When Is Irs Form 712 Required

When Is Irs Form 712 Required - In that case, you may need to become familiar with irs form 712, life insurance statement. Web the irs form 712 is a statement that provides life insurance policy values as of the date of an insured’s or policy owner's death, or at a time a life insurance policy is transferred as a gift. Who must file an irs form 706? Taxation of death benefits paid on a life insurance policy internal revenue service form 712 is primarily. The irs requires that this statement be included. Web step by step instructions comments if you’re the executor of a decedent’s estate, you may be required to include the value of any life insurance proceeds in the gross estate for federal estate tax purposes. Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Web life insurance death proceeds form 712 did you mean: Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706 estate tax return after death. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes.

Web the irs form 712 is a statement that provides life insurance policy values as of the date of an insured’s or policy owner's death, or at a time a life insurance policy is transferred as a gift. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. In that case, you may need to become familiar with irs form 712, life insurance statement. If your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706 estate tax return after death. Decedent tax return 1041 filing requirement 3. Web step by step instructions comments if you’re the executor of a decedent’s estate, you may be required to include the value of any life insurance proceeds in the gross estate for federal estate tax purposes. Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. The irs requires that this statement be included.

Taxation of death benefits paid on a life insurance policy internal revenue service form 712 is primarily. Web step by step instructions comments if you’re the executor of a decedent’s estate, you may be required to include the value of any life insurance proceeds in the gross estate for federal estate tax purposes. Web what is an irs form 712? Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Web life insurance death proceeds form 712 did you mean: In that case, you may need to become familiar with irs form 712, life insurance statement. Web the irs form 712 is a statement that provides life insurance policy values as of the date of an insured’s or policy owner's death, or at a time a life insurance policy is transferred as a gift. Decedent tax return 1041 filing requirement 3. If your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. Who must file an irs form 706?

IRS Form 712 A Guide to the Life Insurance Statement

Web life insurance death proceeds form 712 did you mean: Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Decedent tax return 1041 filing requirement 3. Taxation of death benefits paid on a life insurance policy internal revenue service form 712 is primarily. Web step by step instructions comments if.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

At the request of the estate’s administrator/executor, we will complete this form to provide the. Decedent tax return 1041 filing requirement 3. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions.

What is form 712? Protective Life

Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Taxation of death benefits paid on a life insurance policy internal revenue service form.

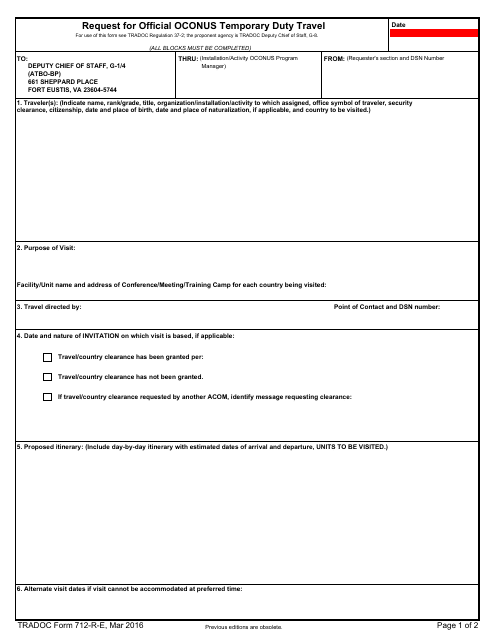

TRADOC Form 712RE Download Fillable PDF or Fill Online Request for

Web what is an irs form 712? Decedent tax return 1041 filing requirement 3. Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes..

Irs Form 7004 Required To Be E Filed Universal Network

Web what is an irs form 712? Web the irs form 712 is a statement that provides life insurance policy values as of the date of an insured’s or policy owner's death, or at a time a life insurance policy is transferred as a gift. Web step by step instructions comments if you’re the executor of a decedent’s estate, you.

Form 712 Life Insurance Statement (2006) Free Download

Web what is an irs form 712? At the request of the estate’s administrator/executor, we will complete this form to provide the. Web form 712 should be included with any form 709 gift tax return related to certain policy transfers during the insured’s lifetime to establish the value of the gift as well as with the form 706 estate tax.

File IRS 2290 Form Online for 20222023 Tax Period

Web what is an irs form 712? At the request of the estate’s administrator/executor, we will complete this form to provide the. Decedent tax return 1041 filing requirement 3. Taxation of death benefits paid on a life insurance policy internal revenue service form 712 is primarily. Web step by step instructions comments if you’re the executor of a decedent’s estate,.

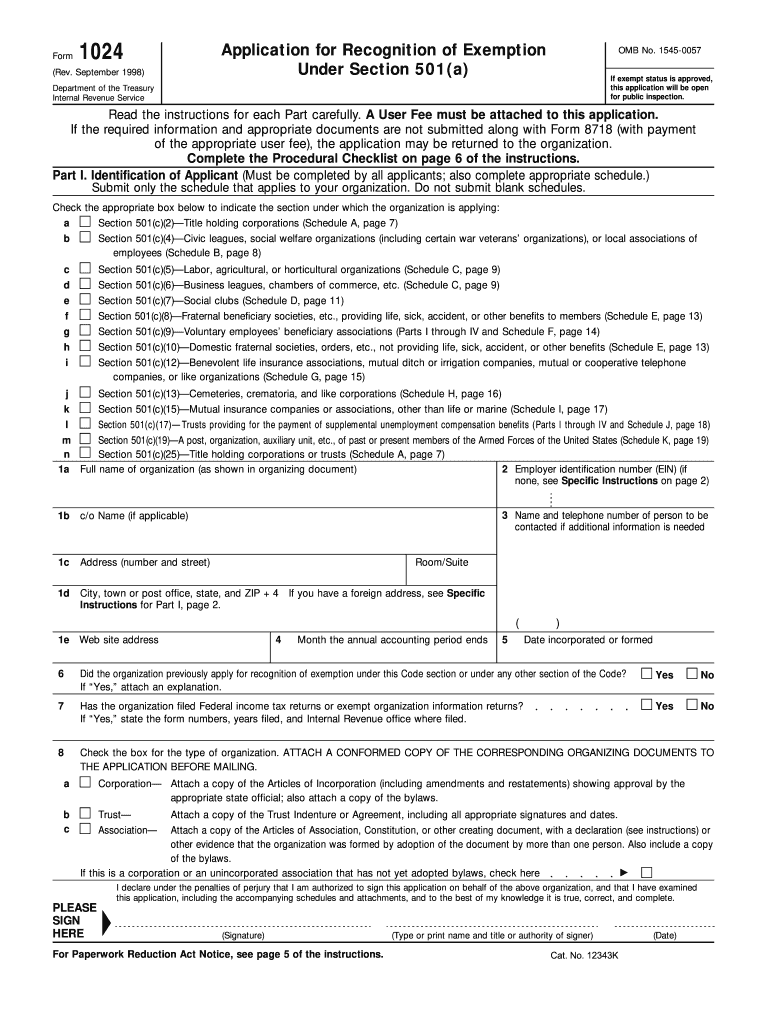

Irs Form 1024 Fill Out and Sign Printable PDF Template signNow

Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web the irs form 712 is a statement that provides life insurance policy values as of the date of an insured’s or policy owner's death, or at a time a life insurance policy is transferred as a.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

At the request of the estate’s administrator/executor, we will complete this form to provide the. If your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. Web what is an irs form 712? Web step by step instructions comments if you’re the executor of a decedent’s estate, you may be required to include.

Form 712 Life Insurance Statement (2006) Free Download

Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Irs form 712 is a gift or estate tax form that may need to be filed with the deceased’s final estate tax return. Web step by step instructions comments if you’re the executor of a decedent’s estate,.

Irs Form 712 Is A Gift Or Estate Tax Form That May Need To Be Filed With The Deceased’s Final Estate Tax Return.

Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Web what is an irs form 712? Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Who must file an irs form 706?

Web Form 712 Should Be Included With Any Form 709 Gift Tax Return Related To Certain Policy Transfers During The Insured’s Lifetime To Establish The Value Of The Gift As Well As With The Form 706 Estate Tax Return After Death.

The irs requires that this statement be included. Decedent tax return 1041 filing requirement 3. Web step by step instructions comments if you’re the executor of a decedent’s estate, you may be required to include the value of any life insurance proceeds in the gross estate for federal estate tax purposes. Web the irs form 712 is a statement that provides life insurance policy values as of the date of an insured’s or policy owner's death, or at a time a life insurance policy is transferred as a gift.

In That Case, You May Need To Become Familiar With Irs Form 712, Life Insurance Statement.

At the request of the estate’s administrator/executor, we will complete this form to provide the. Taxation of death benefits paid on a life insurance policy internal revenue service form 712 is primarily. If your mother's estate was less than (approximately) $5.4 million, you are not required to file form 706. Web life insurance death proceeds form 712 did you mean: