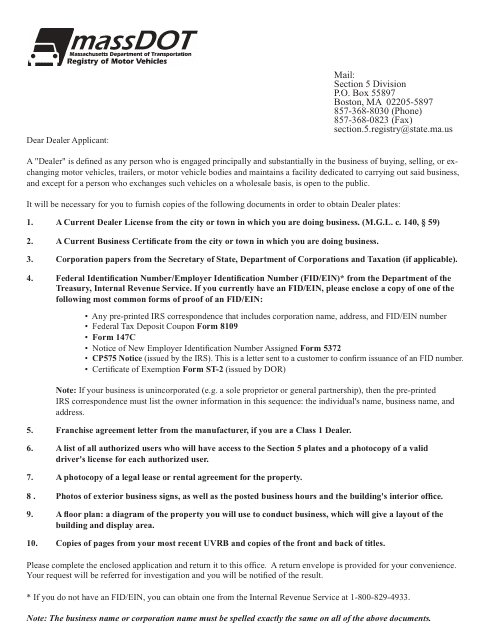

What Is Form 147C

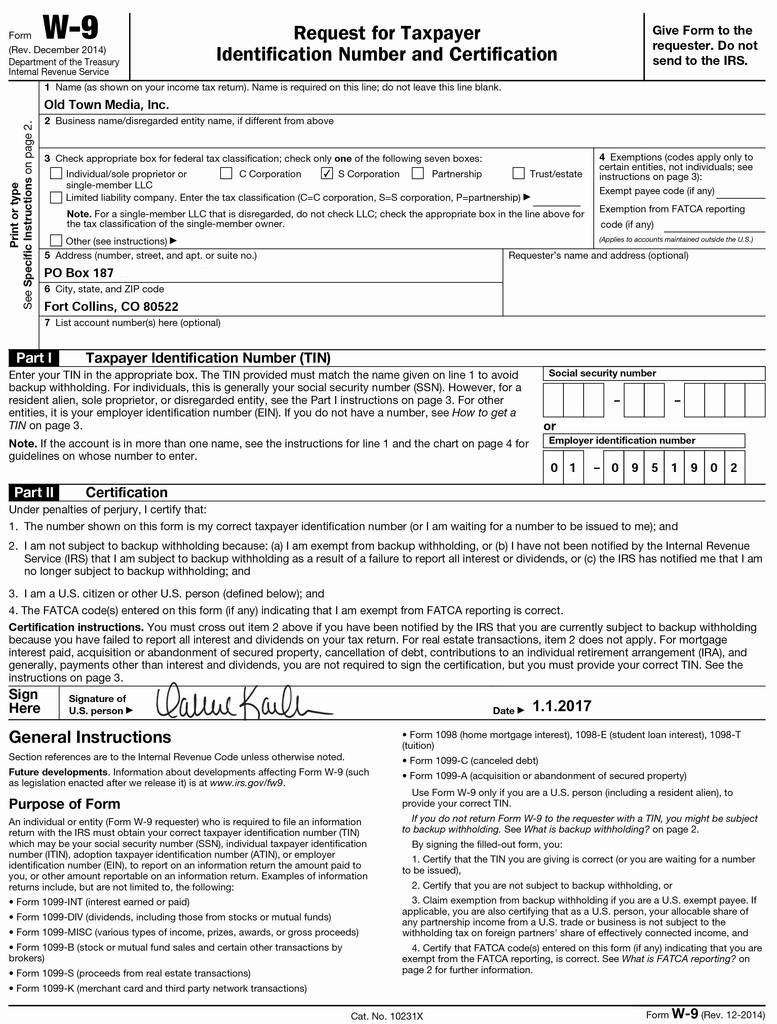

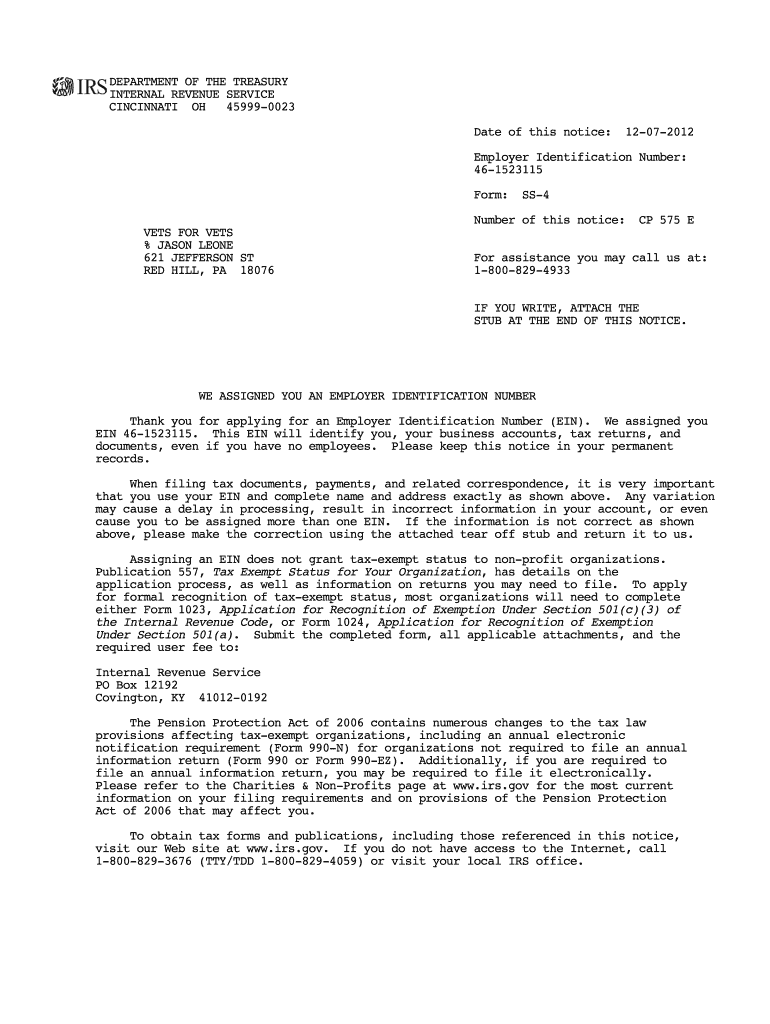

What Is Form 147C - Ein is a unique identification. To request an ein verification letter (147c),. Web an ein verification letter (commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and. Web irs letter 147c is an official form of verification issued by the irs (internal revenue service) that confirms the business or entity’s ein (employer identification. Web when this happens, only you can get your “existing ein” from the irs by asking them for a “147c letter”. The letter requests information about the business’s ein or employer identification number. The letter will confirm the employer name and ein connected with the. The irs letter 147c is sent by individuals to request the irs give them their ein. Web form 147c is not an internal revenue service (irs) form you have to file, nor is it one that you will find in your mailbox unexpectedly. Lost, misplaced or forgot your ein.

Web the 147c letters are documents sent by the irs to businesses. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in. It only provides an existing ein and does not provide a new ein. Ein is a unique identification. Web the 147c letter is one of the most important details you need to know during the ein application and approval process. Web form 147c is a document issued by the internal revenue service (irs) in the united states. The letter requests information about the business’s ein or employer identification number. Learn how to get yours. If you are going to apply for your ein number. The irs letter 147c is sent by individuals to request the irs give them their ein.

It only provides an existing ein and does not provide a new ein. Web the 147c letters are documents sent by the irs to businesses. The irs letter 147c is sent by individuals to request the irs give them their ein. The letter requests information about the business’s ein or employer identification number. Learn how to get yours. Web when setting up an ein as an international founder you should get an ein verification letter (147c). Web irs letter 147c is an official form of verification issued by the irs (internal revenue service) that confirms the business or entity’s ein (employer identification. The main reason people send this letter is they’ve lost their ein, or it is required by a third party. Web an ein verification letter (commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms. Lost, misplaced or forgot your ein.

