What Is Form 8594

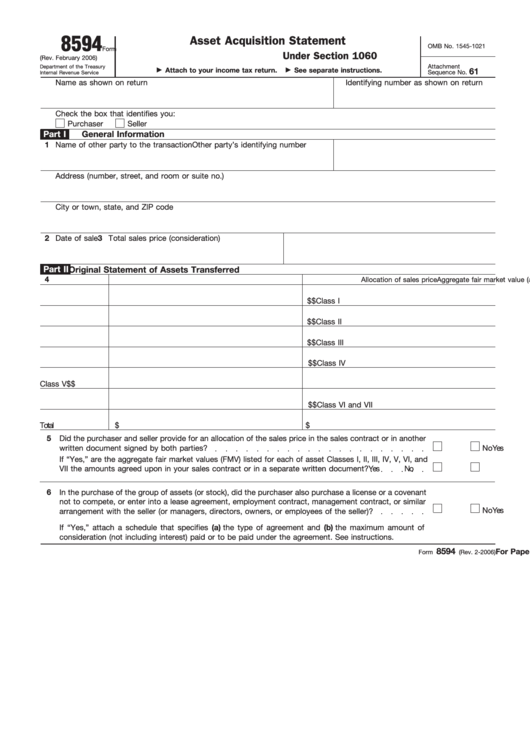

What Is Form 8594 - Generally, attach form 8594 to your federal income tax. Get ready for tax season deadlines by completing any required tax forms today. Negotiating buyer & seller preferences notice that. Web form 8594 is used to report the sale and purchase of a group of assets that constitute a business. Web here is a table that outlines the various “classes” of assets, as prescribed by the irs and as shown on form 8594: Complete, edit or print tax forms instantly. Web help with form 8594 for inventory, equipement and goodwill. Both the buyer and seller have to file form 8594 with their own individual income tax return. Web both the seller and buyer of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could. Web this is what the irs instruction says about form 8594 who must file generally, both the purchaser and seller must file form 8594 and attach it to their.

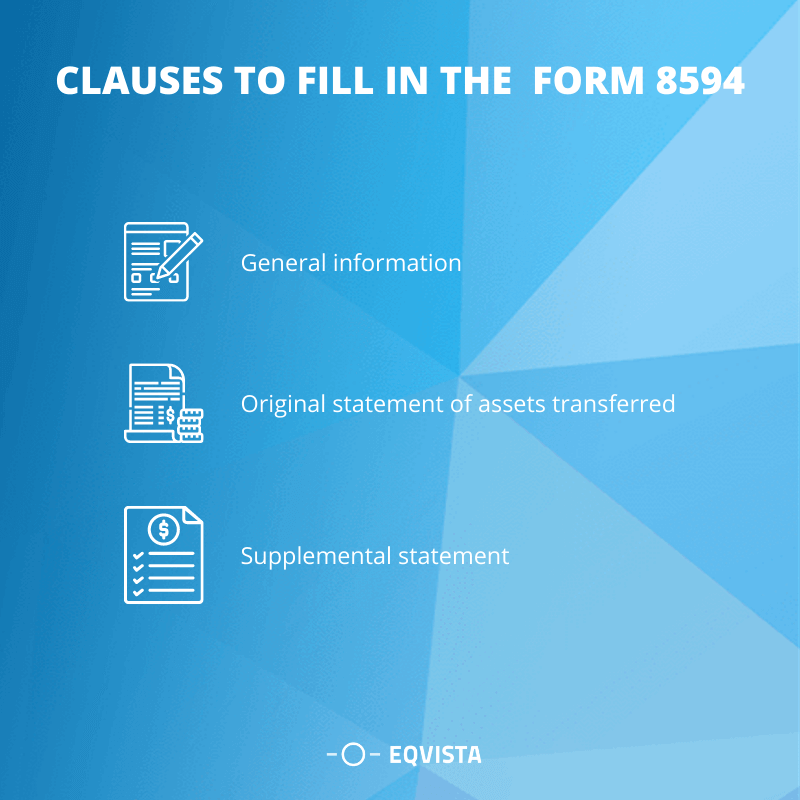

Negotiating buyer & seller preferences notice that. Web purchaser agrees to provide seller with a draft form 8594 within ninety (90) days after closing for review and comment. Web here is a table that outlines the various “classes” of assets, as prescribed by the irs and as shown on form 8594: Get ready for tax season deadlines by completing any required tax forms today. Web irs form 8594 requires that both parties allocate the purchase price among the various assets of the business being purchased so the seller can calculate the taxes due upon. Purchaser and seller shall make reasonable attempts to. Web form 8594 is a compliance made by the irs for reporting the sale of a business. To use form 8594, the. This form gets filed with your tax return and the buyer and seller must agree on how the purchase. Web this is what the irs instruction says about form 8594 who must file generally, both the purchaser and seller must file form 8594 and attach it to their.

