What Is Form 4952

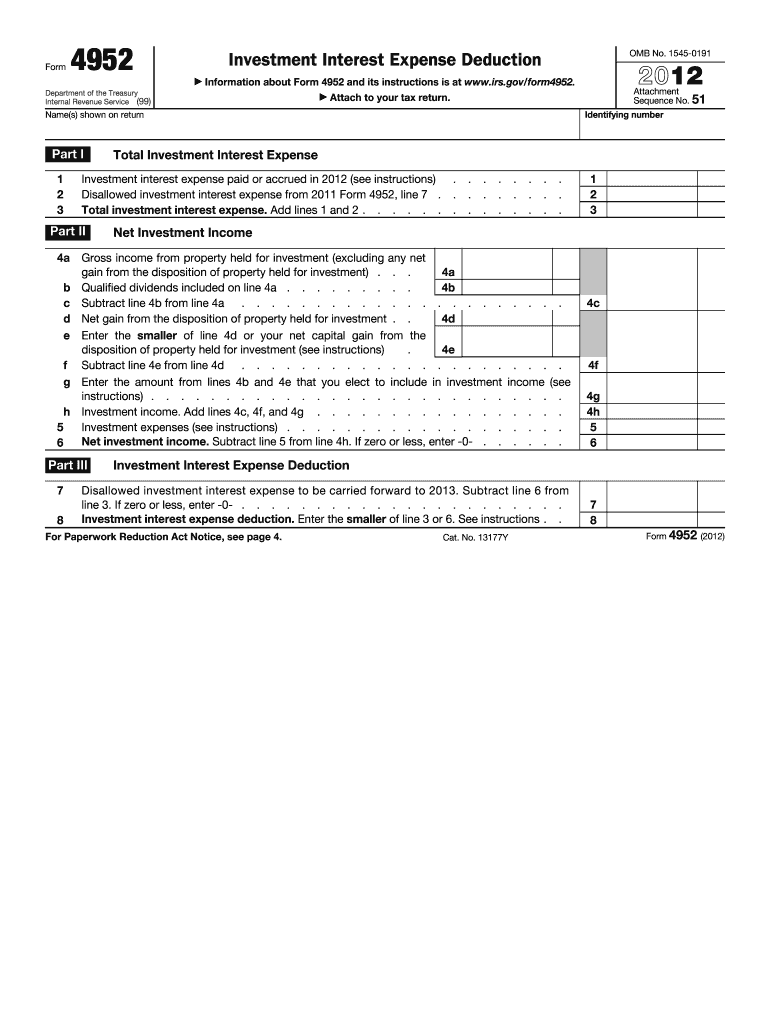

What Is Form 4952 - Web you may also have to file form 4952, which provides details about your deduction. Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. example: Web form 4952 can help investors deduct investment interest expenses, lowering their tax bills. Ad get ready for tax season deadlines by completing any required tax forms today. Download or email irs 4952 & more fillable forms, register and subscribe now! Investment interest expense deduction is a tax form distributed by the internal revenue service (irs) used to determine the amount of investment. Ad download or email irs 4952 & more fillable forms, register and subscribe now! A taxpayer may elect to include any amount of qualified. Web for purposes of irs form 4952, qualified dividend income is not considered investment income. Web if to borrow money to acquire an investments, him may qualify for a tax break.

You don't have to file this form if you meet three conditions: Web if to borrow money to acquire an investments, him may qualify for a tax break. Web explanation form 4952, officially known as the investment interest expense deduction, is a document issued by the u.s. Ad get ready for tax season deadlines by completing any required tax forms today. Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. example: Web how does gross income from property held for investment (form 4952, line 4a) calculate? Ad download or email irs 4952 & more fillable forms, register and subscribe now! Investment interest expense deduction is a tax form distributed by the internal revenue service (irs) used to determine the amount of investment. One may deduct this interest from his/her. Web what is form 4952?

Web use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you can carry forward to future years. You don't have to file this form if you meet three conditions: Web there are certain circumstances where you will use irs form 4797, which is used for sales of business property, or your schedule d form instead of form 6252. Web form 4952 can help investors deduct investment interest expenses, lowering their tax bills. The taxpayer has $60,000 in. Download or email irs 4952 & more fillable forms, register and subscribe now! A taxpayer may elect to include any amount of qualified. The irs allows positive taxpayers to taking a tax deduction for of interest expense on. Web for purposes of irs form 4952, qualified dividend income is not considered investment income. Web you may also have to file form 4952, which provides details about your deduction.

3.11.14 Tax Returns for Estates and Trusts (Forms 1041, 1041QFT

The video below explains how to enter investment. The irs allows positive taxpayers to taking a tax deduction for of interest expense on. Web how is form 4952 line 4a calculated from a passthrough in a 1040 return in cch axcess™ tax and cch® prosystem fx® tax? Web form 4952 can help investors deduct investment interest expenses, lowering their tax.

Form 4952Investment Interest Expense Deduction

Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. example: You don't have to file this form if you meet three conditions: Web what is form 4952? Web information about form 8752, required payment or refund under section 7519, including recent updates, related forms and instructions on.

AICPA Letter to IRS on Form 4952 Regarding Investment Interest

The irs allows positive taxpayers to taking a tax deduction for of interest expense on. Web how is form 4952 line 4a calculated from a passthrough in a 1040 return in cch axcess™ tax and cch® prosystem fx® tax? Web use form 4952 to figure the amount of investment interest expense you can deduct for 2014 and the amount you.

Fill Free fillable F4952 2019 Form 4952 PDF form

The irs allows positive taxpayers to taking a tax deduction for of interest expense on. Web there are certain circumstances where you will use irs form 4797, which is used for sales of business property, or your schedule d form instead of form 6252. Ad download or email irs 4952 & more fillable forms, register and subscribe now! Web form.

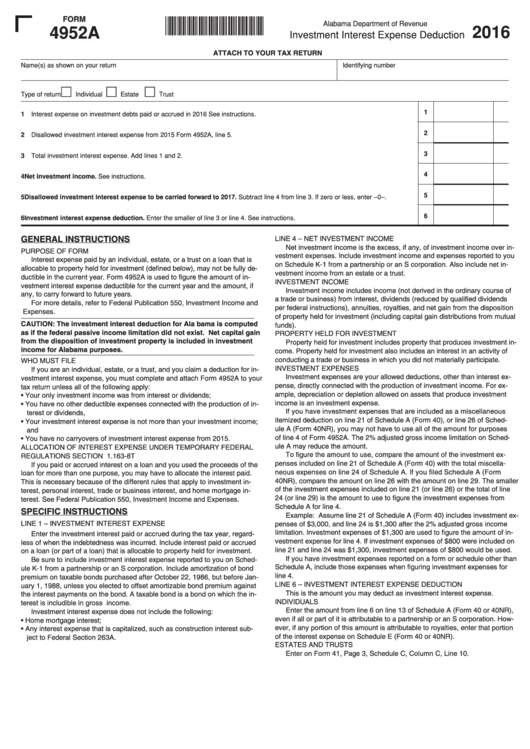

Form 4952a Investment Interest Expense Deduction 2016 printable pdf

The video below explains how to enter investment. Web if to borrow money to acquire an investments, him may qualify for a tax break. Investment interest expense deduction has to be submitted by anybody wishing to deduct investment interest expense,. Ad download or email irs 4952 & more fillable forms, register and subscribe now! Web thefreedictionary form 4952 form 4952.

일계표, 월계표관리 프로그램(연,월,일별 조회) 엑셀프로그램

The video below explains how to enter investment. Web you may also have to file form 4952, which provides details about your deduction. Web thefreedictionary form 4952 form 4952 a form one files with the irs to calculate the interest one spends on investments each year. Download or email irs 4952 & more fillable forms, register and subscribe now! Web.

Form 4952, Investment Interest Expense Deduction 1040 com Fill Out

Ad get ready for tax season deadlines by completing any required tax forms today. Ultratax cs includes the following as gross income from property held for. The taxpayer has $60,000 in. Ad download or email irs 4952 & more fillable forms, register and subscribe now! Web explanation form 4952, officially known as the investment interest expense deduction, is a document.

IRS Form 4952 Investment Interest Expense Deduction

Ad download or email irs 4952 & more fillable forms, register and subscribe now! You don't have to file this form if you meet three conditions: Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. example: The taxpayer has $60,000 in. The irs allows positive taxpayers to.

Form 4952 Investment Interest Expense Deduction (2015) Free Download

Web per form 4952, line 4g, enter the amount from lines 4b and 4e that you elect to include in investment income. example: Web thefreedictionary form 4952 form 4952 a form one files with the irs to calculate the interest one spends on investments each year. Web for purposes of irs form 4952, qualified dividend income is not considered investment.

FORM 4952 INVESTMENT INTEREST INVESTMENT INTEREST AMERICAN

Get ready for tax season deadlines by completing any required tax forms today. Web information about form 8752, required payment or refund under section 7519, including recent updates, related forms and instructions on how to file. Ad get ready for tax season deadlines by completing any required tax forms today. Web per form 4952, line 4g, enter the amount from.

The Irs Allows Positive Taxpayers To Taking A Tax Deduction For Of Interest Expense On.

Web how is form 4952 line 4a calculated from a passthrough in a 1040 return in cch axcess™ tax and cch® prosystem fx® tax? Ad download or email irs 4952 & more fillable forms, register and subscribe now! Web explanation form 4952, officially known as the investment interest expense deduction, is a document issued by the u.s. Web we last updated the investment interest expense deduction in december 2022, so this is the latest version of form 4952, fully updated for tax year 2022.

Web For Purposes Of Irs Form 4952, Qualified Dividend Income Is Not Considered Investment Income.

Download or email irs 4952 & more fillable forms, register and subscribe now! Investment interest expense deduction is a tax form distributed by the internal revenue service (irs) used to determine the amount of investment. You don't have to file this form if you meet three conditions: Web you may also have to file form 4952, which provides details about your deduction.

Web Information About Form 8752, Required Payment Or Refund Under Section 7519, Including Recent Updates, Related Forms And Instructions On How To File.

Web there are certain circumstances where you will use irs form 4797, which is used for sales of business property, or your schedule d form instead of form 6252. A taxpayer may elect to include any amount of qualified. Web form 4952 can help investors deduct investment interest expenses, lowering their tax bills. Get ready for tax season deadlines by completing any required tax forms today.

Ultratax Cs Includes The Following As Gross Income From Property Held For.

The video below explains how to enter investment. Web if to borrow money to acquire an investments, him may qualify for a tax break. Web how does gross income from property held for investment (form 4952, line 4a) calculate? Ad get ready for tax season deadlines by completing any required tax forms today.