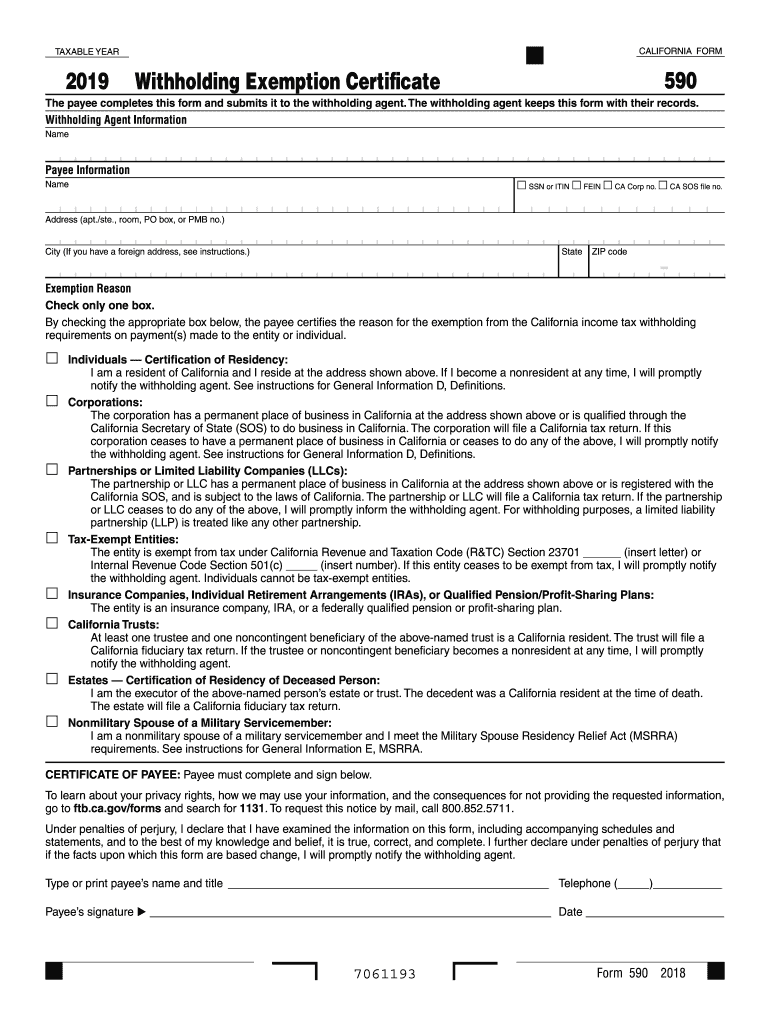

What Is California Form 590 Used For

What Is California Form 590 Used For - Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a. Web use form 590, withholding exemption certificate. Web use form 590 to certify an exemption fromnonresident withholding. References in these instructions are to the california revenue and taxation. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. The payee is a corporation, partnership, or limited liability company (llc) that has a permanent place of business in california or. Certificate, to certify an exemption from nonresident withholding. Withholding agent information name payee. Web will be used to transport passengers for hire, compensation, or profit. This form is for income earned in tax year 2022,.

The withholding agent keeps this form with their records. Web by checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. We last updated california form 590 in february 2023 from the california franchise tax board. Certificate, to certify an exemption from nonresident withholding. Complete and presentform 590 to the withholding agent. Web will be used to transport passengers for hire, compensation, or profit. This vehicle will not be used to transport property. Wage withholding is administered by the california employment development department (edd). Thewithholding agent will then be relieved of.

The withholding agent keeps this form with their records. Form 590 does not apply to payments of backup withholding. Web use form 590 to certify an exemption fromnonresident withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. This vehicle will not be used to transport property. Complete and presentform 590 to the withholding agent. Web by checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the. References in these instructions are to the california revenue and taxation. Web use form 590, withholding exemption certificate.

Ca590 Fill Out and Sign Printable PDF Template signNow

Web form 590 does not apply to payments for wages to employees. The withholding agent keeps this form with their records. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. Web withholding exemption certificate (form 590) submit form 590 to your withholding agent; Form.

