W8Ben Supplement Form

W8Ben Supplement Form - For general information and the purpose of. Web start on editing, signing and sharing your supplement to form w 8ben citibank online under the guide of these easy steps: Save or instantly send your ready documents. Citizens to certify their foreign status, and if applicable, claim a reduced tax rate or an exemption from tax. Finding a authorized specialist, making an appointment and coming to the workplace for a personal conference makes finishing a supplement. Web follow the simple instructions below: Ad access irs tax forms. Web form 8833 if the amount subject to withholding received during a calendar year exceeds, in the aggregate, $500,000. Certify foreign status for tax withholding purposes (nonresident aliens only). October 2021) to allow an nqi that is to provide alternative withholding statements and beneficial owner withholding.

Ad access irs tax forms. Also includes internal revenue service (irs) instructions for completing. For general information and the purpose of. Under penalties of perjury, i declare that i have examined the. Certify foreign status for tax withholding purposes (nonresident aliens only). Citizenship or residency, but have worked in the u.s. Ad get ready for tax season deadlines by completing any required tax forms today. Try it for free now! Web follow the simple instructions below: Finding a authorized specialist, making an appointment and coming to the workplace for a personal conference makes finishing a supplement.

Easily fill out pdf blank, edit, and sign them. Ad get ready for tax season deadlines by completing any required tax forms today. October 2021) to allow an nqi that is to provide alternative withholding statements and beneficial owner withholding. Edit your supplement to form w 8ben online type text, add images, blackout confidential details, add comments, highlights and more. Click on the get form or get form now button on. Certify foreign status for tax withholding purposes (nonresident aliens only). Web certificate of foreign status of beneficial owner for united states tax withholding. Web form 8833 if the amount subject to withholding received during a calendar year exceeds, in the aggregate, $500,000. Complete, edit or print tax forms instantly. Finding a authorized specialist, making an appointment and coming to the workplace for a personal conference makes finishing a supplement.

What Is W8ben Form In Upwork Koman's Template

Web form 8833 if the amount subject to withholding received during a calendar year exceeds, in the aggregate, $500,000. Name (as shown on line 1 of. For general information and the purpose of. Also includes internal revenue service (irs) instructions for completing. Easily fill out pdf blank, edit, and sign them.

W8BEN Form Instructions for Canadians Cansumer

Ad access irs tax forms. Upload, modify or create forms. Try it for free now! Ad get ready for tax season deadlines by completing any required tax forms today. Also includes internal revenue service (irs) instructions for completing.

W8BEN Form Instructions for Canadians Cansumer

Try it for free now! Web follow the simple instructions below: Also includes internal revenue service (irs) instructions for completing. October 2021) to allow an nqi that is to provide alternative withholding statements and beneficial owner withholding. Ad access irs tax forms.

Affidavit Of Unchanged Status Citibank Fill Online, Printable

Click on the get form or get form now button on. Ad access irs tax forms. For general information and the purpose of. Citizens to certify their foreign status, and if applicable, claim a reduced tax rate or an exemption from tax. Save or instantly send your ready documents.

How to Complete W8BEN Form YouTube

Web form 8833 if the amount subject to withholding received during a calendar year exceeds, in the aggregate, $500,000. Save or instantly send your ready documents. Upload, modify or create forms. Edit your supplement to form w 8ben online type text, add images, blackout confidential details, add comments, highlights and more. Ad get ready for tax season deadlines by completing.

