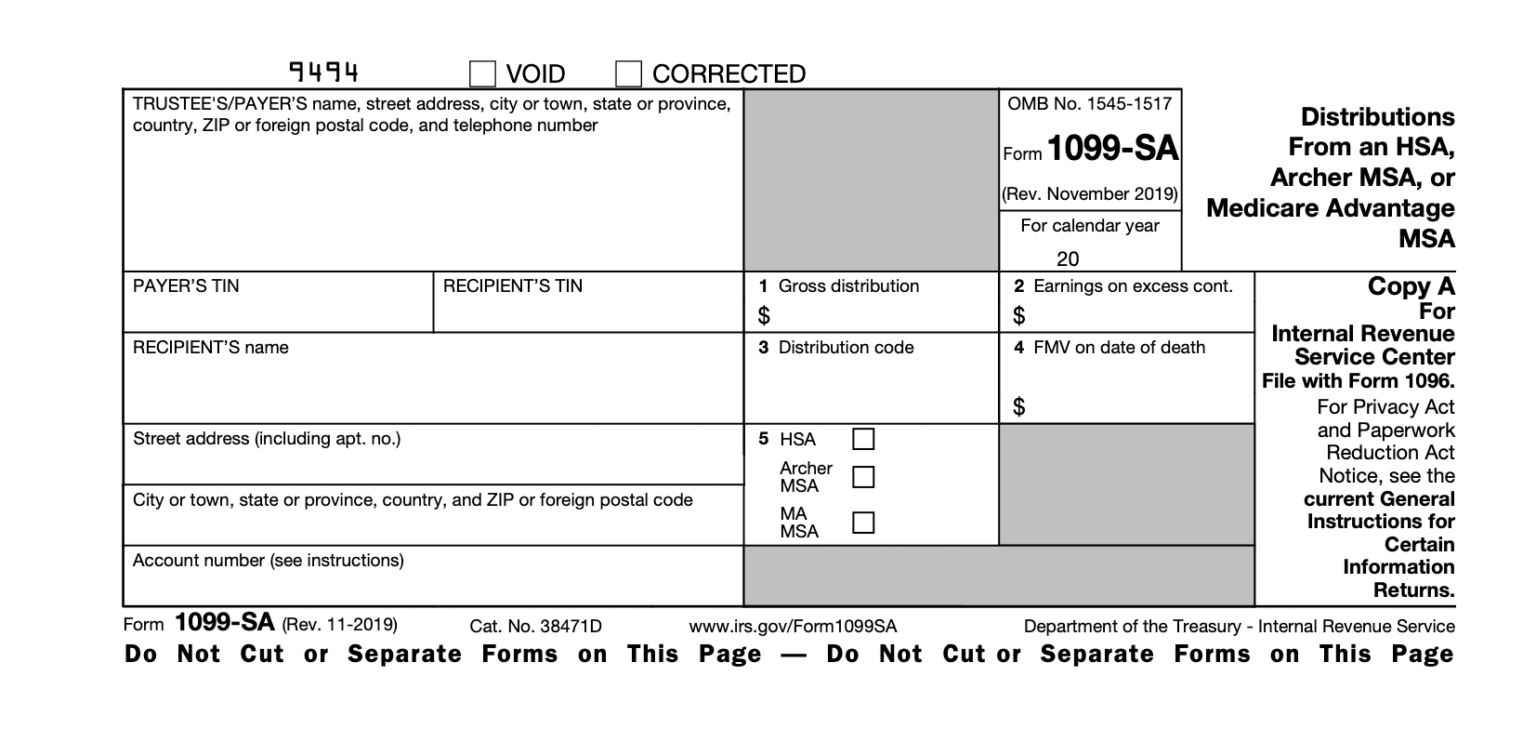

Whats A 1099 Sa Form

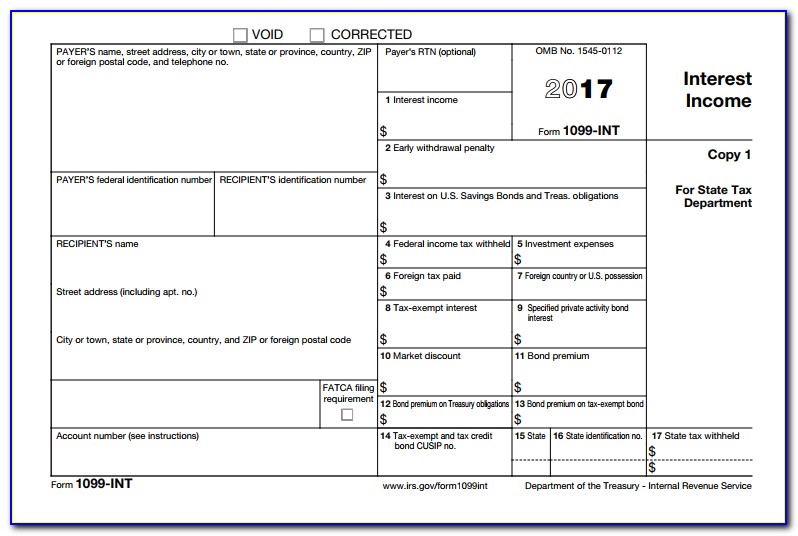

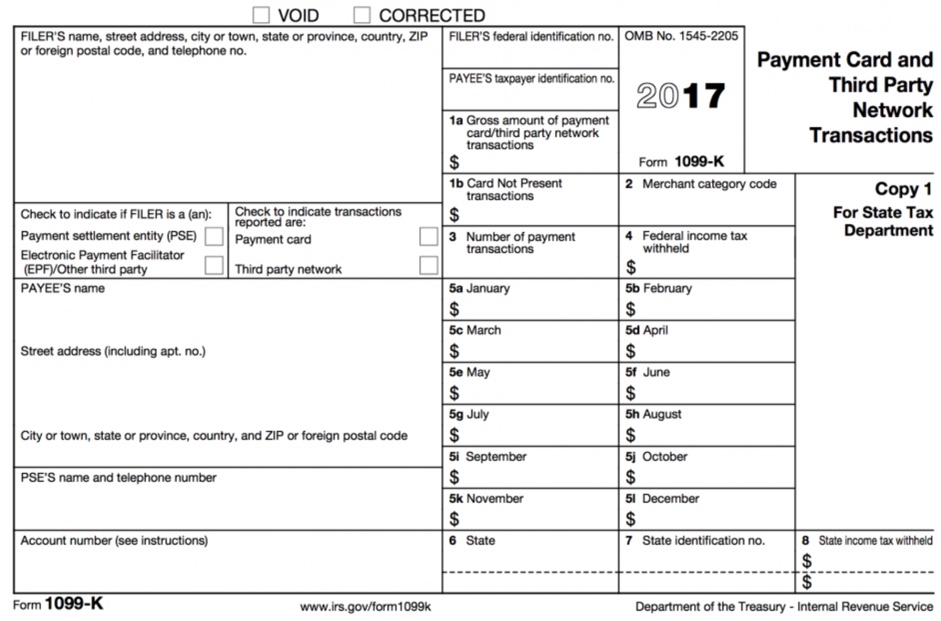

Whats A 1099 Sa Form - Let’s start with the basics. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer. And you’ll receive 1099s reporting withdrawals from 529 college. Web 6 min read june 14, 2017 h&r block the 1099 form is a common one that covers several types of situations. It distributes from an hsa, archer msa or medicare advantage msa which is used to record distributions from various health. Web for recipient this information is being furnished to the irs. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Depending on what’s happened in your financial life. Tax form that reports distributions made from a health savings account (hsa), archer medical savings account (archer msa), or medicare. Web what is a 1099 tax form?

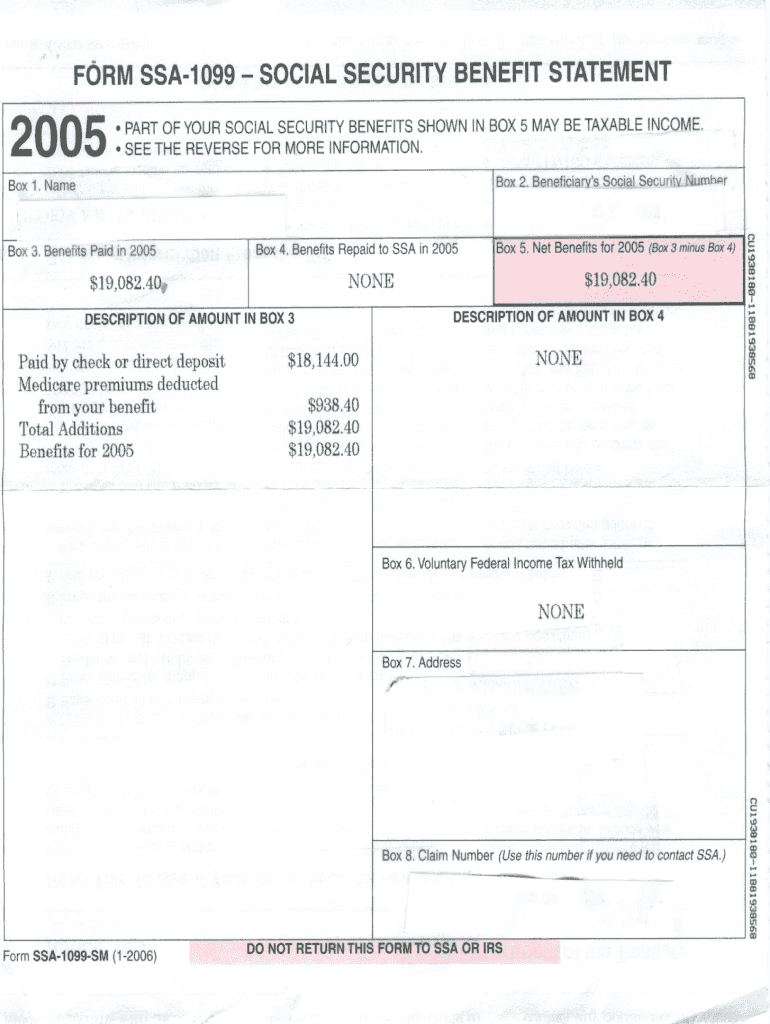

Web the social security administration sends a 1099 reporting the benefits you received during the year. When and where to file. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer. Depending on what’s happened in your financial life. It distributes from an hsa, archer msa or medicare advantage msa which is used to record distributions from various health. Here's how to add it in turbotax: Web 6 min read june 14, 2017 h&r block the 1099 form is a common one that covers several types of situations. Let’s start with the basics. Web what is a 1099 tax form? And you’ll receive 1099s reporting withdrawals from 529 college.

(keep for your records) www.irs.gov/form1099sa instructions for recipient distributions from a health savings. Here's how to add it in turbotax: Web 6 min read june 14, 2017 h&r block the 1099 form is a common one that covers several types of situations. Tax form that reports distributions made from a health savings account (hsa), archer medical savings account (archer msa), or medicare. Web the social security administration sends a 1099 reporting the benefits you received during the year. Web what is a 1099 tax form? When and where to file. Let’s start with the basics. It distributes from an hsa, archer msa or medicare advantage msa which is used to record distributions from various health. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer.

Don't wait until tax time to get ready to send your 1099 tax forms

Web a 1099 form is an information return form used by us payers to report business payments made to taxpayers of over $600 to the internal revenue service (irs). It distributes from an hsa, archer msa or medicare advantage msa which is used to record distributions from various health. Web a 1099 form is a record that an entity or.

¿Qué es un formulario 1099 del IRS? Qué significa y cómo funciona?

And you’ll receive 1099s reporting withdrawals from 529 college. It distributes from an hsa, archer msa or medicare advantage msa which is used to record distributions from various health. (keep for your records) www.irs.gov/form1099sa instructions for recipient distributions from a health savings. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account.

Where To Send Arizona 1099 Forms Form Resume Examples VX5Jm3lDjv

And you’ll receive 1099s reporting withdrawals from 529 college. There are 20 different types of 1099 forms, but don’t panic!. (keep for your records) www.irs.gov/form1099sa instructions for recipient distributions from a health savings. When and where to file. Web a 1099 form is an information return form used by us payers to report business payments made to taxpayers of over.

What Are 10 Things You Should Know About 1099s?

Let’s start with the basics. There are 20 different types of 1099 forms, but don’t panic!. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer. It distributes from an hsa, archer msa or medicare advantage msa which is used to record distributions from various health. Web the social security administration.

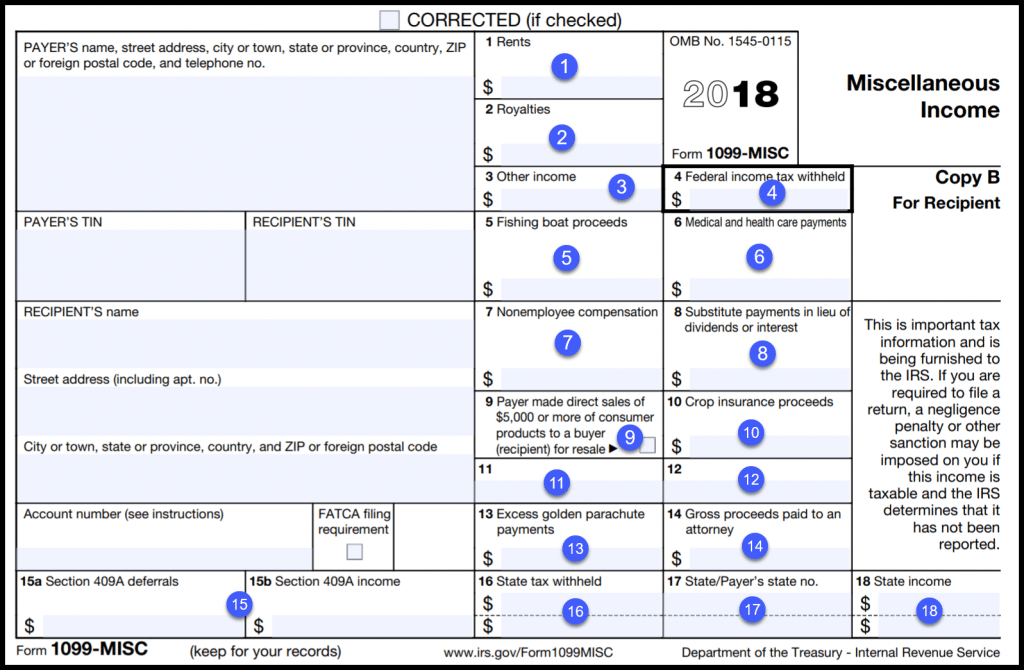

What is a 1099Misc Form? Financial Strategy Center

Depending on what’s happened in your financial life. And you’ll receive 1099s reporting withdrawals from 529 college. It distributes from an hsa, archer msa or medicare advantage msa which is used to record distributions from various health. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer. The payer fills out.

It’s time to file 1099s Avoid 50100 plus late penalties per form

(keep for your records) www.irs.gov/form1099sa instructions for recipient distributions from a health savings. Tax form that reports distributions made from a health savings account (hsa), archer medical savings account (archer msa), or medicare. Web a 1099 form is an information return form used by us payers to report business payments made to taxpayers of over $600 to the internal revenue.

IRS Form 1099 Reporting for Small Business Owners

Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer. The payer fills out the 1099 form and sends copies to you and. Web 6 min read june 14, 2017 h&r block the 1099 form is a common one that covers several types of situations. Web for recipient this information is.

How To Download 1099sa Form Paul Johnson's Templates

Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Web the social security administration sends a 1099 reporting the benefits you received during the year. Tax form that reports distributions made from a health savings account (hsa), archer medical savings account (archer msa), or medicare. Web a 1099.

How Do I Get Form Ssa 1099 For 2020 Darrin Kenney's Templates

(keep for your records) www.irs.gov/form1099sa instructions for recipient distributions from a health savings. And you’ll receive 1099s reporting withdrawals from 529 college. Web a 1099 form is an information return form used by us payers to report business payments made to taxpayers of over $600 to the internal revenue service (irs). Tax form that reports distributions made from a health.

Ssa 1099 Form 2019 Pdf Fill Online, Printable, Fillable, Blank

There are 20 different types of 1099 forms, but don’t panic!. The payer fills out the 1099 form and sends copies to you and. It distributes from an hsa, archer msa or medicare advantage msa which is used to record distributions from various health. Web a 1099 form is an information return form used by us payers to report business.

Here's How To Add It In Turbotax:

Web a 1099 form is an information return form used by us payers to report business payments made to taxpayers of over $600 to the internal revenue service (irs). Depending on what’s happened in your financial life. Web the social security administration sends a 1099 reporting the benefits you received during the year. Web what is a 1099 tax form?

Web For Recipient This Information Is Being Furnished To The Irs.

(keep for your records) www.irs.gov/form1099sa instructions for recipient distributions from a health savings. And you’ll receive 1099s reporting withdrawals from 529 college. There are 20 different types of 1099 forms, but don’t panic!. Tax form that reports distributions made from a health savings account ( hsa ), archer medical savings account (archer.

Web A 1099 Form Is A Record That An Entity Or Person Other Than Your Employer Gave Or Paid You Money.

Web 6 min read june 14, 2017 h&r block the 1099 form is a common one that covers several types of situations. Tax form that reports distributions made from a health savings account (hsa), archer medical savings account (archer msa), or medicare. It distributes from an hsa, archer msa or medicare advantage msa which is used to record distributions from various health. When and where to file.

Let’s Start With The Basics.

The payer fills out the 1099 form and sends copies to you and.

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)