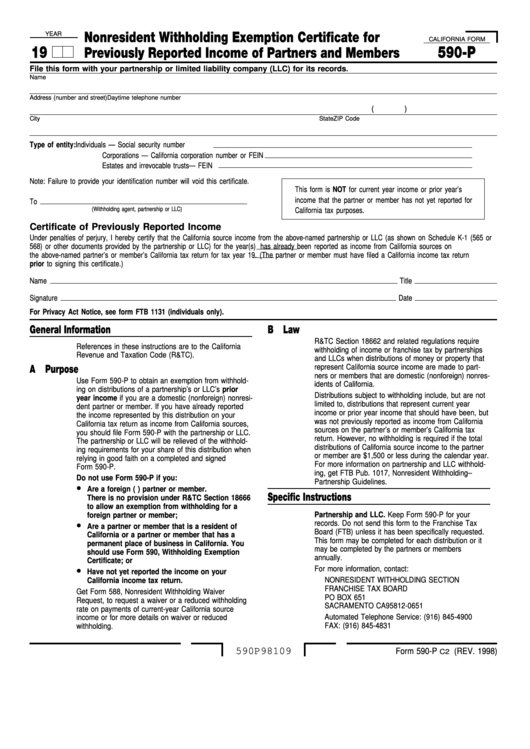

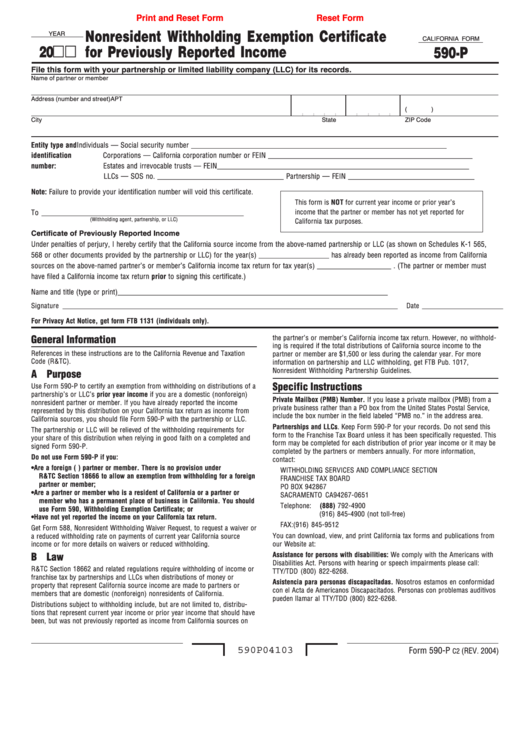

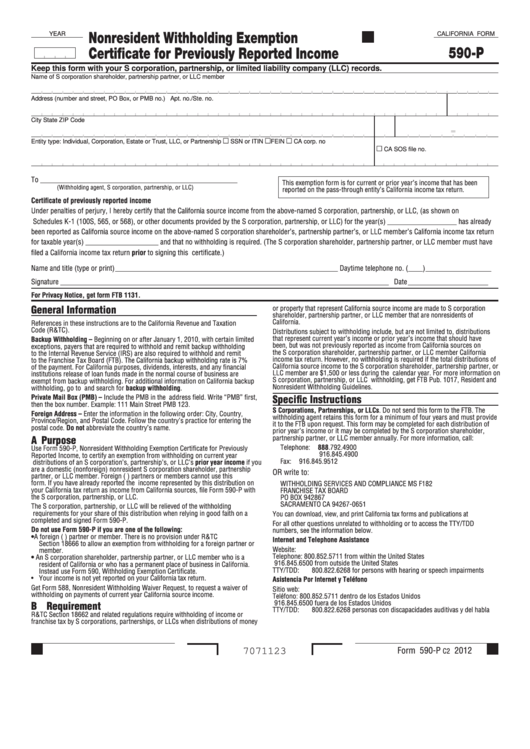

Fillable California Form 590P Nonresident Witholding Exemption

Web form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption. Form 590 does not apply to payments of backup withholding. This form is for income earned in tax year 2022,. Thewithholding agent will then be relieved of. Form 590 does not apply to payments of backup withholding.

California Form 587 2019 Fillable Fill Online, Printable, Fillable

The withholding agent keeps this form with their records. Web withholding exemption certificate (form 590) submit form 590 to your withholding agent; Form 590 does not apply to payments of backup withholding. Use this form to certify exemption from withholding; Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding.

2010 Form USCIS I590 Fill Online, Printable, Fillable, Blank pdfFiller

Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. References in these instructions are to the california revenue and taxation. This form is for income earned in tax year 2022,. Web form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption. Web form 590 does not apply to.

