Where To Report Form 2439 On Tax Return

Where To Report Form 2439 On Tax Return - Go to screen 22.1 dispositions (schedule d, 4797, etc.). If your mutual fund sends you a form 2439: When these fields have an amount, the box is marked, indicating that the other payment was from form 2439. Web if you have received a form 2439 and there was tax paid by the ric or reit (see box 2) then you may be due a refund. Click on jump to 2439. Web to enter the 2439 in the fiduciary module: Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen and select jump to that section. Web or for reporting the tax paid only from form 2439. In turbotax enter 2439 in the search box located in the upper right of the program screen. Web tax paid by the ric and reit on the box 1a gains amounts in these fields transfer to schedule 5 (form 1040).

Advantages and disadvantages of form 2439: Go to screen 22.1 dispositions (schedule d, 4797, etc.). Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen and select jump to that section. Web or for reporting the tax paid only from form 2439. If your mutual fund sends you a form 2439: Web tax paid by the ric and reit on the box 1a gains amounts in these fields transfer to schedule 5 (form 1040). When these fields have an amount, the box is marked, indicating that the other payment was from form 2439. Click on jump to 2439. Go to the payments/penalties > payments worksheet. In turbotax enter 2439 in the search box located in the upper right of the program screen.

This is true even if your investment is held in your ira. Web to enter the 2439 in the fiduciary module: However, a mutual fund might keep some. A mutual fund usually distributes all its capital gains to its shareholders. March 27, 2023 11:14 am. In turbotax enter 2439 in the search box located in the upper right of the program screen. Go to the payments/penalties > payments worksheet. Web if you have received a form 2439 and there was tax paid by the ric or reit (see box 2) then you may be due a refund. Individuals who have already filed their tax returns can file. Advantages and disadvantages of form 2439:

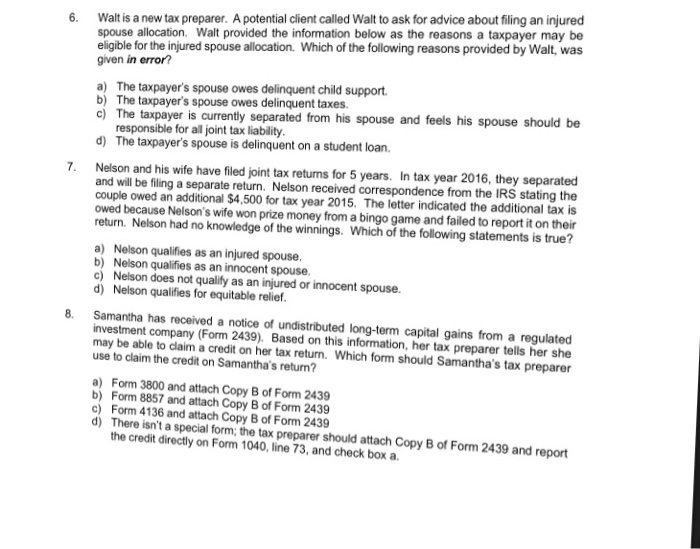

Free Tax Forms PDF Template Form Download

However, a mutual fund might keep some. Go to the payments/penalties > payments worksheet. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen and select jump to that section. March 27, 2023 11:14 am. Individuals who have already filed their.

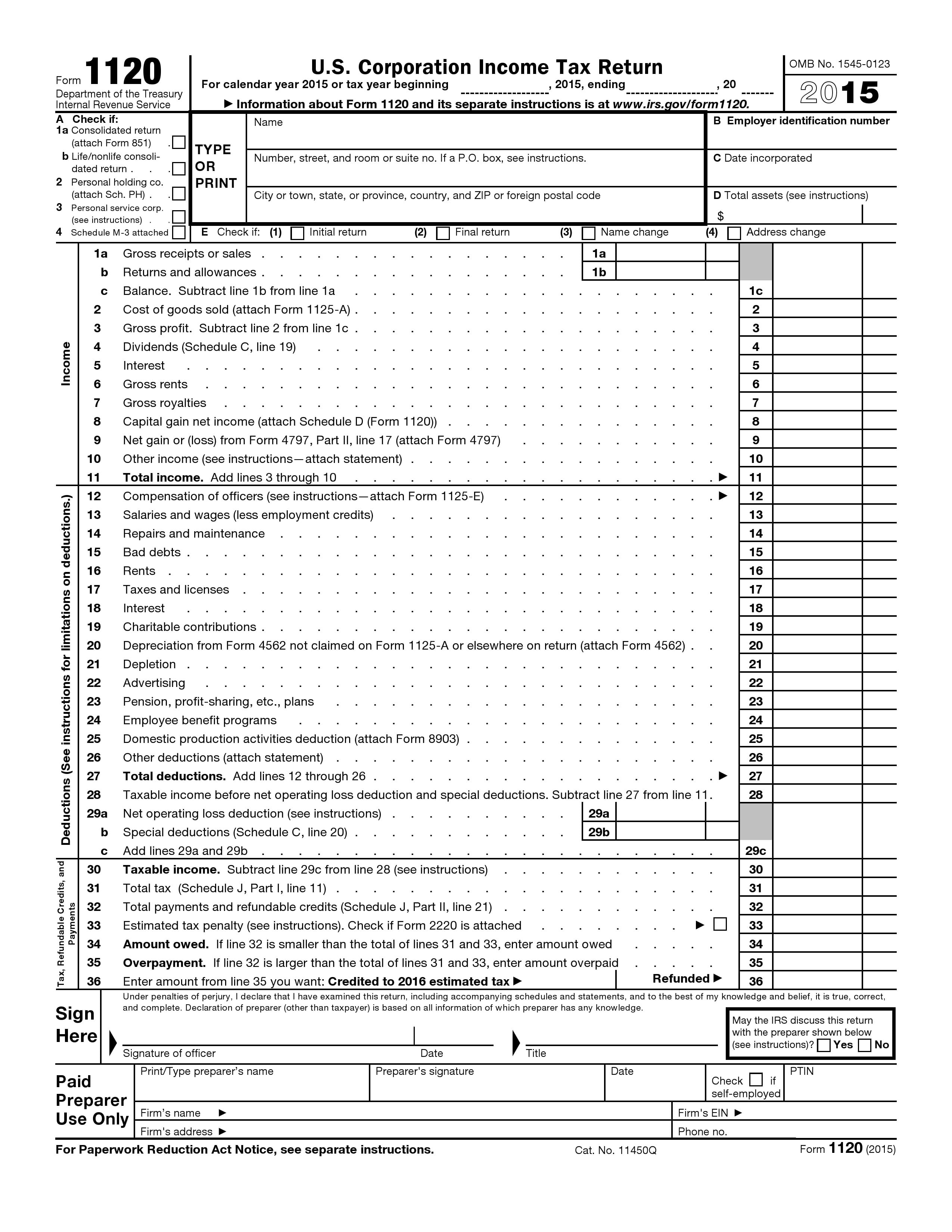

Solved 6 Walt is a new tax preparer. A potential client

Web if you have received a form 2439 and there was tax paid by the ric or reit (see box 2) then you may be due a refund. If your mutual fund sends you a form 2439: Go to screen 22.1 dispositions (schedule d, 4797, etc.). When these fields have an amount, the box is marked, indicating that the other.

Fill Free fillable IRS PDF forms

A mutual fund usually distributes all its capital gains to its shareholders. However, a mutual fund might keep some. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen and select jump to that section. Go to screen 22.1 dispositions (schedule.

Form 2439 Notice to Shareholder of Undistributed LongTerm Capital

Web to enter the 2439 in the fiduciary module: However, a mutual fund might keep some. If your mutual fund sends you a form 2439: Web tax paid by the ric and reit on the box 1a gains amounts in these fields transfer to schedule 5 (form 1040). Web form 2439 is available on the irs website.

1040 Schedule 3 (Drake18 and Drake19) (Schedule3)

Web tax paid by the ric and reit on the box 1a gains amounts in these fields transfer to schedule 5 (form 1040). A mutual fund usually distributes all its capital gains to its shareholders. When these fields have an amount, the box is marked, indicating that the other payment was from form 2439. However, a mutual fund might keep.

Fill Free fillable IRS PDF forms

When these fields have an amount, the box is marked, indicating that the other payment was from form 2439. Go to screen 22.1 dispositions (schedule d, 4797, etc.). This is true even if your investment is held in your ira. Web to enter the 2439 in the fiduciary module: Web form 2439 is available on the irs website.

Publication 17 Your Federal Tax; Refundable Credits

Web tax paid by the ric and reit on the box 1a gains amounts in these fields transfer to schedule 5 (form 1040). From the dispositions section select form 2439. Click on jump to 2439. Web or for reporting the tax paid only from form 2439. Web to enter form 2439 go to investment income and select undistributed capital gains.

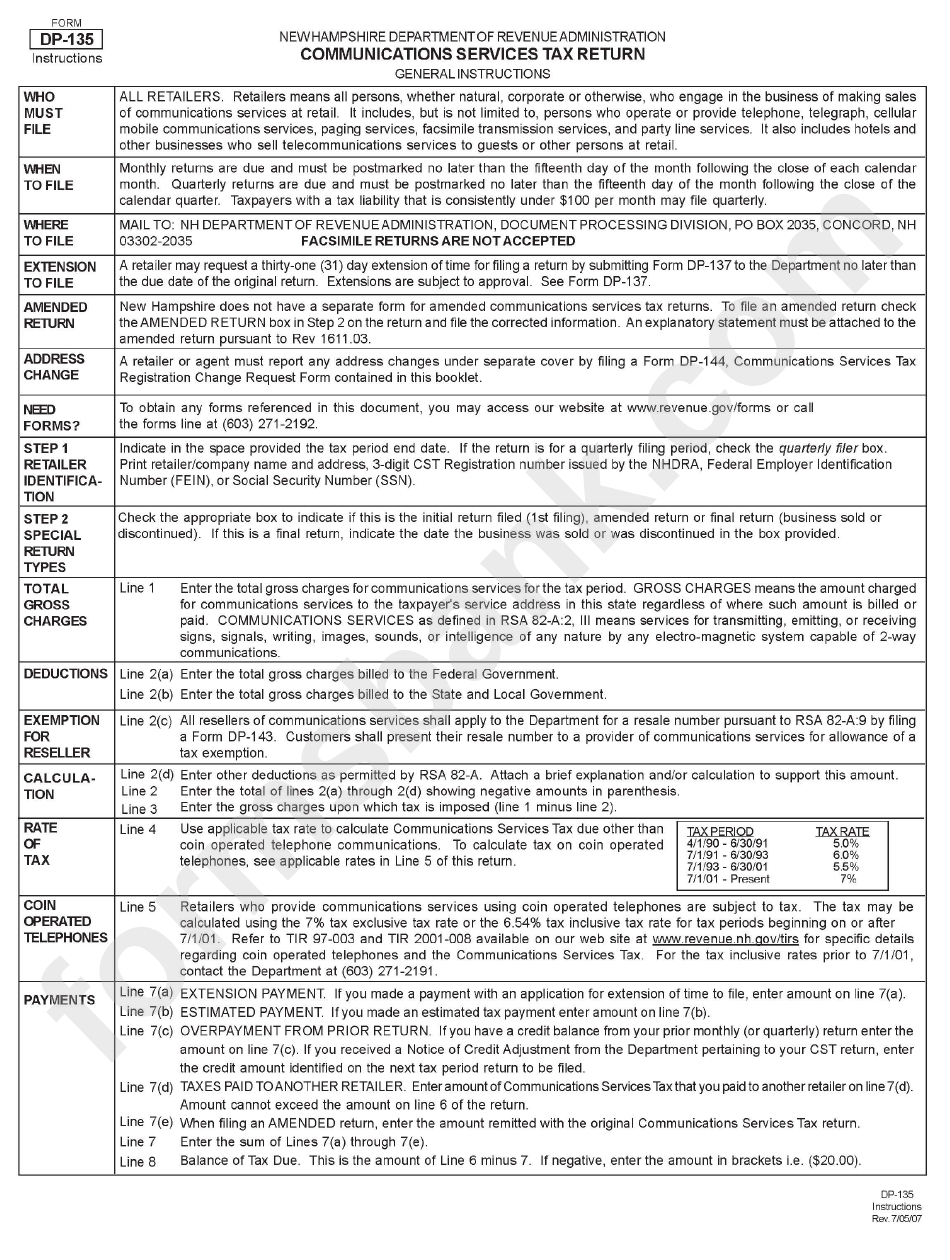

Form Dp135 Instructions Communications Services Tax Return printable

Web or for reporting the tax paid only from form 2439. March 27, 2023 11:14 am. Individuals who have already filed their tax returns can file. This is true even if your investment is held in your ira. If your mutual fund sends you a form 2439:

Fill Free fillable IRS PDF forms

Web or for reporting the tax paid only from form 2439. Web tax paid by the ric and reit on the box 1a gains amounts in these fields transfer to schedule 5 (form 1040). This is true even if your investment is held in your ira. Individuals who have already filed their tax returns can file. Go to screen 22.1.

Certified Quality Auditor Training Acceclass

From the dispositions section select form 2439. Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen and select jump to that section. If your mutual fund sends you a form 2439: Web tax paid by the ric and reit on.

Click On Jump To 2439.

March 27, 2023 11:14 am. Go to screen 22.1 dispositions (schedule d, 4797, etc.). If your mutual fund sends you a form 2439: From the dispositions section select form 2439.

When These Fields Have An Amount, The Box Is Marked, Indicating That The Other Payment Was From Form 2439.

Web to enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right corner of your screen and select jump to that section. Web if you have received a form 2439 and there was tax paid by the ric or reit (see box 2) then you may be due a refund. Web form 2439 is available on the irs website. Go to the payments/penalties > payments worksheet.

Advantages And Disadvantages Of Form 2439:

Web or for reporting the tax paid only from form 2439. A mutual fund usually distributes all its capital gains to its shareholders. However, a mutual fund might keep some. This is true even if your investment is held in your ira.

Individuals Who Have Already Filed Their Tax Returns Can File.

In turbotax enter 2439 in the search box located in the upper right of the program screen. Web to enter the 2439 in the fiduciary module: Web tax paid by the ric and reit on the box 1a gains amounts in these fields transfer to schedule 5 (form 1040).

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)