What Is A Fiscal Calendar

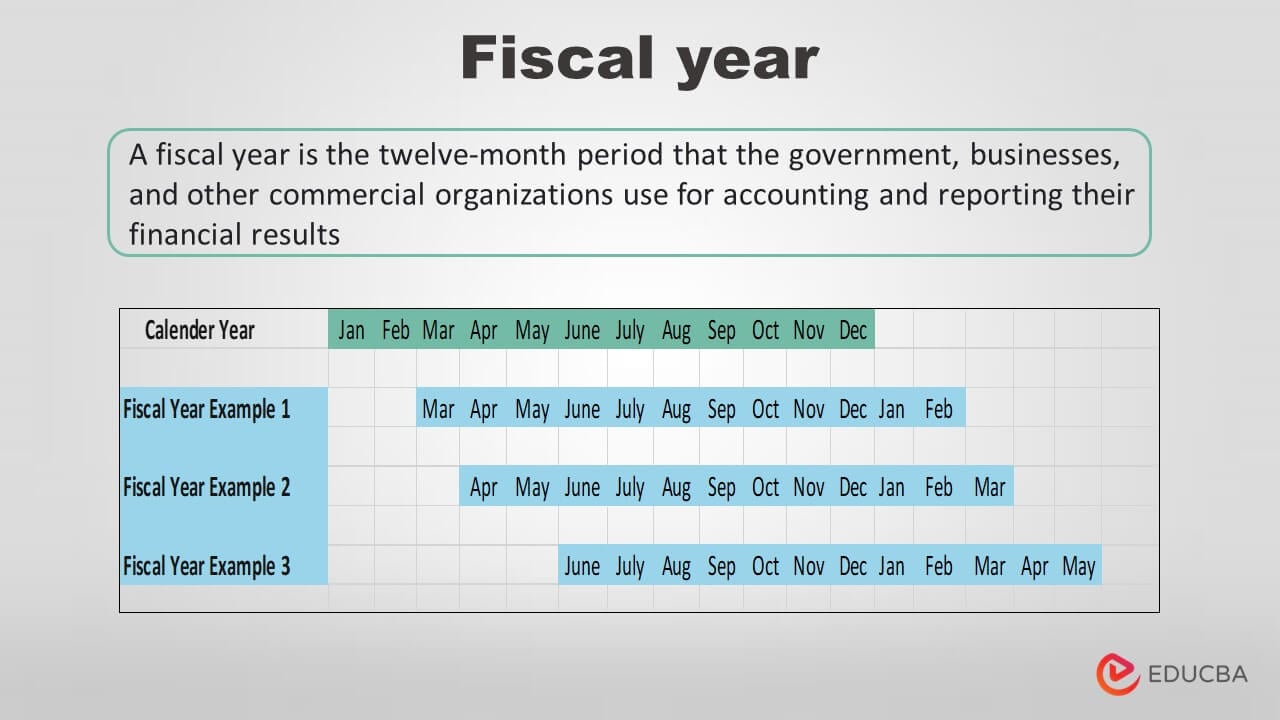

What Is A Fiscal Calendar - Though the length of time is the same, the. Learn when you should use. Web fiscal calendars provide a framework for the financial activity of an organization. Web a fiscal year is an annual timeframe that companies and governments use for financial reporting and budgeting. Also known as a financial year, it’s a span of 12 consecutive months at. A fiscal year, on the other hand, is any. A fiscal year is an accounting period of 365 days (or 366 during a leap year) that doesn’t necessarily correspond to the calendar year. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Web what is a fiscal year? The calendar year represents the most common fiscal year in the business world.

Web the critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the 365th day. Web a company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. Laws in many jurisdictions require company financial reports to be prepared and published on an annual basis but generally with the reporting pe… A fiscal year, on the other hand, is any. It can be any date as long as the fiscal year is. Web what is a fiscal year? Most other countries begin their year at a different calendar quarter—e.g.,. Though the length of time is the same, the. Web fiscal calendars provide a framework for the financial activity of an organization. Web a fiscal year is a period that a company designates as its annual financial reporting period.

