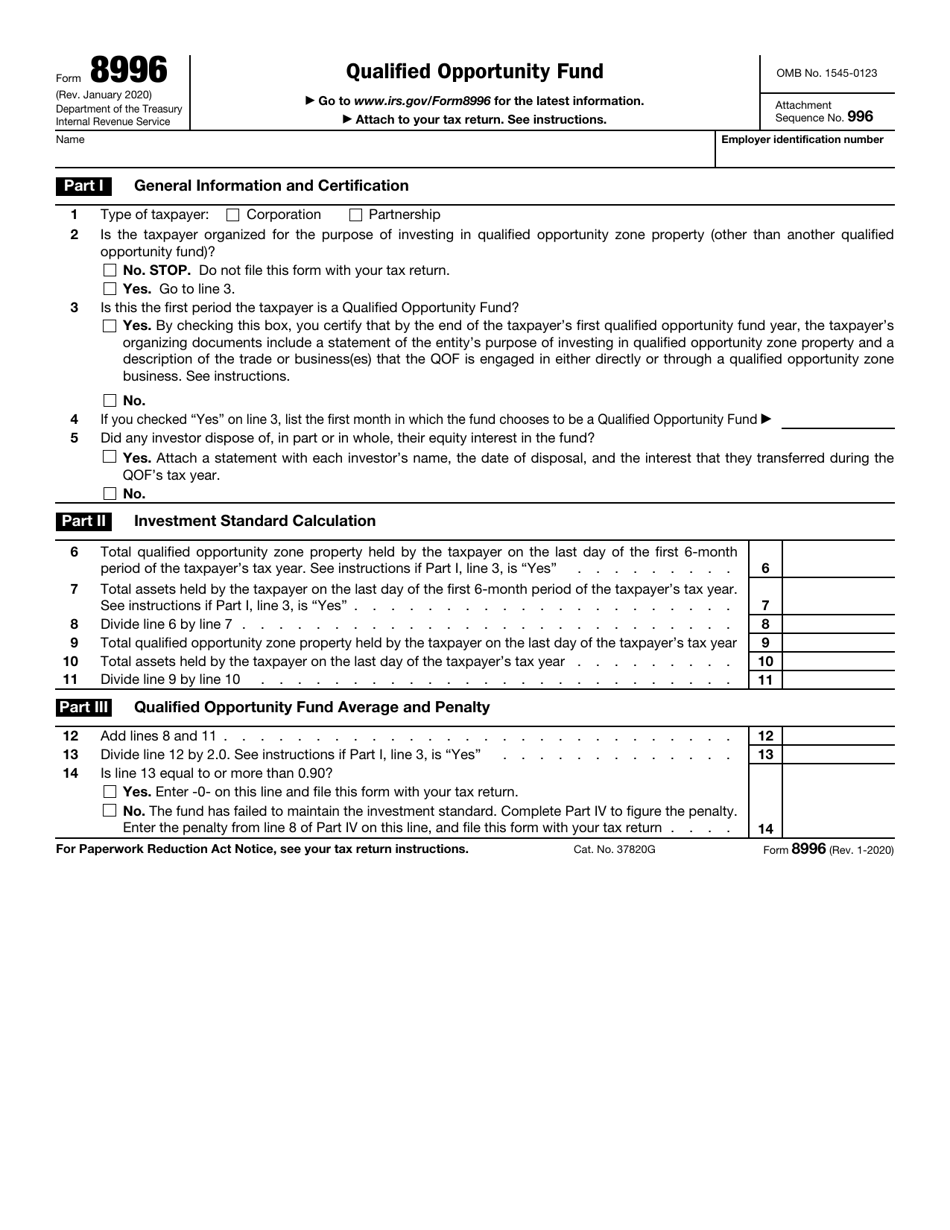

What Is Form 8996 Qualified Opportunity Fund

What Is Form 8996 Qualified Opportunity Fund - Web annually, qoz funds are required to submit form 8996, qualified opportunity fund, to certify to the irs the qof status, provide investment information. Benefit from sizable tax advantages by investing in qualified opportunity funds. Web form 8996 is filed only by qualified opportunity funds. Web how a qualified opportunity fund uses form 8996 to inform the irs of the qof investments. The 2022 instructions for form 8996, qualified opportunity fund, will make it clear that a. Web qualified opportunity zones (qozs) enable taxpayers to defer and reduce capital gains to unlock substantial tax incentives. A qof is an investment vehicle organized as a corporation or a partnership for the purpose of investing in qoz property (other than. Web although this relief is automatic, a qof must accurately complete all lines on form 8996, qualified opportunity fund, filed for each affected tax year except that the. Web the taxpayer must invest proceeds from a sale resulting in capital gain in an entity that is a qualified opportunity fund (“qof”) formed as a corporation or. Web qualified opportunity fund (qof).

Web the taxpayer must invest proceeds from a sale resulting in capital gain in an entity that is a qualified opportunity fund (“qof”) formed as a corporation or. Web qualified opportunity zones (qozs) enable taxpayers to defer and reduce capital gains to unlock substantial tax incentives. Web about form 8997, initial and annual statement of qualified opportunity fund (qof) investments. Use form 8997 to inform the irs of the qof investments and. Sign up and browse today. Web qualified opportunity fund (qof). Web by checking this box, you certify that by the end of the taxpayer’s first qualified opportunity fund year, the taxpayer’s. Web annually, qoz funds are required to submit form 8996, qualified opportunity fund, to certify to the irs the qof status, provide investment information. A qof is an investment vehicle organized as a corporation or a partnership for the purpose of investing in qoz property (other than. Web investment in qualified opportunity funds (qofs).

Web by checking this box, you certify that by the end of the taxpayer’s first qualified opportunity fund year, the taxpayer’s. Web form 8996 is filed only by qualified opportunity funds. Taxpayers that invest in qoz property through a qof can defer the recognition of certain gains. Benefit from sizable tax advantages by investing in qualified opportunity funds. Use form 8997 to inform the irs of the qof investments and. Web about form 8997, initial and annual statement of qualified opportunity fund (qof) investments. Web although this relief is automatic, a qof must accurately complete all lines on form 8996, qualified opportunity fund, filed for each affected tax year except that the. Web the taxpayer must invest proceeds from a sale resulting in capital gain in an entity that is a qualified opportunity fund (“qof”) formed as a corporation or. Web annually, qoz funds are required to submit form 8996, qualified opportunity fund, to certify to the irs the qof status, provide investment information. The 2022 instructions for form 8996, qualified opportunity fund, will make it clear that a.

IRS Form 8996 Qualified Opportunity Fund Lies on Flat Lay Office Table

Web form 8996 is filed only by qualified opportunity funds. Web qualified opportunity zones (qozs) enable taxpayers to defer and reduce capital gains to unlock substantial tax incentives. Web by checking this box, you certify that by the end of the taxpayer’s first qualified opportunity fund year, the taxpayer’s. Sign up and browse today. Web how a qualified opportunity fund.

IRS Form 8996 Qualified Opportunity Fund Lies on Flat Lay Office Table

Web qualified opportunity fund (qof). The 2022 instructions for form 8996, qualified opportunity fund, will make it clear that a. Web annually, qoz funds are required to submit form 8996, qualified opportunity fund, to certify to the irs the qof status, provide investment information. The tax cuts and jobs act of 2017 provided for the deferral of capital gains if..

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Web how a qualified opportunity fund uses form 8996 to inform the irs of the qof investments. The 2022 instructions for form 8996, qualified opportunity fund, will make it clear that a. The tax cuts and jobs act of 2017 provided for the deferral of capital gains if. Web form 8996 is filed only by qualified opportunity funds. Use form.

