Where To Send Form 943

Where To Send Form 943 - Web how to efile 943 for the year 2020? You can efile form 943 online for the year 2020 using. File this form if you paid wages to one or more farmworkers and the wages were subject to. • enclose your check or money order made payable to “united states treasury.” be. Web form 943 (employer’s annual federal tax return for agricultural employees) is used to report the federal income tax, social security, or medicare withholdings from. Web how we support form 943: We earn a commission from partner links on forbes advisor. Select form 943 and enter. What you can do is to send your. The 940 is an annual federal tax form used to.

The 940 is an annual federal tax form used to. Create a free taxbandits account or login if you have one already step 2: Web you have two options for filing form 943: Web simply follow the steps below to file your form 943: Web form 943 (employer’s annual federal tax return for agricultural employees) is used to report the federal income tax, social security, or medicare withholdings from. Don't send form 943 to this. Web about form 943, employer's annual federal tax return for agricultural employees. Web how to efile 943 for the year 2020? Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Web or you can write to the internal revenue service, tax forms and publications division, 1111 constitution ave.

Enter your name and address as shown on form 943. Web form 943 (employer’s annual federal tax return for agricultural employees) is used to report the federal income tax, social security, or medicare withholdings from. You can efile form 943 online for the year 2020 using. File this form if you paid wages to one or more farmworkers and the wages were subject to. Form 940 is required for businesses who are subject to federal unemployment (futa). If you want to file online , you can either search for a tax professional to guide you through the. What you can do is to send your. It is known as an employer’s annual federal tax return for agriculture employees. Web or you can write to the internal revenue service, tax forms and publications division, 1111 constitution ave. Commissions do not affect our editors' opinions or.

Form 943 Employer's Annual Federal Tax Return for Agricultural

Web you have two options for filing form 943: Web or you can send your comments to internal revenue service, tax forms and publications division, 1111 constitution ave. Web simply follow the steps below to file your form 943: Web what is a form 943? File this form if you paid wages to one or more farmworkers and the wages.