2016 Form 590 Withholding Exemption Certificate Edit, Fill, Sign

Certificate, to certify an exemption from nonresident withholding. Complete and presentform 590 to the withholding agent. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. We last updated california form 590 in february 2023 from the california franchise tax board. Web use form 590 to certify an exemption fromnonresident withholding.

Hot 10+ California Franchise Tax Board, Model Dresses Paling Dicari!

California residents or entities should complete and present. Web by checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the. Web withholding exemption certificate (form 590) submit form 590 to your withholding agent; Web use form 590, withholding exemption certificate. The withholding agent keeps this.

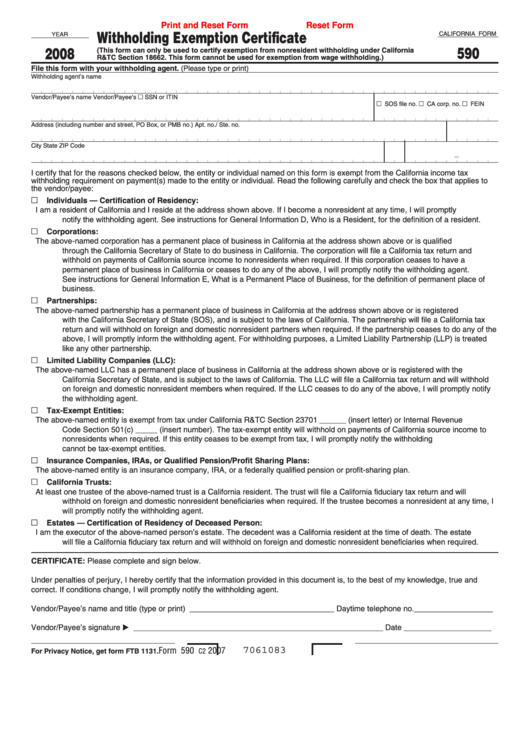

Fillable California Form 590 Withholding Exemption Certificate 2008

Wage withholding is administered by the california employment development department (edd). Web will be used to transport passengers for hire, compensation, or profit. Complete and presentform 590 to the withholding agent. We last updated california form 590 in february 2023 from the california franchise tax board. Thewithholding agent will then be relieved of.

Vintage ProForm 590 Space Saver Treadmill

Wage withholding is administered by the california employment development department (edd). Web will be used to transport passengers for hire, compensation, or profit. Form 590 does not apply to payments of backup withholding. Web 590 the payee completes this form and submits it to the withholding agent. References in these instructions are to the california revenue and taxation.

Fillable California Form 590P Nonresident Withholding Exemption

Thewithholding agent will then be relieved of. Web use form 590, withholding exemption certificate. Web withholding exemption certificate (form 590) submit form 590 to your withholding agent; This vehicle will not be used to transport property. Use this form to certify exemption from withholding;

Fillable California Form 590P Nonresident Withholding Exemption

We last updated california form 590 in february 2023 from the california franchise tax board. Wage withholding is administered by the california employment development department (edd). Web use form 590, withholding exemption certificate. Withholding agent information name payee. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding.

Web By Checking The Appropriate Box Below, The Payee Certifies The Reason For The Exemption From The California Income Tax Withholding Requirements On Payment(S) Made To The.

Web use form 590, withholding exemption. Web use form 590 to certify an exemption fromnonresident withholding. *this form is not required for taxicabs if the vehicle is. References in these instructions are to the california revenue and taxation.

Certificate, To Certify An Exemption From Nonresident Withholding.

Wage withholding is administered by the california employment development department (edd). Form 590 does not apply to payments of backup withholding. Web form 590 is a ca withholding exemption certificate that they are providing you so that they do not have to withhold from your payments. This form is for income earned in tax year 2022,.

Web Withholding Exemption Certificate (Form 590) Submit Form 590 To Your Withholding Agent;

Form 590 does not apply to payments of backup withholding. Waived or reduced withholding some payees may. California residents or entities should complete and present. This vehicle will not be used to transport property.

Web Use Form 590, Withholding Exemption Certificate.

Web more about the california form 590. Web form 590, withholding exemption certificate (see related information) should be completed by the payee to certify exemption. Web form 590 does not apply to payments for wages to employees. Web will be used to transport passengers for hire, compensation, or profit.