What Is Form 8396

What Is Form 8396 - Web form 8396 mortgage interest credit is separate from form 1098 mortgage interest statement you receive from your bank or financial institution for mortgage interest paid. Web step by step instructions comments most taxpayers understand that they may be able to itemize home interest as a tax deduction on schedule a of their federal return. Web irs form 8396 is used by taxpayers to determine and report their mortgage interest credit. Web if you qualified for this program, you claim the credit on form 8396 each year for some of the mortgage interest that you pay. Credit for the elderly or the disabled, alternative motor vehicle credit, and. Web form 8396 department of the treasury internal revenue service (99) mortgage interest credit (for holders of qualified mortgage credit certificates issued by state or local. Web form 8396 mortgage interest credit is separate from the form 1098 you receive from your bank or financial institution for mortgage interest paid. To enter your mortgage credit certificate in. Web what is the form used for? Web for the latest information about developments related to form 8396 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8396.

Web for the latest information about developments related to form 8396 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8396. Enter the amount of mortgage interest paid. Web form 8396 mortgage interest credit is separate from form 1098 mortgage interest statement you receive from your bank or financial institution for mortgage interest paid. Web what is form 8396: Web jun 13, 2023 the purpose of irs form 8949 by barbara weltman feb 26, 2023 irs form 5498: Ira contribution information by barbara weltman mar 17, 2023. Use form 8396 to figure out the mortgage interest credit for 2020 and any credit carryforward to 2021. Web form 8396 department of the treasury internal revenue service (99) mortgage interest credit (for holders of qualified mortgage credit certificates issued by state or local. Web form 8396, titled “mortgage interest credit” , is a document issued by the internal revenue service (irs) in the united states. Web form 8396 is for holders of qualified mortgage credit certificates (mcc) issued by state or local governmental units or agencies;

Enter the amount of mortgage interest paid. However, if the irs calculates. To enter your mortgage credit certificate in. After filing and submitting the form, the irs will review it to ensure it is clear of errors. Web form 8396, titled “mortgage interest credit” , is a document issued by the internal revenue service (irs) in the united states. Web form 8396 department of the treasury internal revenue service (99) mortgage interest credit (for holders of qualified mortgage credit certificates issued by state or local. Part i of form 8396 is used to calculate the taxpayer’s current year. Learn how this form is used, where to get one, and how to file it. Web irs form 8396 is used by taxpayers to determine and report their mortgage interest credit. Web what is form 8396:

Mortgage Brokers Act Regulations

However, if the irs calculates. Enter the amount of mortgage interest paid. Part i of form 8396 is used to calculate the taxpayer’s current year. Web mortgage interest credit (8396) you will be prompted for the home's address and for information about the mcc. Web what is the form used for?

Selling Your Home Pub 523 Selling Your Home

Web irs form 8396 is used by taxpayers to determine and report their mortgage interest credit. Use form 8396 to figure out the mortgage interest credit for 2020 and any credit carryforward to 2021. Learn how this form is used, where to get one, and how to file it. Web form 8396 is a federal individual income tax form. Web.

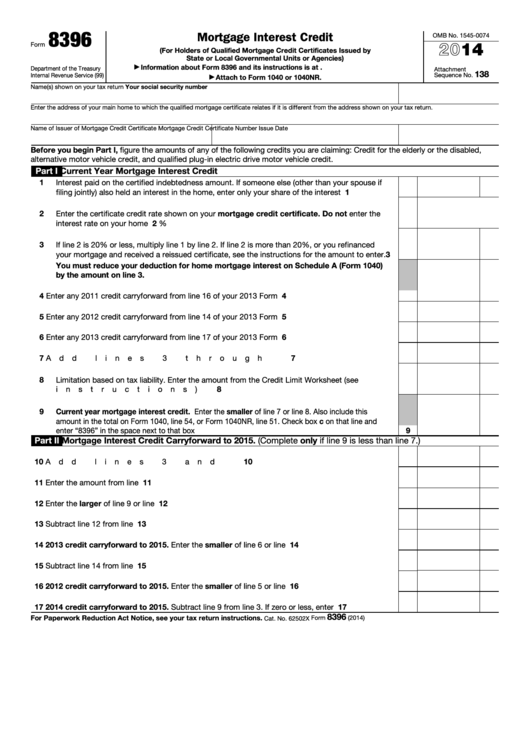

Fillable Form 8396 Mortgage Interest Credit 2014 printable pdf download

Web internal revenue service form 8396, mortgage interest credit, allows you to claim a tax credit on the mortgage interest you paid in the current year on your main. However, if the irs calculates. Credit for the elderly or the disabled, alternative motor vehicle credit, and. Learn how this form is used, where to get one, and how to file.

8396 Stock Photos Free & RoyaltyFree Stock Photos from Dreamstime

Web if you qualified for this program, you claim the credit on form 8396 each year for some of the mortgage interest that you pay. Web what is form 8396: Ira contribution information by barbara weltman mar 17, 2023. Web form 8396, titled “mortgage interest credit” , is a document issued by the internal revenue service (irs) in the united.

Form8396Mortgage Interest Credit

Web form 8396 mortgage interest credit is separate from the form 1098 you receive from your bank or financial institution for mortgage interest paid. Web what is the form used for? Web what is form 8396: Web form 8396 is a federal individual income tax form. Enter the amount of mortgage interest paid.

Ssurvivor Form 2555 Ez 2015

Web jun 13, 2023 the purpose of irs form 8949 by barbara weltman feb 26, 2023 irs form 5498: Learn how this form is used, where to get one, and how to file it. After filing and submitting the form, the irs will review it to ensure it is clear of errors. Its underlying purpose is to allow homeowners to..

Form 8396 Mortgage Interest Credit (2014) Free Download

Web internal revenue service form 8396, mortgage interest credit, allows you to claim a tax credit on the mortgage interest you paid in the current year on your main. Web form 8396 mortgage interest credit is separate from the form 1098 you receive from your bank or financial institution for mortgage interest paid. Web step by step instructions comments most.

Breanna Form 2555 Ez 2016

Part i of form 8396 is used to calculate the taxpayer’s current year. Web form 8396 is a federal individual income tax form. Web for the latest information about developments related to form 8396 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8396. Ira contribution information by barbara weltman mar 17, 2023. Form 8396 is.

Form8396Mortgage Interest Credit

Web form 8396 is available for individuals as well as the irs. Web step by step instructions comments most taxpayers understand that they may be able to itemize home interest as a tax deduction on schedule a of their federal return. Form 8396 is an internal revenue service (irs) form used by homeowners on claim one home interest. Web jun.

Form 8396 Mortgage Interest Credit (2014) Free Download

Form 8396 is an internal revenue service (irs) form used by homeowners on claim one home interest. To enter your mortgage credit certificate in. Web step by step instructions comments most taxpayers understand that they may be able to itemize home interest as a tax deduction on schedule a of their federal return. Web what is the form used for?.

Web Form 8396, Titled “Mortgage Interest Credit” , Is A Document Issued By The Internal Revenue Service (Irs) In The United States.

Web form 8396 mortgage interest credit is separate from the form 1098 you receive from your bank or financial institution for mortgage interest paid. Web form 8396 is a federal individual income tax form. Enter the amount of mortgage interest paid. Web form 8396 mortgage interest credit is separate from form 1098 mortgage interest statement you receive from your bank or financial institution for mortgage interest paid.

Web Form 8396 Is For Holders Of Qualified Mortgage Credit Certificates (Mcc) Issued By State Or Local Governmental Units Or Agencies;

Form 8396 is an internal revenue service (irs) form used by homeowners on claim one home interest. Web for the latest information about developments related to form 8396 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8396. Web mortgage interest credit (8396) you will be prompted for the home's address and for information about the mcc. Web internal revenue service form 8396, mortgage interest credit, allows you to claim a tax credit on the mortgage interest you paid in the current year on your main.

The Certificate Credit Rate Is Shown On The.

Web issue date before you begin part i, figure the amounts of any of the following credits you are claiming: Part i of form 8396 is used to calculate the taxpayer’s current year. Web if you qualified for this program, you claim the credit on form 8396 each year for some of the mortgage interest that you pay. After filing and submitting the form, the irs will review it to ensure it is clear of errors.

Learn How This Form Is Used, Where To Get One, And How To File It.

Web irs form 8396 is used by taxpayers to determine and report their mortgage interest credit. To enter your mortgage credit certificate in. Web what is form 8396: Web what is the form used for?