When Is Form 5500 Due For 2022

When Is Form 5500 Due For 2022 - Web january 17 // deadline for final minimum funding quarterly installment payment for defined benefit plans that had a funding shortfall in 2020 —i.e., due 15 days. August 4, 2022 in this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings. Web vynm2 • 1 min. Yes, form 5500 is due on july 31st for the previous year. Effective march 28 2023, only the. Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: Web new and noteworthy efast2 website credentials are changing to login.gov. 1, 2022 for calendar year plans posted july 14, 2022 employers with employee benefit plans that operate on a calendar year basis must. Web advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil penalties for late filings and. We mail cp403 15 months after the original due.

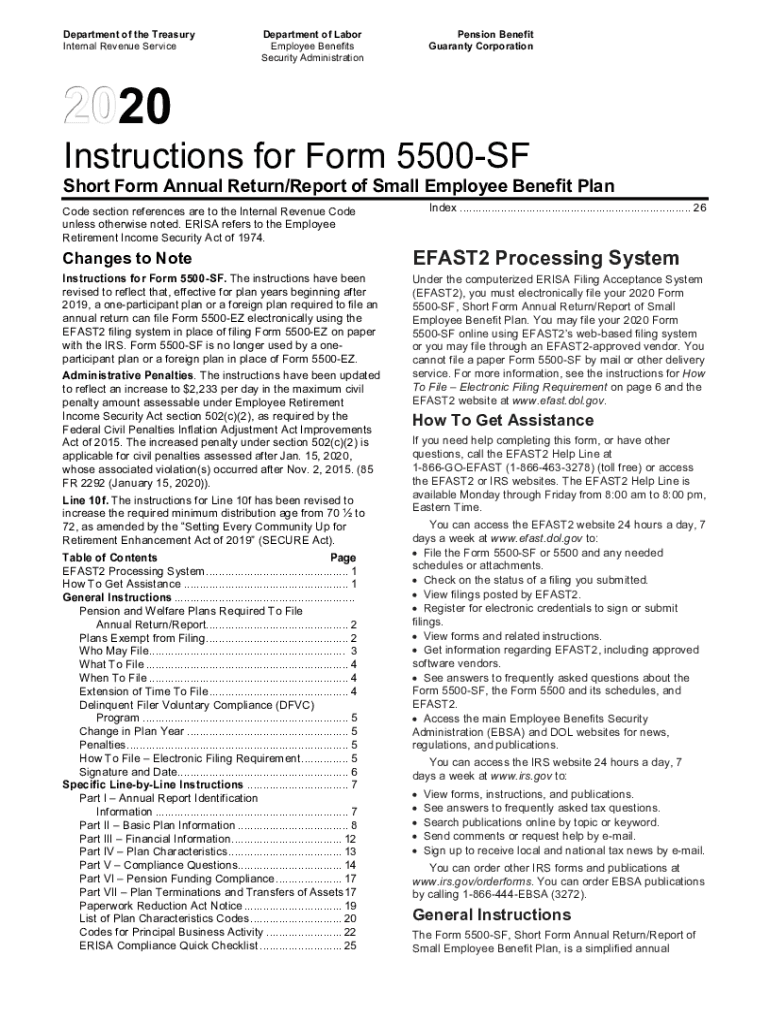

Department of labor, internal revenuevice ser , and the pension benefit. Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: Web form 5500 is due by aug. Web if the filing due date falls on a saturday, sunday or federal holiday, the form 5500 may be filed on the next day that is not a saturday, sunday or federal holiday. 15th, but if the filing due date falls on a saturday, sunday or. Search site you are here. Effective march 28 2023, only the. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Yes, form 5500 is due on july 31st for the previous year. Web schedule a (form 5500) 2022 page 4 part iii welfare benefit contract information if more than one contract covers the same group of employees of the same.

Web advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil penalties for late filings and. Web itr due date 2023 news updates on. Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: So, if you didn't open your 401k until sometime in 2023, you won't need to file form 5500 until 2024. 15th, but if the filing due date falls on a saturday, sunday or. This does not change efast2 signature credentials. Web the agencies published a notice of proposed forms revisions in september 2021. Effective march 28 2023, only the. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web if the filing due date falls on a saturday, sunday or federal holiday, the form 5500 may be filed on the next day that is not a saturday, sunday or federal holiday.

