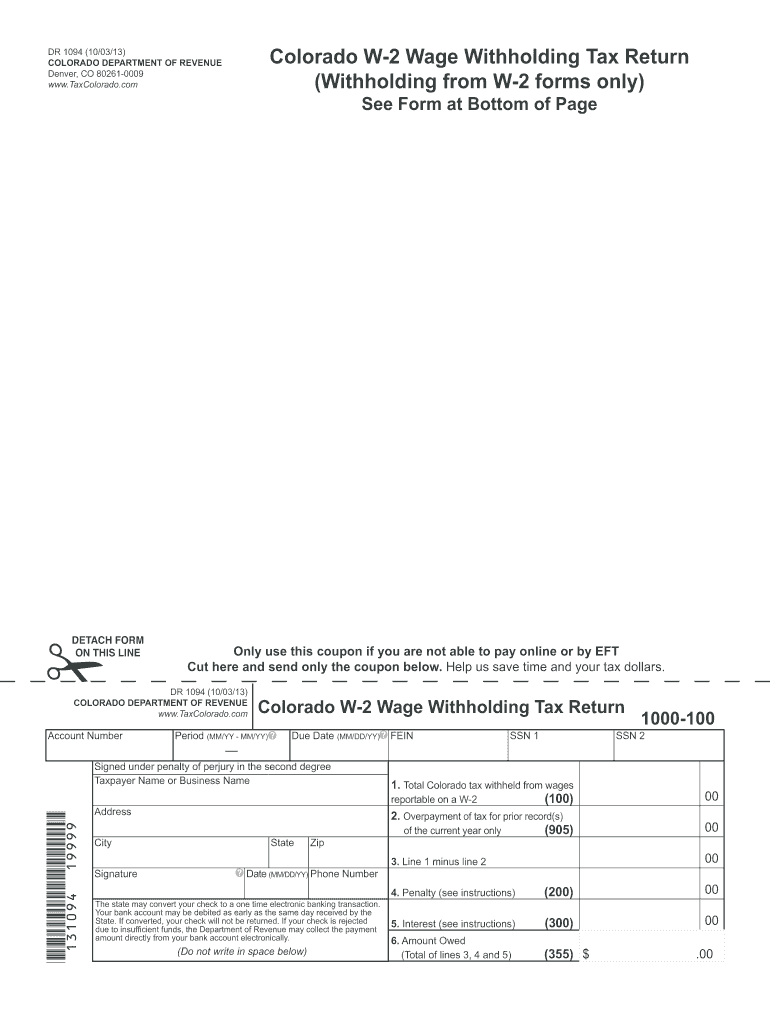

How to fill out a state tax withholding form colorado 2012 Fill out

Web w2 forms for nannies jan 8, 2014 | household payroll & taxes, tax & wage laws tax season is in full swing, and many household employers may have questions. Web if the caregiver employee is a family member, the employer may not owe employment taxes even though the employer needs to report the caregiver's. Subscribe for coverage of u.s..

