What Is A Schedule 1 Tax Form Fafsa

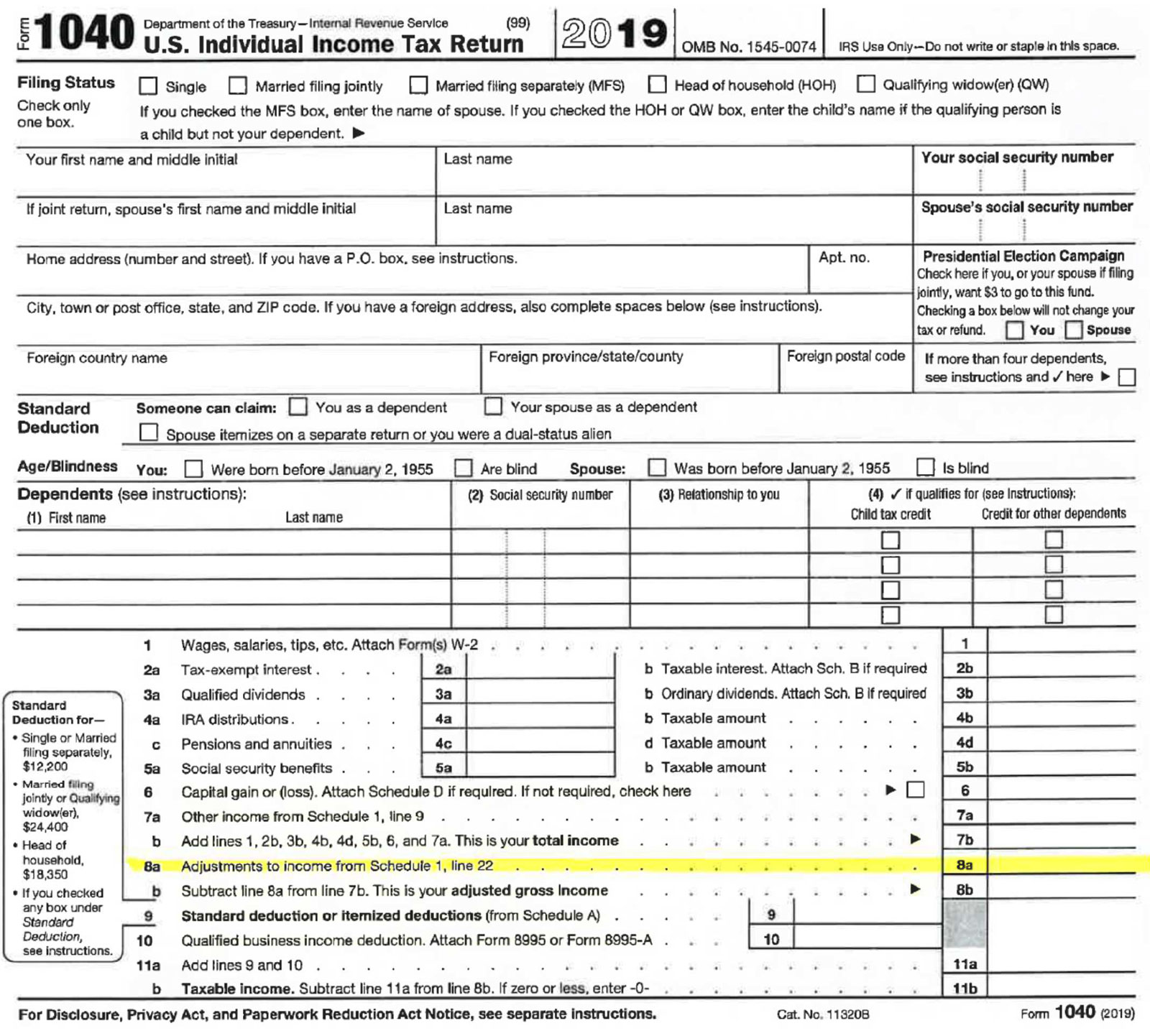

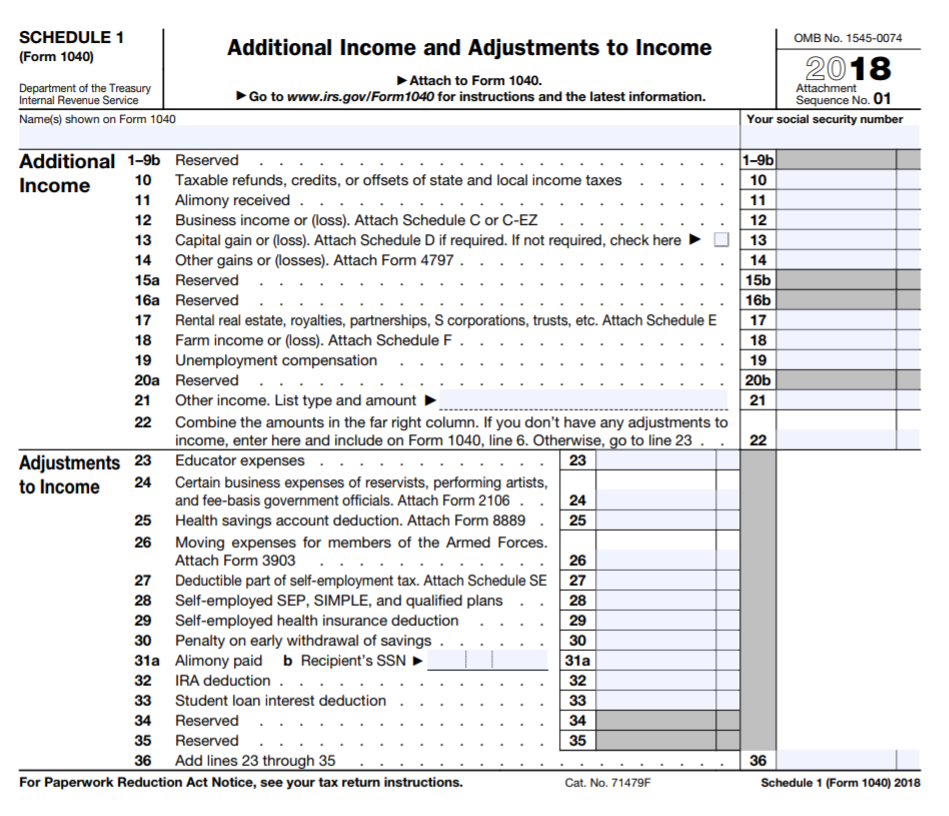

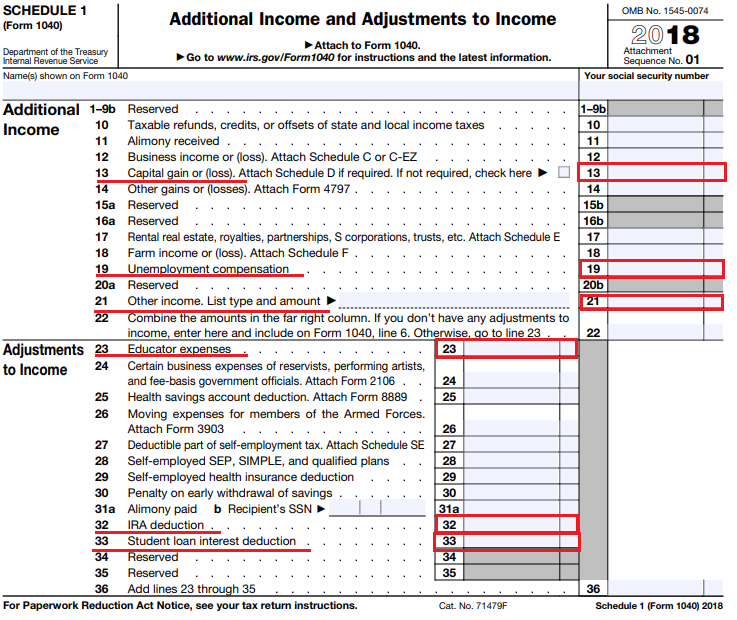

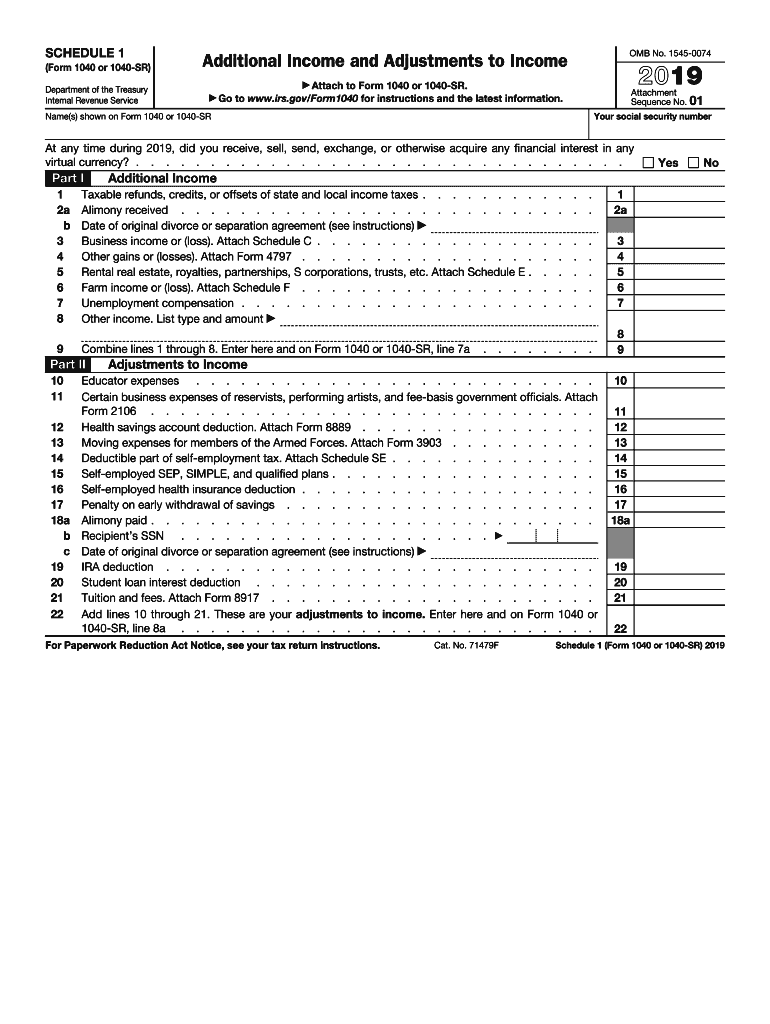

What Is A Schedule 1 Tax Form Fafsa - Schedule 1 schedule 1 contains various types of income and adjustments to income that don’t fit on form 1040 itself. (1) the student and spouse did not file schedule 1 with their irs form 1040, 1 (2). Web mar 8, 2023 3 min read tax forms: Web generally, taxpayers file a schedule 1 to report income or adjustments to income that can't be entered directly on form 1040. Because it’s important to complete the form correctly, this chapter discusses some of the more. This section of the program contains information for part iii of the. It’s easier to complete the fafsa form if you. Your application must be submitted. Web the fafsa form is the first step in the financial aid process. Web the schedule 1 fafsa refers to “additional taxes and adjustments to income” that aren’t directly reported on 2018 form 1040.

While completing your federal income taxes, families will need to file a schedule 1 if they are reporting earnings other than those listed on. Web the fafsa now asks if you filed a schedule 1. Use the amount reported on the fafsa form. It’s easier to complete the fafsa form if you. Generally, taxpayers file a schedule 1 to report income or adjustments to income that can't be entered directly on form 1040. This is a tax form created by congress to report certain adjustments to income and additional taxes paid, and 2018. Web the fafsa form is the first step in the financial aid process. Web schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. This question is used to help determine if you. Web the fafsa on the web worksheet provides a preview of the questions that you may be asked while completing the free application for federal student aid (fafsa ) online at.