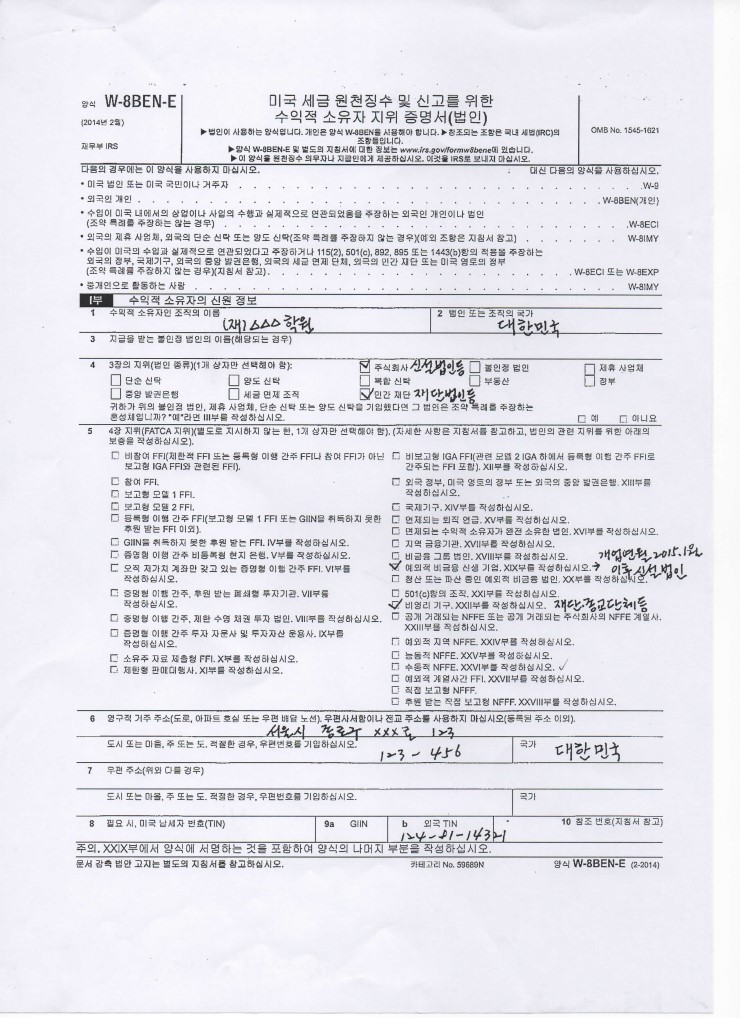

Thoughts on Form W8BENE for companies selling software licenses

Complete, edit or print tax forms instantly. Web certificate of foreign status of beneficial owner for united states tax withholding. Ad access irs tax forms. Under penalties of perjury, i declare that i have examined the. Click on the get form or get form now button on.

미국 기관에서 커미션 등 송금 받기 위해 제출 해야 하는 증빙서류 (W8BENE) 네이버 블로그

October 2021) to allow an nqi that is to provide alternative withholding statements and beneficial owner withholding. Click on the get form or get form now button on. Sign it in a few clicks draw. Web follow the simple instructions below: Try it for free now!