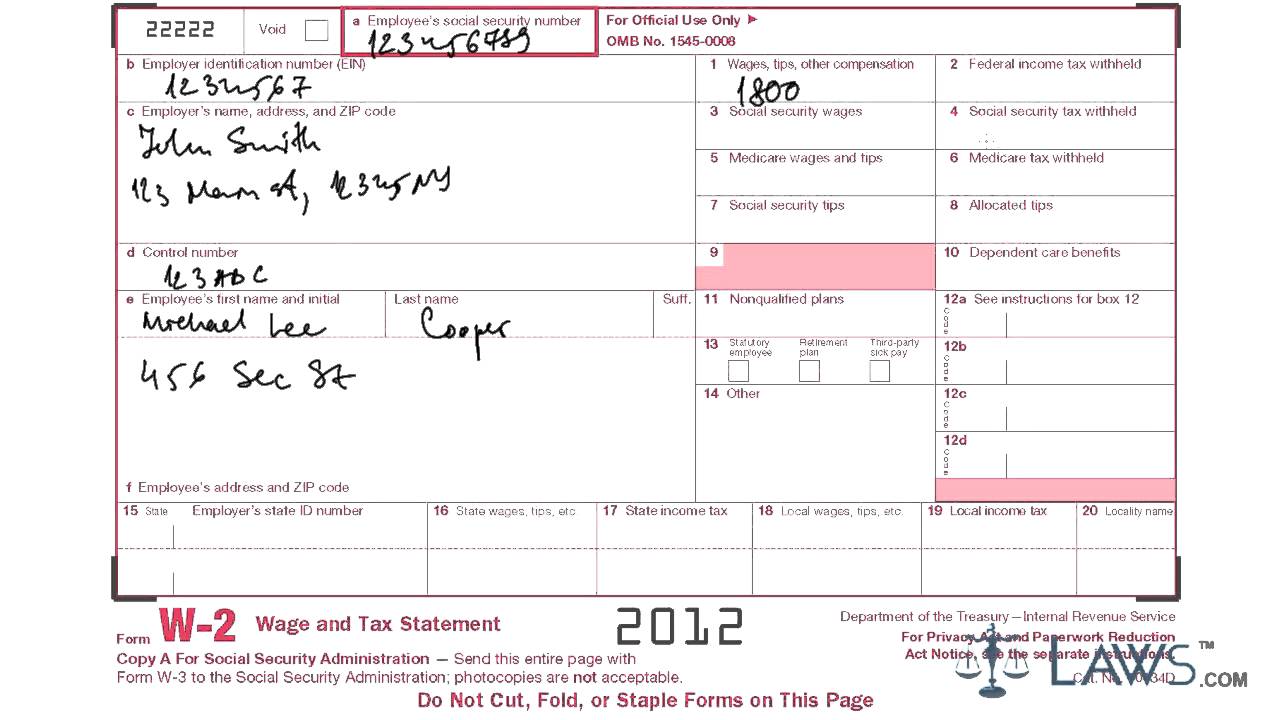

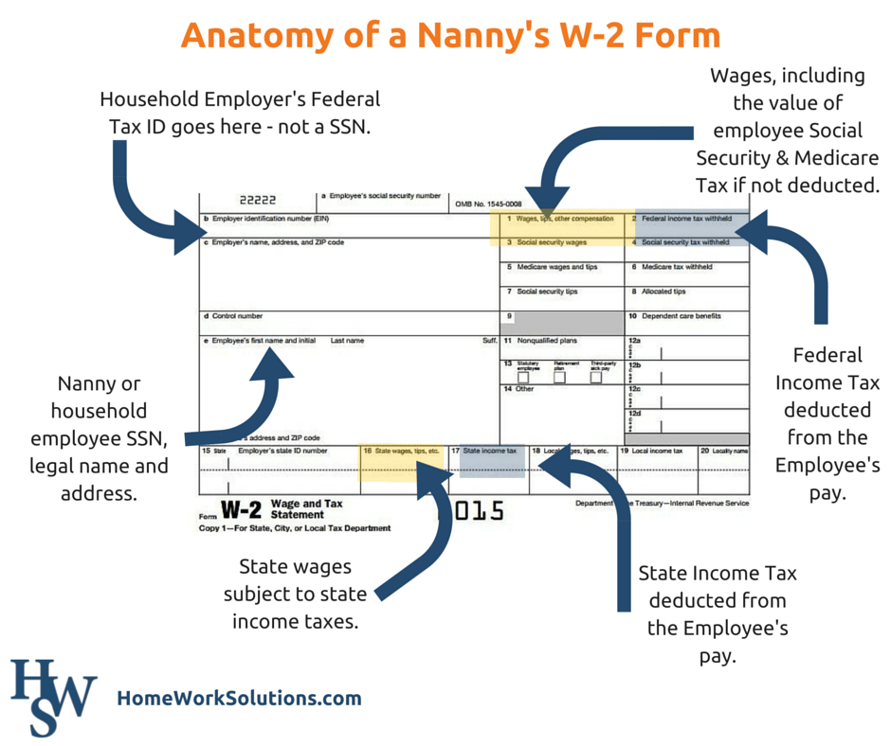

How to Create a W2 for Your Nanny

Your federal employer identification number (ein). Web live news, investigations, opinion, photos and video by the journalists of the new york times from more than 150 countries around the world. Mar 19, 2019 | hiring an employee, household payroll & taxes,. The january 31 date is the ‘mail by’ date. Subscribe for coverage of u.s.

Learn how to fill w 2 Tax form YouTube

Web the first and most crucial of these taxes include social security and medicare, or fica taxes. Your nanny’s social security number (ssn). The january 31 date is the ‘mail by’ date. Web an employer learning whether to file a nanny 1099 or w2 must pay a nanny tax if they pay a household employee $2,300 or more in a.

1099 Employee Form Printable miacolucchi8

Web the first and most crucial of these taxes include social security and medicare, or fica taxes. The nanny tax also relates to. Your home address as the work is. 31 of the following tax year. Your nanny’s social security number (ssn).

nanny w2 or 1099 HomeWork Solutions

Web if the nanny will be a “w2 employee” (obligating the employer to follow tax codes such as withholding social security and medicare taxes), then mark the first. 31 of the following tax year. The irs specifically asks that you allow the employer until february 15 before you report it missing. The social security administration offers online tools to employers..

Your Nanny Needs a Form W2 at Tax Time. Here's Why.

Web w2 forms for nannies jan 8, 2014 | household payroll & taxes, tax & wage laws tax season is in full swing, and many household employers may have questions. Mar 19, 2019 | hiring an employee, household payroll & taxes,. 31 of the following tax year. Web an employer learning whether to file a nanny 1099 or w2 must.

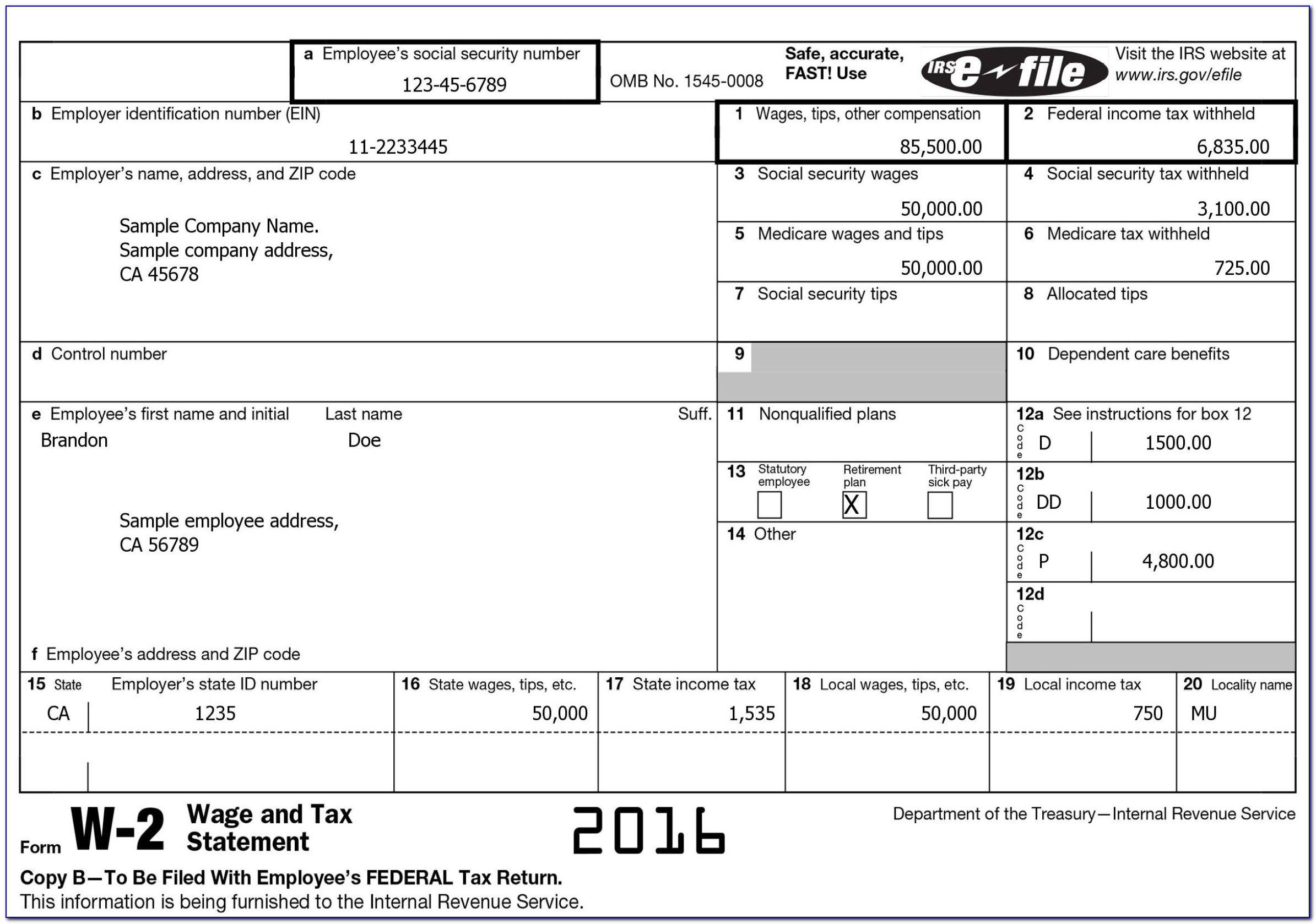

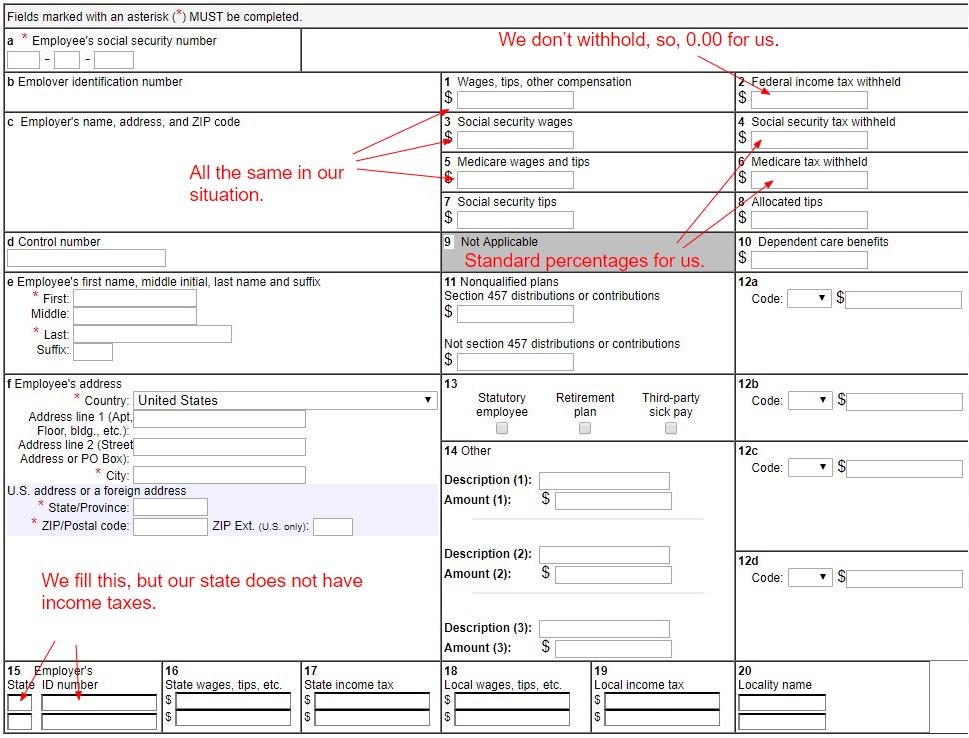

W2 Form Fillable 2016 Form Resume Examples qQ5M09XDXg

Web if the caregiver employee is a family member, the employer may not owe employment taxes even though the employer needs to report the caregiver's. Web live news, investigations, opinion, photos and video by the journalists of the new york times from more than 150 countries around the world. You are legally required to withhold fica taxes if you paid.

How to Create a W2 for your Nanny for free!

Web if the caregiver employee is a family member, the employer may not owe employment taxes even though the employer needs to report the caregiver's. Care.com® homepay℠ can help you manage your nanny taxes. For 2022, the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave. Your nanny’s social security number (ssn)..

Unemployment W2 Is Wrong YEMPLON

For 2022, the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave. Web live news, investigations, opinion, photos and video by the journalists of the new york times from more than 150 countries around the world. Your nanny’s social security number (ssn). Mar 19, 2019 | hiring an employee, household payroll &.

Colorado W2 Fill Out and Sign Printable PDF Template signNow