The irs schedule 1 form is tax paperwork that is filed with your 1040 form. Web the fafsa form is the first step in the financial aid process. This section of the program contains information for part iii of the. Web * why are they asking this information? Web generally, taxpayers file a schedule 1 to report income or adjustments to income that can't be entered directly on form 1040. This is a tax form created by congress to report certain adjustments to income and additional taxes paid, and 2018. This question is used to help determine if you. Web this is question 82 on the fafsa. Web fafsa, which stands for “free application for federal student aid”, is a form completed by current and prospective college students (undergraduate and graduate) in. Web the fafsa form is the first step in the financial aid process.

Do you need to submit a schedule 1, 2, and 3 along with your 1040 Tax

Because it’s important to complete the form correctly, this chapter discusses some of the more. Because it’s important to complete the form correctly, this chapter discusses some of the more. The student’s parents are required to file a schedule 1 to report income or adjustments to income that cannot be entered directly on the irs 1040. Web the fafsa form.

What Is A Schedule 1 Tax Form? Insurance Noon

1 at the official government site, fafsa.gov. Web schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Who needs to do a schedule 1? Web * why are they asking this information? Web the schedule 1 fafsa refers to “additional taxes and adjustments to.

Understanding the New Tax Forms for Filing 2018 Taxes OTAcademy

Schedule 1 schedule 1 contains various types of income and adjustments to income that don’t fit on form 1040 itself. It’s used to report additional. Because it’s important to complete the form correctly, this chapter discusses some of the more. Generally, taxpayers file a schedule 1 to report income or adjustments to income that can't be entered directly on form.

Did Or Will You File A Schedule 1 With Your 2018 Tax 2021 Tax Forms

Web generally, taxpayers file a schedule 1 to report income or adjustments to income that can't be entered directly on form 1040. Because it’s important to complete the form correctly, this chapter discusses some of the more. Anyone who needs to report income. Web the schedule 1 fafsa refers to “additional taxes and adjustments to income” that aren’t directly reported.

What is the schedule 1 tax form? Quora

Anyone who needs to report income. Web this is question 82 on the fafsa. 1 at the official government site, fafsa.gov. Generally, taxpayers file a schedule 1 to report income or adjustments to income that can't be entered directly on form 1040. Web the schedule 1 fafsa refers to “additional taxes and adjustments to income” that aren’t directly reported on.

What Is A Schedule 1 Tax Form? Insurance Noon

1 at the official government site, fafsa.gov. Web what is a schedule 1 form? Schedule 1 schedule 1 contains various types of income and adjustments to income that don’t fit on form 1040 itself. Fill it out as soon as possible on or after oct. The student’s parents are required to file a schedule 1 to report income or adjustments.

Schedule K1 Tax Form What Is It and Who Needs to Know? mojafarma

Schedule 1 schedule 1 contains various types of income and adjustments to income that don’t fit on form 1040 itself. Web the fafsa on the web worksheet provides a preview of the questions that you may be asked while completing the free application for federal student aid (fafsa ) online at. It’s used to report additional. Web what is a.

