What Is Form 2439

What Is Form 2439 - Web on the front of this form has elected under the internal revenue code to keep and pay income tax on certain net capital gain income it received during its tax year. Web to enter the 2439 in the individual module: The 2439 tax form (full title: Web everything you need to know about the internal revenue service (irs) forms required to pay your u.s. From the dispositions section select form 2439.; Turbotax online posted march 25, 2023 6:57 am last. Go to screen 17.1 dispositions (schedule d, 4797, etc.).; Web what is a form 2439? Web the deemed distribution is deemed paid to the stockholders of record as of march 31, 2020. Web form 2439 is an irs form mutual fund companies or other investment managers are required to distribute to shareholders in order to report undistributed long.

Web what is form 2439? Web form 2439 is a form used by the irs to request an extension of time to file a return. Go to screen 17.1 dispositions (schedule d, 4797, etc.).; The form is typically given to shareholders by. From the dispositions section select form 2439.; Use this form to provide shareholders of a regulated investment company. Web the internal revenue service (irs) form 2439 must be given to shareholders by regulated investment companies (rics), mutual funds, exchange. Web level 1 i got a new tax form 2439. Web form 2439 is an irs form mutual fund companies or other investment managers are required to distribute to shareholders in order to report undistributed long. All relevant tax information will be included in internal revenue service.

All relevant tax information will be included in internal revenue service. Use this form to provide shareholders of a regulated investment company. Go to screen 17.1 dispositions (schedule d, 4797, etc.).; What is this, and how do i report the info on my desktop turbo tax return? Web what is form 2439? The 2439 tax form (full title: Turbotax online posted march 25, 2023 6:57 am last. Web form 2439 is an irs form mutual fund companies or other investment managers are required to distribute to shareholders in order to report undistributed long. Web to enter the 2439 in the individual module: The form is typically given to shareholders by.

Form 990T Exempt Organization Business Tax Return (and proxy…

The 2439 tax form (full title: The form is typically given to shareholders by. Web to enter the 2439 in the individual module: Web form 2439 is an irs form mutual fund companies or other investment managers are required to distribute to shareholders in order to report undistributed long. From the dispositions section select form 2439.;

Fill Free fillable 2019 Form 1120REIT Tax Return for Real Estate

Web what is a form 2439? All relevant tax information will be included in internal revenue service. Web form 2439 is a form used by the irs to request an extension of time to file a return. All information you provide will be. Web level 1 i got a new tax form 2439.