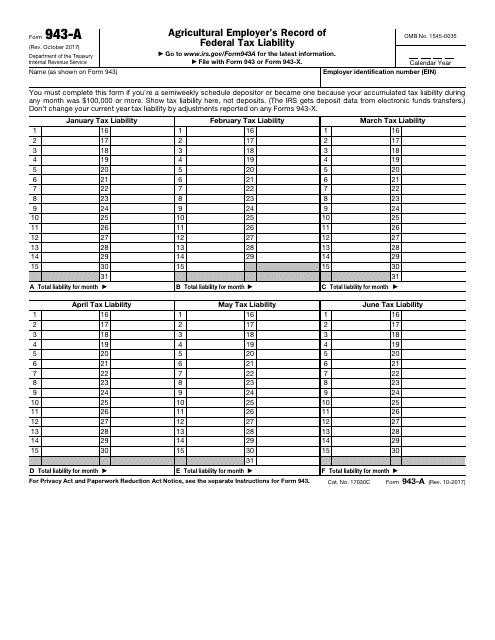

IRS Form 943A Download Fillable PDF or Fill Online Agricultural

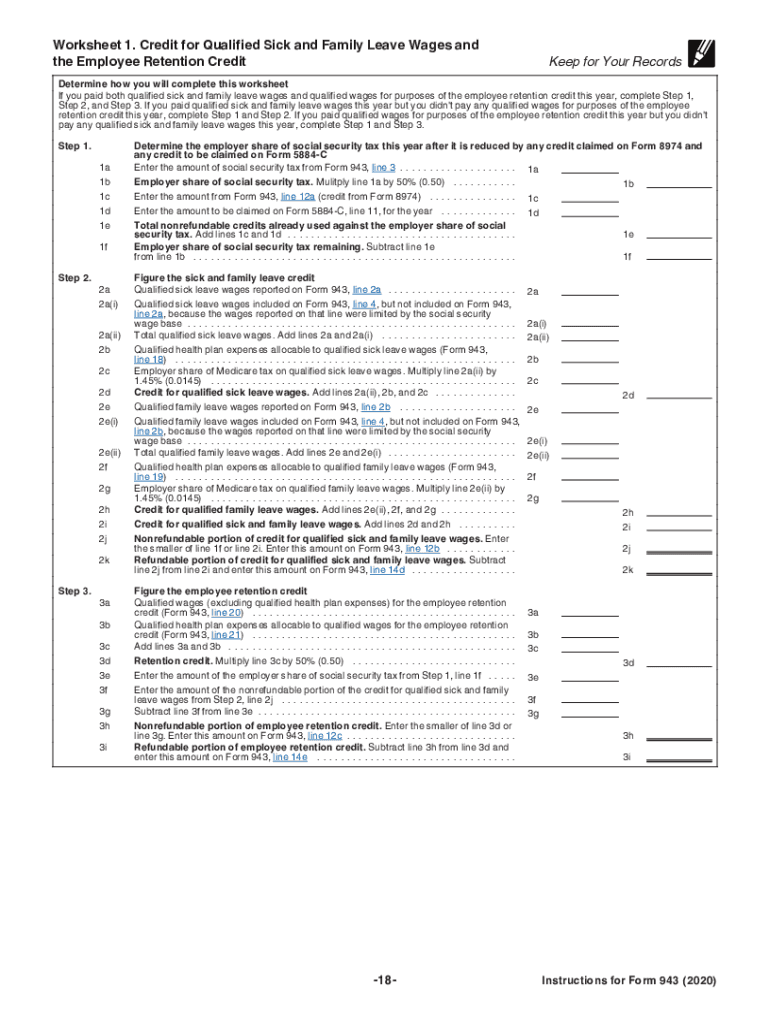

• enclose your check or money order made payable to “united states treasury.” be. Web how we support form 943: If you want to file online , you can either search for a tax professional to guide you through the. Web tiếng việt employers who paid wages to agricultural employees that are subject to income tax, social security or medicare.

Form 943 Employer's Annual Federal Tax Return for Agricultural

Web form 943 (employer’s annual federal tax return for agricultural employees) is used to report the federal income tax, social security, or medicare withholdings from. The 940 is an annual federal tax form used to. Form 940 is required for businesses who are subject to federal unemployment (futa). Web tiếng việt employers who paid wages to agricultural employees that are.

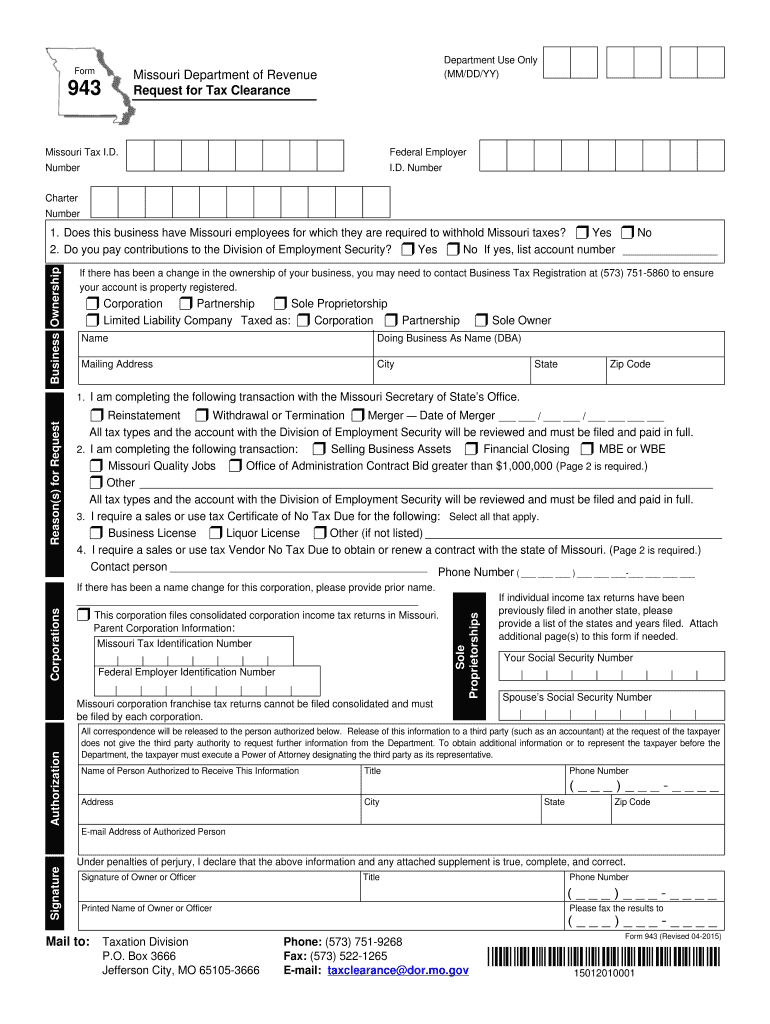

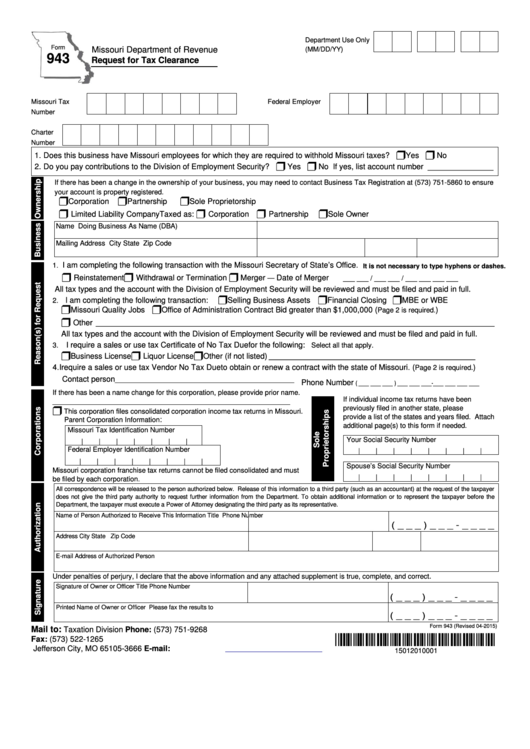

Missouri Form 943 Fill Out and Sign Printable PDF Template signNow

Web you have two options for filing form 943: Web 4 rows follow these easy steps for filing form 943 electronically with taxbandits: Web simply follow the steps below to file your form 943: Web how to efile 943 for the year 2020? Web how we support form 943:

Fill Free fillable Form 943A 2017 Agricultural Employer's Record of

Web or you can send your comments to internal revenue service, tax forms and publications division, 1111 constitution ave. If you want to file online , you can either search for a tax professional to guide you through the. Web 4 rows follow these easy steps for filing form 943 electronically with taxbandits: To ensure proper processing, write “branded prescription.

943 Form Fill Out and Sign Printable PDF Template signNow

Enter your name and address as shown on form 943. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Create a free taxbandits account or login if you have one already step 2: Web about form 943, employer's.

Form 943 Fill Out and Sign Printable PDF Template signNow

Apr 25, 2023, 1:00pm editorial note: Web how we support form 943: Don't send form 943 to this. Create a free taxbandits account or login if you have one already step 2: Web you have two options for filing form 943:

Fill Free fillable F943apr Form 943 APR (Rev. October 2017) PDF form

Web or you can write to the internal revenue service, tax forms and publications division, 1111 constitution ave. Web what is a form 943? Web or you can send your comments to internal revenue service, tax forms and publications division, 1111 constitution ave. To ensure proper processing, write “branded prescription drug fee” across the top of form 843. This form.

Fillable Form 943 Request For Tax Clearance printable pdf download

File this form if you paid wages to one or more farmworkers and the wages were subject to. Create a free taxbandits account or login if you have one already step 2: Web simply follow the steps below to file your form 943: What you can do is to send your. Web how we support form 943:

Form 943 What You Need to Know About Agricultural Withholding

Web what is a form 943? What you can do is to send your. Form 940 is required for businesses who are subject to federal unemployment (futa). Commissions do not affect our editors' opinions or. Web or you can write to the internal revenue service, tax forms and publications division, 1111 constitution ave.

• Enclose Your Check Or Money Order Made Payable To “United States Treasury.” Be.

The 940 is an annual federal tax form used to. Create a free taxbandits account or login if you have one already step 2: Web you have two options for filing form 943: Don't send form 943 to this.

If You Want To File Online , You Can Either Search For A Tax Professional To Guide You Through The.

Form 940 is required for businesses who are subject to federal unemployment (futa). File this form if you paid wages to one or more farmworkers and the wages were subject to. This form will be used by employers in the agricultural field. We earn a commission from partner links on forbes advisor.

It Is Known As An Employer’s Annual Federal Tax Return For Agriculture Employees.

Web form 943 (employer’s annual federal tax return for agricultural employees) is used to report the federal income tax, social security, or medicare withholdings from. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Web tiếng việt employers who paid wages to agricultural employees that are subject to income tax, social security or medicare withholding must file a form 943,. To ensure proper processing, write “branded prescription drug fee” across the top of form 843.

Apr 25, 2023, 1:00Pm Editorial Note:

Commissions do not affect our editors' opinions or. Web or you can write to the internal revenue service, tax forms and publications division, 1111 constitution ave. Web how we support form 943: Select form 943 and enter.