This form gets filed with your tax return and the buyer and seller must agree on how the purchase. Web irs form 8594 requires that both parties allocate the purchase price among the various assets of the business being purchased so the seller can calculate the taxes due upon. Web basically the us tax law requires both the seller and purchaser of a group of assets that makes up a trade or business to file irs form 8594 to report the sale if: Web form 8594 is a compliance made by the irs for reporting the sale of a business. Both the purchaser and seller must file form 8594 with their own. Purchaser and seller shall make reasonable attempts to. Web help with form 8594 for inventory, equipement and goodwill. To use form 8594, the. Get ready for tax season deadlines by completing any required tax forms today. Negotiating buyer & seller preferences notice that.

Form 8594 Edit, Fill, Sign Online Handypdf

Web form 8594 is used to report the sale and purchase of a group of assets that constitute a business. Web form 8594 is a compliance made by the irs for reporting the sale of a business. Web purchaser agrees to provide seller with a draft form 8594 within ninety (90) days after closing for review and comment. Web this.

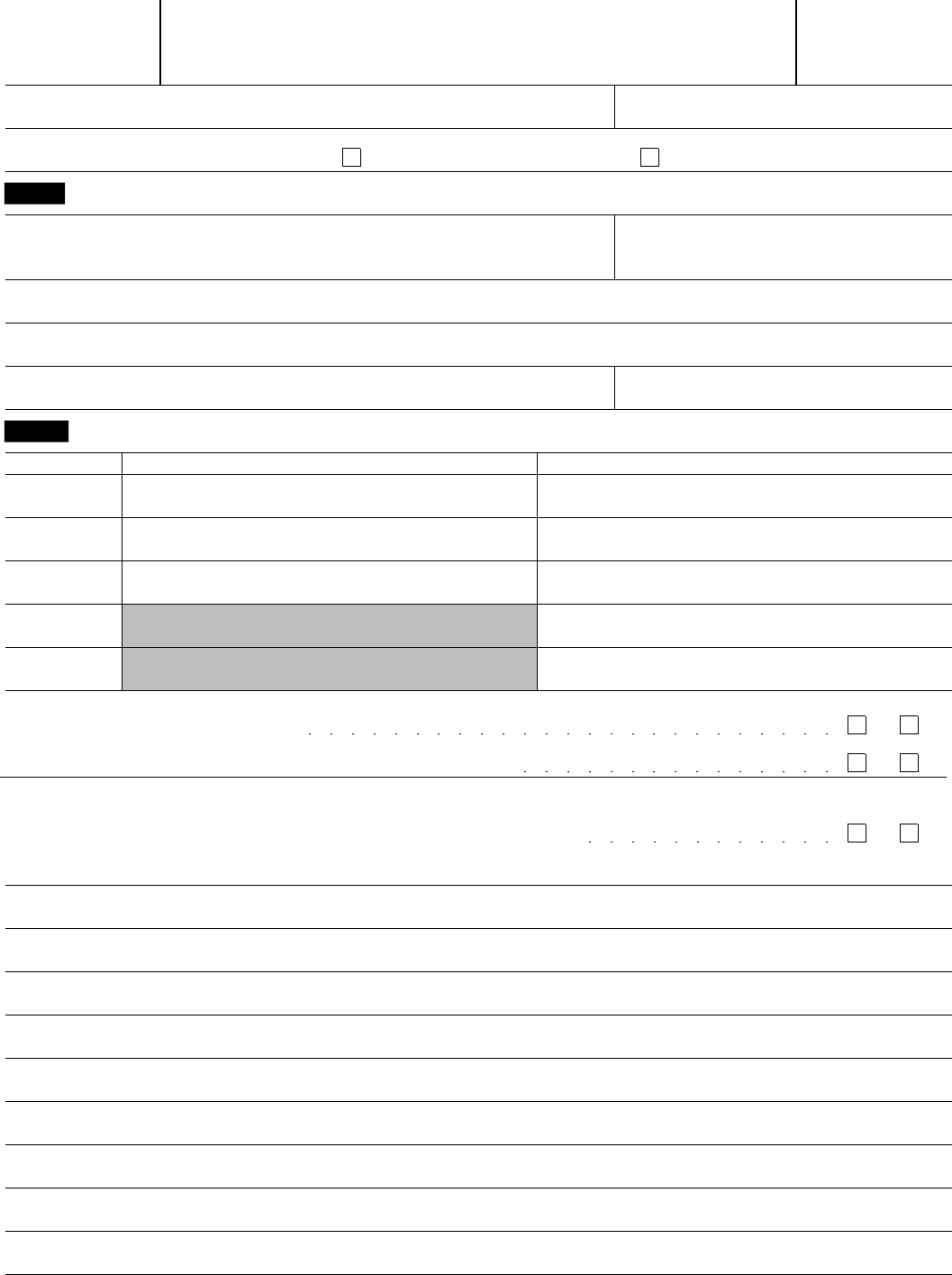

Form 8594 Asset Acquisition Statement Under Section 1060 (2012

Web form 8594 is used to report the sale and purchase of a group of assets that constitute a business. Web help with form 8594 for inventory, equipement and goodwill. Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or.

Form 8594 Reporting Asset Acquisition 1800Accountant

Web both the seller and buyer of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could. Complete, edit or print tax forms instantly. Web form 8594 is used to report the sale and purchase of a group of assets that.