What is the Invalid TIN or Regulatory Fee on my

The easiest way to request your ein is to call the irs or send them a. Ein is a unique identification. Web an ein verification letter (commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms. Web a 147c letter, also known as an ein verification letter,.

Irs Letter 147c Sample

Web when setting up an ein as an international founder you should get an ein verification letter (147c). Web understanding your cp147 notice what this notice is about after previously notifying you that we couldn't apply the full amount you requested to the following year's. Learn how to get yours. Web the 147c letters are documents sent by the irs.

Getting 147C Online (EIN Designation Confirmation Letter) by Vadym

Ein is a unique identification. Web the 147c letter is one of the most important details you need to know during the ein application and approval process. If you are going to apply for your ein number. Web when setting up an ein as an international founder you should get an ein verification letter (147c). Web when this happens, only.

Free Printable I 9 Forms Example Calendar Printable

Web the 147c letter is one of the most important details you need to know during the ein application and approval process. Learn how to get yours. Web form 147c is not an internal revenue service (irs) form you have to file, nor is it one that you will find in your mailbox unexpectedly. Web a 147c letter, also known.

Irs Form 147c Printable Printable Form, Templates and Letter

Web irs letter 147c is an official form of verification issued by the irs (internal revenue service) that confirms the business or entity’s ein (employer identification. Instead, this is a form that will be sent to you if. Learn how to get yours. Web understanding your cp147 notice what this notice is about after previously notifying you that we couldn't.

IRS FORM 147C PDF

The easiest way to request your ein is to call the irs or send them a. Web when this happens, only you can get your “existing ein” from the irs by asking them for a “147c letter”. Web an ein verification letter (commonly known as a form 147c) is an official document from the internal revenue service that lists your.

147c Letter Irs Sle Bangmuin Image Josh

Web form 147c is a document issued by the internal revenue service (irs) in the united states. The main reason people send this letter is they’ve lost their ein, or it is required by a third party. Web you can only obtain an ein verification letter (147c) by contacting the irs directly for assistance over the phone. Instead, this is.

Irs Letter 147c Ein Previously Assigned

Web what does letter 147c stand for? Web form 147c is not an internal revenue service (irs) form you have to file, nor is it one that you will find in your mailbox unexpectedly. Web when this happens, only you can get your “existing ein” from the irs by asking them for a “147c letter”. Web the 147c letter is.

IRS FORM 147C

Web you can only obtain an ein verification letter (147c) by contacting the irs directly for assistance over the phone. Ein is a unique identification. Lost, misplaced or forgot your ein. The main reason people send this letter is they’ve lost their ein, or it is required by a third party. Web when setting up an ein as an international.

IRS FORM 147C

Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification. Web an ein verification letter (commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms. Web form 147c.

The Easiest Way To Request Your Ein Is To Call The Irs Or Send Them A.

Web the 147c letter is a document that is sent to businesses by the irs. Web follow the steps below to obtain a faxed irs letter (147c) if you are unable to locate the ss‐4 document call the irs at (800) 829‐4933 press “1” for service in. Web an ein verification letter (commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and. Instead, this is a form that will be sent to you if.

Web What Does Letter 147C Stand For?

Web a 147c letter, also known as an ein verification letter, is a form sent to the internal revenue service (irs) by a company to request their employee identification. It is also known as the ein verification letter. The letter requests information about the business’s ein or employer identification number. Web how to obtain a confirmation letter (147c letter) of the employer identification number (ein) if your clergy and/or employees are unable to e‐file their income tax returns because of.

It Only Provides An Existing Ein And Does Not Provide A New Ein.

It is common that most established. Web the 147c letters are documents sent by the irs to businesses. Web when this happens, only you can get your “existing ein” from the irs by asking them for a “147c letter”. Web when setting up an ein as an international founder you should get an ein verification letter (147c).

The Irs Letter 147C Is Sent By Individuals To Request The Irs Give Them Their Ein.

Web you can only obtain an ein verification letter (147c) by contacting the irs directly for assistance over the phone. Learn how to get yours. The company is sent a letter asking for information about its ein or employer identification. The main reason people send this letter is they’ve lost their ein, or it is required by a third party.