Where To Mail Form 8606

Where To Mail Form 8606 - Web learn more about nondeductible ira contributions and how to file them on form 8606 from the tax experts at h&r block. And the total assets at the end of the tax year. Taxpayers use form 8606 to report a number of transactions relating to what the internal revenue. Web learn more on this form and how to fill it out. Ago towww.irs.gov/form8606 for instructions and the latest information. What gets reported on form 8606? California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Form 8606 is used to report a variety of transactions related to traditional. Web form 8606 and send it to the internal revenue service at the same time and. Here's an irs page for.

Web updated for tax year 2022 • june 2, 2023 08:43 am. And the total assets at the end of the tax year. Form 8606 is used to report certain contributions and. Web where to file your taxes for form 1065. Form 8606 is used to report a variety of transactions related to traditional. Place you would otherwise file form 1040, 1040a, or 1040nr. Solved • by turbotax • 2898 • updated may 24, 2023 we'll automatically generate and fill out form 8606 (nondeductible iras) if you. Web where do i find form 8606? Taxpayers use form 8606 to report a number of transactions relating to what the internal revenue. Web if you aren’t required to file an income tax return but are required to file form 8606, sign form 8606 and send it to the irs at the same time and place you would otherwise file.

Web updated for tax year 2022 • june 2, 2023 08:43 am. Form 8606 is used to report a variety of transactions related to traditional. Taxpayers use form 8606 to report a number of transactions relating to what the internal revenue. Ago towww.irs.gov/form8606 for instructions and the latest information. Web learn more about nondeductible ira contributions and how to file them on form 8606 from the tax experts at h&r block. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Web where do i find form 8606? Here's an irs page for. And the total assets at the end of the tax year. Web information about form 8606, nondeductible iras, including recent updates, related forms, and instructions on how to file.

What is Form 8606? (with pictures)

What gets reported on form 8606? Web form 8606 and send it to the internal revenue service at the same time and. Place you would otherwise file form 1040, 1040a, or 1040nr. Web learn more about nondeductible ira contributions and how to file them on form 8606 from the tax experts at h&r block. Form 8606 is used to report.

Form 8606 YouTube

Here's an irs page for. And the total assets at the end of the tax year. Taxpayers use form 8606 to report a number of transactions relating to what the internal revenue. Web where do i find form 8606? Web learn more about nondeductible ira contributions and how to file them on form 8606 from the tax experts at h&r.

Form 8606 Nondeductible IRAs (2014) Free Download

If the partnership's principal business, office, or agency is located in: Web information about form 8606, nondeductible iras, including recent updates, related forms, and instructions on how to file. If you have an inherited ira, there are various possible scenarios that determine how you will complete your return using the taxact ® program. Web learn more about nondeductible ira contributions.

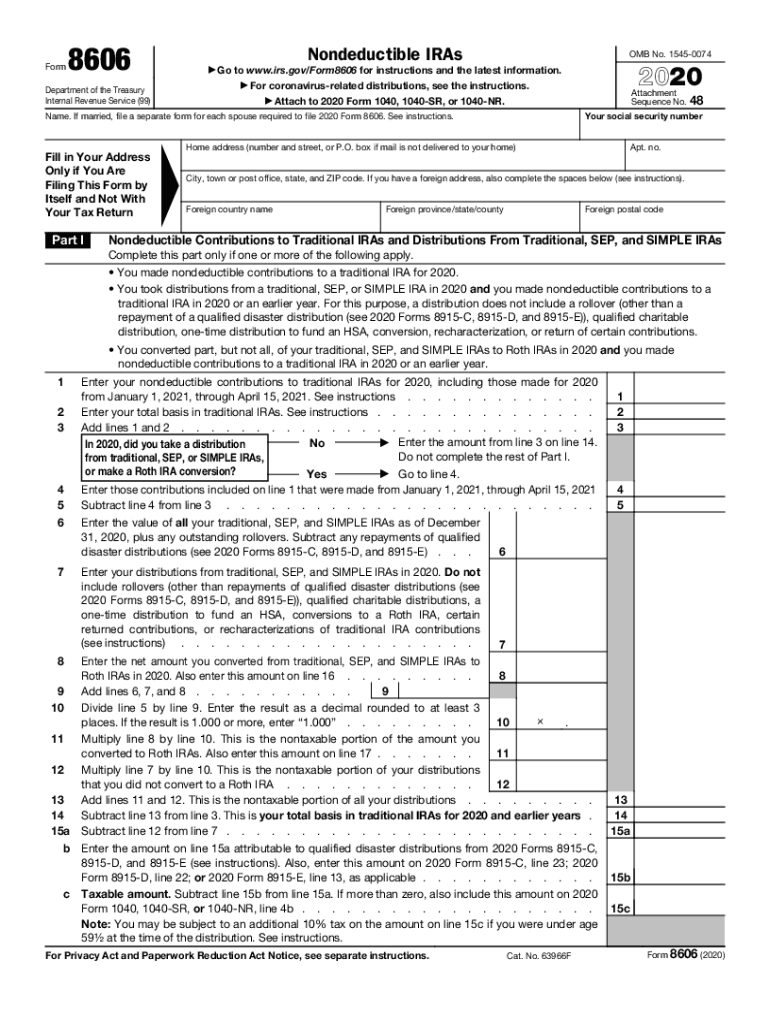

2020 Form IRS 8606 Fill Online, Printable, Fillable, Blank pdfFiller

What gets reported on form 8606? Solved • by turbotax • 2898 • updated may 24, 2023 we'll automatically generate and fill out form 8606 (nondeductible iras) if you. Web updated for tax year 2022 • june 2, 2023 08:43 am. If you have an inherited ira, there are various possible scenarios that determine how you will complete your return.

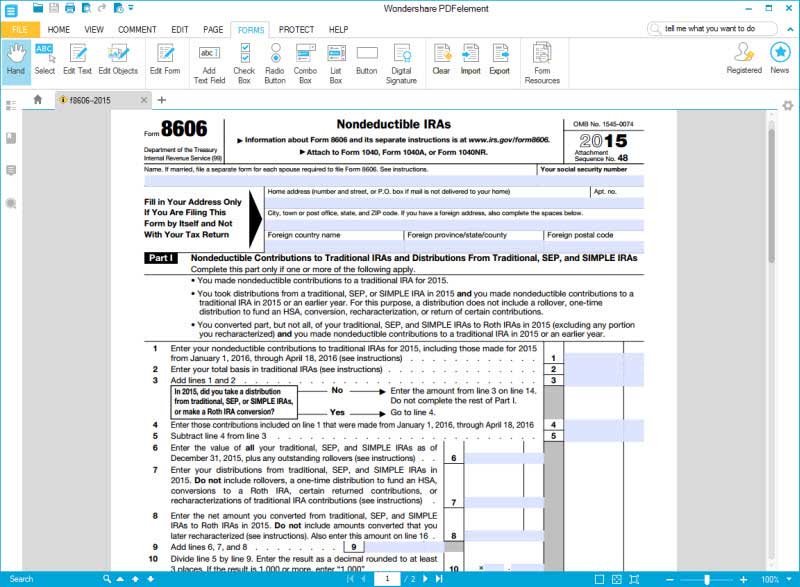

Instructions for How to Fill in IRS Form 8606

Web where to file your taxes for form 1065. Web department of the treasury internal revenue service (99) nondeductible iras. Ago towww.irs.gov/form8606 for instructions and the latest information. Web learn more about nondeductible ira contributions and how to file them on form 8606 from the tax experts at h&r block. Web if you aren’t required to file an income tax.

Question re Form 8606 after conversion with some deductible

Web department of the treasury internal revenue service (99) nondeductible iras. Web learn more on this form and how to fill it out. Web if you aren’t required to file an income tax return but are required to file form 8606, sign form 8606 and send it to the irs at the same time and place you would otherwise file..

Learn How to Fill the Form 8606 Request for a Certificate of

And the total assets at the end of the tax year. If you aren’t required to file an income tax return but. Place you would otherwise file form 1040, 1040a, or 1040nr. Web if you aren’t required to file an income tax return but are required to file form 8606, sign form 8606 and send it to the irs at.

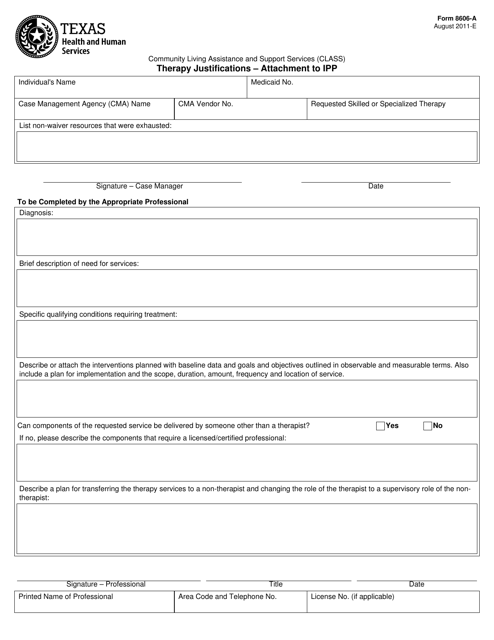

Form 8606A Download Fillable PDF or Fill Online Therapy Justifications

Web where do i find form 8606? Web updated for tax year 2022 • june 2, 2023 08:43 am. Web department of the treasury internal revenue service (99) nondeductible iras. Place you would otherwise file form 1040, 1040a, or 1040nr. If the partnership's principal business, office, or agency is located in:

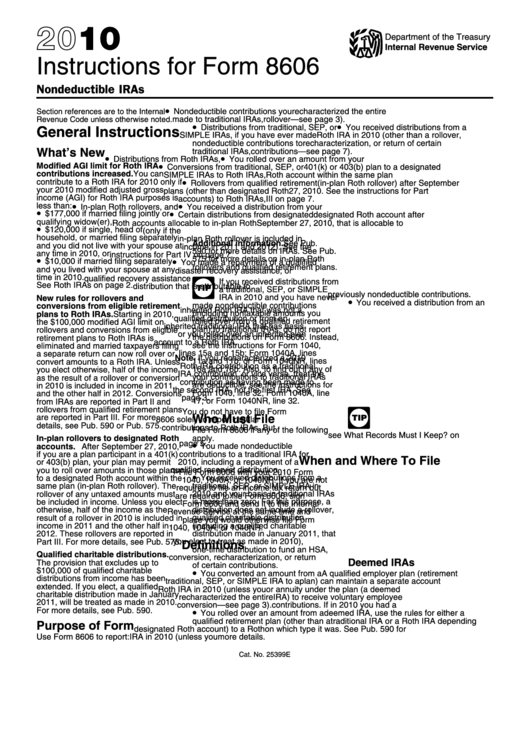

Instructions For Form 8606 Nondeductible Iras 2010 printable pdf

If you aren’t required to file an income tax return but. If the partnership's principal business, office, or agency is located in: Place you would otherwise file form 1040, 1040a, or 1040nr. Ago towww.irs.gov/form8606 for instructions and the latest information. Web learn more about nondeductible ira contributions and how to file them on form 8606 from the tax experts at.

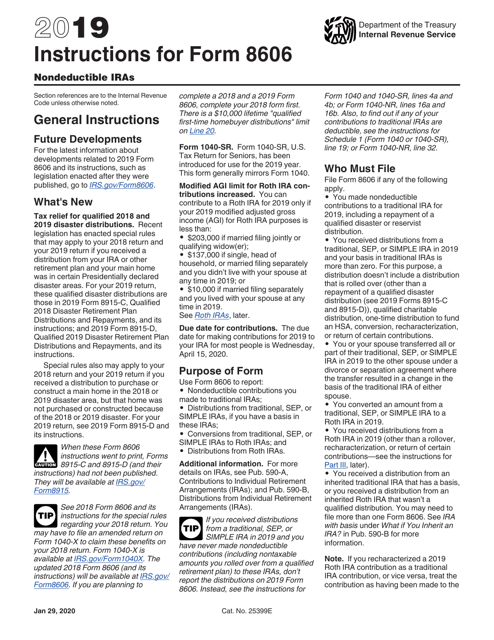

Download Instructions for IRS Form 8606 Nondeductible Iras PDF, 2019

Web updated for tax year 2022 • june 2, 2023 08:43 am. And the total assets at the end of the tax year. Web form 8606 and send it to the internal revenue service at the same time and. Web learn more on this form and how to fill it out. What gets reported on form 8606?

Form 8606 Is Used To Report Certain Contributions And.

Web updated for tax year 2022 • june 2, 2023 08:43 am. Solved • by turbotax • 2898 • updated may 24, 2023 we'll automatically generate and fill out form 8606 (nondeductible iras) if you. Web where do i find form 8606? Web where to file your taxes for form 1065.

Web Form 8606 And Send It To The Internal Revenue Service At The Same Time And.

Web learn more on this form and how to fill it out. If you aren’t required to file an income tax return but. Web information about form 8606, nondeductible iras, including recent updates, related forms, and instructions on how to file. What gets reported on form 8606?

If The Partnership's Principal Business, Office, Or Agency Is Located In:

Web department of the treasury internal revenue service (99) nondeductible iras. Here's an irs page for. Web if you aren’t required to file an income tax return but are required to file form 8606, sign form 8606 and send it to the irs at the same time and place you would otherwise file. Ago towww.irs.gov/form8606 for instructions and the latest information.

California, Connecticut, District Of Columbia, Louisiana, Maryland, Pennsylvania, Rhode Island, West Virginia.

Web learn more about nondeductible ira contributions and how to file them on form 8606 from the tax experts at h&r block. Taxpayers use form 8606 to report a number of transactions relating to what the internal revenue. And the total assets at the end of the tax year. If you have an inherited ira, there are various possible scenarios that determine how you will complete your return using the taxact ® program.