Form 8594 Everything you need to know Eqvista

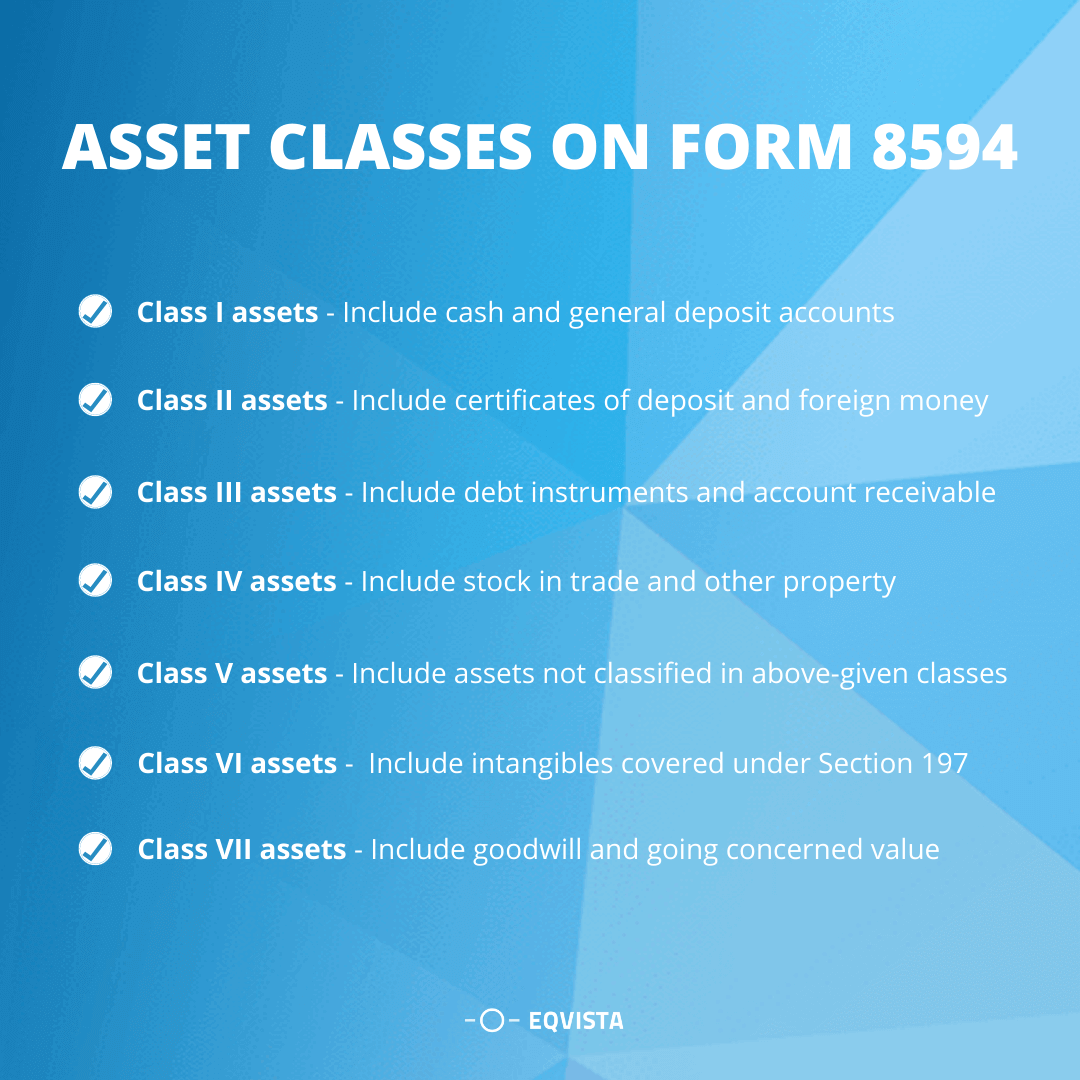

Web here is a table that outlines the various “classes” of assets, as prescribed by the irs and as shown on form 8594: Purchaser and seller shall make reasonable attempts to. To use form 8594, the. Web irs form 8594 requires that both parties allocate the purchase price among the various assets of the business being purchased so the seller.

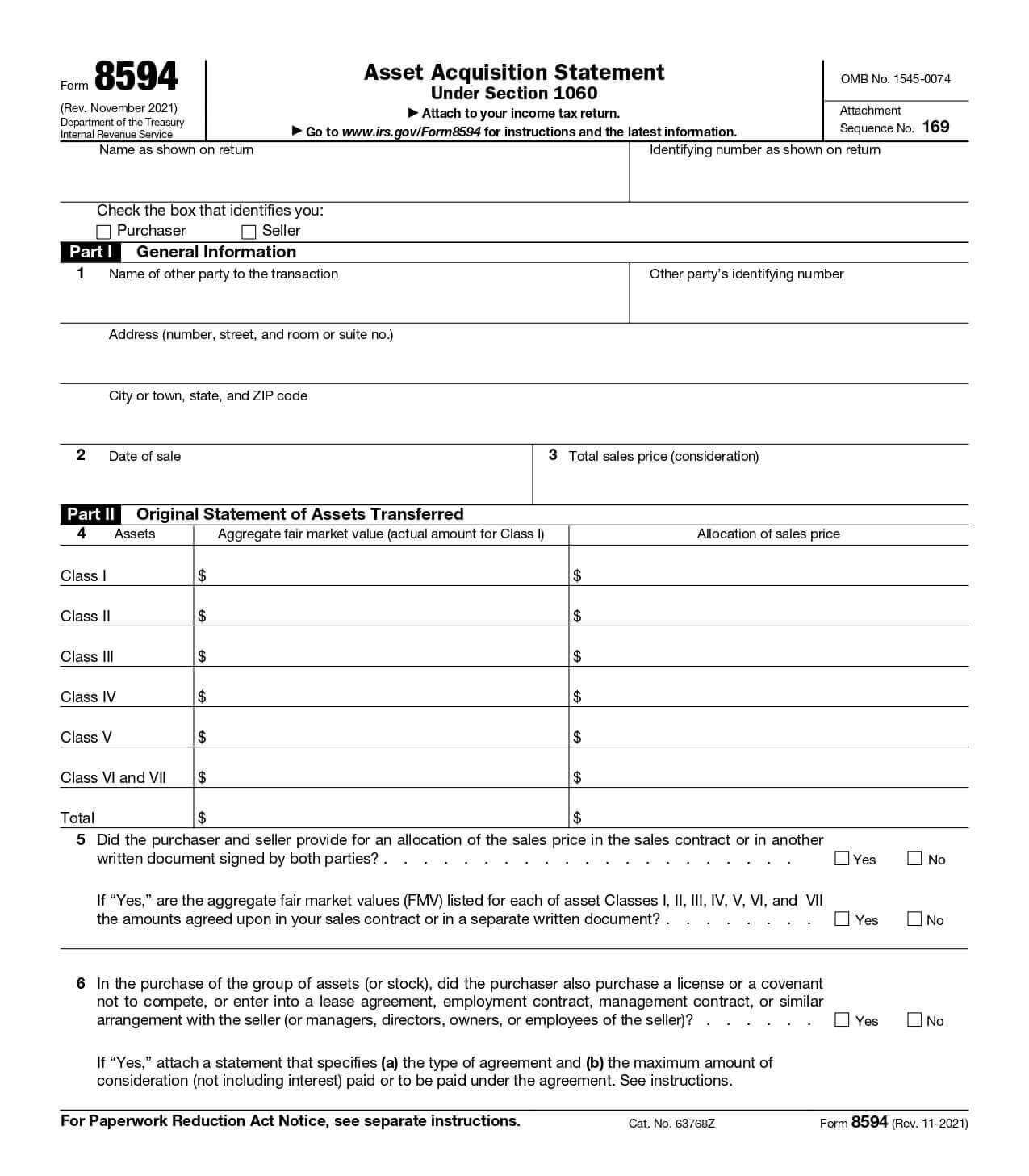

Instructions for Form 8594

Web purchaser agrees to provide seller with a draft form 8594 within ninety (90) days after closing for review and comment. Get ready for tax season deadlines by completing any required tax forms today. Web basically the us tax law requires both the seller and purchaser of a group of assets that makes up a trade or business to file.