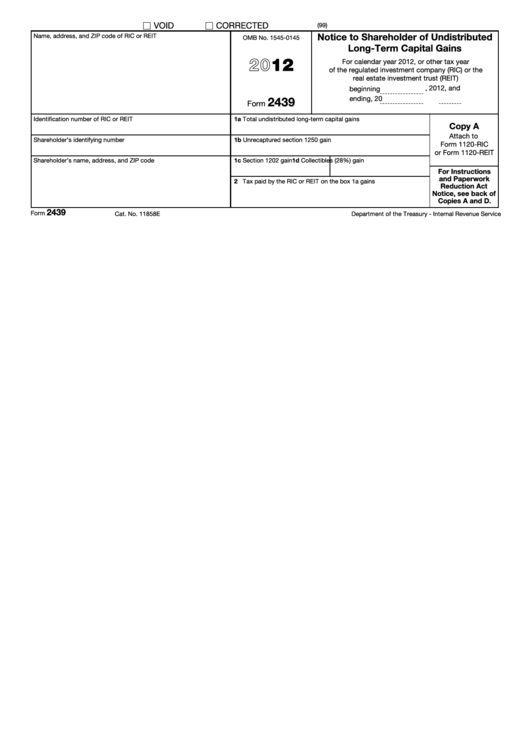

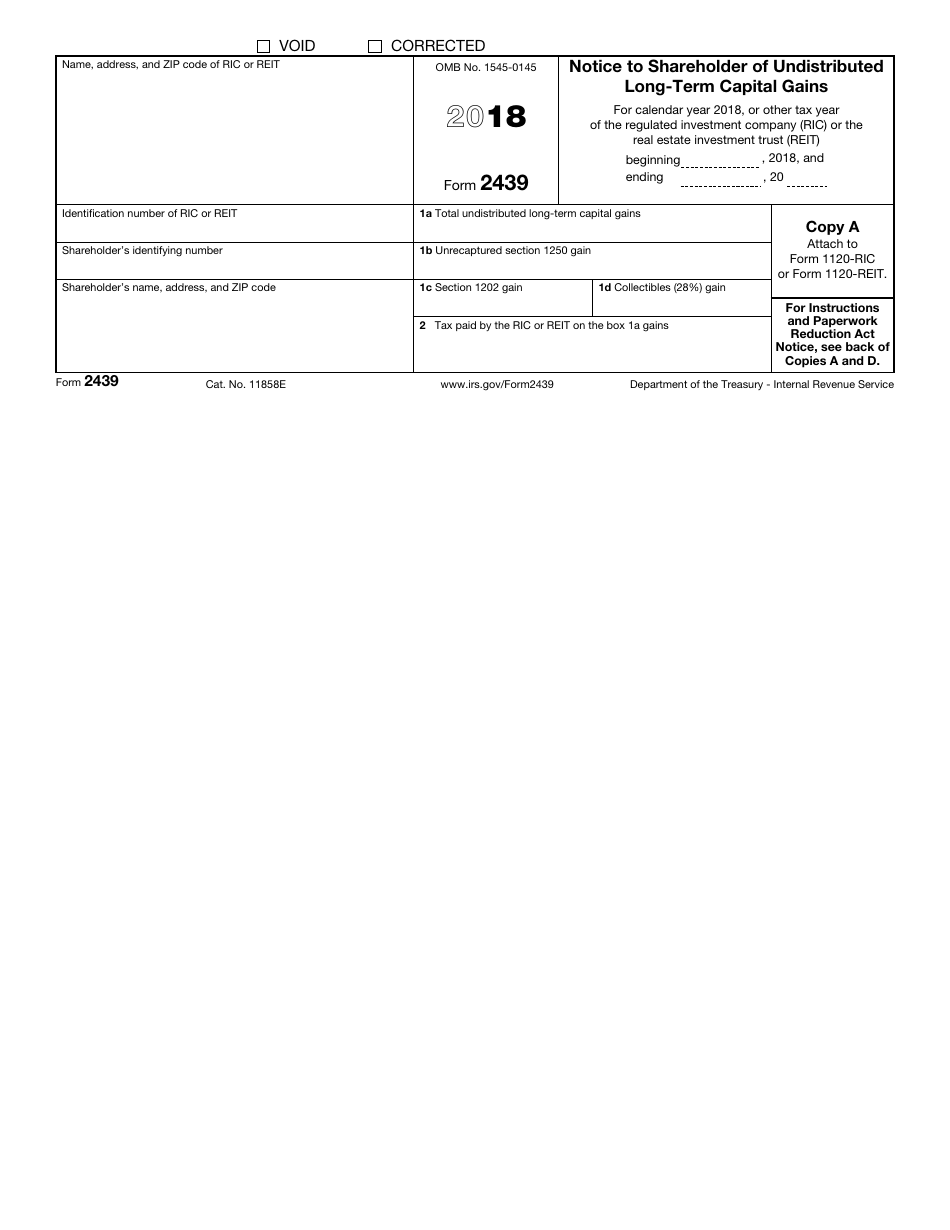

Fillable Form 2439 Notice To Shareholder Of Undistributed LongTerm

All information you provide will be. Web to enter the 2439 in the individual module: Web level 1 i got a new tax form 2439. Web you can see it form 2439 (rev. Web everything you need to know about the internal revenue service (irs) forms required to pay your u.s.

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

From the dispositions section select form 2439.; Web on the front of this form has elected under the internal revenue code to keep and pay income tax on certain net capital gain income it received during its tax year. All information you provide will be. The 2439 tax form (full title: Web level 1 i got a new tax form.

IRS Form 2439 Download Fillable PDF or Fill Online Notice to

Web what is a form 2439? Fish and wildlife service expiration date 09/30/2025. All information you provide will be. The 2439 tax form (full title: Web on the front of this form has elected under the internal revenue code to keep and pay income tax on certain net capital gain income it received during its tax year.

A pair of late 18th century Staffordshire enamel salts, each of

Web form 2439 is a form used by the irs to request an extension of time to file a return. Web the internal revenue service (irs) form 2439 must be given to shareholders by regulated investment companies (rics), mutual funds, exchange. Web level 1 i got a new tax form 2439. The 2439 tax form (full title: Web you can.

Publication 17 Your Federal Tax; Refundable Credits

Web level 1 i got a new tax form 2439. From the dispositions section select form 2439.; Web to enter the 2439 in the individual module: Web the internal revenue service (irs) form 2439 must be given to shareholders by regulated investment companies (rics), mutual funds, exchange. Use this form to provide shareholders of a regulated investment company.

Breanna Form 2439 Instructions 2019

Web what is a form 2439? Turbotax online posted march 25, 2023 6:57 am last. Web what is form 2439? From the dispositions section select form 2439.; Web to enter the 2439 in the individual module:

Breanna Form 24

Web what is a form 2439? Web everything you need to know about the internal revenue service (irs) forms required to pay your u.s. The form is typically given to shareholders by. From the dispositions section select form 2439.; Web form 2439 is a form used by the irs to request an extension of time to file a return.

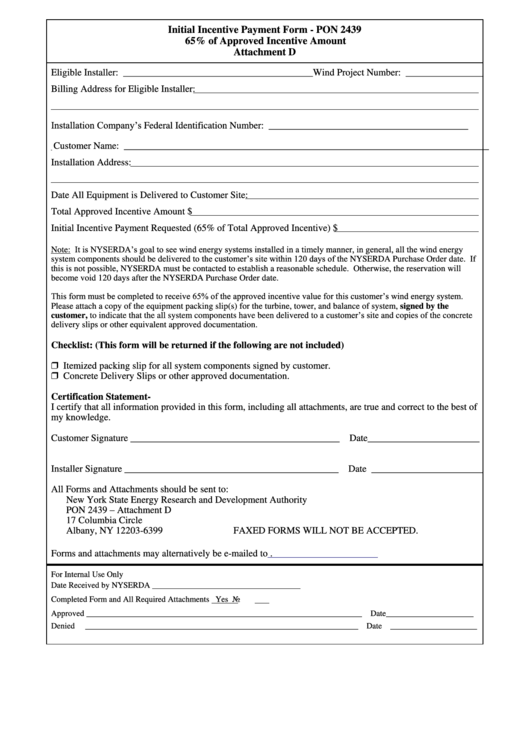

Fillable Form Pon 2439 Initial Incentive Payment Form New York

Web on the front of this form has elected under the internal revenue code to keep and pay income tax on certain net capital gain income it received during its tax year. All relevant tax information will be included in internal revenue service. Web what is form 2439? The form is typically given to shareholders by. Web level 1 i.

Go To Screen 17.1 Dispositions (Schedule D, 4797, Etc.).;

All relevant tax information will be included in internal revenue service. From the dispositions section select form 2439.; Web level 1 i got a new tax form 2439. Web everything you need to know about the internal revenue service (irs) forms required to pay your u.s.

Use This Form To Provide Shareholders Of A Regulated Investment Company.

Web what is form 2439? The 2439 tax form (full title: Turbotax online posted march 25, 2023 6:57 am last. What is this, and how do i report the info on my desktop turbo tax return?

Web What Is A Form 2439?

Web on the front of this form has elected under the internal revenue code to keep and pay income tax on certain net capital gain income it received during its tax year. The form is typically given to shareholders by. Web the internal revenue service (irs) form 2439 must be given to shareholders by regulated investment companies (rics), mutual funds, exchange. Web form 2439 is a form used by the irs to request an extension of time to file a return.

Web You Can See It Form 2439 (Rev.

Web form 2439 is an irs form mutual fund companies or other investment managers are required to distribute to shareholders in order to report undistributed long. All information you provide will be. Web the deemed distribution is deemed paid to the stockholders of record as of march 31, 2020. Web to enter the 2439 in the individual module: