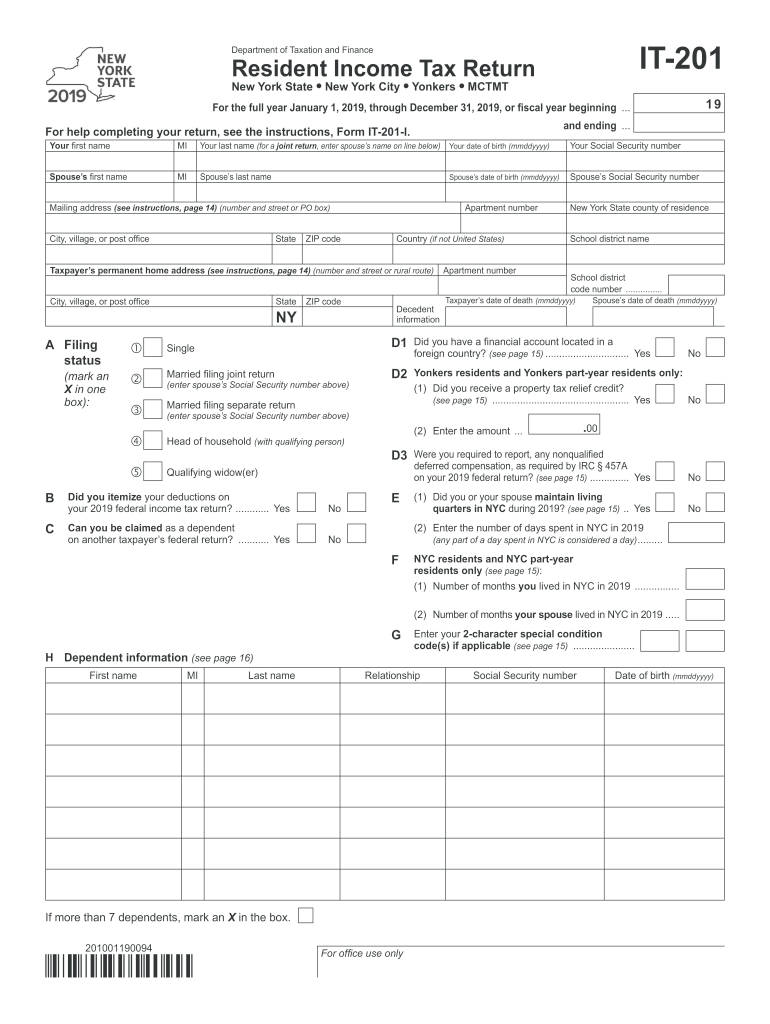

What Is Form It 201

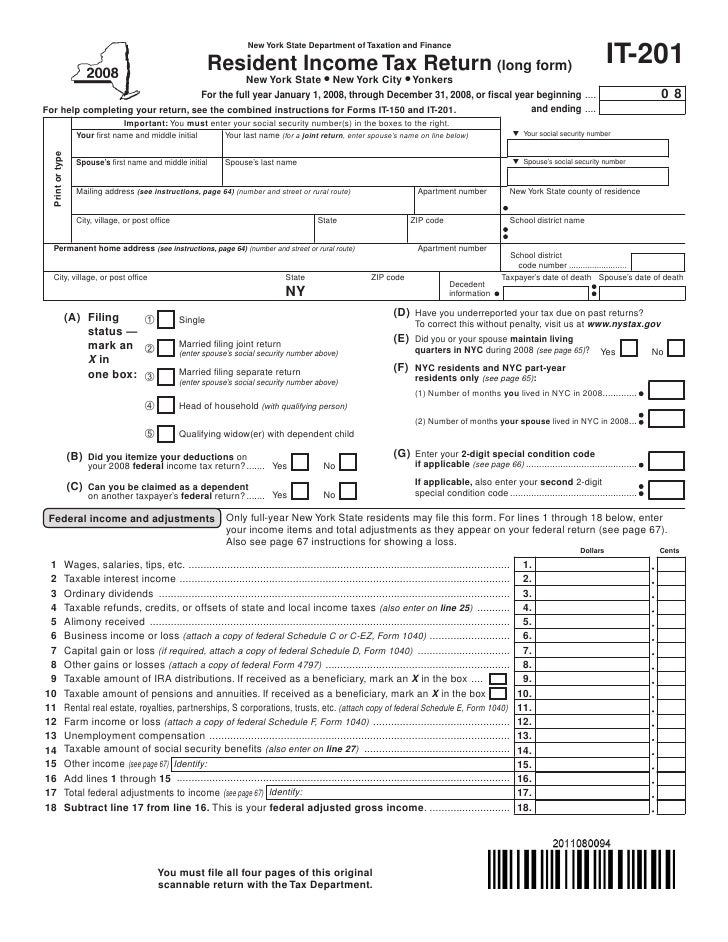

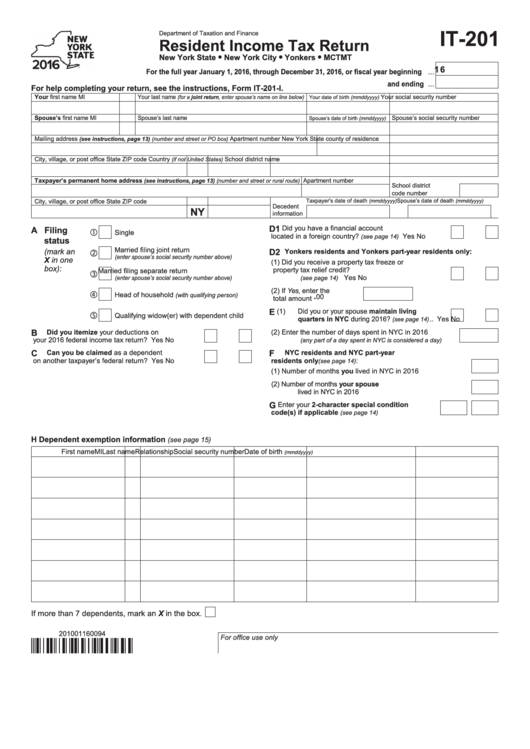

What Is Form It 201 - It is analogous to the us form 1040, but it is four pages long, instead of two pages. Single married filing joint return (enter spouse’s social security number above) married filing separate return (enter spouse’s social. Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below) <rxu. If you filed for tax year your requested refund amount is; This is the total of your new york state taxes.42. If you are filing state taxes for new york this year, then yes you will need this form and you want to make sure. Electronic filing for income tax. 42 add lines 40 and 41. Web find your requested refund amount by form and tax year;

If you are filing state taxes for new york this year, then yes you will need this form and you want to make sure. Web find your requested refund amount by form and tax year; This is the total of your new york state taxes.42. Single married filing joint return (enter spouse’s social security number above) married filing separate return (enter spouse’s social. 42 add lines 40 and 41. If you filed for tax year your requested refund amount is; Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below) <rxu. Electronic filing for income tax. It is analogous to the us form 1040, but it is four pages long, instead of two pages.

42 add lines 40 and 41. Web find your requested refund amount by form and tax year; Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below) <rxu. It is analogous to the us form 1040, but it is four pages long, instead of two pages. This is the total of your new york state taxes.42. If you filed for tax year your requested refund amount is; Electronic filing for income tax. If you are filing state taxes for new york this year, then yes you will need this form and you want to make sure. Single married filing joint return (enter spouse’s social security number above) married filing separate return (enter spouse’s social.