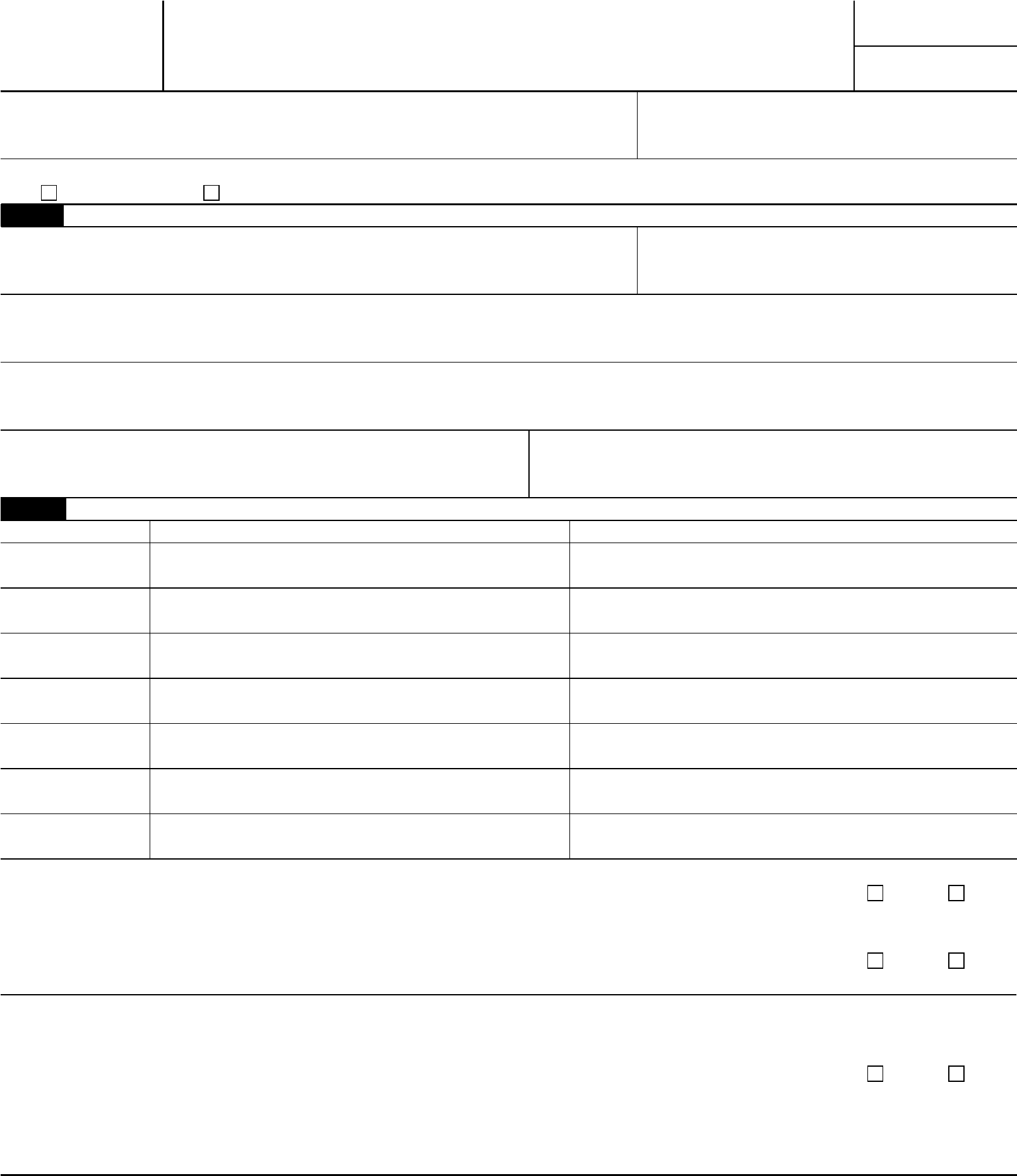

U.S. TREAS Form treasirs85942002

Web this is what the irs instruction says about form 8594 who must file generally, both the purchaser and seller must file form 8594 and attach it to their. Web here is a table that outlines the various “classes” of assets, as prescribed by the irs and as shown on form 8594: This form is required under section 1060 of.

Form 8594 Everything you need to know Eqvista

Web here is a table that outlines the various “classes” of assets, as prescribed by the irs and as shown on form 8594: This form gets filed with your tax return and the buyer and seller must agree on how the purchase. Web purchaser agrees to provide seller with a draft form 8594 within ninety (90) days after closing for.

Form 8594 Everything you need to know Eqvista

Negotiating buyer & seller preferences notice that. Both the purchaser and seller must file form 8594 with their own. Web both the seller and buyer of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could. Web form 8594 is a.

Form 8594 ≡ Fill Out Printable PDF Forms Online

Web both the seller and buyer of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could. Web help with form 8594 for inventory, equipement and goodwill. Web both the seller and purchaser of a group of assets that makes up.

Fillable Form 8594 (Rev. February 2006) Asset Acquisition Statement

Both the purchaser and seller must file form 8594 with their own. Web here is a table that outlines the various “classes” of assets, as prescribed by the irs and as shown on form 8594: Purchaser and seller shall make reasonable attempts to. To use form 8594, the. Web basically the us tax law requires both the seller and purchaser.

Web Purchaser Agrees To Provide Seller With A Draft Form 8594 Within Ninety (90) Days After Closing For Review And Comment.