Web the irs defines a tax year as “an annual accounting period for keeping records and reporting income and expenses.” most folks understand that part but. It is also used for financial reporting by businesses and other organizations. A fiscal year is an accounting period of 365 days (or 366 during a leap year) that doesn’t necessarily correspond to the calendar year. Web what is a fiscal year? Most other countries begin their year at a different calendar quarter—e.g.,. Web a fiscal year is an annual timeframe that companies and governments use for financial reporting and budgeting. Many businesses may just use the. A fiscal year, on the other hand, is any. Each fiscal calendar contains one or more fiscal years, and each fiscal. Web fiscal calendars provide a framework for the financial activity of an organization.

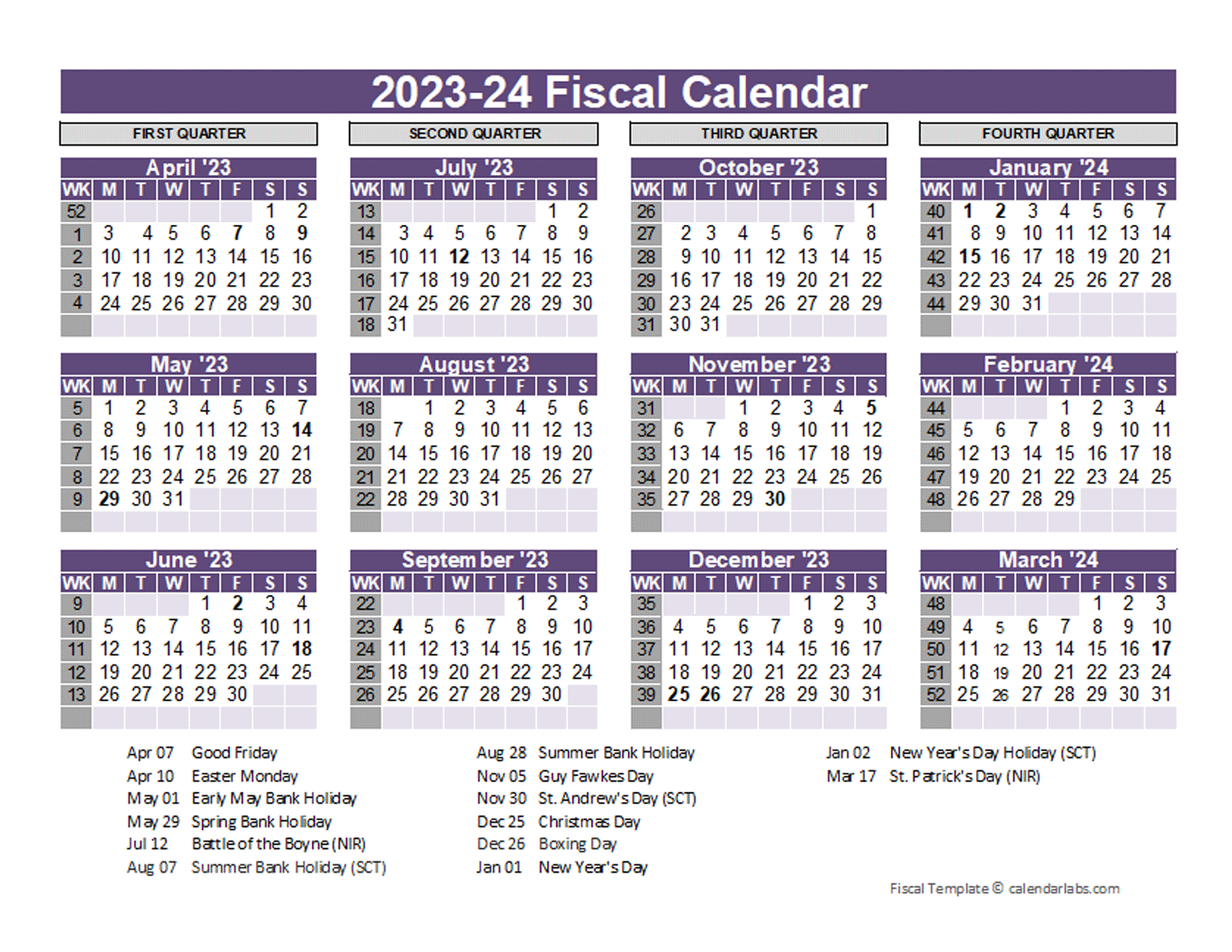

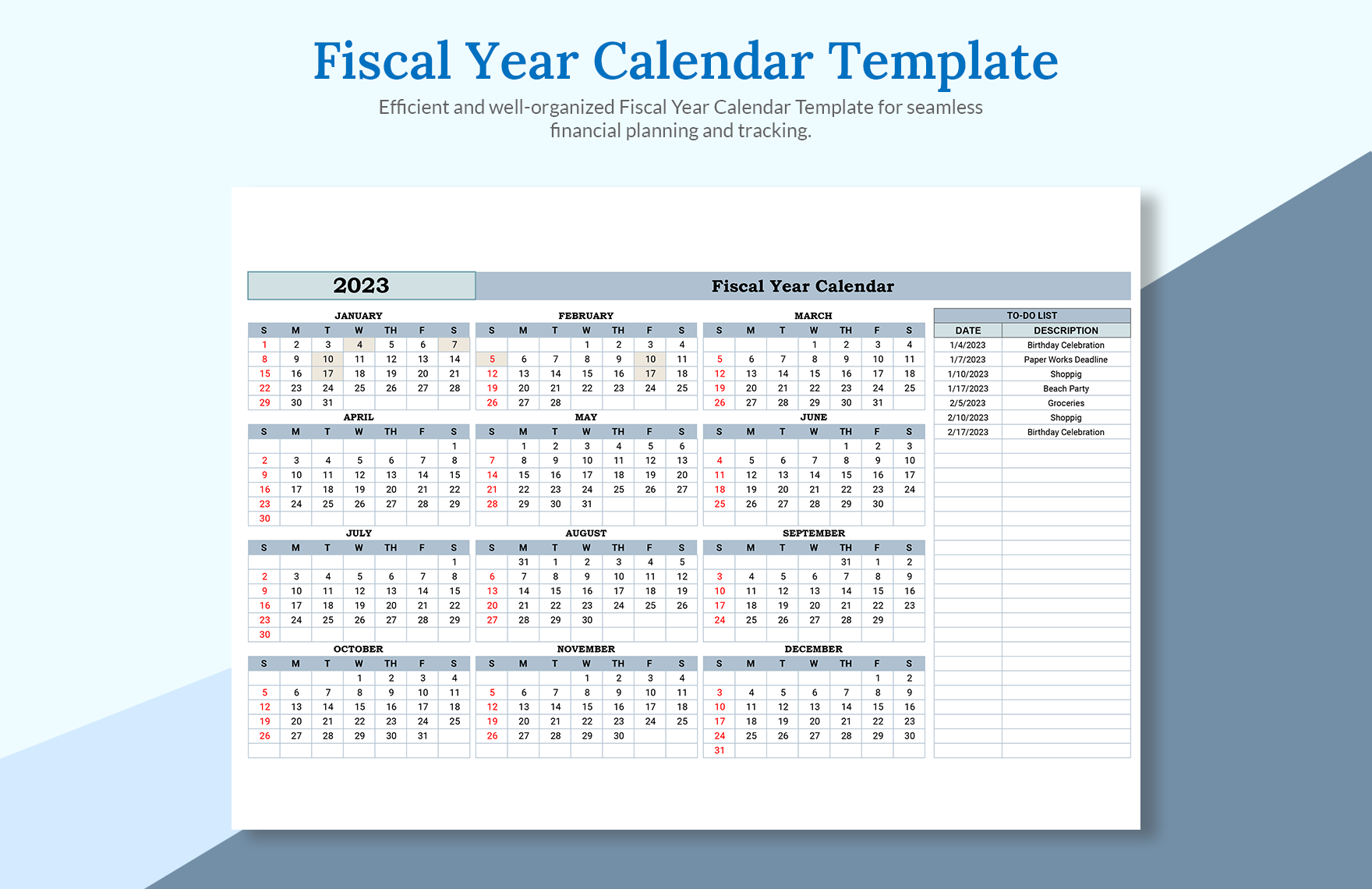

Download Printable Fiscal Year Calendar Template PDF

Web the critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the 365th day. Web a fiscal and a calendar year are two different things. Web the irs defines a tax year as “an annual accounting period for keeping records and reporting income and expenses.” most.

Navigating The Fiscal Landscape Understanding The Government Fiscal

Learn when you should use. The calendar year represents the most common fiscal year in the business world. It can be any date as long as the fiscal year is. Web a company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. A fiscal year, on the other hand,.

What is a Fiscal Year? Your GoTo Guide

Each fiscal calendar contains one or more fiscal years, and each fiscal. Web the critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the 365th day. Web a company that starts its fiscal year on january 1 and ends it on december 31 operates on a.

What Is A Fiscal Year 2024 Rebe Valery

Web a fiscal and a calendar year are two different things. Though the length of time is the same, the. Each fiscal calendar contains one or more fiscal years, and each fiscal. A fiscal year is an accounting period of 365 days (or 366 during a leap year) that doesn’t necessarily correspond to the calendar year. A fiscal year (also.

What is a Fiscal year? Benefits, IRS Guidelines, & Examples

A fiscal year is an accounting period of 365 days (or 366 during a leap year) that doesn’t necessarily correspond to the calendar year. It can be any date as long as the fiscal year is. Web a company that starts its fiscal year on january 1 and ends it on december 31 operates on a calendar year basis. Web.

What is the Difference Between Fiscal Year and Calendar Year

Laws in many jurisdictions require company financial reports to be prepared and published on an annual basis but generally with the reporting pe… Web the irs defines a tax year as “an annual accounting period for keeping records and reporting income and expenses.” most folks understand that part but. Many businesses may just use the. Web a fiscal year is.

Fiscal Year Calendar Template in Excel, Google Sheets Download

Web what is a fiscal year? A fiscal year is an accounting period of 365 days (or 366 during a leap year) that doesn’t necessarily correspond to the calendar year. Each fiscal calendar contains one or more fiscal years, and each fiscal. Learn when you should use. A fiscal year, on the other hand, is any.

FREE 8+ Sample Fiscal Calendar Templates in Excel PDF

Though the length of time is the same, the. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Most other countries begin their year at a different calendar quarter—e.g.,. Many businesses may just use the. Laws in many jurisdictions require company financial reports.

What is the Difference Between Fiscal Year and Calendar Year

It can be any date as long as the fiscal year is. Though the length of time is the same, the. Learn when you should use. Web a fiscal and a calendar year are two different things. A fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and.

Download US Federal Fiscal Calendar 202021 With Notes Excel Template

Many businesses may just use the. The calendar year represents the most common fiscal year in the business world. Each fiscal calendar contains one or more fiscal years, and each fiscal. It is also used for financial reporting by businesses and other organizations. Most other countries begin their year at a different calendar quarter—e.g.,.

Many Businesses May Just Use The.

Though the length of time is the same, the. Web the irs defines a tax year as “an annual accounting period for keeping records and reporting income and expenses.” most folks understand that part but. It can be any date as long as the fiscal year is. Web fiscal calendars provide a framework for the financial activity of an organization.

Web A Company That Starts Its Fiscal Year On January 1 And Ends It On December 31 Operates On A Calendar Year Basis.

It is also used for financial reporting by businesses and other organizations. Web the critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the 365th day. Laws in many jurisdictions require company financial reports to be prepared and published on an annual basis but generally with the reporting pe… A fiscal year (also known as a financial year, or sometimes budget year) is used in government accounting, which varies between countries, and for budget purposes.

Each Fiscal Calendar Contains One Or More Fiscal Years, And Each Fiscal.

The calendar year represents the most common fiscal year in the business world. Web the fiscal year, a period of 12 months ending on the last day of the month, does not line up with the traditional calendar year. Learn when you should use. Here's why businesses opt to.

Also Known As A Financial Year, It’s A Span Of 12 Consecutive Months At.

Most other countries begin their year at a different calendar quarter—e.g.,. Web a fiscal year is an annual timeframe that companies and governments use for financial reporting and budgeting. A fiscal year, on the other hand, is any. A fiscal year is an accounting period of 365 days (or 366 during a leap year) that doesn’t necessarily correspond to the calendar year.