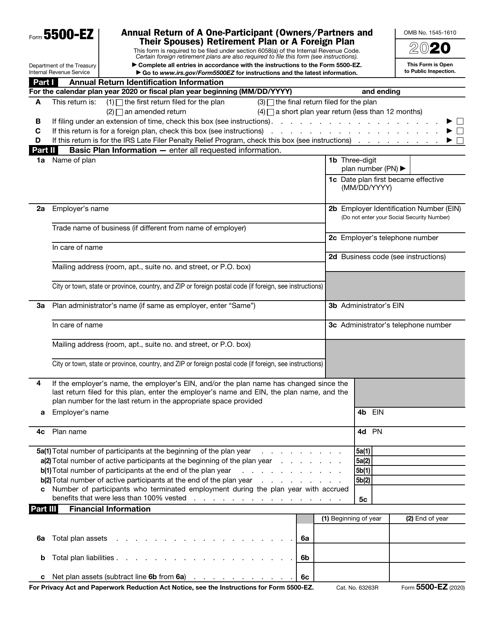

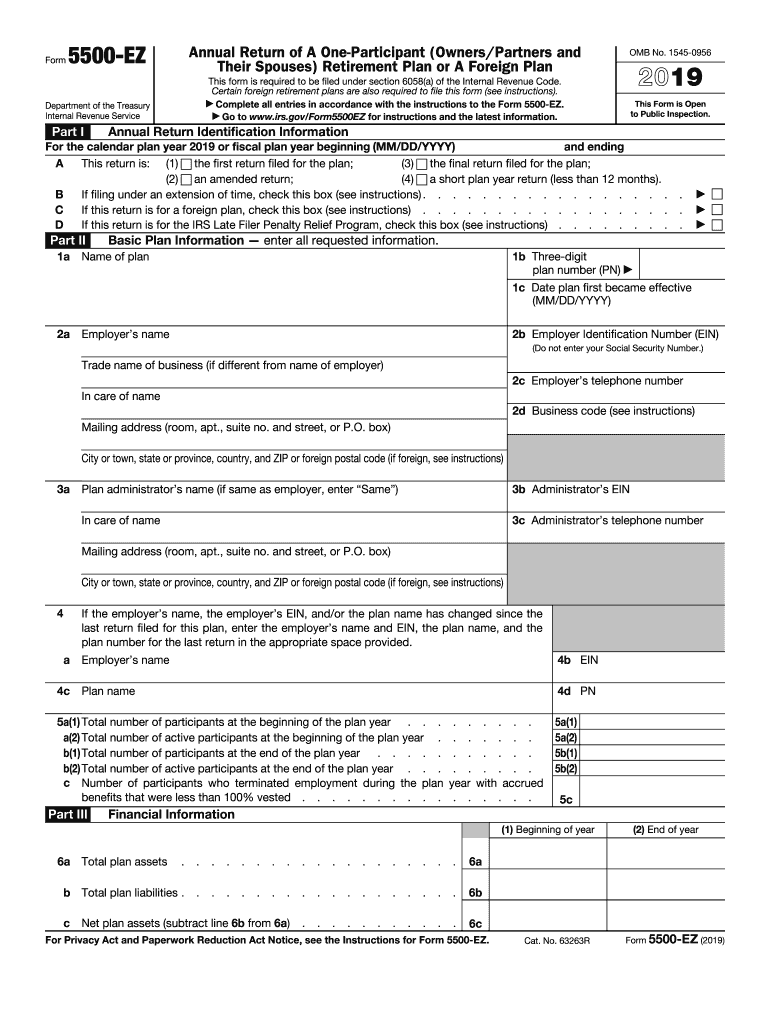

IRS Form 5500EZ Download Fillable PDF or Fill Online Annual Return of

1, 2022 for calendar year plans posted july 14, 2022 employers with employee benefit plans that operate on a calendar year basis must. Web schedule a (form 5500) 2022 page 4 part iii welfare benefit contract information if more than one contract covers the same group of employees of the same. Search site you are here. Department of labor, internal.

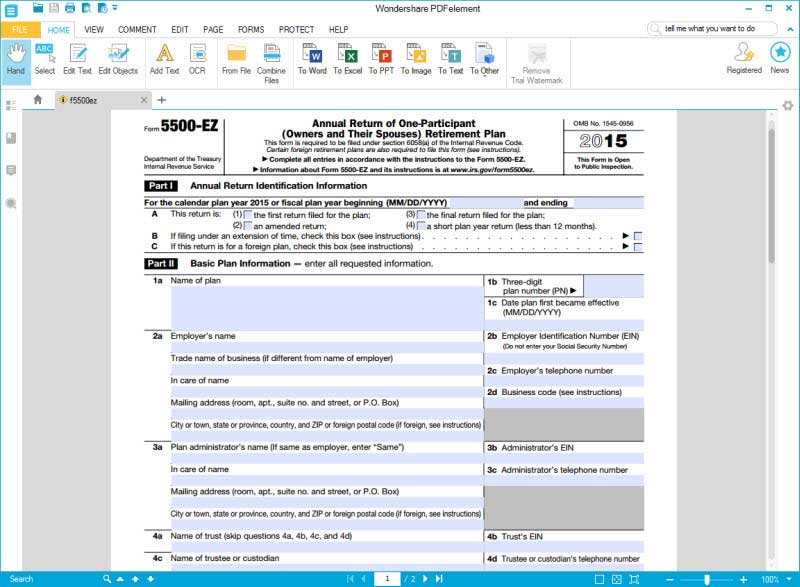

IRS Form 5500EZ Use the Most Efficient Tool to Fill it

Effective march 28 2023, only the. Web itr due date 2023 news updates on. This does not change efast2 signature credentials. August 4, 2022 in this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings. We mail cp403 15 months after the original due.

Know the Considerations for Form 5500 Prenger and Profitt

Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: 15th, but if the filing due date falls on a saturday, sunday or. Effective march 28 2023, only the. A separate federal register notice was published in december 2021. Yes, form 5500 is due on july 31st for the previous year.

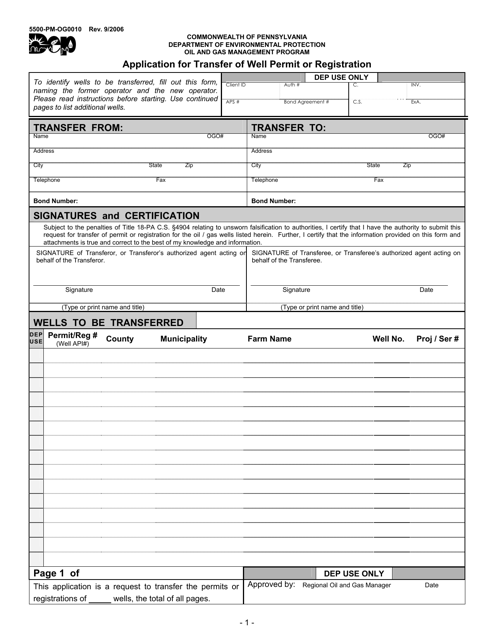

Form 5500PMOG0010 Download Printable PDF or Fill Online Application

So, if you didn't open your 401k until sometime in 2023, you won't need to file form 5500 until 2024. Search site you are here. Web vynm2 • 1 min. Yes, form 5500 is due on july 31st for the previous year. Web january 17 // deadline for final minimum funding quarterly installment payment for defined benefit plans that had.

2019 Form IRS 5500EZ Fill Online, Printable, Fillable, Blank pdfFiller

This does not change efast2 signature credentials. Web january 17 // deadline for final minimum funding quarterly installment payment for defined benefit plans that had a funding shortfall in 2020 —i.e., due 15 days. Search site you are here. (1) the first return filed for the plan (3) the final return filed for the plan (2). Web for the calendar.

Form 5500 Annual Fill Out and Sign Printable PDF Template signNow

Web new and noteworthy efast2 website credentials are changing to login.gov. Web if the filing due date falls on a saturday, sunday or federal holiday, the form 5500 may be filed on the next day that is not a saturday, sunday or federal holiday. Web schedule a (form 5500) 2022 page 4 part iii welfare benefit contract information if more.

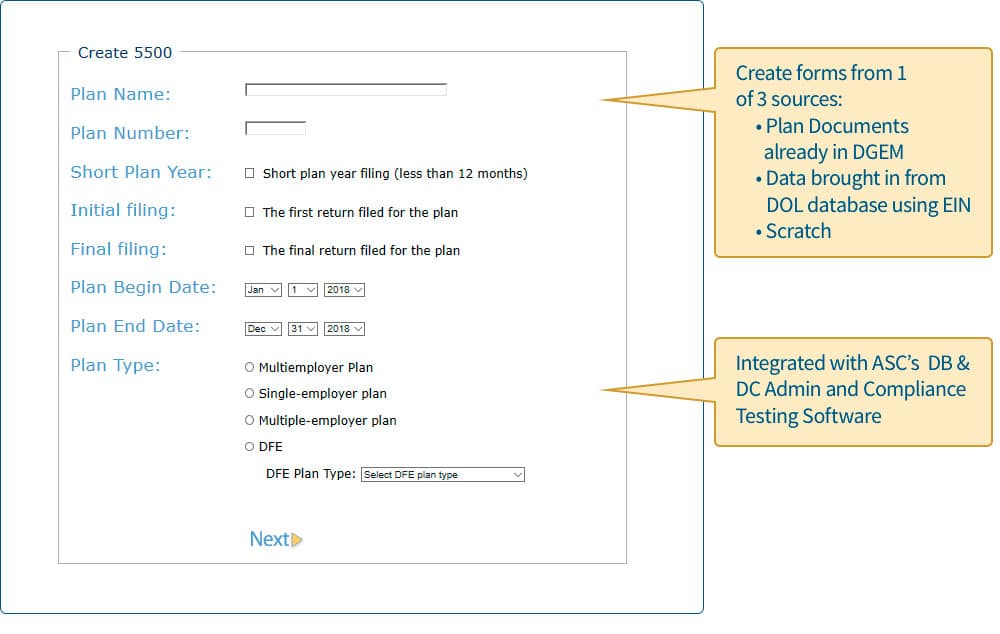

5500 Forms for Qualified Retirement Plans

Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: August 4, 2022 in this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings. Web new and noteworthy efast2 website credentials are changing to login.gov. This does not change efast2.

Form 5500 Due Date Avoid Serious Late Filing Penalties BASIC

Search site you are here. This does not change efast2 signature credentials. A separate federal register notice was published in december 2021. Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of.

Pin on calendar ideas

Effective march 28 2023, only the. Web schedule a (form 5500) 2022 page 4 part iii welfare benefit contract information if more than one contract covers the same group of employees of the same. Department of labor, internal revenuevice ser , and the pension benefit. Web vynm2 • 1 min. 15th, but if the filing due date falls on a.

Retirement plan 5500 due date Early Retirement

Web new and noteworthy efast2 website credentials are changing to login.gov. Web schedule a (form 5500) 2022 page 4 part iii welfare benefit contract information if more than one contract covers the same group of employees of the same. Yes, form 5500 is due on july 31st for the previous year. Web january 17 // deadline for final minimum funding.

Web If The Filing Due Date Falls On A Saturday, Sunday Or Federal Holiday, The Form 5500 May Be Filed On The Next Day That Is Not A Saturday, Sunday Or Federal Holiday.

Web itr due date 2023 news updates on. August 4, 2022 in this primer article we highlight who must file, the deadlines to file, and the extensions of time available to those filings. 15th, but if the filing due date falls on a saturday, sunday or. Web new and noteworthy efast2 website credentials are changing to login.gov.

Web The Agencies Published A Notice Of Proposed Forms Revisions In September 2021.

So, if you didn't open your 401k until sometime in 2023, you won't need to file form 5500 until 2024. Web advance copies of form 5500 information returns, to report on plan year 2021 benefits during 2022, reflect an increase in maximum civil penalties for late filings and. Web for the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and ending a this return is: Department of labor, internal revenue service, and pension benefit guaranty corporation to simplify and expedite the.

Yes, Form 5500 Is Due On July 31St For The Previous Year.

Web form 5500 is due by aug. This does not change efast2 signature credentials. Department of labor, internal revenuevice ser , and the pension benefit. Effective march 28 2023, only the.

A Separate Federal Register Notice Was Published In December 2021.

Web vynm2 • 1 min. Search site you are here. Web schedule a (form 5500) 2022 page 4 part iii welfare benefit contract information if more than one contract covers the same group of employees of the same. We mail cp403 15 months after the original due.