Web this is what the irs instruction says about form 8594 who must file generally, both the purchaser and seller must file form 8594 and attach it to their. Get ready for tax season deadlines by completing any required tax forms today. This form gets filed with your tax return and the buyer and seller must agree on how the purchase. Negotiating buyer & seller preferences notice that.

Web Basically The Us Tax Law Requires Both The Seller And Purchaser Of A Group Of Assets That Makes Up A Trade Or Business To File Irs Form 8594 To Report The Sale If:

Web form 8594 is a form used by the internal revenue service (irs) called “asset acquisition statement”. Web here is a table that outlines the various “classes” of assets, as prescribed by the irs and as shown on form 8594: Web both the seller and purchaser of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or. Web irs form 8594 requires that both parties allocate the purchase price among the various assets of the business being purchased so the seller can calculate the taxes due upon.

Complete, Edit Or Print Tax Forms Instantly.

Generally, attach form 8594 to your federal income tax. Purchaser and seller shall make reasonable attempts to. Web when buying or selling a business you are required by the irs to file form 8594. Web both the seller and buyer of a group of assets that makes up a trade or business must use form 8594 to report such a sale if goodwill or going concern value attaches, or could.

We Purchased A Business In March 2019 With Inventory (Independent Valuation), Equipment (Value.

Web form 8594 is a compliance made by the irs for reporting the sale of a business. Both the purchaser and seller must file form 8594 with their own. Both the buyer and seller have to file form 8594 with their own individual income tax return. Web assets must prepare and attach form 8594 to their federal income tax returns (forms 1040, 1041, 1065, 1120, 1120s, etc.).