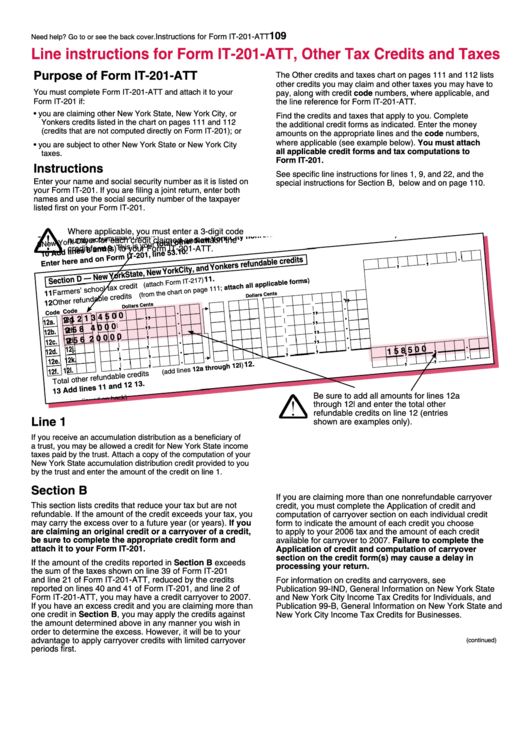

Line Instructions For Form It201Att, Other Tax Credits And Taxes

42 add lines 40 and 41. Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below) <rxu. Electronic filing for income tax. It is analogous to the us form 1040, but it is four pages long, instead of two pages. This is the total of your new york state taxes.42.

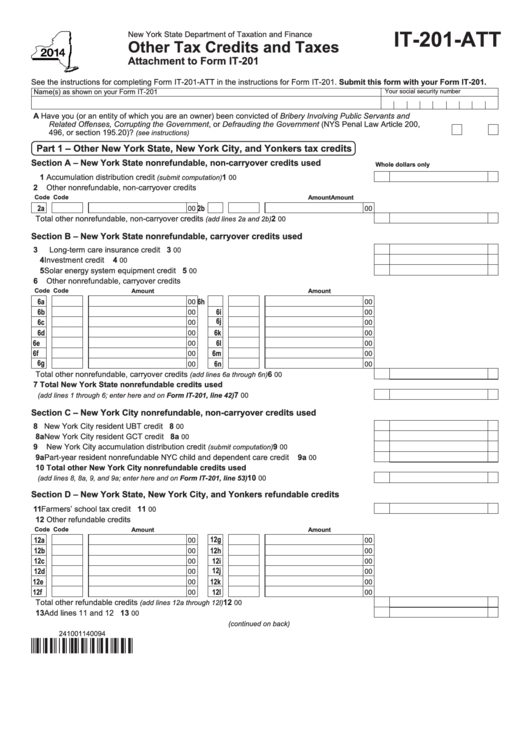

IT201ATT Other Taxes and Tax Credits Attachment to Form IT201

Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below) <rxu. If you filed for tax year your requested refund amount is; 42 add lines 40 and 41. Web find your requested refund amount by form and tax year; Electronic filing for income tax.

Top 106 New York State Form It201 Templates free to download in PDF format

This is the total of your new york state taxes.42. Web find your requested refund amount by form and tax year; Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below) <rxu. It is analogous to the us form 1040, but it is four pages long, instead of two pages. If you filed.

New York State Form It 201 59 Personalized Wedding Ideas We Love

Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below) <rxu. Web find your requested refund amount by form and tax year; If you filed for tax year your requested refund amount is; Single married filing joint return (enter spouse’s social security number above) married filing separate return (enter spouse’s social. 42 add.

Form IT 201 Download Fillable PDF Or Fill Online Resident Printable

This is the total of your new york state taxes.42. Electronic filing for income tax. Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below) <rxu. 42 add lines 40 and 41. If you filed for tax year your requested refund amount is;

