Where To Send 8843 Form

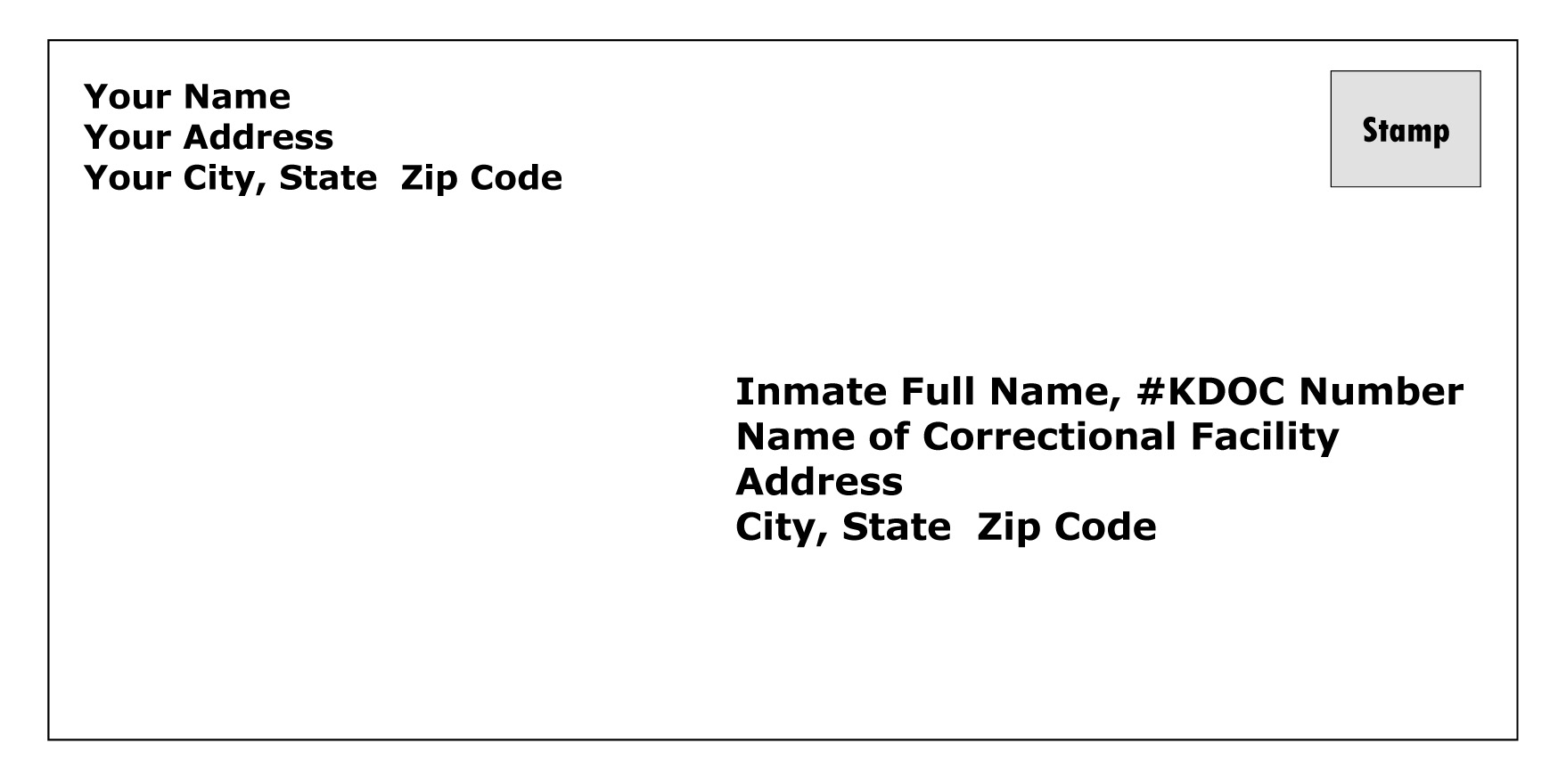

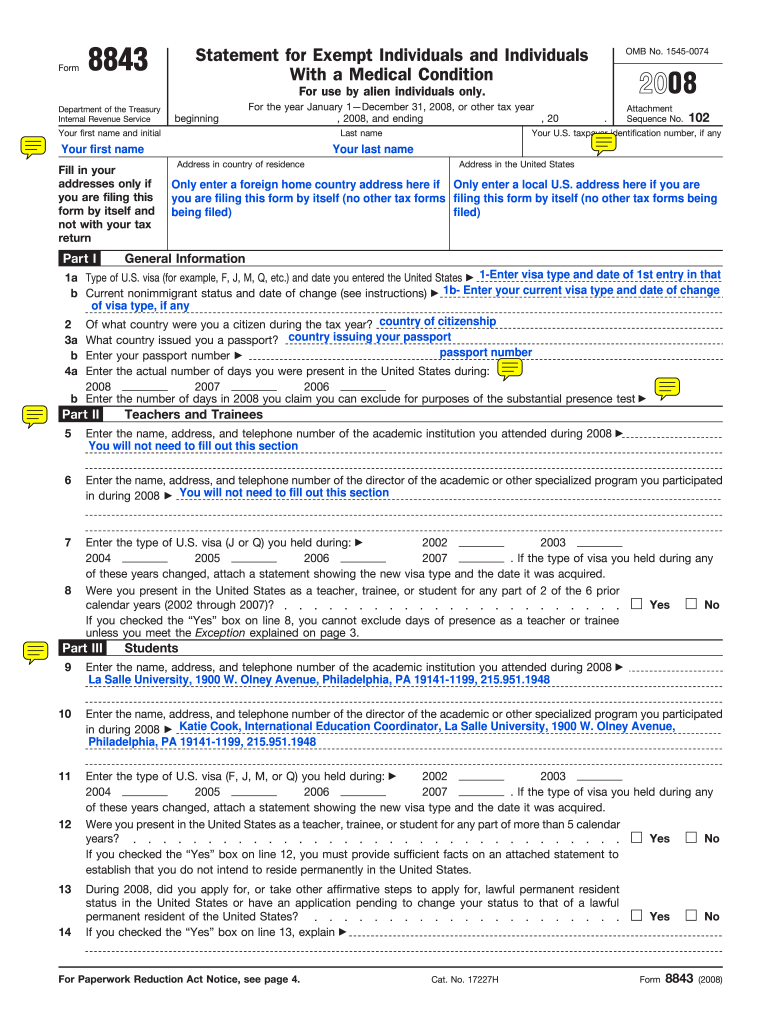

Where To Send 8843 Form - Web the general rules for form 8843 • if you are an exempt individual, you must file form 8843 • if you have income subject to tax then you send it in with your income tax form. If you have dependents, everyone must submit their form 8843 individually(in separate envelope s). 12/2021 general instructions future developments for the latest information about developments related to form 843 and its instructions, such as. Web all nonresident aliens for tax purposes exempting days of presence from the substantial presence test need to file form 8843, regardless of whether they need to. The irs instructions for form 8843 summarizes who qualifies as. Web how do i file form 8843? Web if you are required to file an income tax return, attach form 8843 to the back of the tax return. How can i file form 8843? Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during: Web mail form 8843 and supporting documents in an envelope to the following address:

Web how to fill out the federal form 8843 all international students & scholars (including their dependents) present in the u.s. Mail the tax return and the form 8843 by the due date (including extensions) to the address shown in the tax. Web what if form 8843 is not filed? Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during: Then mail the form to… in response to an irs notice regarding a tax or fee related to certain taxes. Overview of form 8843 irs form 8843 is a. Web if you are required to file an income tax return, attach form 8843 to the back of the tax return. Do not include more than one form 8843 per envelope. How can i file form 8843? Web the general rules for form 8843 • if you are an exempt individual, you must file form 8843 • if you have income subject to tax then you send it in with your income tax form.

12/2021 general instructions future developments for the latest information about developments related to form 843 and its instructions, such as. The irs instructions for form 8843 summarizes who qualifies as. If you are filing form 843. Web the general rules for form 8843 • if you are an exempt individual, you must file form 8843 • if you have income subject to tax then you send it in with your income tax form. If you have dependents, everyone must submit their form 8843 individually(in separate envelope s). If form 8843 is for a spouse or dependent eligible to be claimed as a dependent. 2021 2020 2019 enter the number of days in 2021 you claim you. In 2021, whether they worked and earned money or not,. Web what if form 8843 is not filed? Mail the tax return and the form 8843 by the due date (including extensions) to the address shown in the tax.

Letter Envelope Format gplusnick

Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during: If form 8843 is for a spouse or dependent eligible to be claimed as a dependent. Web all nonresident aliens for tax purposes exempting days of presence from the substantial presence test need to file form 8843, regardless of whether.

IRS Form 8843 Editable and Printable Statement to Fill out

Department of the treasury internal revenue service center austin, tx 73301. Web all nonresident aliens for tax purposes exempting days of presence from the substantial presence test need to file form 8843, regardless of whether they need to. If you did not receive any u.s. Web each individual who has no income and files only a form 8843 must send.

AnnaLeah & Mary for Truck Safety received word of IRS TaxExempt Status

Source income in 2022, mail form 8843 along with your tax return form 1040nr. Web what if form 8843 is not filed? Web if you are required to file an income tax return, attach form 8843 to the back of the tax return. There is no monetary penalty for not filing form 8843. The irs instructions for form 8843 summarizes.

Tax how to file form 8843 (1)

Web how do i file form 8843? Source income in 2022, mail form 8843 along with your tax return form 1040nr. Source income in 2022, mail. Web mail your completed form 8843 to: Web if you received taxable income last year, uconn’s volunteer income tax assistance (vita ) program will create and file the 8843 along with your income tax.

1+ 8843 Form Free Download

Web if you are required to file an income tax return, attach form 8843 to the back of the tax return. In 2021, whether they worked and earned money or not,. Web mailing addresses for form 843; If you did not receive any u.s. Web how do i file form 8843?

Form 8843留学生报税必填表格 Tax Panda 美国报税大熊猫

There is no monetary penalty for not filing form 8843. If you are filing form 843. If form 8843 is for a spouse or dependent eligible to be claimed as a dependent. Web how to fill out the federal form 8843 all international students & scholars (including their dependents) present in the u.s. 2021 2020 2019 enter the number of.

8843 Form Tutorial YouTube

If you have dependents, everyone must submit their form 8843 individually(in separate envelope s). Web if you received taxable income last year, uconn’s volunteer income tax assistance (vita ) program will create and file the 8843 along with your income tax return, as well. However, days of presence that are excluded must be properly recorded by filing form. Web mail.

2008 Form IRS 8843 Fill Online, Printable, Fillable, Blank PDFfiller

2021 2020 2019 enter the number of days in 2021 you claim you. Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during: If you are filing form 843. Web all nonresident aliens for tax purposes exempting days of presence from the substantial presence test need to file form 8843,.

form 8843 example Fill Online, Printable, Fillable Blank

If form 8843 is for a spouse or dependent eligible to be claimed as a dependent. Department of the treasury internal revenue service center austin, tx 73301. 2021 2020 2019 enter the number of days in 2021 you claim you. Web if you received u.s. You can not file this form electronically, you must mail the paper form.

Form 8843 YouTube

Web all nonresident aliens for tax purposes exempting days of presence from the substantial presence test need to file form 8843, regardless of whether they need to. Web if you are required to file an income tax return, attach form 8843 to the back of the tax return. Web what if form 8843 is not filed? Web mail your completed.

Web All Nonresident Aliens For Tax Purposes Exempting Days Of Presence From The Substantial Presence Test Need To File Form 8843, Regardless Of Whether They Need To.

The irs instructions for form 8843 summarizes who qualifies as. You can not file this form electronically, you must mail the paper form. Overview of form 8843 irs form 8843 is a. Web if you received taxable income last year, uconn’s volunteer income tax assistance (vita ) program will create and file the 8843 along with your income tax return, as well.

However, Days Of Presence That Are Excluded Must Be Properly Recorded By Filing Form.

Web how to fill out the federal form 8843 all international students & scholars (including their dependents) present in the u.s. Web each individual who has no income and files only a form 8843 must send the form in a separate envelope. If you have dependents, everyone must submit their form 8843 individually(in separate envelope s). 2021 2020 2019 enter the number of days in 2021 you claim you.

If Form 8843 Is For A Spouse Or Dependent Eligible To Be Claimed As A Dependent.

There is no monetary penalty for not filing form 8843. Web mailing addresses for form 843; Web the general rules for form 8843 • if you are an exempt individual, you must file form 8843 • if you have income subject to tax then you send it in with your income tax form. Mail the form by june 15, 2022 to:

Department Of The Treasury Internal Revenue Service Center Austin, Tx 73301.

Web what if form 8843 is not filed? Then mail the form to… in response to an irs notice regarding a tax or fee related to certain taxes. Web mail your completed form 8843 to: Web enter your passport number(s) 4a enter the actual number of days you were present in the united states during: