Where Do I Mail Form 1310 To The Irs

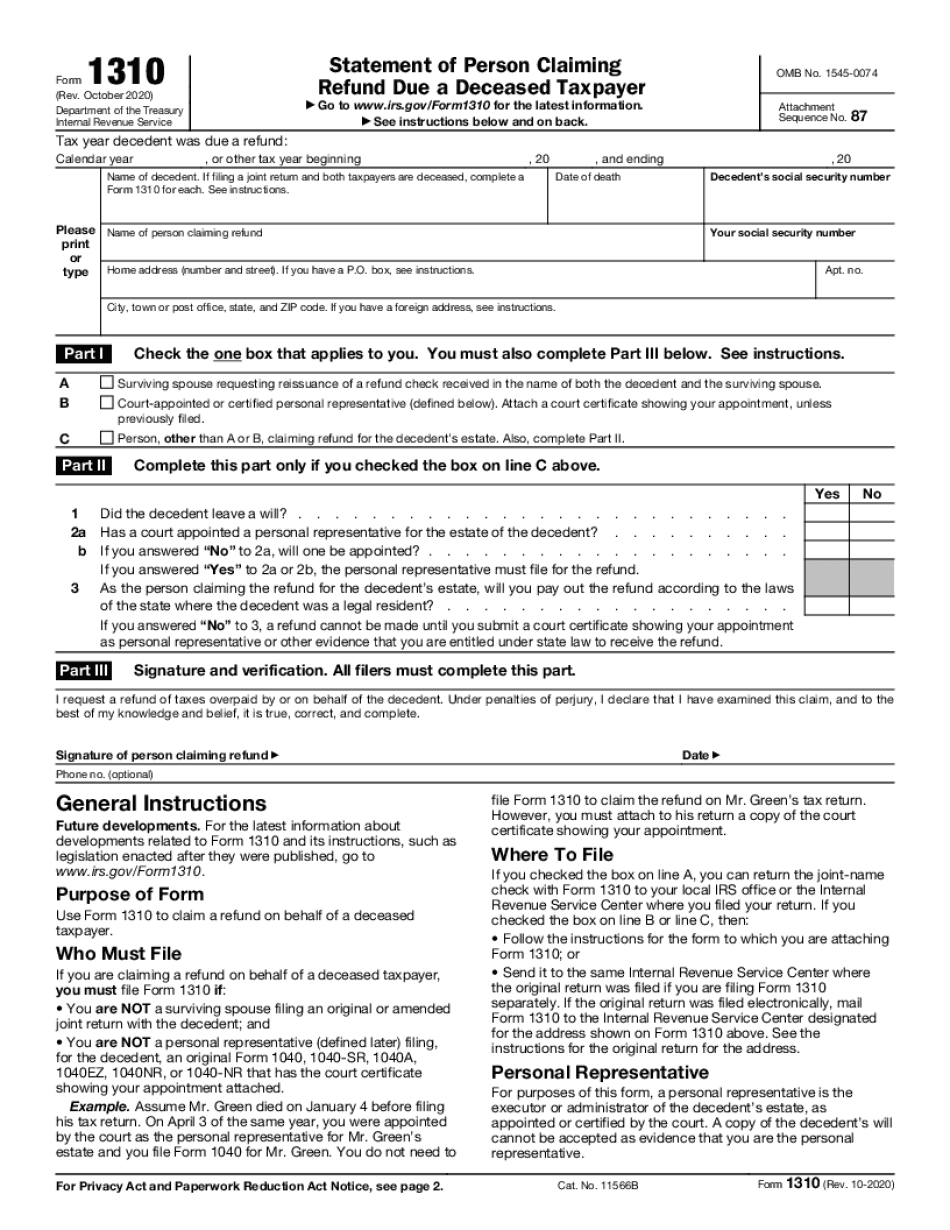

Where Do I Mail Form 1310 To The Irs - Web irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that a taxpayer has passed away and a trust or beneficiary will be. Fill, sign, print and send online instantly. You can prepare the form and then mail it in to the same irs service center as the decedent's. Read the blog to know about the form. Also, complete part ii and mail it to irs with. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web the irs has set specific electronic filing guidelines for form 1310. Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. Securely download your document with other editable. Web 1 day agofor years, the irs has warned about scammers using phone calls, text messages, emails and even social media.

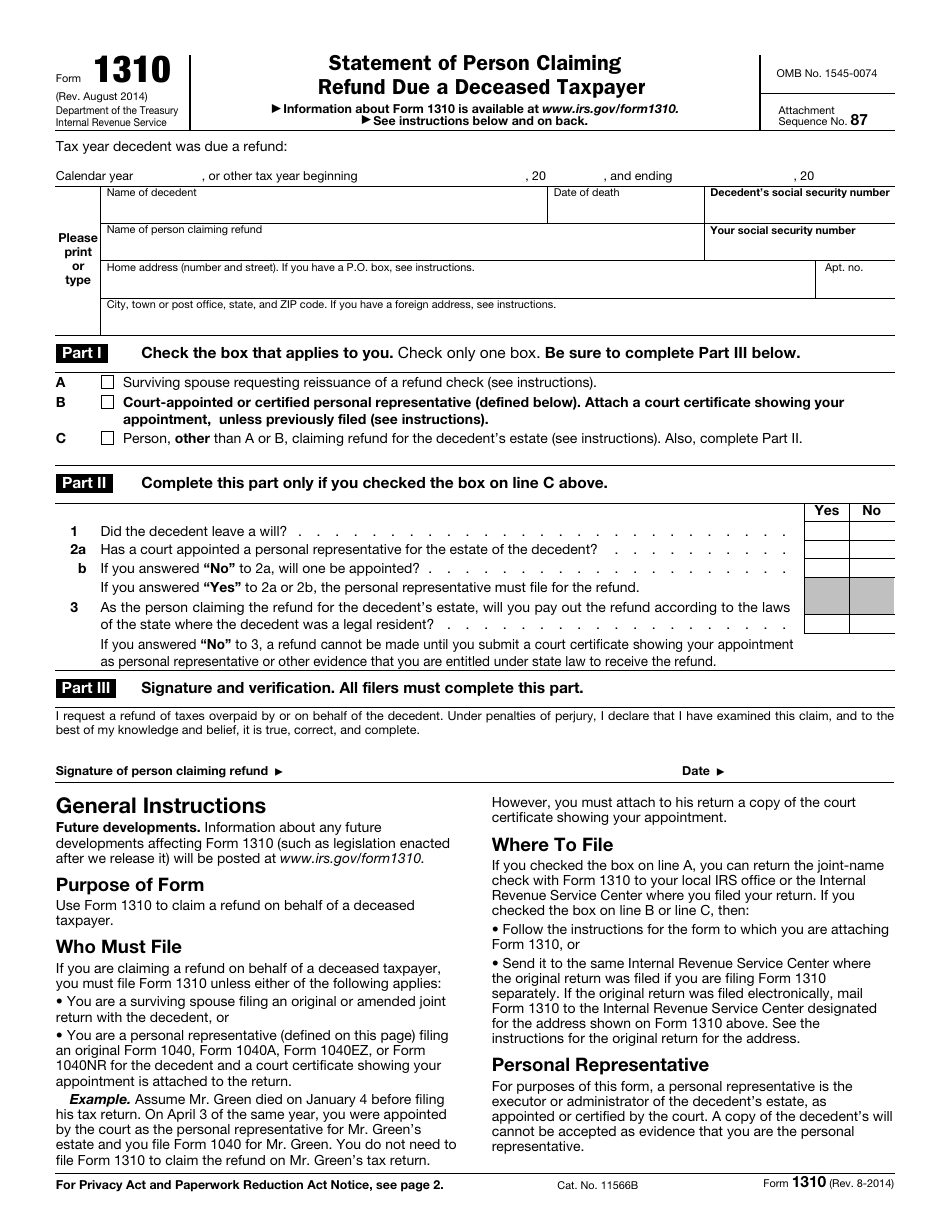

If data entry on the 1310 screen does not meet the irs guidelines, there will be elf critical diagnostics and error. If the taxpayer's ssn was not locked yet and. Fill, sign, print and send online instantly. Web taxpayer refund due a deceased statement of person claiming tax year decedent was due a refund: If you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you filed your return. Web the irs has set specific electronic filing guidelines for form 1310. Web if a refund is due to the decedent, it may be necessary to file form 1310, statement of person claiming refund due a deceased taxpayer with the return. Web 1 day agofor years, the irs has warned about scammers using phone calls, text messages, emails and even social media. Web where do i mail form 1310? Web send it to the same internal revenue service center where the original return was filed if you are filing form 1310 separately.

If the taxpayer's ssn was not locked yet and. Web the irs has set specific electronic filing guidelines for form 1310. Person, other than a or b, claiming a refund for the decedent’s estate. Web 1 day agofor years, the irs has warned about scammers using phone calls, text messages, emails and even social media. December 2021) department of the treasury internal revenue service go omb no. Securely download your document with other editable. Read the blog to know about the form. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web 1310 statement of person claiming refund due a deceased taxpayer form (rev. If you aren’t the surviving.

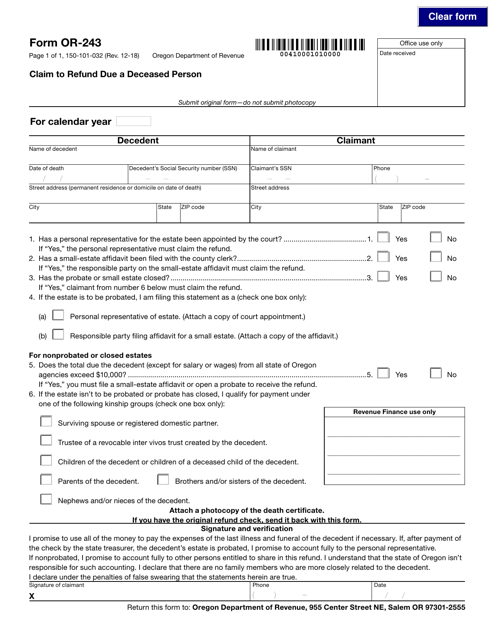

If IRS Letter arrives in the mail? WXC Corporation

If the taxpayer's ssn was not locked yet and. Web if a refund is due on the individual income tax return of the deceased, claim the refund by submitting form 1310, statement of a person claiming refund due a. Web click on c in part i of form 1310 where it asks. Calendar year , or other tax year beginning.

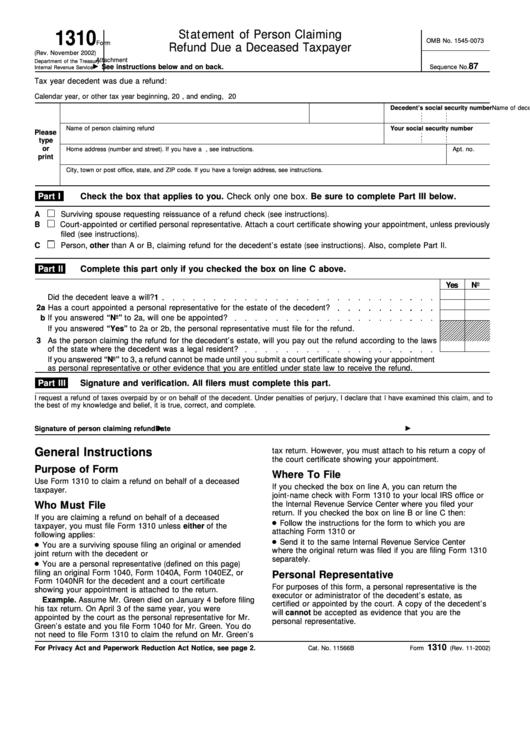

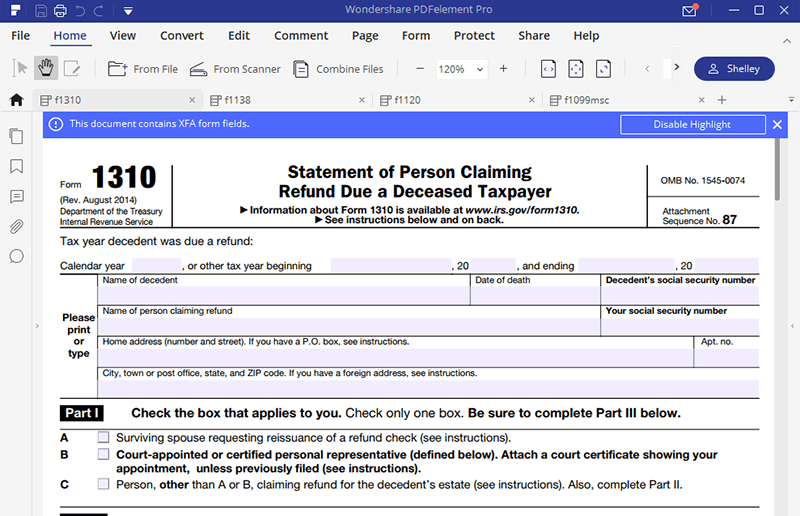

IRS Form 1310 How to Fill it Right

December 2021) department of the treasury internal revenue service go omb no. Web where do i mail form 1310? Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web 1310 statement of person claiming refund due a deceased taxpayer.

Manage Documents Using Our Document Editor For IRS Form 1310

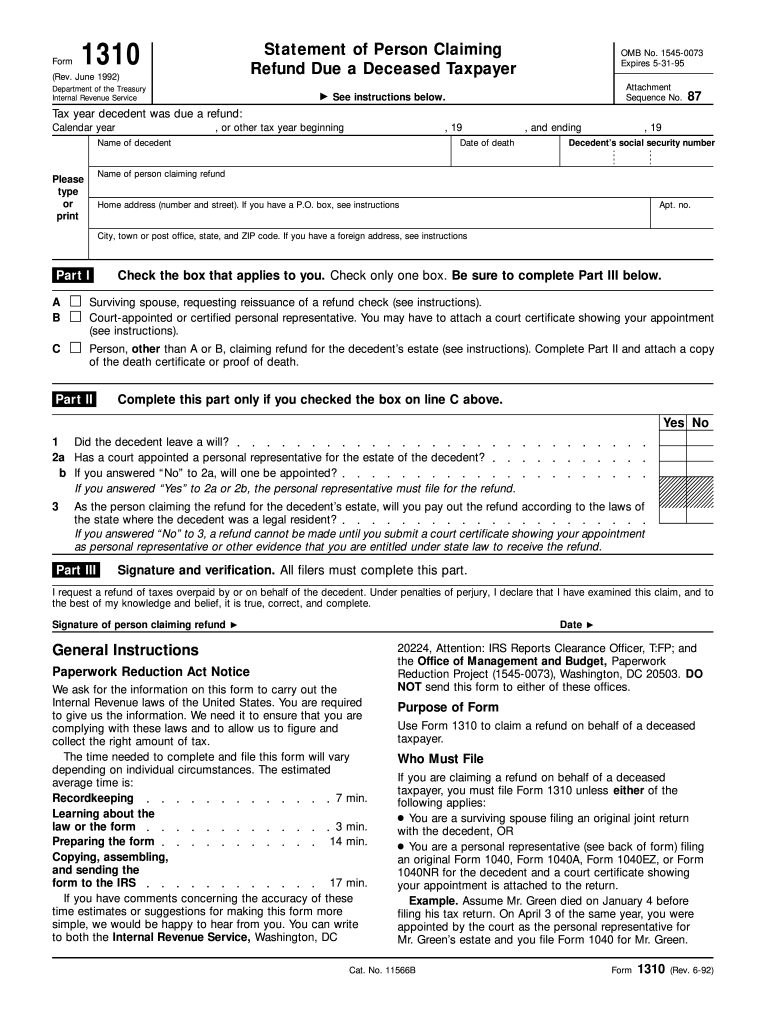

Calendar year , or other tax year beginning , 19 , and ending , 19 part i. Web if a refund is due to the decedent, it may be necessary to file form 1310, statement of person claiming refund due a deceased taxpayer with the return. Fill, sign, print and send online instantly. Web up to $40 cash back do.

IRS Form 1310 Download Fillable PDF or Fill Online Statement of Person

Securely download your document with other editable. Calendar year , or other tax year beginning , 19 , and ending , 19 part i. If the taxpayer's ssn was not locked yet and. Web send it to the same internal revenue service center where the original return was filed if you are filing form 1310 separately. Also, complete part ii.

1992 Form IRS 1310 Fill Online, Printable, Fillable, Blank pdfFiller

If you aren’t the surviving. Now, a new letter purporting to be from the. Also, find mailing addresses for other returns, including corporation,. Web taxpayer refund due a deceased statement of person claiming tax year decedent was due a refund: You can prepare the form and then mail it in to the same irs service center as the decedent's.

Form 1310 Definition

December 2021) department of the treasury internal revenue service go omb no. Web up to $40 cash back do whatever you want with a form 1310 (rev. If data entry on the 1310 screen does not meet the irs guidelines, there will be elf critical diagnostics and error. Fill, sign, print and send online instantly. Also, find mailing addresses for.

Irs Form 1310 Printable Master of Documents

If you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you filed your return. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Web search by state and form number the mailing.

Where Do I Mail Medicare Form Cms 1763 Form Resume Examples G28BAjpr3g

Web taxpayer refund due a deceased statement of person claiming tax year decedent was due a refund: Web the irs has set specific electronic filing guidelines for form 1310. Person, other than a or b, claiming a refund for the decedent’s estate. If you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you.

IRS Form 1310 Claiming a Refund for a Deceased Person YouTube

Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Calendar year , or other tax year beginning , 19 , and ending , 19 part i. Web do you want to fill out irs form 1310 to claim the.

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Web where do i mail form 1310? Now, a new letter purporting to be from the. Read the blog to know about the form. Web up to $40 cash back do whatever you want with a form 1310 (rev. You can prepare the form and then mail it in to the same irs service center as the decedent's.

Web 1 Day Agofor Years, The Irs Has Warned About Scammers Using Phone Calls, Text Messages, Emails And Even Social Media.

Web the irs has set specific electronic filing guidelines for form 1310. Person, other than a or b, claiming a refund for the decedent’s estate. Web irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that a taxpayer has passed away and a trust or beneficiary will be. Also, complete part ii and mail it to irs with.

Calendar Year , Or Other Tax Year Beginning , 19 , And Ending , 19 Part I.

You can prepare the form and then mail it in to the same irs service center as the decedent's. Web 1310 statement of person claiming refund due a deceased taxpayer form (rev. Web click on c in part i of form 1310 where it asks. Web if a refund is due to the decedent, it may be necessary to file form 1310, statement of person claiming refund due a deceased taxpayer with the return.

Read The Blog To Know About The Form.

If you’re a surviving spouse, you’ll mail form 1310 to the same internal revenue service center where you filed your return. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. December 2021) department of the treasury internal revenue service go omb no. Securely download your document with other editable.

Web Do You Want To Fill Out Irs Form 1310 To Claim The Federal Tax Refund On The Behalf Of A Deceased Family Member?

If data entry on the 1310 screen does not meet the irs guidelines, there will be elf critical diagnostics and error. Web send it to the same internal revenue service center where the original return was filed if you are filing form 1310 separately. Web search by state and form number the mailing address to file paper individual tax returns and payments. Now, a new letter purporting to be from the.

:max_bytes(150000):strip_icc()/1310-RefundClaimDuetoDeceasedTaxpayer-1-292bd14843c94bf4abf09ea5d6eb9a4b.png)