When Is Form 2290 Due For 2023

When Is Form 2290 Due For 2023 - This revision if you need to file a return for a tax period that began on or before june 30, 2023. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web the irs form 2290 due date for heavy vehicle use taxes (hvut) is on august 31 of every year. Form 2290 due dates for vehicles first used on public. The current period begins july 1, 2023, and ends june 30, 2024. Web the current tax period for heavy highway vehicles begins on july 1, 2023, and ends on june 30, 2024. Web this july 2023 revision is for the tax period beginning on july 1, 2023, and ending on june 30, 2024. Form 2290 is due on the last day of the month following the vehicle's first use month. If you fail to file by this date, you may be subject to penalties and interest on any taxes owed. Irs heavy vehicle use tax (hvut) form 2290 due is on august 31st of every year.

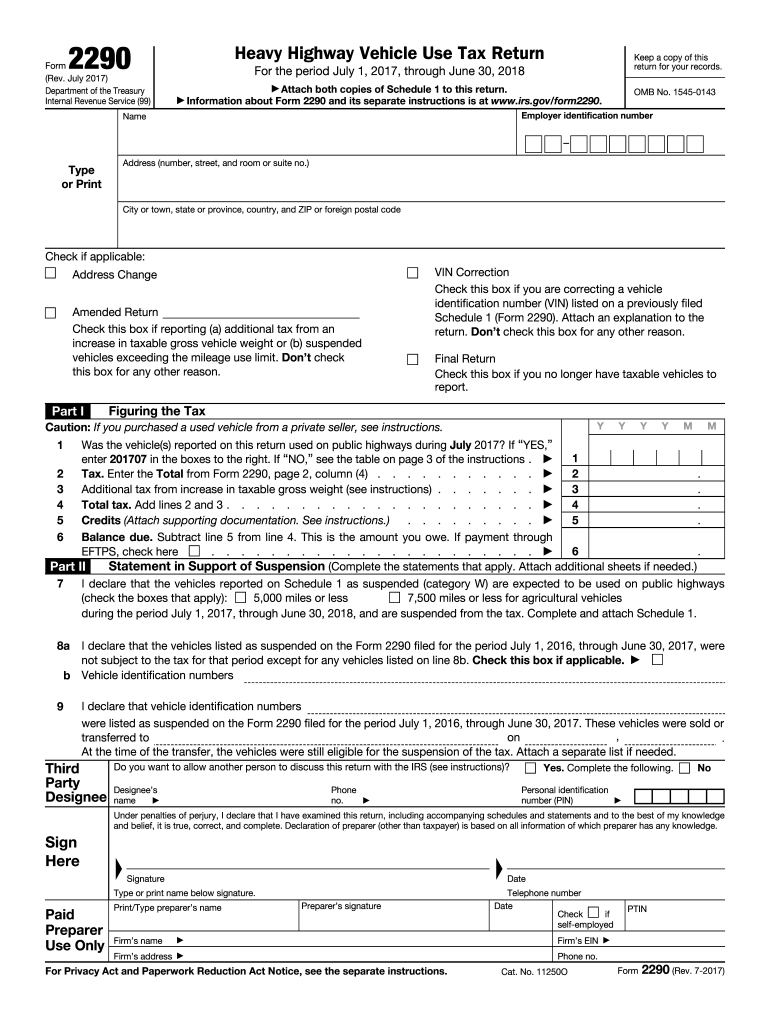

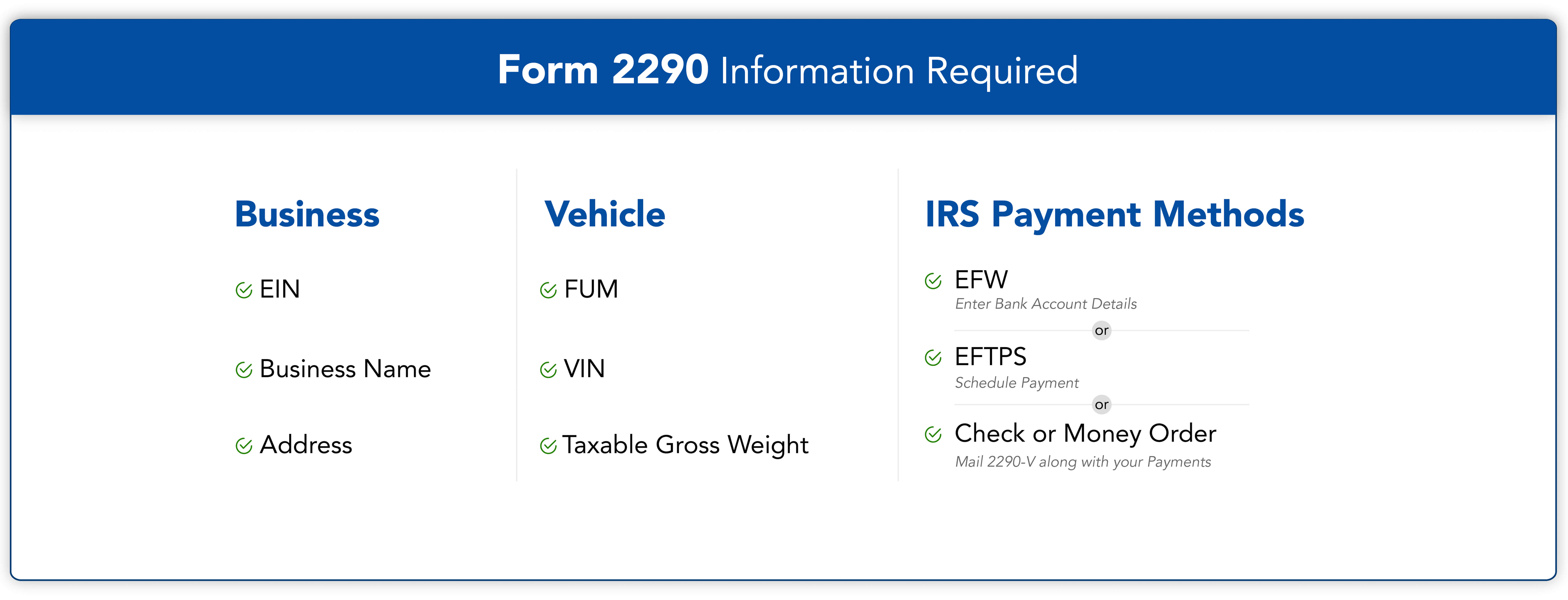

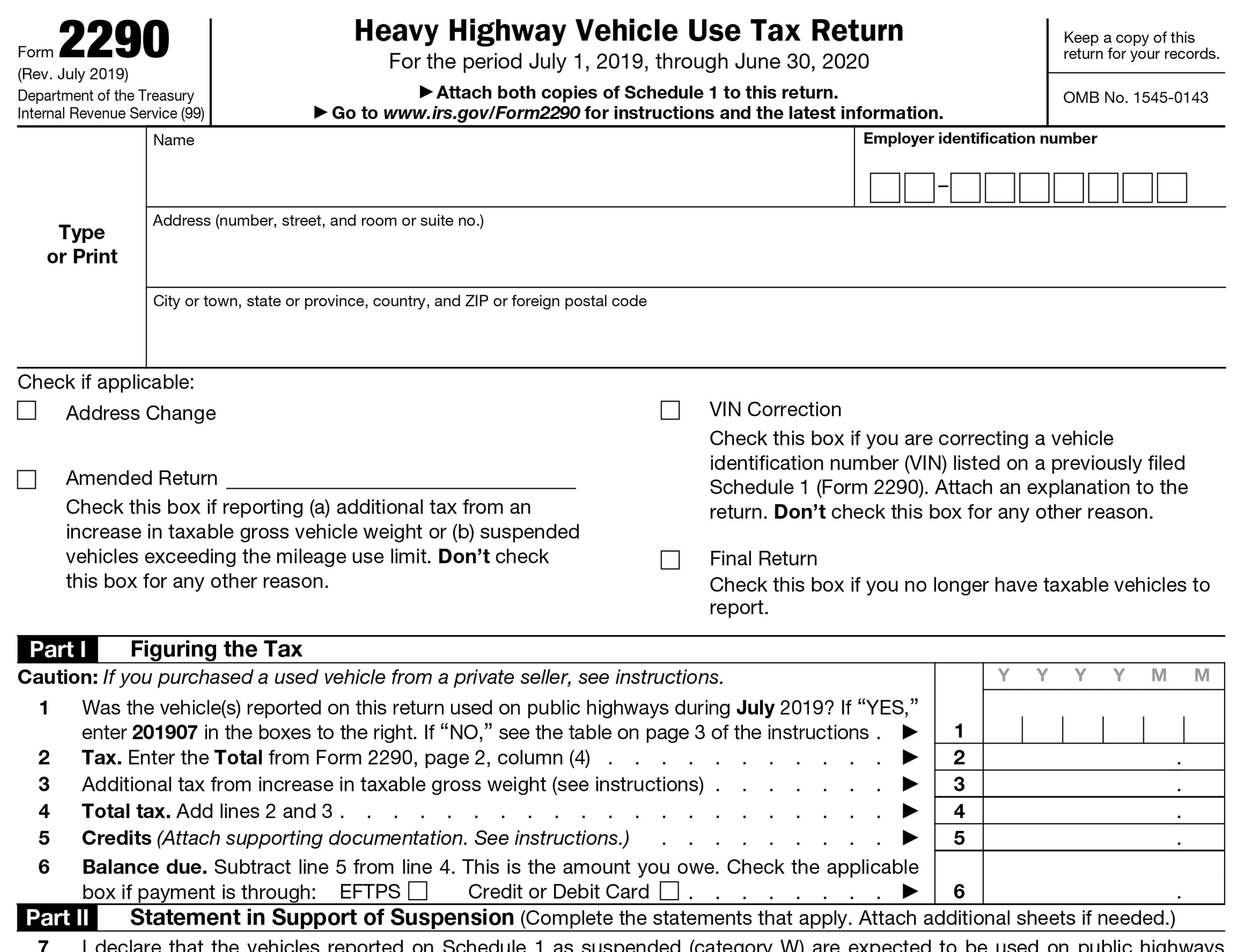

If you have vehicles with a combined gross weight of 55,000 pounds or more, the irs requires you to file heavy vehicle use tax form 2290 each year by august 31. Tax computation for privately purchased used vehicles Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Irs heavy vehicle use tax (hvut) form 2290 due is on august 31st of every year. Most trucking businesses put their trucks on road by july for every tax period and they will have the deadline by the last date of the following month i. Web the current tax period for heavy highway vehicles begins on july 1, 2023, and ends on june 30, 2024. Form 2290 due dates for vehicles first used on public. It’s important to note that this deadline applies to all vehicles from july 1, 2023, through june 30, 2024. Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). Web form 2290 due dates and extended due dates for tax year 2023

Most trucking businesses put their trucks on road by july for every tax period and they will have the deadline by the last date of the following month i. To obtain a prior revision of form 2290 and its separate instructions, visit. Form 2290 due dates for vehicles first used on public. If the due date falls on a saturday, sunday or any federal holidays, you should file form 2290. The current period begins july 1, 2023, and ends june 30, 2024. If you fail to file by this date, you may be subject to penalties and interest on any taxes owed. This revision if you need to file a return for a tax period that began on or before june 30, 2023. Irs heavy vehicle use tax (hvut) form 2290 due is on august 31st of every year. Web form 2290 due dates and extended due dates for tax year 2023 What is the irs form 2290 due date?

Irs 8962 form 2018 Brilliant 50 Beautiful Printable 2290 form Wallpaper

Web john must file form 2290 by august 31, 2023, for the period beginning july 1, 2023, through june 30, 2024. Form 2290 is due on the last day of the month following the vehicle's first use month. Web form 2290 due dates and extended due dates for tax year 2023 What is the irs form 2290 due date? Web.

20232024 Form 2290 Generator Fill, Create & Download 2290

Irs heavy vehicle use tax (hvut) form 2290 due is on august 31st of every year. What is the irs form 2290 due date? Tax computation for privately purchased used vehicles Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. To obtain a prior revision of form 2290 and its separate instructions,.

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

Form 2290 must be filed by the last day of the month following the month of first use (as shown in the chart, later). To obtain a prior revision of form 2290 and its separate instructions, visit. Web the irs form 2290 due date for heavy vehicle use taxes (hvut) is on august 31 of every year. If you fail.

PreFile 2290 Form Online for 20222023 Tax Year & Pay HVUT Later

Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. This revision if you need to file a return for a tax period that began on or before june 30, 2023. It’s important to note that this deadline applies to all vehicles from july 1, 2023, through june.

IRS Form 2290 Due Date For 20232024 Tax Period

Form 2290 due dates for vehicles first used on public. This revision if you need to file a return for a tax period that began on or before june 30, 2023. Web john must file form 2290 by august 31, 2023, for the period beginning july 1, 2023, through june 30, 2024. Web form 2290 must be filed for the.

File IRS 2290 Form Online for 20222023 Tax Period

This revision if you need to file a return for a tax period that began on or before june 30, 2023. Tax computation for privately purchased used vehicles Web this july 2023 revision is for the tax period beginning on july 1, 2023, and ending on june 30, 2024. If you have vehicles with a combined gross weight of 55,000.

IRS Form 2290 Instructions for 20222023

The current period begins july 1, 2023, and ends june 30, 2024. Web the irs form 2290 due date for heavy vehicle use taxes (hvut) is on august 31 of every year. Web the current tax period for heavy highway vehicles begins on july 1, 2023, and ends on june 30, 2024. Irs heavy vehicle use tax (hvut) form 2290.

Irs Form 2290 Printable Form Resume Examples

If you are still using the same truck as last year, august 31 will be the due date for each tax period. Form 2290 due dates for vehicles first used on public. Irs heavy vehicle use tax (hvut) form 2290 due is on august 31st of every year. Web form 2290 must be filed for the month the taxable vehicle.

IRS Form 2290 Due Date For 20222023 Tax Period

Most trucking businesses put their trucks on road by july for every tax period and they will have the deadline by the last date of the following month i. Web form 2290 due dates and extended due dates for tax year 2023 It’s important to note that this deadline applies to all vehicles from july 1, 2023, through june 30,.

Printable IRS Form 2290 for 2020 Download 2290 Form

Web john must file form 2290 by august 31, 2023, for the period beginning july 1, 2023, through june 30, 2024. What is the irs form 2290 due date? Form 2290 is due on the last day of the month following the vehicle's first use month. Form 2290 is used to figure and pay the tax due on certain heavy.

The Current Tax Period For Heavy Highway Vehicles Begins On July 1, 2023, And Ends On June 30, 2024.

If you are still using the same truck as last year, august 31 will be the due date for each tax period. What is the irs form 2290 due date? Tax computation for privately purchased used vehicles To obtain a prior revision of form 2290 and its separate instructions, visit.

Form 2290 Is Used To Figure And Pay The Tax Due On Certain Heavy Highway Motor Vehicles.

Web the irs form 2290 due date for heavy vehicle use taxes (hvut) is on august 31 of every year. Web form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. Form 2290 is due on the last day of the month following the vehicle's first use month. It’s important to note that this deadline applies to all vehicles from july 1, 2023, through june 30, 2024.

Most Trucking Businesses Put Their Trucks On Road By July For Every Tax Period And They Will Have The Deadline By The Last Date Of The Following Month I.

If the due date falls on a saturday, sunday or any federal holidays, you should file form 2290. If you fail to file by this date, you may be subject to penalties and interest on any taxes owed. Irs heavy vehicle use tax (hvut) form 2290 due is on august 31st of every year. Web this july 2023 revision is for the tax period beginning on july 1, 2023, and ending on june 30, 2024.

Form 2290 Must Be Filed By The Last Day Of The Month Following The Month Of First Use (As Shown In The Chart, Later).

If you have vehicles with a combined gross weight of 55,000 pounds or more, the irs requires you to file heavy vehicle use tax form 2290 each year by august 31. Form 2290 due dates for vehicles first used on public. The current period begins july 1, 2023, and ends june 30, 2024. Web the current tax period for heavy highway vehicles begins on july 1, 2023, and ends on june 30, 2024.