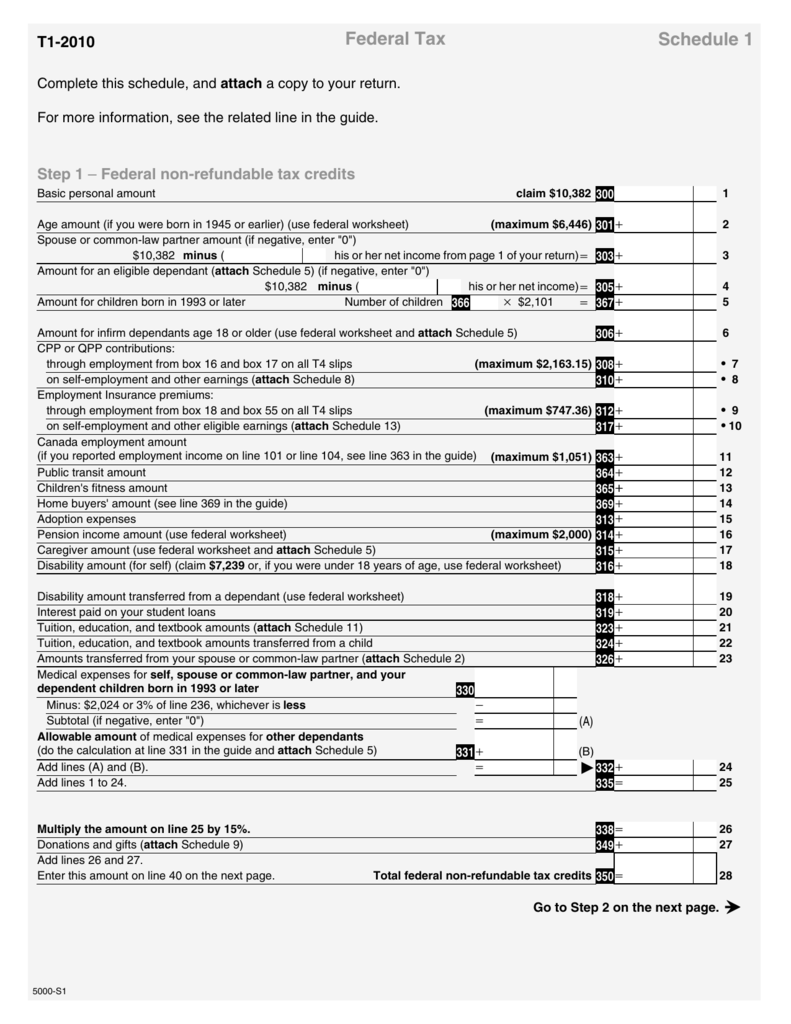

Schedule 1 Federal Tax

Web generally, taxpayers file a schedule 1 to report income or adjustments to income that can't be entered directly on form 1040. Anyone who needs to report income. Web mar 8, 2023 3 min read tax forms: It’s used to report additional. See the table to the right for state deadlines.

Schedule K1 Form 1065 Box 16 Codes Armando Friend's Template

Because it’s important to complete the form correctly, this chapter discusses some of the more. Web we recommend that you complete and submit your fafsa form as soon as possible on or after october 1, 2021. 1 at the official government site, fafsa.gov. Web the schedule 1 fafsa refers to “additional taxes and adjustments to income” that aren’t directly reported.

Irs Form 1040 Schedule 1 Download Fillable Pdf Or Fill 1040 Form

Who needs to do a schedule 1? This is a tax form created by congress to report certain adjustments to income and additional taxes paid, and 2018. Web the fafsa form is the first step in the financial aid process. While completing your federal income taxes, families will need to file a schedule 1 if they are reporting earnings other.

Generally, Taxpayers File A Schedule 1 To Report Income Or Adjustments To Income That Can't Be Entered Directly On Form 1040.

Web this is question 82 on the fafsa. Anyone who needs to report income. Fill it out as soon as possible on or after oct. You can do this by.

This Is A Tax Form Created By Congress To Report Certain Adjustments To Income And Additional Taxes Paid, And 2018.

It’s easier to complete the fafsa form if you. Use the amount reported on the fafsa form. Who needs to do a schedule 1? Your application must be submitted.

While Completing Your Federal Income Taxes, Families Will Need To File A Schedule 1 If They Are Reporting Earnings Other Than Those Listed On.

Web the fafsa now asks if you filed a schedule 1. See the table to the right for state deadlines. (1) the student and spouse did not file schedule 1 with their irs form 1040, 1 (2). 1 at the official government site, fafsa.gov.

Web The Schedule 1 Fafsa Refers To “Additional Taxes And Adjustments To Income” That Aren’t Directly Reported On 2018 Form 1040.

This section of the program contains information for part iii of the. Web what is a schedule 1 form? Web what is a schedule 1? Web * why are they asking this information?