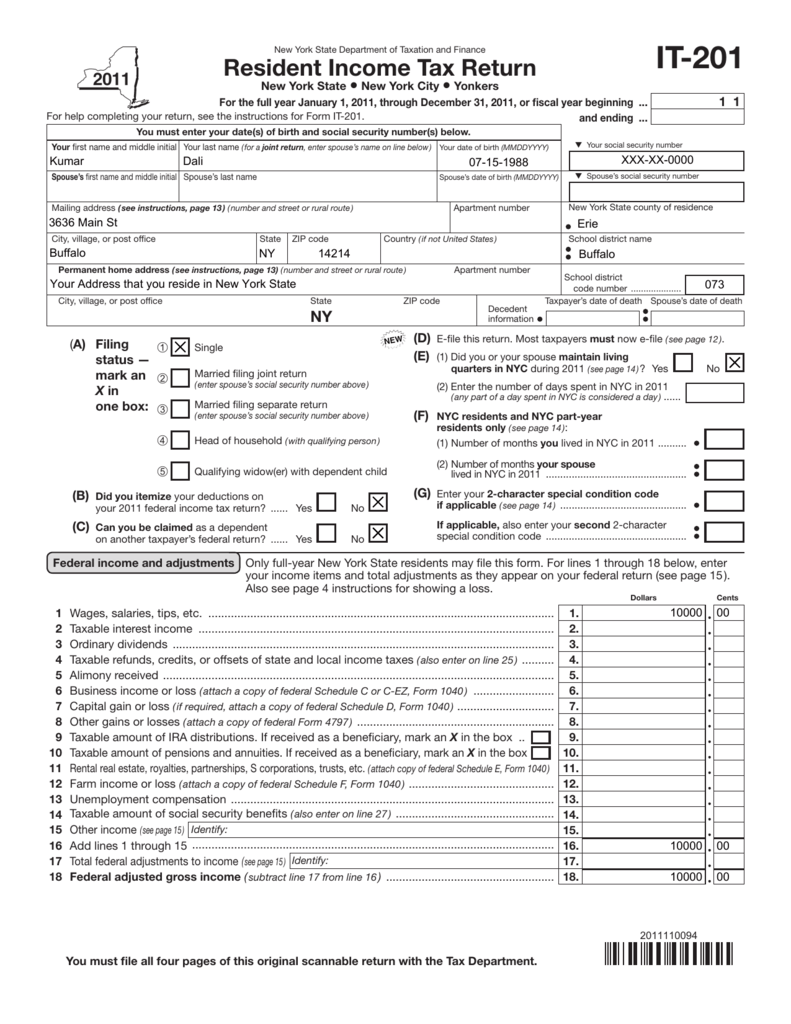

Form IT2012011Resident Tax ReturnIT201

This is the total of your new york state taxes.42. Your ¿uvw qdph 0, <rxu odvw qdph (for a joint return, enter spouse’s name on line below) <rxu. It is analogous to the us form 1040, but it is four pages long, instead of two pages. If you filed for tax year your requested refund amount is; Electronic filing for.

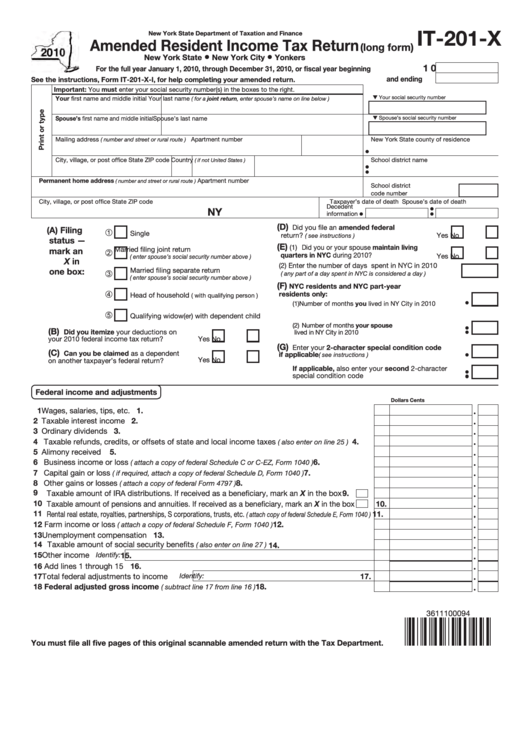

Fillable Form It201X Amended Resident Tax Return (Long Form

If you filed for tax year your requested refund amount is; Electronic filing for income tax. This is the total of your new york state taxes.42. If you are filing state taxes for new york this year, then yes you will need this form and you want to make sure. 42 add lines 40 and 41.

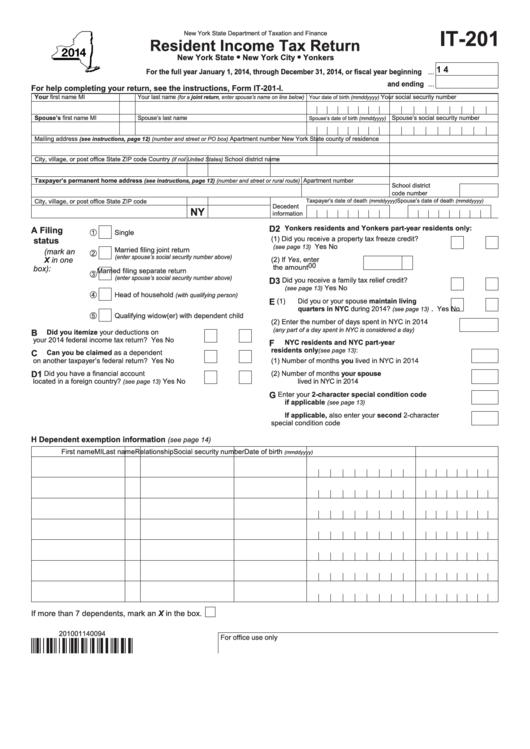

Fillable Form It201 2014 Resident Tax Return New York State

It is analogous to the us form 1040, but it is four pages long, instead of two pages. Web find your requested refund amount by form and tax year; If you are filing state taxes for new york this year, then yes you will need this form and you want to make sure. 42 add lines 40 and 41. If.

Form IT 201 Resident Tax Return YouTube

Electronic filing for income tax. If you are filing state taxes for new york this year, then yes you will need this form and you want to make sure. 42 add lines 40 and 41. Web find your requested refund amount by form and tax year; It is analogous to the us form 1040, but it is four pages long,.

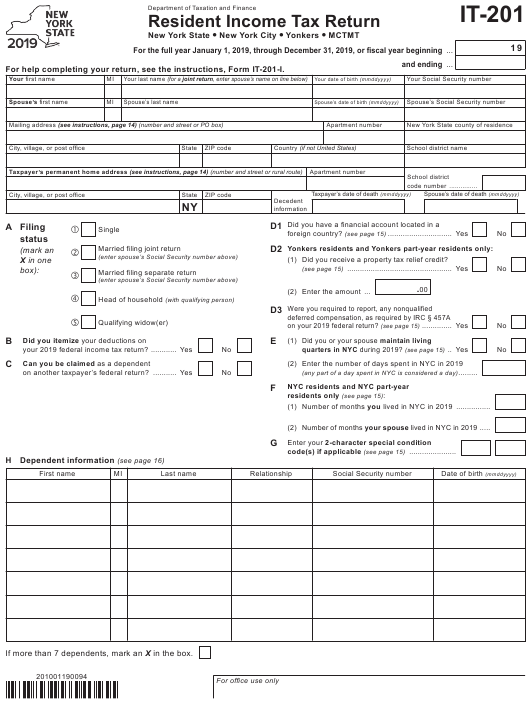

2019 Form NY DTF IT201 Fill Online, Printable, Fillable, Blank pdfFiller

42 add lines 40 and 41. This is the total of your new york state taxes.42. Electronic filing for income tax. Single married filing joint return (enter spouse’s social security number above) married filing separate return (enter spouse’s social. If you are filing state taxes for new york this year, then yes you will need this form and you want.

Web Find Your Requested Refund Amount By Form And Tax Year;

If you are filing state taxes for new york this year, then yes you will need this form and you want to make sure. Single married filing joint return (enter spouse’s social security number above) married filing separate return (enter spouse’s social. It is analogous to the us form 1040, but it is four pages long, instead of two pages. 42 add lines 40 and 41.

Electronic Filing For Income Tax.

If you filed for tax year your requested refund amount is; Your ¿uvw qdph 0,