W9 Form Maryland

W9 Form Maryland - It’s an essential document that you’ll need to keep on file and possibly submit every year. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or transfer. Web a w9 form is used to request your taxpayer identification number (tin) for tax reporting functions. Forms are available for downloading in the employer withholding forms section below. Individual tax return form 1040 instructions; Person (including a resident alien), to provide your correct tin. Web business income tax employer withholding 2022 withholding forms 2022 employer withholding forms instruction booklets note: Maryland return of income tax withholding for nonresident sale of real property. The maryland w9 form 2023 can be found on the irs website, and it is. Web popular forms & instructions;

Maryland return of income tax withholding for nonresident sale of real property. The instruction booklets listed here do not include forms. Web a w9 form is used to request your taxpayer identification number (tin) for tax reporting functions. Web business income tax employer withholding 2022 withholding forms 2022 employer withholding forms instruction booklets note: What is backup withholding, later. Forms are available for downloading in the employer withholding forms section below. Individual tax return form 1040 instructions; It’s an essential document that you’ll need to keep on file and possibly submit every year. The maryland w9 form 2023 can be found on the irs website, and it is. Person (including a resident alien), to provide your correct tin.

Forms are available for downloading in the employer withholding forms section below. Web a w9 form is used to request your taxpayer identification number (tin) for tax reporting functions. The maryland w9 form 2023 can be found on the irs website, and it is. It’s an essential document that you’ll need to keep on file and possibly submit every year. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or transfer. What is backup withholding, later. Web popular forms & instructions; Individual tax return form 1040 instructions; Maryland return of income tax withholding for nonresident sale of real property. Person (including a resident alien), to provide your correct tin.

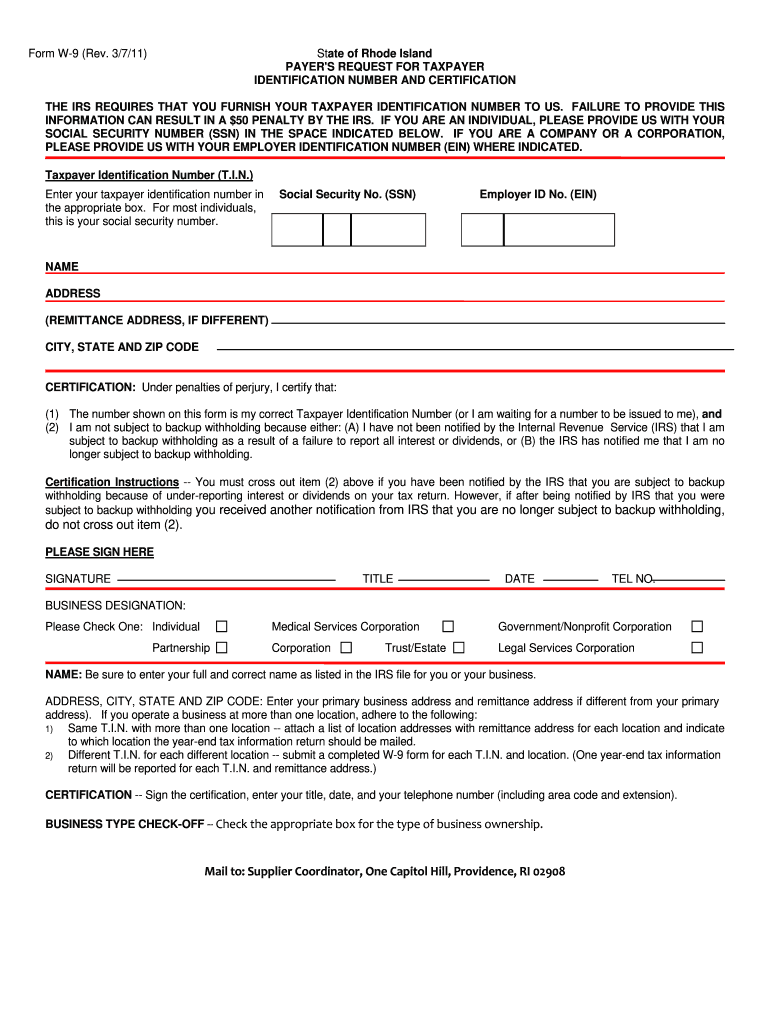

W9 Form Ri Fill Online, Printable, Fillable, Blank pdfFiller

Individual tax return form 1040 instructions; The instruction booklets listed here do not include forms. Web popular forms & instructions; Maryland return of income tax withholding for nonresident sale of real property. What is backup withholding, later.