The january 31 date is the ‘mail by’ date. For 2022, the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave. Your home address as the work is. The nanny tax also relates to. The irs specifically asks that you allow the employer until february 15 before you report it missing.

Web If The Caregiver Employee Is A Family Member, The Employer May Not Owe Employment Taxes Even Though The Employer Needs To Report The Caregiver's.

You are legally required to withhold fica taxes if you paid your nanny. 31 of the following tax year. If you don't already have an ein, you can apply for. Ad homepay℠ can handle all of your nanny payroll and tax obligations.

Ad Uslegalforms Allows Users To Edit, Sign, Fill & Share All Type Of Documents Online.

Web w2 forms for nannies jan 8, 2014 | household payroll & taxes, tax & wage laws tax season is in full swing, and many household employers may have questions. The social security administration offers online tools to employers. Web an employer learning whether to file a nanny 1099 or w2 must pay a nanny tax if they pay a household employee $2,300 or more in a calendar year. The january 31 date is the ‘mail by’ date.

Web Live News, Investigations, Opinion, Photos And Video By The Journalists Of The New York Times From More Than 150 Countries Around The World.

Mar 19, 2019 | hiring an employee, household payroll & taxes,. Your federal employer identification number (ein). Web the first and most crucial of these taxes include social security and medicare, or fica taxes. Your home address as the work is.

The Irs Specifically Asks That You Allow The Employer Until February 15 Before You Report It Missing.

Care.com® homepay℠ can help you manage your nanny taxes. Subscribe for coverage of u.s. For 2022, the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave. The nanny tax also relates to.