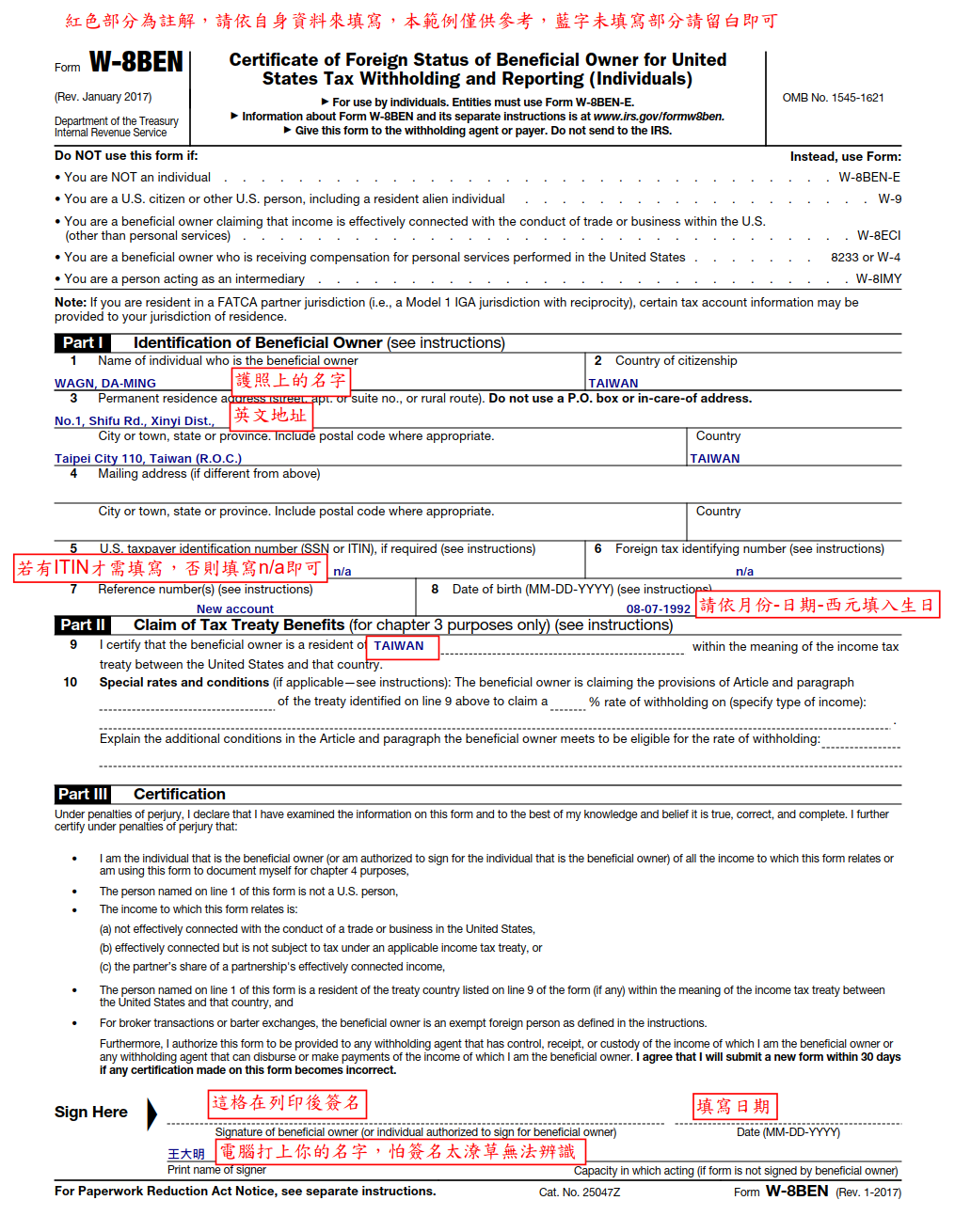

美國券商開戶 Form W8BEN 填寫教學懶人包 (20160709 更新) HC愛筆記 財經部落格

Easily fill out pdf blank, edit, and sign them. Also includes internal revenue service (irs) instructions for completing. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

美國券商開戶 Form W8BEN 填寫教學(How to fill out Form W8BEN) 伊格財經酒吧

Web certificate of foreign status of beneficial owner for united states tax withholding. Give this form to thewithholding agent or payer. Edit your supplement to form w 8ben online type text, add images, blackout confidential details, add comments, highlights and more. Under penalties of perjury, i declare that i have examined the. October 2021) to allow an nqi that is.

Try It For Free Now!

Also includes internal revenue service (irs) instructions for completing. Name (as shown on line 1 of. Sign it in a few clicks draw. Ad get ready for tax season deadlines by completing any required tax forms today.

Complete, Edit Or Print Tax Forms Instantly.

For general information and the purpose of. Citizens to certify their foreign status, and if applicable, claim a reduced tax rate or an exemption from tax. Complete, edit or print tax forms instantly. Finding a authorized specialist, making an appointment and coming to the workplace for a personal conference makes finishing a supplement.

Web Form 8833 If The Amount Subject To Withholding Received During A Calendar Year Exceeds, In The Aggregate, $500,000.

Edit your supplement to form w 8ben online type text, add images, blackout confidential details, add comments, highlights and more. Upload, modify or create forms. Web certificate of foreign status of beneficial owner for united states tax withholding. Failure to do so could result in 30%.

Ad Access Irs Tax Forms.

October 2021) to allow an nqi that is to provide alternative withholding statements and beneficial owner withholding. Give this form to thewithholding agent or payer. Save or instantly send your ready documents. Certify foreign status for tax withholding purposes (nonresident aliens only).