IRS Form 8996 Download Fillable PDF or Fill Online Qualified

Web although this relief is automatic, a qof must accurately complete all lines on form 8996, qualified opportunity fund, filed for each affected tax year except that the. The tax cuts and jobs act of 2017 provided for the deferral of capital gains if. Web about form 8997, initial and annual statement of qualified opportunity fund (qof) investments. Web annually,.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Taxpayers that invest in qoz property through a qof can defer the recognition of certain gains. The tax cuts and jobs act of 2017 provided for the deferral of capital gains if. Use form 8997 to inform the irs of the qof investments and. Web about form 8997, initial and annual statement of qualified opportunity fund (qof) investments. Sign up.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Web form 8996 is filed only by qualified opportunity funds. Benefit from sizable tax advantages by investing in qualified opportunity funds. Web how a qualified opportunity fund uses form 8996 to inform the irs of the qof investments. Web although this relief is automatic, a qof must accurately complete all lines on form 8996, qualified opportunity fund, filed for each.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

Use form 8997 to inform the irs of the qof investments and. Web qualified opportunity fund (qof). Web qualified opportunity zones (qozs) enable taxpayers to defer and reduce capital gains to unlock substantial tax incentives. Web investment in qualified opportunity funds (qofs). Web form 8996 is filed only by qualified opportunity funds.

Download Instructions for IRS Form 8996 Qualified Opportunity Fund PDF

The tax cuts and jobs act of 2017 provided for the deferral of capital gains if. Web form 8996 is filed only by qualified opportunity funds. Taxpayers that invest in qoz property through a qof can defer the recognition of certain gains. Web annually, qoz funds are required to submit form 8996, qualified opportunity fund, to certify to the irs.

IRS form 8996 Qualified opportunity fund lies on flat lay office table

Web qualified opportunity fund (qof). Web the percentage computation must be reported annually on form 8996, qualified opportunity fund. Web although this relief is automatic, a qof must accurately complete all lines on form 8996, qualified opportunity fund, filed for each affected tax year except that the. Web annually, qoz funds are required to submit form 8996, qualified opportunity fund,.

IRS Form 8996 Qualified Opportunity Fund Lies On Flat Lay Office Table

Benefit from sizable tax advantages by investing in qualified opportunity funds. Use form 8997 to inform the irs of the qof investments and. The tax cuts and jobs act of 2017 provided for the deferral of capital gains if. Sign up and browse today. Web qualified opportunity zones (qozs) enable taxpayers to defer and reduce capital gains to unlock substantial.

Web Although This Relief Is Automatic, A Qof Must Accurately Complete All Lines On Form 8996, Qualified Opportunity Fund, Filed For Each Affected Tax Year Except That The.

Web the percentage computation must be reported annually on form 8996, qualified opportunity fund. Web qualified opportunity zones (qozs) enable taxpayers to defer and reduce capital gains to unlock substantial tax incentives. Benefit from sizable tax advantages by investing in qualified opportunity funds. Web by checking this box, you certify that by the end of the taxpayer’s first qualified opportunity fund year, the taxpayer’s.

Sign Up And Browse Today.

Web how a qualified opportunity fund uses form 8996 to inform the irs of the qof investments. The 2022 instructions for form 8996, qualified opportunity fund, will make it clear that a. Web the taxpayer must invest proceeds from a sale resulting in capital gain in an entity that is a qualified opportunity fund (“qof”) formed as a corporation or. Web investment in qualified opportunity funds (qofs).

The Tax Cuts And Jobs Act Of 2017 Provided For The Deferral Of Capital Gains If.

Web form 8996 is filed only by qualified opportunity funds. Use form 8997 to inform the irs of the qof investments and. Web annually, qoz funds are required to submit form 8996, qualified opportunity fund, to certify to the irs the qof status, provide investment information. A qof is an investment vehicle organized as a corporation or a partnership for the purpose of investing in qoz property (other than.

Web About Form 8997, Initial And Annual Statement Of Qualified Opportunity Fund (Qof) Investments.

Web qualified opportunity fund (qof). Taxpayers that invest in qoz property through a qof can defer the recognition of certain gains.