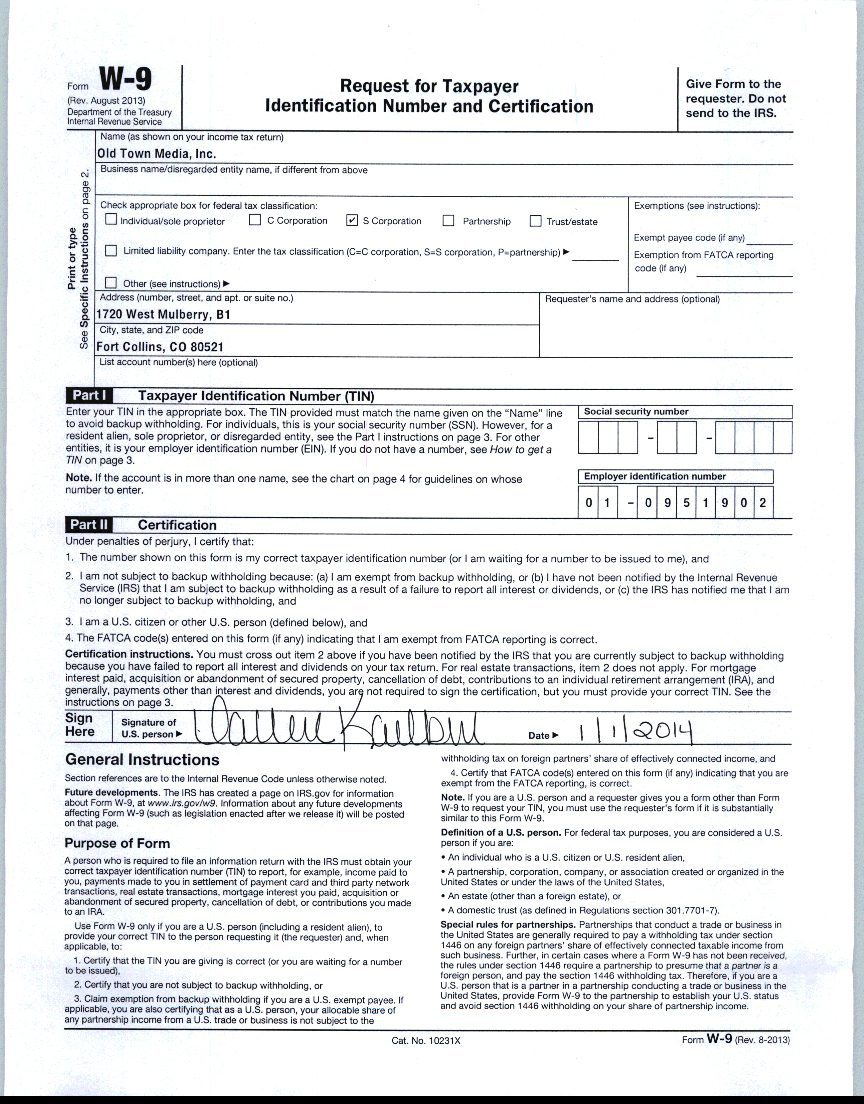

form w9 DriverLayer Search Engine

It’s an essential document that you’ll need to keep on file and possibly submit every year. Forms are available for downloading in the employer withholding forms section below. What is backup withholding, later. Person (including a resident alien), to provide your correct tin. Web popular forms & instructions;

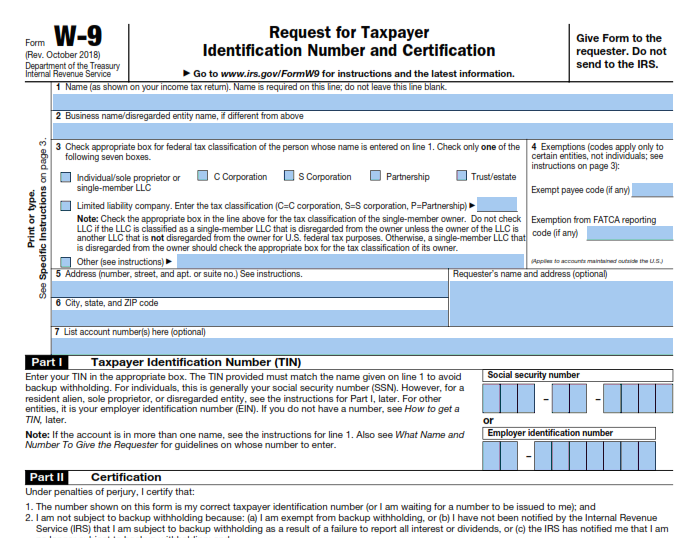

Blank W9 Form Fill Online, Printable, Fillable, Blank with regard to

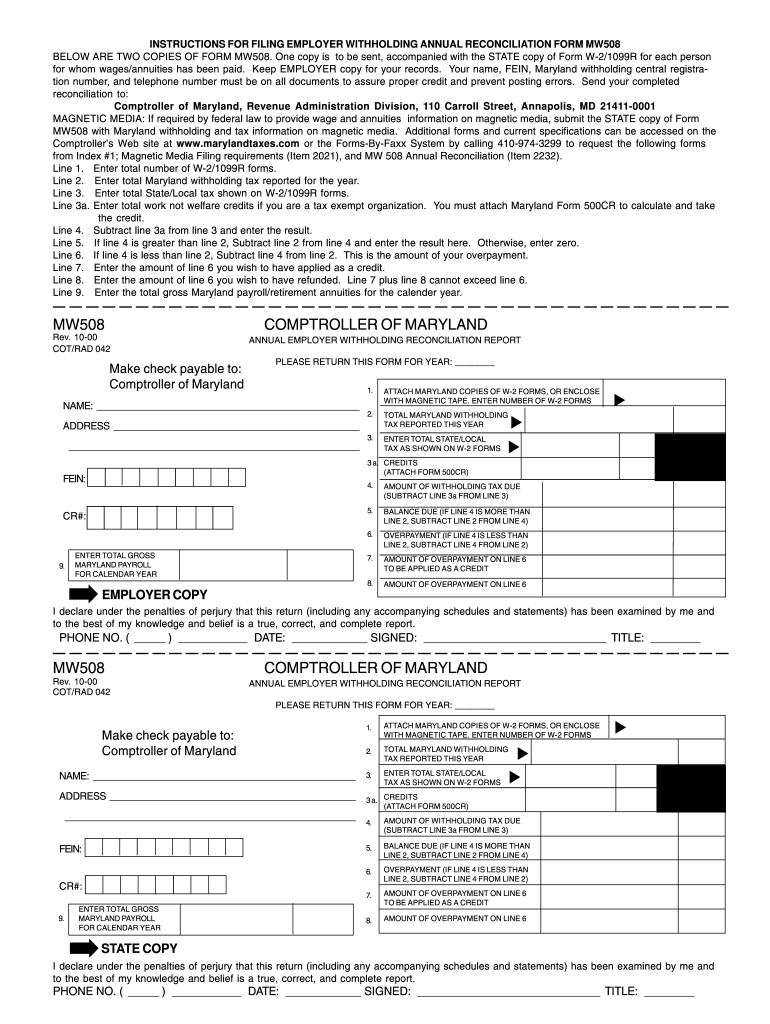

Web business income tax employer withholding 2022 withholding forms 2022 employer withholding forms instruction booklets note: The maryland w9 form 2023 can be found on the irs website, and it is. Web popular forms & instructions; Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and.

W9 Form Maryland Here’s Why You Should Attend W9 Form Maryland AH

Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or transfer. The maryland w9 form 2023 can be found on the irs website, and it is. Maryland return of income tax withholding for nonresident sale.

IRS W9 Form BBX Operating, LLC

Individual tax return form 1040 instructions; Person (including a resident alien), to provide your correct tin. The instruction booklets listed here do not include forms. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or.

Form For W9 Fill Online, Printable, Fillable, Blank pdfFiller

Web popular forms & instructions; What is backup withholding, later. The instruction booklets listed here do not include forms. The maryland w9 form 2023 can be found on the irs website, and it is. It’s an essential document that you’ll need to keep on file and possibly submit every year.

Free Fillable W9 Form W9 Invoice Template Attending W11 pertaining to

Forms are available for downloading in the employer withholding forms section below. The instruction booklets listed here do not include forms. The maryland w9 form 2023 can be found on the irs website, and it is. It’s an essential document that you’ll need to keep on file and possibly submit every year. What is backup withholding, later.

Maryland Rental Application Free Download

Web a w9 form is used to request your taxpayer identification number (tin) for tax reporting functions. Forms are available for downloading in the employer withholding forms section below. What is backup withholding, later. It’s an essential document that you’ll need to keep on file and possibly submit every year. Person (including a resident alien), to provide your correct tin.

Top20 US Tax Forms in 2022 Explained PDF.co

Person (including a resident alien), to provide your correct tin. The maryland w9 form 2023 can be found on the irs website, and it is. Web popular forms & instructions; Individual tax return form 1040 instructions; Maryland return of income tax withholding for nonresident sale of real property.

Downloadable W9 Tax Form How To Fill Out A W9 Form Line W within Irs

Maryland return of income tax withholding for nonresident sale of real property. The maryland w9 form 2023 can be found on the irs website, and it is. Web business income tax employer withholding 2022 withholding forms 2022 employer withholding forms instruction booklets note: What is backup withholding, later. It’s an essential document that you’ll need to keep on file and.

Web Popular Forms & Instructions;

Person (including a resident alien), to provide your correct tin. Individual tax return form 1040 instructions; It’s an essential document that you’ll need to keep on file and possibly submit every year. Web business income tax employer withholding 2022 withholding forms 2022 employer withholding forms instruction booklets note:

Forms Are Available For Downloading In The Employer Withholding Forms Section Below.

The instruction booklets listed here do not include forms. What is backup withholding, later. The maryland w9 form 2023 can be found on the irs website, and it is. Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the time of the sale or transfer.

Maryland Return Of Income Tax Withholding For Nonresident Sale Of Real Property.

Web a w9 form is used to request your taxpayer identification number (tin) for tax reporting functions.